Summary:

- Snapchat’s stock has been volatile in 2024, but strong Q3 performance and growth in Snapchat+ subscriptions position it well for 2025.

- The potential TikTok ban in the U.S. could significantly boost Snapchat’s user base and Snapchat+ subscriptions, offering a substantial growth catalyst.

- Despite high forward P/E ratios, Snapchat’s impressive revenue growth justifies the premium, making shares a strong buy with a potential 20% upside.

- Risks include competition from Google and Meta, but Snapchat’s focus on AI and strategic partnerships mitigate these concerns effectively.

Rob Kim

Co-authored by Noah Cox and Brock Heilig.

Investment Thesis

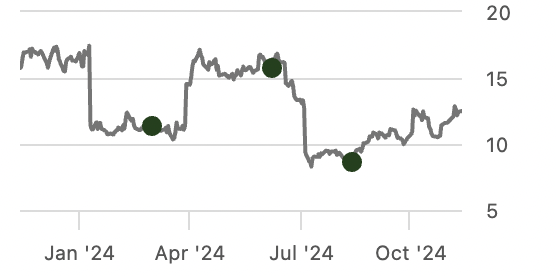

Snapchat (NYSE:SNAP) stock has been on a turbulent path for most of 2024, with the stock swinging from large YTD gains on the back of strong earnings performances (Q1 2024, Q3 2024), to more precipitous downfalls after some earnings expectations were missed (Q4 2023, Q2 2024).

Underpinning this is Wall Street’s rapid assessment (and reassessment) of the fair value of Snapchat’s business. Specifically, a big part of the equation from here is how fast the consumer social media giant’s business can grow going forward.

Social media is a fairly mature market in the tech sector (and competitors like Reddit (RDDT) and Meta (META) have really powerful plans in place to grab user attention).

Can we really expect Snapchat to accelerate growth here, and grow into their valuation?

I think the answer is yes.

There are a handful of strong, but silent tailwinds that tell me that the company is in an excellent position for 2025. For this reason, I continue to be bullish. I believe shares remain a strong buy.

Why I’m Doing Follow-Up Coverage

Snapchat shares are up roughly 46.2% since the last time I wrote on the company in early September. When I last covered the social media company, shares were holding at $8.55. However, this was down almost 50% since my July piece of coverage.

In the three months since September coverage, Snapchat’s stock has risen to about $12.50 per share. Not quite back to our July highs, but this gives shares (and investors) plenty of upside to still capture.

A big reason for this uptick since September has been Snapchat’s strong Q3, which I believe helped convince investors that the company’s revenue is finally on a sustainable growth trajectory. Shares have had a really volatile 2024 because the company is transitioning its business model. So it only makes sense that the market reacts so strongly to each quarterly update. The fundamental trajectory of the company changed multiple times this year according to Wall Street analysts.

SNAP Share Price Performance (Seeking Alpha)

I’ve been bullish basically the whole time (and rode the rollercoaster with my bullish opinion). I think we’re finally out of the woods.

The purpose of me doing this follow-up coverage is to show how this key transformation is going to power 2025, which I think will be a pivotal year in the history of the social media firm.

Why 2025 Will Be Their Year

While Snapchat shares have been on a tear over the last few months, I think the core operating performance more than justifies this run-up. As I mentioned before, Snapchat’s Q3 performance was incredibly successful.

While the quarterly results came out a couple of months ago, I’m digging into them now to show how 2025 is set up well for the company.

Chief Financial Officer Derek Andersen discussed their growth in their earnings call from late October.

