Summary:

- Snapchat’s Q4 2023 results showed an increase in daily active users and revenue, but concerns remain about their ability to compete with larger social media companies like Meta.

- Snapchat has been investing in driving user engagement through new offerings like Snapchat+.

- The company’s Snapchat+ subscription service has seen growth, with 7 million subscribers and $249 million in annual revenue in Q4.

Klaus Vedfelt/DigitalVision via Getty Images

Investment Thesis

While Snap Inc. (NYSE:SNAP) had a lukework Q4 2023, where they reported a 10% year-over-year increase in daily active users, at 414 million, and revenue rising 5% to $1.36 billion, investors are still concerned. Some investors have reservations about whether the smaller social media company can offer up competitive ad offerings like larger social media firms like Meta (META). The light guidance brought concerns as well.

To help combat this, Snapchat has been investing heavily towards driving user engagement through new offerings such as Snapchat+.

In younger generations, particularly Gen Z, Snapchat stands as a crucial mode of communication, with 4 billion messages and over 5 billion snaps created daily. For Gen Z, Snapchat not only stands as a method of communication, but also acts as storage for photos/videos. I’ll dive more into this later. I believe this is an under-appreciated part of their business.

Despite Snapchat’s slowing revenue growth, I believe Gen Z’s core addiction to sending streaks and using the app as photo storage (through the memories feature) presents the company as a strong buy (rating upgrade). I believe Snapchat can (and will) capitalize on user revenue growth opportunities through subscriptions like Snapchat+.

Why I Am Writing Follow Up Coverage (What Has Changed)

I last wrote about Snapchat back in late October when I argued the stock was a hold. At the time, my concern was that Snapchat’s reliance on revenue (and the fact that global conflicts were affecting their ad sales) made me concerned that the company’s business model was more vulnerable to other global shocks and could cause the company to have extra volatility in revenue.

Since then two things have happened. One, Q4 earnings showed that Snapchat+ revenue is now a notable part of revenue and is demonstrating that the company has more upside in this division (more on this later). Two, a proposed TikTok ban in the United States sets up a potential asymmetric opportunity for Snapchat to see an uptick in US engagement and users.

Background

In recent years, Snapchat has encountered issues monetizing their users. Despite having strong daily active user growth from 2014 to 2023, their revenue per user (ARPU) has actually fallen since the fourth quarter of 2021. APRU is down 19% from Q4 2021. This compares to Meta (META)’s ARPU growing almost 10% since 2021.

