Summary:

- Snap reported better than expected results for Q3 FY24, with revenue and Adjusted EBITDA growing 15% and 230% YoY, respectively, leading to a jump of over 10% in after hours trading.

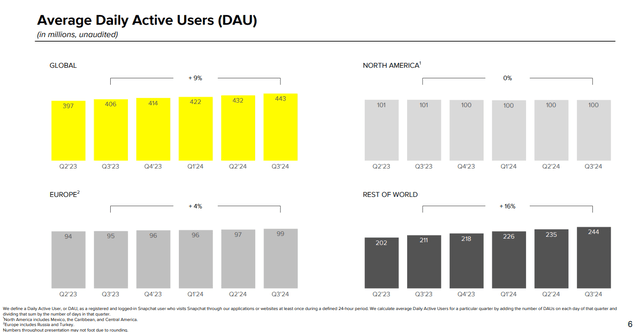

- Although the company posted its highest overall DAU’s, its North America segment remained unchanged, while Europe and Rest of World contributed a higher share of Total Revenue.

- Although Snap continued to innovate with the launch of Simple Snapchat to boost user engagement along with targeted AI and AR investments, its long-term business outlook remains muddied.

- As Snap faces stiffer competition, overall future revenue and earnings projections are trending down, with most of the upside from my previous “buy” rating already realized, making it a “hold”.

We Are

Introduction & Investment Thesis

I last wrote about Snap (NYSE:SNAP) in September, where I reiterated my “buy” rating despite severely reducing my price target of the stock, as I believed there to be an attractive tradeable bottom in the stock from a risk-reward perspective. However, I also cautioned longer-term investors that the company’s long-term prospects looked muddied as growth in its North America market had stagnated, along with weakness in brand-oriented advertising, resulting in it missing its Q2 FY24 revenue and earnings target.

Since then, the stock is up over 22%, outperforming the S&P 500 index.

However, I believe that most of the upside has now been captured, despite it beating its Q3 FY24 earnings, where revenue and Adjusted EBITDA grew 15% and 230%, respectively. While this may initially look optimistic given the company’s initiatives in deepening engagement in its community with the launch of Simple Snapchat, along with driving AI and AR (Augmented Reality) efforts to boost creator activity, its DAU’s (Daily Active Users) in North America showed no upward movement compared to the previous quarter.

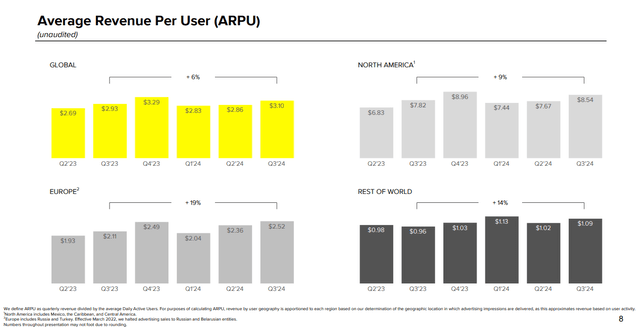

Although its Europe and Rest of World geographies are contributing to a higher share of overall revenue given accelerating DAU growth along with ARPU (Average Revenue per User), its North American segment continues to hold a significantly heavier weight when it comes to its contribution to overall revenue and ARPU.

Meanwhile, brand-oriented advertising continued to see weakness, while strength in DR (direct response) advertising continued with Active Advertisers doubling on the platform given the company’s innovations to drive superior return on ad spend.

However, when we take a look at the analyst estimates for future revenue and earnings growth, they continue to trend downward as the company faces stiff competition from Meta (NASDAQ:META), TikTok, and more.

Therefore, after assessing both the “good” and the “bad”, I have decided to downgrade the stock to a “hold” with a price target of $13.90, as I believe that most of the upside in the current rally is now over.

DAU’s reach an all-time high as Snap invests in AI and AR to boost community engagement

Snap reported its Q3 FY24 earnings, where revenue grew 15% YoY to $1.373B, beating estimates, with DAU’s growing 9% YoY to 443M as the company continued to prioritize growing its community and improving depth of engagement, with total time spent watching content growing 25% on a year-over-year basis.

Q3 FY24 Earnings Slides: DAU’s reach an all-time high, but NA DAU’s have stagnated

In Q3, Snap introduced a simplified version of Snapchat that is organized into three core experiences that include 1) communicating with friends, 2) using the camera, and 3) watching entertaining content, thus providing Snapchatters with a more personalized experience. So far, 10M Snapchatters are using Simple Snapchat, which is driving the “greatest content engagement gains” with increased time spent with content, increased story views, and more replies to friends’ stories, according to management commentary during the earnings call.

