Summary:

- I believe paying 33x this year’s EBITDA for Snap is unsustainable given its sub-20% CAGR growth.

- Snap has already squeezed much of its operating efficiencies, leaving little room for margin expansion.

- In contrast, Reddit’s faster growth rate and untapped potential make it a more compelling investment.

- After Snap’s Q3 earnings, I think $10 per share will be seen as an aspirational price target.

cyano66/iStock via Getty Images

Investment Thesis

Snap (NYSE:SNAP) is now growing less than 20% CAGR. And it’s priced at a very high premium of approximately 33x this year’s EBITDA.

I struggle to imagine that Snap is a compelling investment at this price point. And as we head into earnings, I believe that after Q3 earnings, investors will look back to $10 per share as a price to aspire towards.

Moreover, I provide some contrast with Reddit (RDDT) to show why I believe Reddit is a better investment than Snap.

Rapid Recap

Back in April, I titled my analysis “Snaps Back from the Dead” stating,

Investors had long ago called Snap as a dead company walking. And yet, its Q1 2024 results put substantial doubt into the bear thesis.

And yet, this doubt cuts both ways. On the one hand, this company still has some growth left in the tank. But on the other hand, is this enough to get investors back in? Or is it just a temporary flashback, before Snap tumbles back down once more?

It’s too tough to call. I’m sticking to neutral.

author’s work on SNAP

As it turns out, I made the right call to stick firmly on the sidelines with Snap.

Snap’s Near-Term Prospects

Snapchat, the social media platform, is built around fostering personal connections through its unique features like Snaps, Stories, and Snap Map. By opening directly to the camera, it encourages users to communicate visually, often replacing text-based interactions with images and augmented reality.

Its appeal lies in the ability to instantly share moments with friends, explore places on Snap Map, and enjoy personalized content through Stories and Spotlight, which combine entertainment and engagement. With AI-powered Lenses and features like Bitmoji, Snapchat enhances user interaction, making communication visually expressive.

Moving on, in the near term Snap’s prospects look promising as it tests “Simple Snapchat,” a streamlined version of the app designed to focus on its core strengths: communication and entertainment.

The company is leveraging AI to enhance user experience through instant AI Snaps, personalized content, and augmented reality tools. With a growing creator community and increasing interactions between users, Snap believes that it’s positioned well to increase user engagement while offering new monetization opportunities for creators.

Given this bullish narrative, next, let’s discuss some of its more down to earth fundamentals.

Snap’s Growth Rates Moderate to Less than 20% CAGR

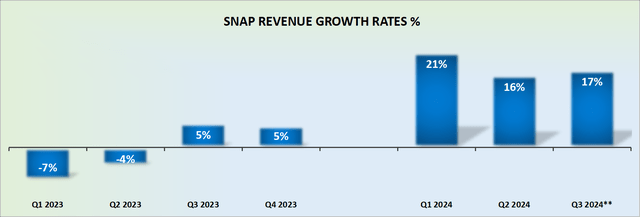

SNAP revenue growth rates

Snap’s growth rates are maturing. This is a fact that is reflected in its revenue growth rates being decidedly below 20% CAGR. Meanwhile, I estimate that Reddit is growing at around 30% CAGR into 2025.

What this means in practical terms is two-fold. Firstly, a business with sub-20% CAGR should do everything in its might to improve its profitability prospects.

Secondly and concurrently, growth investors are not going back to a business growing at less than 20%. So, if Snap is growing at less than 20%, the majority of its shareholders will be a mixture of ”growth at a reasonable price” and value investors. And these investors pay a lot of attention to underlying multiples that Snap trades for. And on this note, Snap doesn’t fare well.

SNAP Stock Valuation — 33x This Year’s EBITDA

For Q4 2024 I’ve estimated that Snap will deliver $200 million of EBITDA. For this estimate, I’ve assumed that on the back of mid-teens growth rates, Snap’s EBITDA improves by approximately 25% y/y. This is a strong profit margin expansion, on the back of what has already been multiple years of squeezing out cost efficiencies from its operations.

In other words, together with its Q3 guidance of $100 million, this implies that Snap’s 2024 EBITDA could approximate $400 to $450 million.

Consequently, this means that investors are being asked to pay 33x this year’s EBITDA.

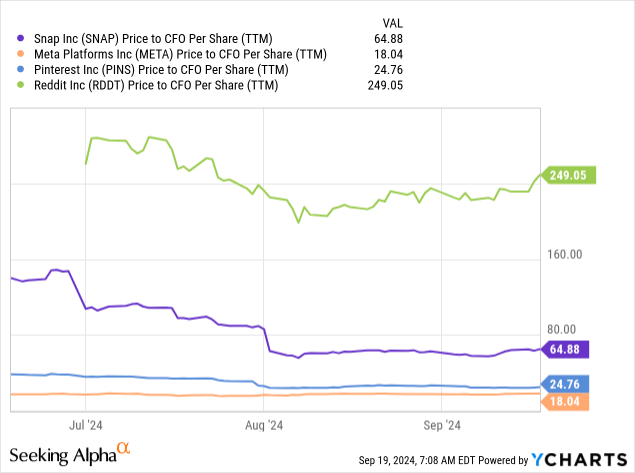

Now, bear with me while I add more perspective to the graph that follows.

Right away, you’ll see that Reddit is by far the most expensive stock of the group, by a wide margin. So, why would I recommend something to you, that is trading at the most expensive multiple?

First, the obvious one. The graphic above is a trailing metric. It provides you with a sense of the different investors’ expectations. But not as a hard and fast rule.

Secondly, companies that are growing at a faster clip, such as Reddit, will end up trading a lot cheaper two years out than they appear to be trading at right now.

Thirdly, Snap has already to a large extent maxed out many of its operating efficiencies. Its ability to squeeze out a lot more profit margins from its business will be a struggle. Meanwhile, Reddit, with its less than 100 million users, is just getting started.

What’s more, it doesn’t make a lot of sense to me why Snap should be priced so much more expensively than Pinterest (PINS), when Pinterest is growing at a faster clip, with higher gross margins than Snap, hence, more opportunities to further improve its profitability.

In sum, I believe that Snap is a stock that is best avoided.

The Bottom Line

Paying 33x this year’s EBITDA for Snap feels like a bad investment to me because the company’s growth is no longer compelling.

With its CAGR dropping below 20%, it’s difficult to justify such a steep premium, especially for a company whose ability to drive further margin improvements is limited.

I believe that after Snap’s Q3 earnings report, investors will likely look back at $10 per share as a target price, with disillusionment setting in once the gap between expectations and reality becomes clear.

Additionally, when comparing Snap to Reddit, I see more long-term value on Reddit, which is growing faster, has more room for operational efficiencies, and is ready to snap higher.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.