Summary:

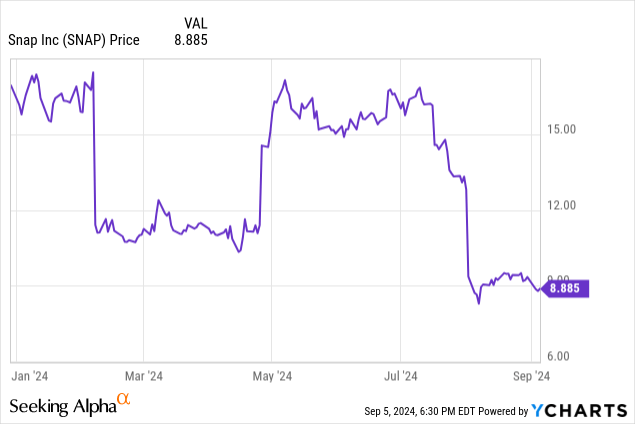

- Shares of Snap have fallen substantially after reporting Q2 results, meriting addition to your watch list.

- Year to date, the stock has nearly fallen 50%, wiping out more than $10 billion of market value.

- Despite competition and macroeconomic challenges, Snap shows promise with user growth in developing markets, new ad formats, and improved profitability.

- The stock is now trading at <3x forward revenue. Due to its drastically reduced valuation, I'm upgrading Snap to neutral.

J Studios/DigitalVision via Getty Images

The fact that the market is near all-time highs amid the potential for a U.S. recession later this year is a trigger, in my view, for investors to rotate more of our portfolios away from winners and more toward rebound value-oriented plays. And now toward the end of the Q2 earnings season, we’ve seen many companies tilt from winners to losers in the blink of an eye.

Snap (NYSE:SNAP) has been one of these unfortunate companies. The disappearing-chat company has been plagued by both slowing user growth and weaker advertising demand. The company tumbled sharply after reporting dismal Q2 results, causing the stock to fall nearly 50% YTD.

I last wrote a bearish note on Snap in June when the stock was trading closer to $17 per share, at the time arguing that the company’s lackluster user trends, particularly in the U.S. would threaten its rally. Fast-forward to today, when the stock is substantially lower, and its new valuation warrants a change in tune. I’m upgrading Snap to a neutral rating and recommending that investors add this name to their watch lists.

Yes: there are risks to acknowledge here. Competition is a major factor: the company is a social media outlet after all, and it’s heavily prone to being a victim of passing fads. Alternative social media platforms like Reddit (RDDT), in particular, have been gaining plenty of steam – Reddit in particular is planning a big international push from using AI to machine translate its content into foreign languages. Against this backdrop, Snap’s user traction is slowing, at the very same time that a poorer macro outlook is dampening advertiser demand.

And yet at the same time, there are upside drivers to be aware of:

- Snap is growing users and monetization at a rapid clip in developed markets. Though it is true that Snap’s user growth in developed markets has slowed down considerably, the company is managing double-digit DAU growth in the “Rest of World” segment while also simultaneously improving ARPUs.

- Experimenting with new ad formats to drive better engagement. The company is consistently A/B testing new approaches for advertising and new ad placements to drive better engagement as well as advertiser demand. We note as well that the company’s subscription service, the $4/month Snapchat Plus, continues to grow.

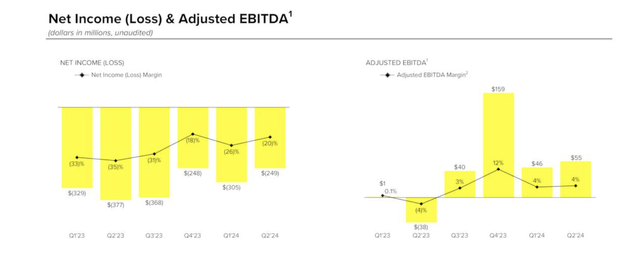

- Profitable. Snapchat is dramatically improving its adjusted EBITDA, the result of both continued advertising revenue growth (despite nearer-term headwinds) as well as headcount reductions made over the past few years.

With all this in mind, it’s a great time to add Snap back to your watch list.

Q2 download

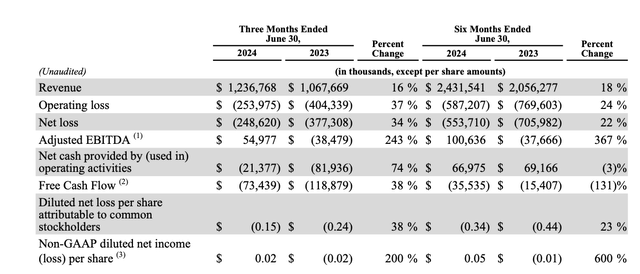

Let’s now go through Snap’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Snap Q2 highlights (Snap Q2 earnings deck)

Snap’s revenue grew 16% y/y to $1.24 billion, missing Wall Street’s expectations of $1.25 billion (+17% y/y) while also decelerating from Q1’s 21% y/y pace by a huge five-point margin – hence investors’ skittishness on Snap post-Q2 earnings.