At the same time, Snap continued to innovate with AI, where it introduced it in Snapchat Memories to allow Snapchatters to share AI-generated collages and video mashups with friends, while simultaneously announcing a strategic partnership with Google Cloud (NASDAQ:GOOG) to leverage Gemini to power their AI-powered chatbot, My AI, with the number of Snaps sent to My AI tripling quarter over quarter in Q3. Furthermore, the company is also investing in ML (machine learning) models to improve the ranking and personalization of their Spotlight recommendation system, while deploying multi-modal ML models to enhance recognition of video, text, and audio in content submitted by creators, leading to creators posting content growing by 50% YoY, along with the number of people sharing Spotlight content with friends up more than 60% YoY in Q3.

Finally, the company continues to invest in its AR platform as it executes towards its long-term vision by introducing the fifth generation of Spectacles, powered by SnapOS, which will enable developers to use Lenses and create new experiences for the community. With over 375,000 AR creators that have built over 4M Lenses, Snap rolled out new genAI features in Lens Studio that will make it easier to bring creativity to life with features such as Animation Blending, Body Morph and more.

Total Active Advertisers doubled YoY with outperformance in DR. Weakness in Brand Advertising continued.

Shifting our focus to user monetization through its advertising platform, the company saw its ARPU grow 6% YoY to $3.10. While North America continued to contribute over 62% to Total Revenue, with ARPU that is significantly higher than Europe and Rest of World, it is growing at the slowest rate out of all the geographies. Meanwhile, the share of Total Revenue from Europe and Rest of World continued to grow on a year-over-year basis to 37%, compared to 33% a year ago, as DAU’s and ARPU are growing at a faster rate in these regions compared to North America.

Q3 FY24 Earnings Slides: Trend of ARPU growth across geographic segments

Meanwhile, the company continues to make progress on driving better performing ad formats to deliver improved campaign performance for their advertising partners and help shift more advertiser spend on the platform over time. So far, the expansion of 7-0 Pixel Purchase Optimization has driven 24% and 27% decreases in cost-per-install and cost-per-purchase, respectively, compared to 28-1 Optimization, with demand for 7-0 Pixel Optimization up more than 160% YoY. With continued improvements to the DR advertising business where they announced two new ad placements to help their advertising partners expand their reach with Sponsored Snaps and Promoted Places during their Partner Summit, they have seen total active advertisers double on a year-over basis in Q3.

I would also like to point out that Snap is also focused on accelerating its revenue growth from its Snapchat+ subscription business, with revenue and subscribers doubling year-over-year in Q3 to $123M and 12M users. While still a small percentage, the contribution of revenue from Snapchat+ now stands at close to 9% and is acting as an important revenue diversifier for the company.

However, brand-oriented advertising continued to face pressure, similar to the previous quarter, with revenues down 1% YoY as demand from select consumer discretionary verticals, including technology, entertainment, and retail, was weak.

Focus on a leaner organizational structure to drive profit margin expansion.

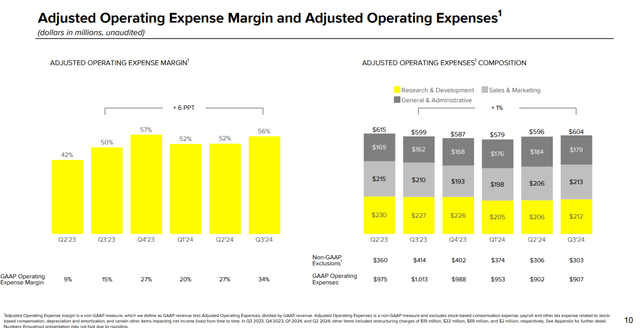

In terms of profitability, Snap was able to hold its Adjusted Gross Margins steady at 54%, despite a 16% YoY increase in Adjusted Cost of Revenue from growing infrastructure costs due to the large ramp in ML and AI investments over the past year. In the meantime, Snap generated an Adjusted EBITDA of $132M in Q3, which grew over 230% YoY, with a margin expansion of 700 basis points to 10%. This was driven by a combination of stronger than expected revenue growth as well as operating expense discipline, with Adjusted Operating Expenses growing just 1% driven by a decline in full-time headcount as the company prioritizes a leaner organizational structure to direct strategic investments towards top-line growth.

Q3 FY24 Earnings Slides: Streamlining operating expenses to expand profitability

Stagnation in North America continues, while competition gets fiercer.

Similar to my previous post, the growth rate of DAU’s in North America remained stagnant, growing 0% YoY, with no momentum on a sequential basis either. Although Europe and Rest of World are driving a higher share of DAU’s, with accelerating ARPU’s, given the 62% contribution to the topline from North America, a stagnation in DAU’s is not good news over the long term.