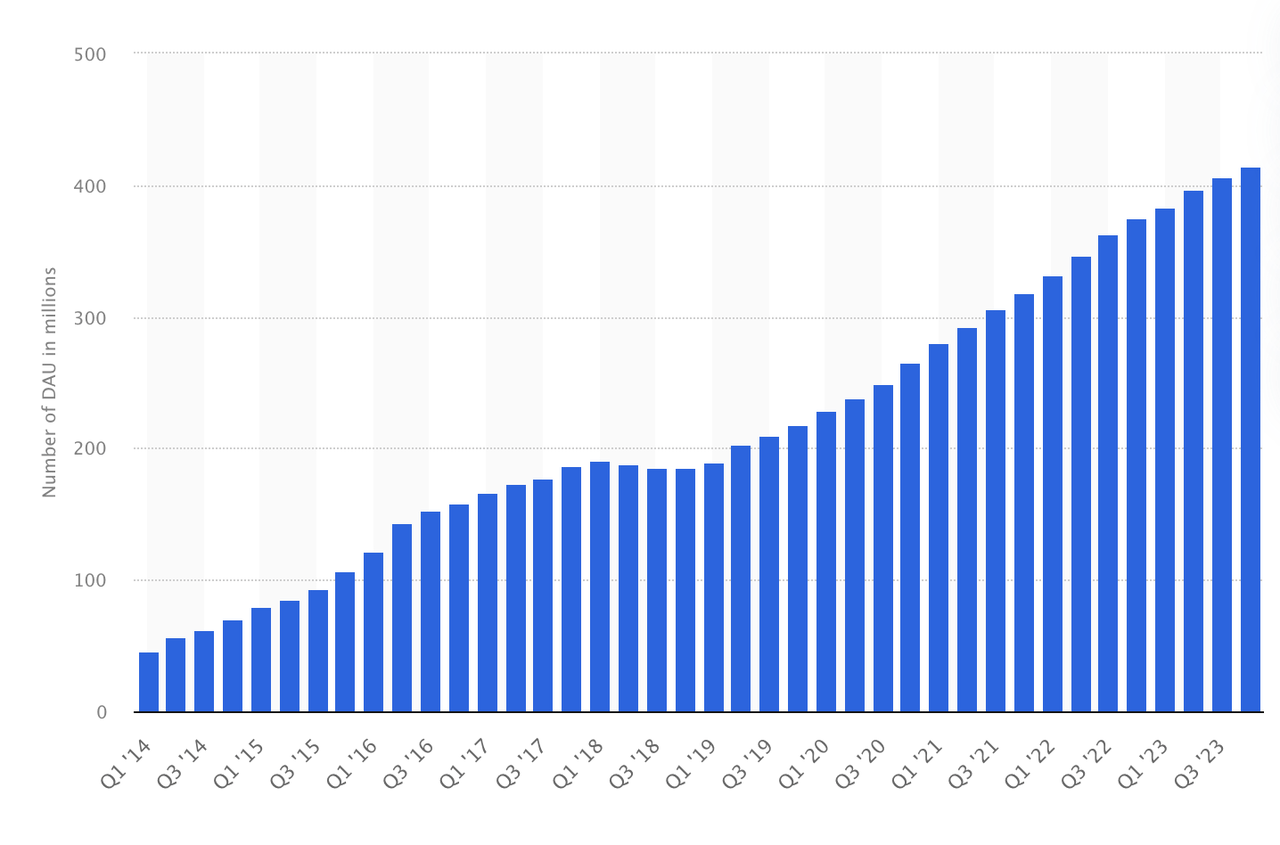

Snapchat DAUs By Quarter (Statista)

Above is a chart representing Snapchat’s promising user growth since 2014. As mentioned previously, even with these numbers, their average revenue per user decreased by 5% year-over-year in Q4 of 2023. Along with this, Snapchat’s annual revenues added up to $4.6 billion in 2023 for the second consecutive year (essentially flat from 2022), and the company reported a net loss of $1.322 billion in the same year.

Despite this, Snapchat has performed well in markets outside the U.S., such as India, Saudi Arabia, and Mexico. Snapchat’s user base in India saw a 150% increase in daily active users, crossing the 60 million mark back in 2021 when a Tik Tok ban was implemented. Fast forward to May 2023, and Snapchat reached over 200 million monthly active users in India, making it one of the app’s leading growth markets globally. This surge in user engagement is supported by local content initiatives and the widespread use of Snapchat’s AR features, particularly during cultural festivities, with Indian Snapchatters using AR lenses over 50 billion times each month.

In essence, user growth for the smaller social media player (compared to Meta) seems to be actually going well but its monetization efforts are lacking. We saw this in Q4 2023, when Meta reported strong advertising revenue but Snapchat blamed conflicts in the Middle East for less than optimal ad sales. Meta reported strong revenue. Investor concerns are warranted that they are struggling to win advertising dollars.

How They Are Diversifying

While Snapchat developed Snapchat+, a subscription-based service that offers exclusive features in 2022, Snapchat has started to see the growth of the product in 2023. The subscription now has 7 million subscribers and revenue is running at a $249 million annual rate in Q4. Subscriber count grew from 5 million to 7 million in Q4.

What is Snapchat+?

Snapchat+ is a premium subscription service for $3.99/month. This subscription allows users to gain access to a collection of exclusive, experimental, and pre-release features all aimed to enhance user experience. Some of these features include pinning a #1 Best Friend, viewing a Story Rewatch Indicator, customizing the app icon and themes, and sporting a Snapchat+ Badge. Other features include a Friend Solar System, custom notification sounds, get priority story reply, and the ability to change map appearance. On top of this, users even have the ability to restore one Snapstreak per month for free. This streak restore I believe is key. I’ll dive into this later.

With 58% of Gen Z having Snapchat, this enhanced version of the app appeals specifically to this generation due to the increased personalization and exclusivity. Snapchat+ was launched with the aim of improving user experience, providing them with new and innovative features while also offering prioritized support. As a generation that values individual expression and digital experiences tailored to their preferences, Snapchat+ is viewed as an extension of their social media toolkit.