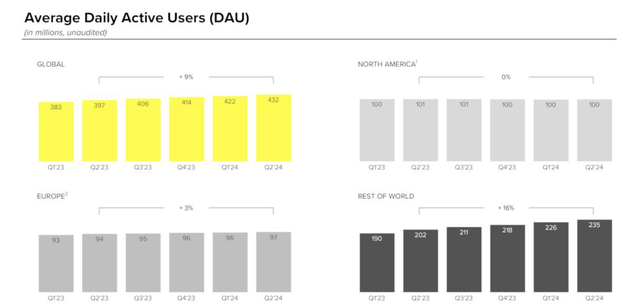

One of the core issues here is a slowdown in users: particularly in North America. On a year-over-year basis, the company’s 100 million users actually declined by a fractional amount.

Snap DAU trends (Snap Q2 earnings deck)

The good news: the company noted that several feature additions have helped turn user engagement trends around in the region. Per CEO Evan Spiegel’s remarks on the Q2 earnings call:

For example, in Q2, we introduced Map Reactions that enable Snapchatters to send their favorite emojis to friends on the Snap Map to start conversations. We also launched Editable Chats, which allow Snapchatters to edit messages up to five minutes after sending them, and My AI Reminders that give Snapchatters the ability to ask for a reminder for an upcoming deadline.

In addition, we are investing to enhance iOS app performance by making improvements to battery management, app and screen loading latency, and camera quality. We are also leveraging machine learning and generative AI to help our community form meaningful connections and to deliver engaging product experiences. These improvements have contributed to all-time highs in the number of daily active users sending Snaps in every region, which is an important input to sustained daily engagement.

The results of these initiatives are reflected in our global community reaching 432 million Daily Active Users in Q2, an increase of 10 million quarter-over-quarter. Daily Active Users in North America was 100 million, down by less than 1% year-over-year, but up quarter-over-quarter as our initiatives to improve the way Snapchatters communicate begin to show early signs of progress.“

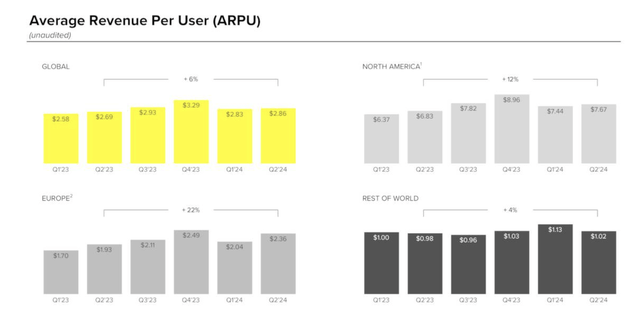

Growth in ARPU was the main driver of revenue growth in the quarter. Globally, ARPU advanced 6% y/y to $2.86. What will be key to watch, however, will be the company’s ARPU expansion in the “Rest of World” region, which at $1.02 on a nominal basis is less than a fifth of what a user in North America generates.

Snap ARPU trends (Snap Q2 earnings deck)

This, to me, is the biggest risk that Snapchat faces: with over 100 million users, Snap is already penetrated into over a quarter of the total U.S. and Canada population – and with new social media apps constantly on the rise, it’s unlikely that Snap will find many more greenfield growth opportunities in its most lucrative region. The company will have to better monetize its Rest of World region, which is where currently user growth is concentrated.

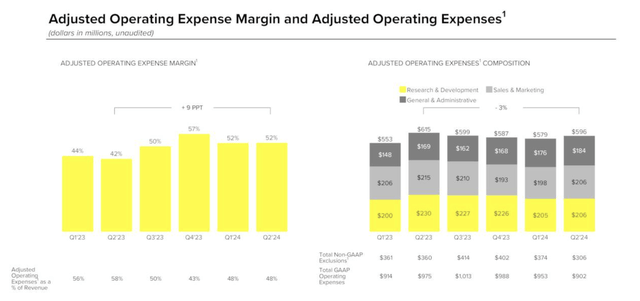

At least on the expense front, the company is keeping a tight rein. Operating expenses adjusted for stock comp actually fell -3% y/y to $596 million. This, in turn, has helped boost adjusted operating margins to 52%, up nine points y/y.

Snap opex (Snap Q2 earnings deck)

In turn, adjusted EBITDA also jumped to $55 million, at a 4% margin: up eight points y/y.

Snap adjusted EBITDA (Snap Q2 earnings deck)

Valuation and key takeaways

What makes Snap most appealing after the recent drop is its valuation. At current share prices near $9, the company trades at a market cap of $14.72 billion. After we net off the $3.08 billion of cash and $3.64 billion of convertible debt on the company’s latest balance sheet, the company’s resulting enterprise value is $15.28 billion.

Meanwhile, for next fiscal year FY25, Wall Street analysts are expecting Snap to generate $6.09 billion in revenue, or 14% y/y growth. And if we conservatively peg the company’s adjusted EBITDA margin at 6% (in line with the company’s TTM margin, assuming no further improvements), adjusted EBITDA would be $365.4 million.

This puts Snap’s valuation multiples at:

- 2.5x EV/FY25 revenue

- 42x EV/FY25 adjusted EBITDA

For a company that is still seeing high-teens revenue growth and has a path to further monetization in the faster-growing Rest of World region, and with profitability improvements under the hood from ongoing efficiency measures, I’d say there’s a case to be made for buying Snap on the dip, especially at a <3x forward revenue multiple.

Watch for an opportunistic entry point around $8.25-$8.50 here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNAP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.