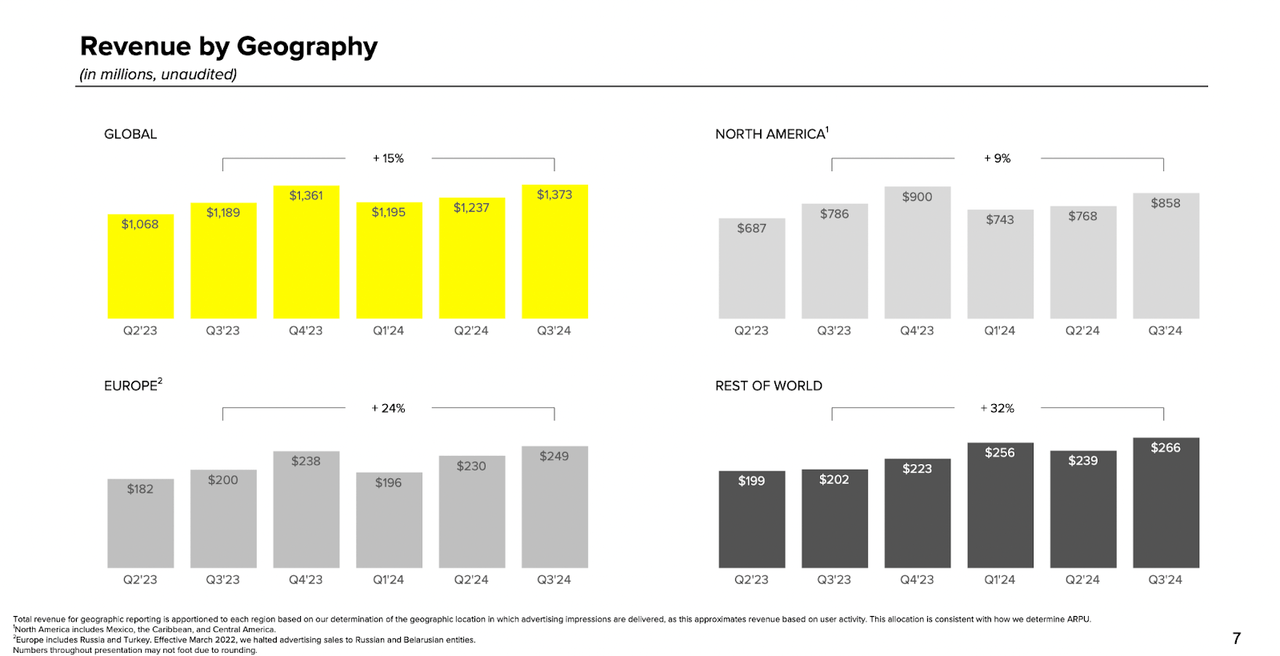

In Q3, total revenue was $1.37 billion, up 15% year-over-year and 11% quarter-over-quarter, Andersen said.

Advertising revenue was $1.25 billion, up 10% year-over-year, driven primarily by growth from DR advertising revenue, which increased 16% year-over-year. DR ad revenue growth was driven by continued strong demand for our 7-0 pixel purchase optimization that was up more than 160% year-over-year, as well as a growing contribution from App Purchase optimization.

Andersen noted that growth in high CPM North America was a touch lower than growth in the rest of the world, but overall, the company is still headed on an upward trajectory.

In Q3, North America revenue grew 9% year-over-year, with the relatively lower rate of growth in this region due to the impact of weaker Brand-oriented demand being relatively concentrated in North America. Europe revenue grew 24% year-over-year, as continued progress on our DR ad platform fully offset the impact of more challenging prior year comparisons. Rest of World revenue grew 32% year-over-year, driven by the continued progress with our DR ad platform.

Revenue By Geography (Snapchat)

As I mentioned before, part of what has been driving the volatility in shares this year is oscillating investor confidence that the company’s transition from just an advertising model to an ads + subscription revenue + hardware model will be successful.

I think by the end of Q3 it became clear: this will be wildly successful. At the heart of the transformation is Snapchat+. While I have written on this before, the product is continuing to execute well. This is huge.

Released in July 2022, Snapchat+ costs $3.99 per month and allows subscribers to pin their number one best friend, have a custom app icon, boost their story, and much more.

According to Andersen on the Q3 call, there are more than 12 million Snapchat+ users worldwide.

Snapchat+ subscribers more than doubled year-over-year to exceed 12 million in Q3.

This is a $576 million run rate for the consumer subscription service. As fellow Seeking Alpha analyst Stone Fox Capital pointed out in his analysis earlier this week, Snapchat+ could see its subscriber base double again next year to roughly 25 million people. This would be (as he points out in his math) a $1 billion+ run rate. Since this is high-margin software, most of this will roll down to their bottom line (as profits).

