Summary:

- Snap’s stock has shown significant gains, with a potential for further appreciation.

- The company’s strong Q1 earnings and growth prospects make it an attractive investment opportunity.

- Snap’s unique position as a favored social media platform among young people and its AI potential contribute to its appeal.

Tim Robberts/DigitalVision via Getty Images

We discussed buying Snap Inc. (NYSE:SNAP) shares “on the cheap” in the $10-$12 range. Snap’s stock cratered following the company’s Q4 results in early February. I entered Snap in two tranches with an average buy-in price of around $11 and have been very happy with my investment, as we may have nailed Snap around another long-term low.

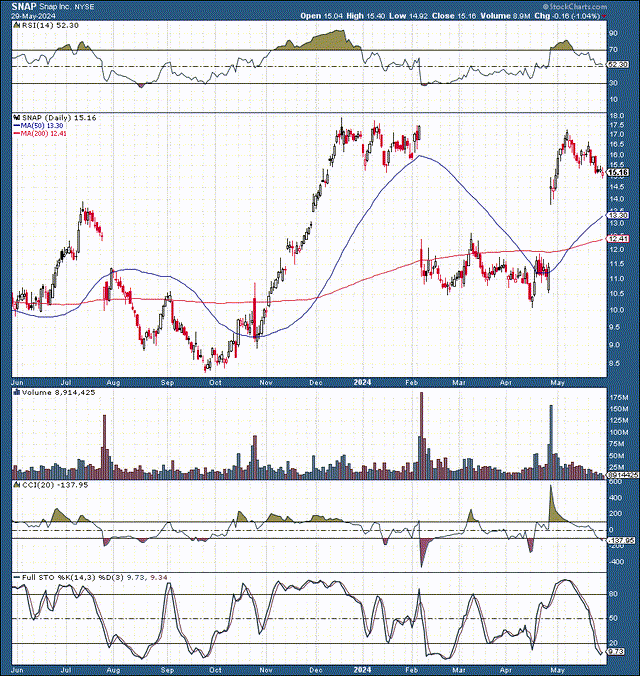

Snap: 1-Year Chart

SNAP (stockcharts.com )

Snap’s stock surged by about 25% following its better-than-anticipated Q1 earnings announcement. However, total gains have been much more significant, as Snap surged by about 75% from its recent low of around $10 to its near-term high around the $17.50-$18 resistance range. Even with the pullback to $15-$15.50, my Snap position is up by around 40%.

Moreover, Snap is currently at an attractive buy-in level, aligning with the $14-$15 support. Technical indicators such as the CCI, full stochastic, and others signal that Snap is becoming oversold, presenting a favorable buying opportunity. This should instill confidence in your investment decision, even if you’re concerned about Snap filling the $12-$14 gap.

From a fundamental standpoint, Snap appears highly attractive. It reported much better than expected earnings, indicating a strong growth trajectory. Thus, we don’t need to see the gap fill from the recent post-earnings surge. Snap’s growth and profitability prospects are improving faster and more than anticipated, providing a reassuring outlook for the future.

Moreover, Snap should benefit from the increased ad spending as the Fed cuts rates and the economy enters a higher growth phase. Snap should also benefit from the tailwinds provided by AI, and it appears to be an underrated AI play right now.

Snap is also one of the only capable social media companies left outside of Meta’s social networking monopoly and could be a takeover target for one of the big tech firms. Snap is also cheap at about four times next year’s sales, and I like Snap as a long-term investment, as Snap’s stock has a high probability of appreciating considerably in future years.

Snap Delivers – More Upside Likely Ahead

There’s a reason why we witnessed a 25% post-earnings surge and a 75% trough-to-peak gain in Snap’s stock recently. Snap’s earnings came in much better than anticipated, providing a constructive image concerning future guidance and general prospects for Snap as we advance.

Snap reported non-GAAP EPS of $0.03 in Q1, beating the consensus estimate by 8 cents (a considerable beat). Snap’s revenue of $1.19B also beat estimates by $70M, increasing by over 20% YoY. Q1 DAUs came in at 422 million, an increase of 39M, a 10% YoY increase.

The time spent watching “Spotlight” content increased more than 125% YoY. Snapchat+ subscribers more than tripled YoY to over 9 million subscribers in Q1. The number of small/medium-sized advertisers increased by 85% YoY.

For Q2, Snap guided to revenues of $1.225B to $1.255B, vs. the $1.21B consensus estimate, suggesting YoY sales growth of 15% to 18%. Given the sales forecast range, Snap expects adjusted EBITDA to be $15-$45M in Q2.

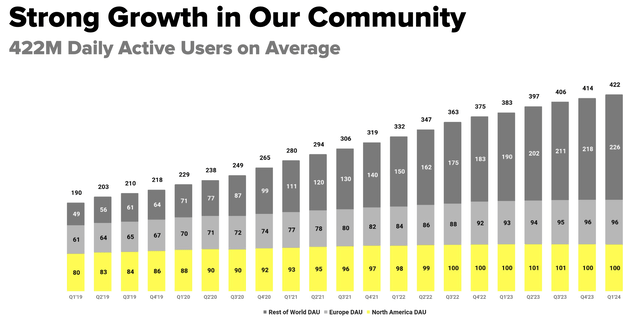

Daily Active Users Keep Growing

DAUs (investor.snap.com)

Snap reported 422M DAUs in its latest quarterly earnings announcement. While DAU growth has stagnated in Europe and North America, global DAUs continue climbing and should continue increasing. There are over five billion internet users globally, illustrating that Snap only has about a 7.9% penetration rate globally. Also, we could see accelerated growth in North America and Europe as the company moves forward.

