Summary:

- Snap reported weak Q2 results, with poor advertising revenue growth leading to a significant stock price decline.

- While Snap attributed weakness to market conditions, there appears to be company-specific issues.

- Outside of Snap’s soft growth, profitability is improving, even if efficiency remains a concern. The current situation could spur Snap to further reduce excessive R&D spend.

hocus-focus/iStock Unreleased via Getty Images

Snap (NYSE:SNAP) reported extremely soft second quarter results and was appropriately punished by the market. It could be argued that the stock actually escaped lightly given how poor advertising revenue growth was though. Snapchat+ strength may have softened the blow for investors, although I question whether subscriptions will ever be more than a niche part of the business.

I previously suggested that Snap had been unfairly maligned by investors and that accelerating growth should be supportive of the company’s share price, despite having reservations about the company’s efficiency. The stock is now down over 40% since then, primarily due to unexpectedly weak advertising revenue growth. The stock is now more reasonably priced, but a global recession looks imminent, and this would likely result in a significant share price decline from current levels.

Market Conditions

Snap attributed much of its weakness in the quarter to a difficult brand advertising environment within certain consumer discretionary verticals (retail, technology, and entertainment). While macro weakness may have been a contributor to Snap’s poor performance, there are clearly company specific issues.

Most other digital advertising companies have reported fairly solid earnings in the second quarter. While growth is generally expected to slow later in the year, this is mainly the result of comparable periods in 2023 becoming more difficult as the year progresses.

Snap should be capturing ad spend migrating off of Twitter and improved targeting and attribution capabilities should be supporting a rebound in advertising revenue growth. The fact that this isn’t occurring, despite the macro environment remaining stable, is a concern.

With a range of leading economic indicators suggesting that the global economy is now teetering on the edge of recession, Snap’s current woes could be exacerbated by a significant drop in ad spend going forward.

Snap Business Updates

Snap continues to make incremental updates to its app, including:

- Editable chats

- Map emoji reactions

- My AI reminders

Snap also renewed some of its sports partnerships to provide content across Stories and Spotlight, which is supportive of engagement. In addition, Snap continues to invest in machine learning to improve content ranking and personalization. Content viewers increased 12% YoY in Q2, while time spent watching content increased 25%.

The company has also partnered with Live Nation to provide users with access to tour and festival experiences. These types of initiatives are a positive, and highlight Snapchat’s differentiation, but they are unlikely to meaningfully impact the company’s financials in the near term. It also remains questionable whether Snap’s enormous R&D investments are creating sufficient outcomes.

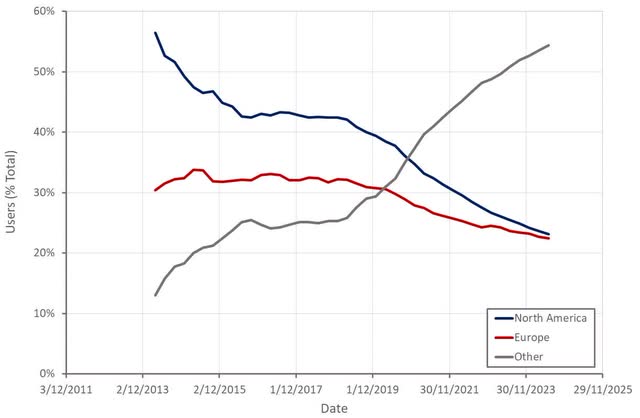

In addition, Snap has introduced new features to help protect users, including expanded in-app warnings, enhanced friending protections, simplified location-sharing, and blocking improvements. This is an interesting development as Snap’s relatively young user base could be vulnerable to aggressive regulators, something I have previously highlighted. Snap serves more than 75% of 13 to 34-year-olds in over 25 countries, although approximately 80% of Snapchatters are over the age of 18.

Snap also continues to improve its advertising solutions. Brands are now able to utilize Generative AI to create custom sponsored AR Lenses. Snap also made ad format enhancements and streamlined the app download experience for app-based advertisers, with initial testing demonstrating improved ROAS.

Snap’s direct response advertising business was a bright spot in the second quarter, although growth still appeared weak relative to social media peers. Growth in SMBs contributed to Snap’s active advertiser base more than doubling YoY in Q2. Conversions API integrations also increased more than 300% YoY.

Financial Analysis

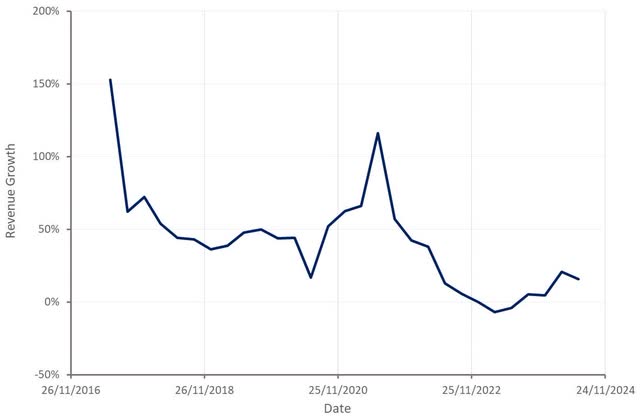

Snap’s revenue increased 16% YoY in the second quarter to 1.24 billion USD. Advertising revenue was 1.13 billion USD, up 10% YoY, with direct response advertising increasing 16% and brand-oriented advertising down 1%. Other revenue increased 151% YoY to 105 million USD, driven by Snapchat+ subscription revenue. Snapchat+ reached 11 million subscribers in the quarter.

