Summary:

- Snap reported its Q2 FY24 earnings where revenue growth missed estimates due to weakness in brand-oriented advertising, which hurt its North American market.

- While the company saw its highest ever count of DAUs, its North American DAUs growth rate has stagnated, which is one of the drivers of investor pessimism.

- While the management sounded optimistic on its progress in DR advertising solutions to drive higher ROAS, its Q3 guidance points to a further slowdown in revenue growth.

- The bright spot is the company’s focus on expanding its profitability; however, investor sentiment is likely to remain dampened until it executes a turnaround.

- In the meantime, the stock is extremely oversold at current levels, and my valuation assumptions suggest near-term upside. Therefore, I will maintain my “buy” rating with a drastically reduced price target.

We Are

Introduction & Investment Thesis

I initiated a “buy” rating on Snap (NYSE:SNAP) in June, where my thesis was predicated on my belief that the stock should see upside from growing DAUs (Daily Active Users) and higher user monetization as the company drives innovation on deepening user engagement and growing its advertising business. However, this is probably my worst call, as the stock is down 43% since my price at publication, where the company failed to impress investors in its latest Q2 FY24 earnings report.

While the company continued to expand its overall profitability, with Adjusted EBITDA growing to $55M, it saw its revenue miss analyst estimates from weakness in brand-oriented advertising affecting the growth of its North American market, which contributed 62% to overall revenue. While the management sounded optimistic on its DAUs growing to an all-time high of 432M as it drives AR (Augmented Reality) based product innovation to boost engagement along with progress in its DR (Direct Response) advertising solutions, where total active advertisers doubled on a year-over-year basis, investors are concerned about stagnating DAUs in North America along with lackluster Q3 revenue guidance.

With Evan Spiegel, CEO of Snap, admitting that its advertising business is growing at a slower pace relative to competitors, the business outlook has since worsened, calling for caution until the company can execute a comeback to reinstate investor confidence.

However, in the meantime, the stock has gotten oversold at its current levels, with investors pricing it at a price-to-earnings multiple of 15-16 for its estimated FY26 earnings. After assessing both the “good” and the “bad,” I have decided that I will maintain my “buy” rating but have drastically reduced my price target to $12.6 for investors who want to initiate a small position. But I would like to reiterate that, from a sentiment perspective, I have turned cautious on the company.

Weakness in Brand Oriented Advertising along with a stagnation in North America DAUs leading to a slowdown in Revenue growth

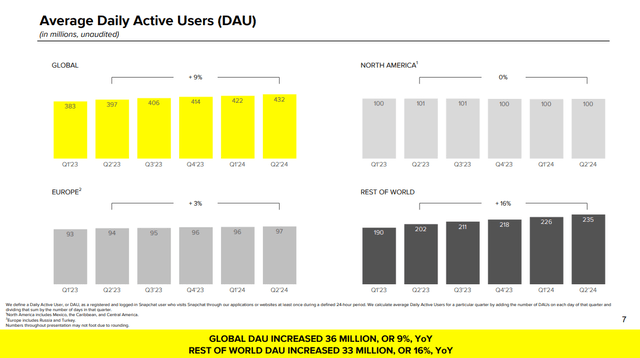

Snap reported its Q2 FY24 earnings in early August, where its revenue grew 16% YoY to $1.237B at a slower pace than the previous quarter and missed analyst estimates. Although the company saw a 9% YoY growth in its DAUs along with a management that sounded optimistic on the progress made on DR, where the total active advertisers more than doubled with momentum in their 7-0 Pixel Purchase Optimization coupled with Snapchat+ also reaching 11M subscribers, the company saw its brand-oriented advertising drop 1% YoY due to weakness in certain consumer discretionary verticals.