Furthermore, Snap faces stiff competition from Meta’s Instagram and ByteDance’s TikTok, which are growing at a faster rate than Snap despite its robust product innovation to boost user engagement on the platform and building bottom-of-the funnel advertising solutions to drive a higher return on ad spend. At the same time, Meta also dropped some serious AI heat at its Meta Connect 2024 event, with Meta’s Ray Bans getting improved AI updates, making it more conversational, memory-enabled, action-oriented, multimodal, and responsive in real time, while also revealing Orion in its experimental stage that will overlay actual holograms onto the physical world using cutting-edge optics, custom silicon, and compact power solutions. This is indicating that competition is about to get fiercer from its current levels, and if Snap is unable to attract advertiser spend on the platform given its size relative to its competitors, it might lose market share in the future.

Revisiting my valuation: The size of upside has shrunk since my last writing.

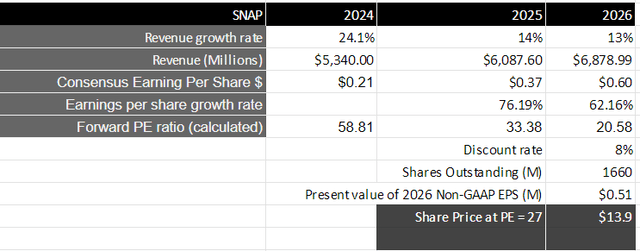

Looking forward, Snap expects to grow its DAU’s at approximately the same rate of 9% YoY to 451M in Q4, given the potential for Simple Snapchat, Sponsored Snaps, and Promoted Places to contribute to top line growth, along with its innovation in AI and AR to boost creator activity and lower funnel advertising solutions such as 7-0 Pixel Optimization to drive a higher return on ad spend and user monetization. At the same time, management also anticipates higher upper funnel advertising from large enterprise clients in Q4, driven by seasonality factors. Taking all of this into account, management has guided for Q4 revenue of $1.510-$1.56B, representing a year-over-year growth rate of 11-15%. For the whole year FY24, this will translate to a year-over-year growth rate of 24.10% to $5.34B. Assuming that Snap is able to grow its revenues in the mid teens over the next two years as per consensus estimates, it should generate a total of $6.78B.

From a profitability standpoint, Snap is estimated to generate an Adjusted EBITDA of $235M, which will represent a year-over-year growth of approximately 48% with a margin expansion of 330 basis points to 15.3%. For the full year FY24, taking the analyst estimates for non-GAAP EPS of $0.21 along with FY25 and FY26 projections of $0.37 and $0.60, we can see that it will be growing at a much faster rate than overall revenue growth as it unlocks higher operating leverage from streamlining its operating expenses and better monetizing its user base. This will be equivalent to a present value of $0.49 in non-GAAP EPS when discounted at 8%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15-18, I believe that Snap should trade at 1.5-1.6 times the multiple, given the growth rate of its earnings during this period of time. This will translate to a PE ratio of 27, or a price target of $13.90, which represents an upside of 12% from its current levels after the stock rose 13% after the earnings call.

Author’s Valuation Model

My final verdict and conclusion

Since the time of my previous writing, the stock is up more than 22%, beating the S&P 500 index. In my previous post, I had outlined that I had severely reduced my price target with an uncertain business outlook with stagnation in North American markets, weakness in brand-oriented advertising, and increasing competitive pressures. Yet, I maintained my “buy” rating as I believed that the stock presented a likely candidate for a short-term trade given the risk/reward, as pessimism was overdone.

Although Snap reported better than expected revenue and earnings growth in Q3, leading to the afterhours jump in the stock price, I believe that the rally has mostly run its course, as its long-term picture has still not materially improved, as per management guidance. What is also concerning is that its longer-term revenue and earnings projections continue to get revised downward despite the company investing in its product innovation to boost user engagement and build targeted advertising solutions to drive superior advertiser outcomes and user monetization. The growth rate of DAU’s in North America remained stagnant, while weakness in brand-oriented advertising persisted, even though overall DAU’s reached an all-time high, driven by growth in its Europe and Rest of World geographies. While innovations such as Simple Snapchat may reignite the growth rate of DAU’s in North America, along with several lower funnel solutions that can drive higher advertiser spend, I believe the stock is no longer as attractively priced as it was back in early September.

As a result, I am downgrading the stock to a “hold” with a price target of $13.90.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I am Amrita and I write primarily about growth software stocks.

I recently joined The REIT Forum and if you are looking for more investment ideas like this one, get them exclusively at The REIT Forum with access to our subscriber only portfolios.