Snap is guiding to 1.335-1.375 billion USD revenue in the third quarter, representing a 12-16% YoY growth rate. Guidance assumes approximately 441 million DAUs. While this guide appears weak, much of the weakness comes from comparable periods in 2023 becoming more difficult as the year progresses.

Figure 1: Snap Revenue Growth (source: Created by author using data from Snap)

Snap had 432 million DAUs and 850 million MAUs in the second quarter, with DAUs increasing 9% YoY. While this is a positive, user growth continues to be driven by international markets with low ARPUs, which does little for revenue growth and pressures margins in the short term.

Figure 2: Snap Users by Region (source: Created by author using data from Snap)

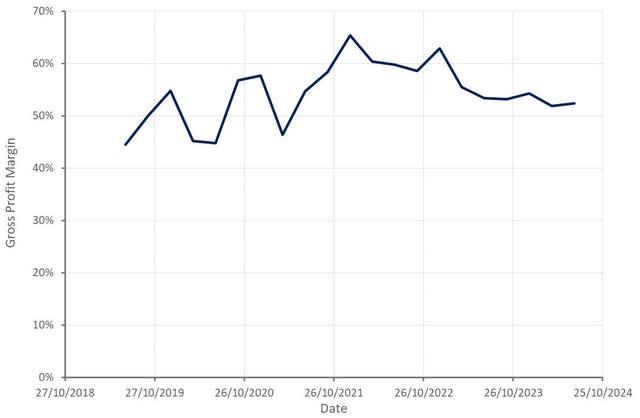

Snap’s adjusted cost of revenue increased 19% YoY in Q2, as a result of AI investments increasing infrastructure costs. Infrastructure cost per DAU was 0.81 USD, up slightly sequentially but below expectations. This was attributed to engineering efficiencies and a more moderate ramp in AI investments. Given advertising weakness and growth in international users, it is difficult to see gross margins rebounding in the near term.

Figure 3: Snap Gross Profit Margin (source: Created by author using data from Snap)

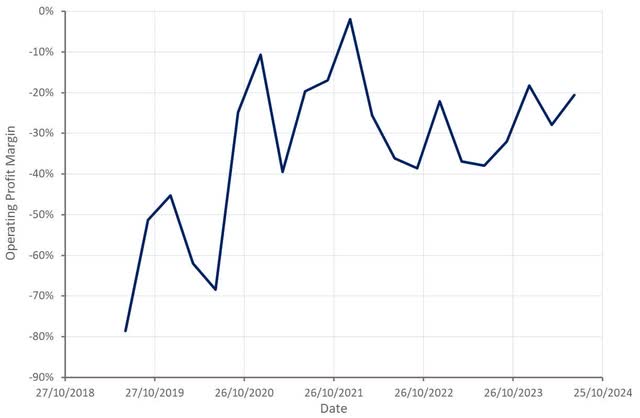

Adjusted operating expenses declined 3% YoY in Q2, driven by a 12% decrease in personnel costs, which was partially offset by increased legal expenses.

Despite gross margin headwinds, Snap’s bottom line has been slowly improving, which may be the most positive aspect of the company at the moment. Snap’s compensation expenses remain high, and the company continues to invest an enormous amount in R&D with questionable outcomes. If Snap is forced to become genuinely disciplined, it could be in a position to begin returning serious amounts of capital to investors. It is unclear what could catalyze this at the moment though.

Figure 4: Snap Operating Profit Margin (source: Created by author using data from Snap)

Snap’s share count increased 1.9% YoY in Q2, down from 3.8% in the prior quarter. Since Q3 2022, Snap has repurchased 151.5 million shares at an average price of 9.91 USD per share. Snap issued 750 million USD in convertible notes maturing in 2030 in the second quarter. The company also repurchased 386 million USD of convertible notes and unwound capped calls associated with its 2025 convertible notes. Snap now has 3.1 billion USD in cash and marketable securities on its balance sheet, with limited debt maturing until 2026.

Conclusion

Snap’s advertising business continues to struggle, which stands in stark contrast to the relatively strong performance of companies like Meta (META). While Snap’s subscription business is a positive, it is currently too small to make a meaningful difference. Snap’s profitability is improving though and there is still significant room for cost cutting if Snap is serious about achieving profitability.

While Snap is now more reasonably priced, investors must decide whether they are willing to hold the stock through a recession and face a significant drawdown. I continue to feel that Snap’s stock will probably outperform the market from current levels, but I do not believe the valuation is low enough to offset the downside risk.

Figure 5: Snap EV/S Ratio (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.