Summary:

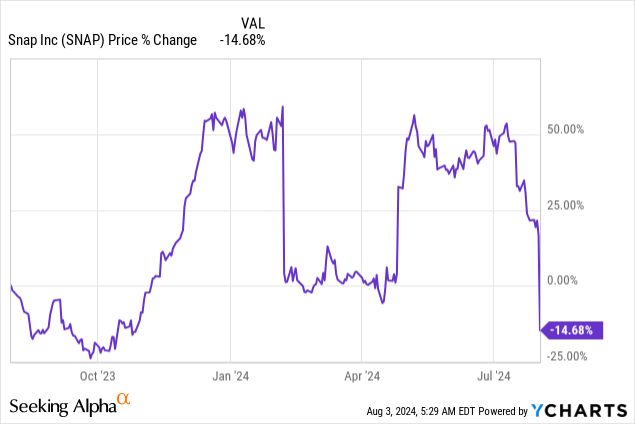

- Snap’s shares dropped 27% on Friday after a poorly received Q2 report.

- SNAP’s Q3 revenue guidance also disappointed, although the social media company only fell short of estimates by a small amount.

- Snapchat+’s momentum and monetization potential make Snap’s shares attractive for investors.

- Investors likely overreacted to the social media company’s Q2 report, in my opinion, and I see a short-term rebound as well as a long-term investment opportunity here.

Flashpop/DigitalVision via Getty Images

Shares of social media company Snap (NYSE:SNAP) tanked 27% after the company’s second fiscal quarter earnings report. Snap collapsed because of a relatively small revenue miss and a weak outlook for the third-quarter, but the market reaction seems widely out of proportion given the overall solid nature of Snap’s earnings report. Snap is making solid progress in growing its paid subscription service Snapchat+ and the social media company remained widely EBITDA-profitable. Snapchat+ momentum and a likely overreaction on the part of investors is why I maintain my strong buy rating for the social media company after the Q2’24 report.

Previous rating

Snap was a strong buy for me after the social media company’s shares plunged after its Q1’24 report. Snap has been good for sharp after-report stock prices moves, both the upside and downside, in the past. I believe Snap’s earnings report was not nearly as bad as the 27% price retreated indicated, and I see a contrarian buying opportunity here for investors. Snap made a lot of progress growing its Snapchat+ subscription service and now counts 11M paying subscribers in this offering.

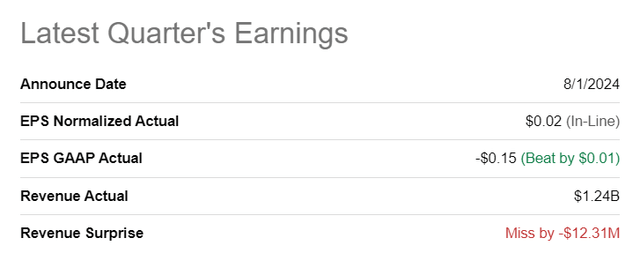

Mixed Q2 earnings

Snap’s adjusted EPS came in at $0.02 per-share in Q2’24 which was in-line with expectations. Revenues came in at $1.24B, missing top-line estimates by $12.3M.

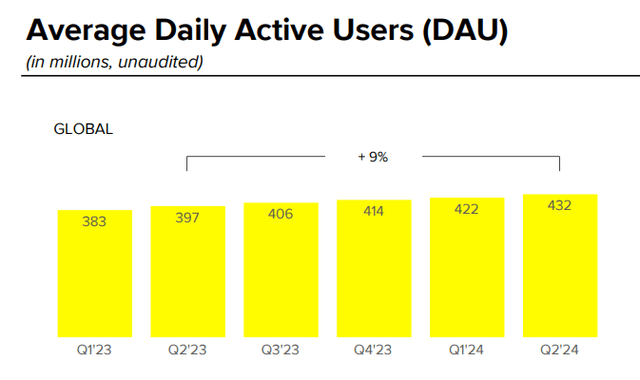

Continual momentum in DAUs, Snapchat+

Snapchat’s user base is growing, fast. The social media company added both users in core business, which is free, and in its paid subscriber model. As to the core platform, Snap added 35M new users to its business in the last year, which brought the customer total at the end of the June quarter to 432M (+9% year over year).

In the second quarter alone, Snap added 10M users, the majority of which were added in markets outside the U.S., Canada and Europe. Growth in users as well as increasing digital marketing spend resulted in a 16% Y/Y increase in Snap’s top line. For comparison, Meta Platforms, which reported blow-out Q2’24 results as well, saw a 22% year-over-year increase in its top line, driven by strong ad spending in the lucrative U.S. market.

Snap has suffered monetization challenges on its free platform for a long time, resulting in a multi-year streak of high operating losses. The core problem was that the social media company is very much focused on a younger demographic (mostly users below the age of 24) which don’t have a lot of disposable income. As a result, Snap chiefly monetized its users through brand deals with large advertisers, but this is changing as the company has rolled out its own paid subscription service called Snapchat+.

Snapchat+ gives users the ability to try out new products and features early, including Snap’s AI tech which has been quite a successful hook: Snapchat+ had 11M users as of the end of the June quarter, meaning the social media company added a solid 2M new subscribers to its paid subscription offer just in Q2’24.