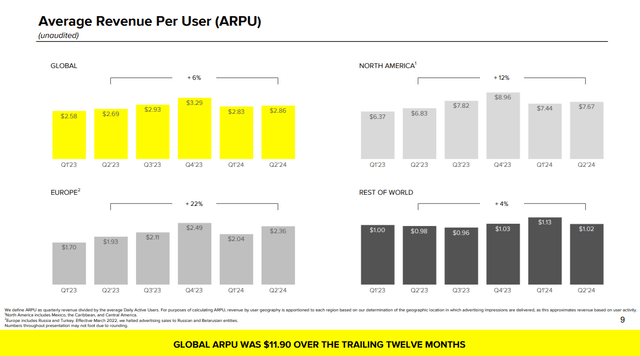

At the same time, when you take a deeper look at the data, Snap’s growth rate of DAUs in North America has stagnated at 0% YoY. While NA DAUs contribute approximately 23% to Total DAUs, with the remaining 77% of DAUs generated from Europe and the Rest of the World, I would like to point out that the NA DAUs carry a significantly higher weight when it comes to overall revenue contribution. In Q2, NA DAUs contributed over 62% of total revenue, with ARPU (Average Revenue Per User) growing 12% YoY. What we need to be paying attention to in the coming quarters is whether the stagnation of NA DAUs reverts back to growth because if it fails to, it will ultimately affect the growth rate of NA ARPU at some point, which will spell trouble for the overall top-line growth.

Q2 FY24Earnings Slides: ARPU Trend across geographies

The management remains committed to driving robust product innovation to boost user engagement and community

During the earnings call, the management reiterated their strategy to drive DAU growth and engagement by improving the way Snapchatters communicate by delivering a number of new communication features and user experience enhancements to better engage their users, such as Map Reactions, Editable Chats, and My AI Reminders, while simultaneously enhancing their iOS app performance to improve latency and camera quality. At the same time, the company is also investing in machine learning models to improve content ranking and drive personalization, which has resulted in global time spent watching content growing 25% YoY and 10% sequentially. Meanwhile, Snap is expanding their content supply by growing their creator community and working with publisher partners to bring targeted and engaging content such as Snap Nation, which is an evolution in their partnership with Live Nation (LYV) to give Snapchatters access to tour and festival experiences. Finally, when it comes to AR, the company saw Snapchatters sharing AR Lens experiences grow 12% YoY, driven by innovative GenAI Lenses and personalized AR experiences, while releasing Lens Studio 5.0, which will enable creators to generate Lenses using simple text prompts. With the Snap Partner Summit coming up on September 17, it will be important to understand how the company is driving its ongoing product innovation to build better engaged communities and power monetization opportunities. So far, we can see that its product innovations have translated into record high DAUs. However, investors will be watching for how the management maneuvers the issue of stagnating DAUs in NA, especially as its monetization of international DAUs is significantly lower than NA.

Q2 FY24 Earnings Slides: DAU Trend across geographies

Higher ROAS for advertisers should attract more advertisers and spend, thus completing the flywheel

Turning our focus to the advertising platform, which completes the flywheel from community to monetization, the company continued to make progress with its 7-0 Purchase Optimization Model while starting its testing with the Value Optimization Model, continuing to drive higher ROAS for advertising partners with improved privacy-centric signals and higher-performing ad formats. Simultaneously, for app-based advertisers, the company has invested to improve the entire stack while expanding their 7-0 Optimization, with early testing showing improved ROAS for advertisers. In addition, Snap continued to build compelling advertising products for their advertising partners, including AR advertising solutions to enable marketers to build engaging experiences and unlock higher performance. During the earnings call, the management sounded optimistic in terms of the progress that they are seeing with attracting SMB advertising partners, which has doubled on a year-over-year basis in Q2.

Pressures on gross margins, but operating profitability expands from superior cost management structures

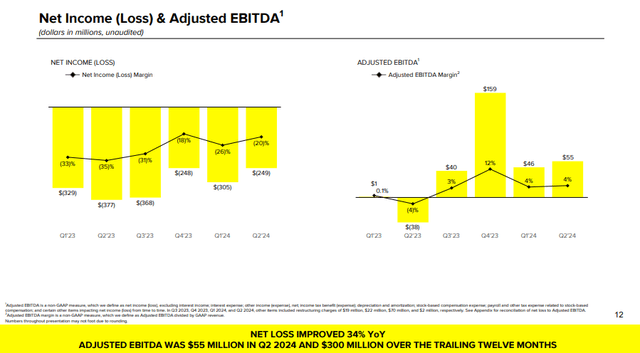

However, what is slightly concerning is that its cost revenue grew 19% YoY, at a faster pace than overall revenue growth, which squeezed gross margins on a GAAP basis. This was driven by higher infrastructure costs from the ramp in AI-related investments, with infrastructure costs per DAU growing from $0.80 in Q1 to $0.81 in Q2.