Snap – The “Young People’s” Platform Of Choice

Snap is unique because it is the favored social media platform among young people, who are early adopters and could become lifelong users of Snap, implying its DAU count can go much higher. Remarkably, Snapchat reaches 90% of the 13 to 24-year-old population and 75% of the 13 to 34-year-old population in more than 25 countries. This dynamic implies we can see continued growth in developed markets and globally as more people come online and become users of Snap.

Snap – Becoming Increasingly Profitable

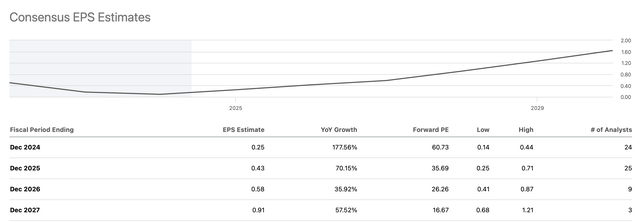

EPS estimates (seekingalpha.com)

Snap’s profitability is improving faster than anticipated. Consensus estimates are for EPS of $0.25 this year and $0.43 next year. However, given Snap’s tendency to outperform, Snap could achieve EPS closer to the higher-end estimates in future years.

Snap has missed EPS estimates in only one of its last twenty quarters. Moreover, while the TTM EPS estimates were for -$0.08, Snap brought in 11 cents more instead, illustrating considerable outperformance over the forecast that could persist in the coming quarters.

My projections imply that Snap has the potential to earn around $0.35-$0.40 this year and $0.60-$0.70 next year. This suggests that despite its current stock price of around $15, Snap could be trading at just 20-25 times next year’s EPS projections, making it an exceptionally affordable investment for a company poised for significant growth.

Furthermore, Snap is not only expanding revenues—it delivered about $4.6B last year—but it also has the potential to increase sales to about $5.5B this year and roughly $6-$6.5B in 2025.

Considering Snap’s current low valuation, trading at only 4x forward sales, and its tremendous growth potential, Snap presents a compelling investment opportunity. In fact, Snap appears to be a more affordable choice compared to Meta (META), which is now trading at about 7x forward sales, making it an attractive opportunity for investors.

Snap’s AI Potential

Snapchatters now have the My AI Chatbot. My AI can answer many questions (trivia and others), offer advice on the perfect gift for your girlfriend/boyfriend, help plan a trip for the weekend, or suggest what to make for dinner or eat for lunch. Moreover, Snap can leverage AI to improve the customer experience, increase ad spending, and optimize efficiency, leading to increased profitability in future years.

One Of The Only Alternatives Still Standing

Snap is one of the only formidable social networking platforms still standing outside of Meta’s social media “monopoly.” This dynamic makes Snap a highly valuable company, and its value may move substantially higher than its current depressed $25B valuation. Moreover, as Snap becomes increasingly profitable, it could become a takeover target for one of the tech giants that may want to increase their presence in the social media/networking space.

The Bottom Line: Snap Is A Strong Buy Here

Snap is often underrated and undervalued by the market. Snap went through a challenging phase as ad spending declined due to high interest rates and a slow economic period. However, growth is picking up, things are bouncing back, and Snap’s sales could go much higher. The social networking platform continues to experience growth, especially among young people. Furthermore, Snap is becoming increasingly more profitable, recently delivering another solid earnings announcement. Snap is relatively cheap, has considerable AI potential, and could become a takeover target. Snap’s profitability should strengthen, leading to a substantially higher stock price in the coming years.

Where Snap’s stock price could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $5.4 | $6.4 | $7.3 | $8.1 | $9 | $9.9 | $11 |

| Revenue growth | 17% | 18% | 14% | 11% | 11% | 10% | 10% |

| EPS | $0.35 | $0.65 | $0.85 | $1.10 | $1.38 | $1.65 | $1.95 |

| EPS growth | 288% | 86% | 31% | 29% | 25% | 20% | 18% |

| Forward P/E | 30 | 31 | 32 | 33 | 32 | 31 | 30 |

| Stock price | $20 | $27 | $35 | $45 | $53 | $61 | $69 |

Source: The Financial Prophet

I’ve slightly increased my long-term EPS estimates from my previous analysis due to Snap’s improving fundamental setup, increasing AI potential, and other variables. Given its current low price of just around $15, Snap’s stock has the potential to move considerably higher with relatively modest increases in sales, earnings growth, and multiple expansions in the years ahead. Therefore, Snap may be an underrated investment opportunity and is an excellent buy-and-hold contender for the next decade.

Risks To Snap

Snap faces numerous risks despite my bullish thesis. We should consider the potential impact of an economic slowdown and possible declines in ad spending. Snap is especially vulnerable to decreases in ad spending, and a higher interest rate for a more extended regime may harm Snap’s bottom line. Snap also faces competition from Meta, TikTok, and other social media/networking platforms. Snap must also maintain its user growth and should work to expand ARPUs, especially in the secondary markets in which it has growth potential. Snap also risks posting worse or slower-than-expected profitability and slower-than-anticipated revenue growth. Investors should examine these and other risks before investing in Snap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!