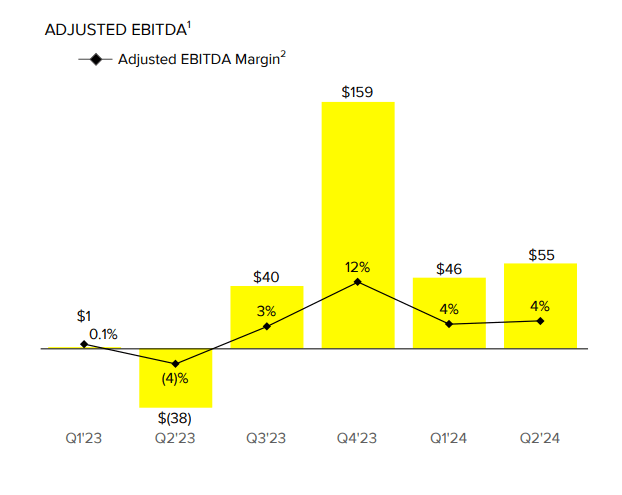

Besides positive Snapchat+ momentum, Snap has been solidly profitable on an adjusted EBITDA basis. In fact, in every single quarter in the last year, Snap has generated a positive EBITDA margin. The firm’s Q2’24 EBITDA even increased $9M quarter over quarter. While Snap’s paid subscriber trends and EBITDA growth on a Q/Q basis were positive takeaways, the revenue outlook for Q3’24 disappointed.

Snap

Overall solid Q3’24 revenue guidance

Investors have a tendency to overreact to Snap’s guidance, which is why the company’s shares have often reacted in such a volatile fashion when the company released its quarterly earnings. Snap guided for between $1.335B and $1.375B, which missed the consensus estimate of $1.36B by only $5M. Yet, shares dropped a massive 27% on Friday, which is an indication that investors overreacted to Snap’s guidance. Over time, I would expect shares to recover from this fear-driven sell-off, potentially allowing investors to earn double-digit returns.

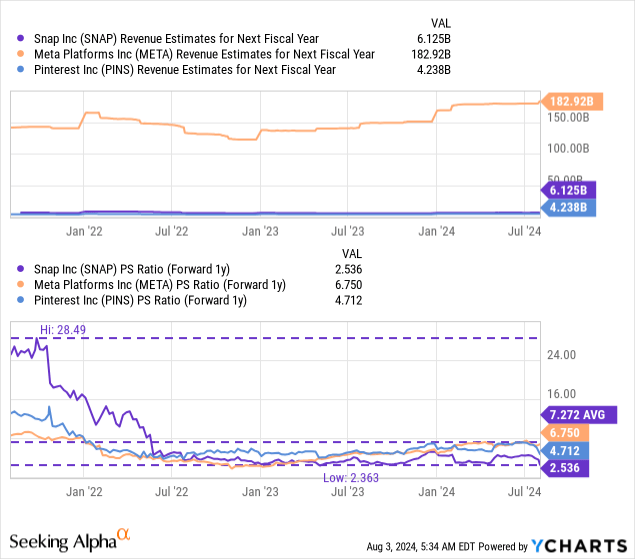

Snap’s valuation

Snap is valued highly based off of revenues, but shares almost look like a bargain compared to the company’s historical valuation. The average price-to-revenue ratio for Snap in the last three years was 7.3X… meaning investors are currently getting a 65% discount to the longer-term valuation average. Snap is not profitable, which sets the social media company apart from companies like Meta Platforms or Pinterest (PINS), both of which are generating positive earnings (including EBITDA). Meta Platforms benefits from growing ad spending, and its shares are extremely cheap when factoring in the company’s strong earnings growth.

The industry group average P/S ratio is 4.7X, so if the social media company were to start trading like its rivals, Snap may have a fair value closer to $18.50 per-share. Of course, Snap is not profitable and faced continual challenges in its business, such as its reliance on brand deals. However, user trends look like solid to me, both in the free and in the paid part of Snap’s business. In my last work on the social media platform in April, I derived at a fair value of $18.00, and I have not seen anything in Snap’s Q2 earnings release that would fundamentally justify a change in the company’s fair value.

Snap’s risks

Snap does still overly rely on brand deals, and its young user demographic can be seen as a negative for the platform from a short-term monetization perspective. On the other hand, Snapchat+ shows very promising momentum and subscription price increases could potentially boost this monetization opportunity for the social media company. Snap is still not profitable on a GAAP basis, and a lack of profitability may be a reason for the market to continue to shun Snap as a valid investment alternative to more established rivals such as Meta Platforms or Pinterest.

Final thoughts

Snap put up a solid earnings scorecard for the second-quarter and while the outlook for Q3’24 revenue came in slightly below expectations, the outlook was not nearly as bad as investors made it out to be. Shares of Snap should not have crashed 27% on what was mainly a solid earnings report. Positives were the continual momentum in Snapchat+ subscribers, DAU growth in the core free business and positive adjusted EBITDA. Because of the growth in users, both in the free and paid services, Snap was able to report a 16% jump in revenues year over year. Shares are not a total bargain, but can be acquired on the drop at a massive discount to the firm’s historical valuation average.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.