Special Circumstance To Accelerate Growth

Snapchat could be set up for even more success in 2025 (and with a powerful catalyst). A US Federal Appeals Court recently upheld a US law effectively banning TikTok in the United States. According to NPR:

TikTok has until Jan. 19 to be sold off from its Beijing-based owner ByteDance, or face a nationwide ban. That deadline may be extended by 90 days if there is “significant progress” toward a sale.

TikTok brings in over 120 million users in the United States every month. Should the ban go through, it would result in a large number of United States content consumers looking to move to other social media platforms to consume their content. Many likely have a Snapchat account that they don’t use as much as they used to. This could be an excellent catalyst for them to move back over. This is an excellent opportunity for Snapchat+ to grow its subscription base.

Snapchat should be one of the social media platforms that will benefit from this the most.

Valuation

While Snapchat has a strong story set up for 2025, shares are clearly expensive on a forward price-to-earnings ratio, but I think their earnings growth is going to be even more impressive (and make this premium P/E worth it).

Currently, Snapchat’s forward Non-GAAP price-to-earnings ratio is 47.28, compared to the sector median, which is considerably lower at 13.63. This is a 246.96% premium to the sector median.

Seeking Alpha Quant rates this D- for Snapchat.

However, forward growth rates look much more promising. Snapchat’s forward revenue growth of 9.72% YoY is 325.61% higher than the sector median of 2.28%. Seeking Alpha Quant gives this forward revenue growth a grade of B+.

Overall, Seeking Alpha Quant gives Snapchat a growth grade of an A+.

So while we are paying a 246.96% premium on shares from a traditional valuation standpoint, we get growth that is 325.61% better. I think this is worth it.

While somewhat controversial, I think shares could have another 20% upside left in them from here. A 20% move from here would put the forward P/E ratio at a 296.35% premium to the sector median. This is still below the growth rate premium. I think this is worth it.

Risks

While the company is riding a strong Snapchat+ tailwind, strong revenue growth, and a more likely-than-not TikTok ban, a big risk for Snapchat is that the company still faces incredible advertising pressure from the likes of Google (GOOGL) and Meta. This was one of my main concerns in my last piece of research as well.

I’ve remained slightly concerned that Google and Meta make almost an unfair match for Snapchat. Each one of these juggernauts has a large in-house AI team that helps support strong, proprietary ad platforms that could potentially make Snapchat’s ad service look less sophisticated in comparison.

Offsetting this risk (and in alignment with my analysis from a few months ago) Snapchat’s main defense to the two big digital ad platforms is a keen focus on AI ad efforts.

In September, Snapchat signed an expanded partnership with Google Cloud to grow out their AI capabilities including a custom chatbot. This is a big deal. A system that is closely trained on Snapchat’s proprietary data so they can serve better ads (and compete with the bigger tech giants in a big deal). CEO Spiegel talked about this on the Q3 call:

…[we] announced an expanded strategic partnership with Google Cloud to leverage the multimodal capabilities of Gemini on Vertex AI to power Snapping with My AI, our AI-powered chatbot. In Q3, the number of Snaps sent to My AI in the US more than tripled quarter-over-quarter.

With this, I think Snapchat is eliminating some of the key risks with the future of the company. They’re leaning heavily into AI today to help support strong ad placements. They’re focusing on Snapchat+ for tomorrow so the company has more SAAS-like revenue.

I think this is a great combination.

Bottom Line

While having faced a rocky 2024, Snapchat could be on the verge of experiencing a strong 2025. With the US federal appeals court upholding a new law to effectively ban TikTok in the United States starting January 19th, Snapchat could be in a position to gain significant momentum among social media consumers. Snapchat+ subscriptions should be able to follow.

Even regardless of what happens with TikTok, Snapchat is already seeing incredible growth in the right places.

While Snapchat has pushed to try to compound its business since its IPO, shares have been largely range-bound (minus a breakout at the end of COVID). This mean-reverted in 2022.

Now, the company has (I believe) the strongest tailwinds in the company’s history. I feel really confident about the company from here (and in 2025). With this, I think shares continue to be a strong buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP, META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.