But what is also encouraging to see is that the company is prioritizing its operating profitability landscape as it continues to optimize their cost structure by streamlining their operating expenses by close to 8% on a GAAP basis. This resulted in an Adjusted EBITDA of $55M, which grew from a loss of -$38M in the previous year. While Adjusted EBITDA margin is still low at 4.4%, I believe their restructuring efforts should set them up for continued improvement in operating leverage as the year progresses. Furthermore, as the company sees an overall increase in ARPU, it further allows the management to better calibrate their investments to build a strong financial foundation and drive targeted innovation.

Q2 FY24 Earnings Slides: Expanding Adjusted EBITDA

Revisiting my valuation: Turning to a cautious buy

Looking forward, Snap expects its DAUs to grow 8.6% YoY to 441M in Q3, which would be a slight deceleration in pace from Q2 along with revenue, which will further slow down to a year-over-year growth rate of 13.9% to $1.355B. While the management remains focused on executing improvements to their advertising platform to drive strong performance to their advertising partners, Evan Spiegel said that their advertising business is growing slower than their competitors, which include Meta’s Instagram (META) and ByteDance’s TikTok. In the meantime, it expects its Adjusted EBITDA to grow approximately 112% YoY to $85M, which would represent a margin expansion of over 300 basis points year-over-year to 6.3%.

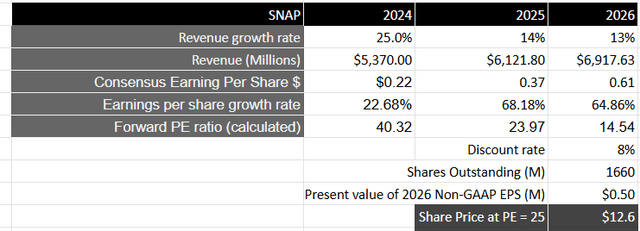

For the full year FY24, I will take the consensus revenue expectations into consideration, where revenue is expected to grow roughly 25% YoY. For the years after that, I will assume that revenue will grow in the mid-teens range, which sits within consensus estimates. Although I can see that there is opportunity for the company to continue driving innovation to better engage its user base while building better advertising solutions for its advertising partners, driving higher ROAS, a slowdown in expected revenue growth in the coming years would likely not be received by investors with enthusiasm, which could keep the stock under pressure.

From a profitability standpoint, I will take consensus estimates for non-GAAP EPS of $0.61 for FY26, which will be growing at a much faster rate than overall revenue growth as it unlocks higher operating leverage from streamlining its operating expenses and better monetizing its user base. This will be equivalent to a present value of $0.46 in non-GAAP EPS when discounted at 8%.

Currently, the stock is priced approximately at a price-to-earnings multiple of 15-16 for its projected FY26 earnings. However, when we look at the price-to-earnings multiple of the S&P 500, its 10-year average multiple is between 15 and 17, with the average growth rate of its earnings at 8%. This means that Snap is currently trading at par with the S&P 500 multiple when we take its FY26 projected earnings into account.

I believe that there is room for multiple expansion given the current set of assumptions to at least 1.5 times the multiple of the S&P 500, which will translate to a PE ratio of 25 and a price target of $12.6, representing an upside of at least 40% from its current levels.

My final verdict and conclusions

While I will maintain my “buy” rating on the stock given its upside potential, I have severely reduced the price target since my previous post. In my previous post, I had outlined that the stock had likely priced in the uncertainties from its North American market. However, as per its recent earnings call, we can see that the business outlook has gotten muddied. While DAUs have reached an all-time high, NA DAUs have stagnated. Simultaneously, revenue growth is also slowing, with brand-oriented advertising declining on a year-over-year basis, hurting NA ARPU growth rate. Furthermore, its Q3 guidance points to a further slowdown in the pace of revenue growth rate. While the company is trying to innovate by driving user engagement while simultaneously building its advertiser business to drive higher ROAS with the intent of attracting more advertising spend on the platform along with expanding profitability, the truth is investors have turned sour on the fact that its advertising business is not growing nearly as fast, thus losing market share to its competitors.

While I haven’t invested in the stock and won’t initiate a position at the moment, I can see that from a valuation perspective, the stock is extremely oversold at current levels with a strong near-term upside potential intact. As a result, I will maintain my “buy” rating for investors who may want to initiate a small position at current levels, but I will insist that from a sentiment perspective, I have turned cautious on the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.