Valuation

For context, when I wrote about Snapchat in October, I expressed concern that their ad revenue appeared to be exposed to geopolitical shocks. At the time, Snapchat had not broken out their Snapchat+ revenue (but an offhand remark earlier in 2023 said that it was running at about $100 million annually). For a company that does about $4.6 billion in revenue annually, this did not seem to move the needle much.

Now that the company has officially gone on the record with a run rate of $249 million in Q4, this represents strong growth, and something I am excited about.

In essence, as someone who technically falls in the Gen Z generation myself, I can see the streak recovery piece of the Snapchat+ value proposition as a key selling point. I know people my age will likely pay more for Snapchat+ if they offered a package that allowed them to recover more than one streak per month.

Right now the company trades at a forward price to sales of 3.57. This is a significant discount to both Meta which trades at a forward price to sales of 7.98 and Reddit (RDDT) which trades at a forward price to sales multiple of 10.69.

Previously, I said this discount was warranted because Snap’s ad business seemed to be struggling where Meta’s was not. I still believe this. But I now believe that the Snapchat+ part of the business has the potential to help offset revenue declines or turbulence from ads and offer a higher margin, consistent cash flow opportunity.

Keep in mind that Snapchat+ has only 7 million subscribers right now out of the 414 million daily active users (DAU) Snapchat has as a whole. There is a lot of room for growth.

|

Ticker |

SNAP |

META |

RDDT |

|

Forward P/S |

If we could see accelerating revenue continue in Snapchat+ I think the market will start to reward the company with a higher price to sales multiple. Investors’ main concern seems to be that Snapchat is having a harder time competing with Meta’s ad sales. This offers a solution. If investors start to appreciate this, I think the stock could converge on a forward price to sales multiple of 7 (still below Meta’s price to sales). This would represent 96% upside from where the stock is today. In my opinion, this would give Snapchat a fair value of around $22.20/share.

Keep in mind the company currently gets a ‘B+‘ rating for their forward revenue growth estimates of 9.10%. This is higher than the sector median growth of 3.02%, meaning they are 201.13% above median. I am applying a forward price to sales multiple to the company to generate a fair value that is below both Meta’s and Reddit’s forward price to sales multiples even though they get a ‘B+’ for revenue growth. I think this provides a reasonable fair value estimate.

A Possible Hidden Gem: Google Photos Offers Clues (What Could Make Me Even More Bullish)

While Snapchat+ is starting to see stronger growth, I’m most interested actually in one of Snapchats unique features: Snapchat Memories. I believe a premium version of Snapchat memories as a part of the Snapchat+ subscription would seriously bolster sales.

Snapchat memories allows users to house their own library of photos and videos separate from their camera roll but inside the Snapchat app. Snapchat does not charge their users to house their photos and videos in the app; it is essentially unlimited free storage.

In my opinion, this demographic (Gen Z) has shown a willingness to pay for photo storage solutions, with services like Google Photos indicating market readiness for such offerings. As an added feature of Snapchat+, users could be able to transport their memories into a google cloud offering powered through Snapchat memories and paid for in part through Snapchat+.

Although revenue per user is on the decline, I believe a feature like this may help Snapchat turn this around for all users. I have multiple friends in this target demographic (Gen Z) that only have Snapchat still because of memories to keep their photos as they transition from phone to phone.

On the app, there is no option to export all photos/videos to your camera roll. If a user wanted to download all memories to their camera roll, they would have to do so individually. Thus, if users become less active on the app, it is unlikely they will delete it all together if they want to keep their memories. A collaboration with Google photos like this may appeal to users who value their memories and unlock incredible revenue from the user base.

As of right now Snapchat’s cloud provider is Google Cloud and Amazon Web Services (meaning a partnership with Google photos could be straight forward.

As an example, historically, Google Photos used to be free for unlimited storage. Then, in 2021 Google photos started to charge for their photo cloud storage.

Google Photos offers their users up to 15GB of storage for free, after that an additional 100GB is $1.99/month, an additional 200GB is $2.99/month, and 2TB is $9.99/month. If Snapchat were to allow users to upload their memories to Google photos, or charge for their own subscription, the revenue opportunities could be immense.

Keep in mind, for me, this is an added bonus that is not part of what I think the fair value of Snapchat is today. I am a strong buy simply because I think the revenue stability that the current Snapchat+ offering brings could cause the price to sales multiple to jump once investors appreciate it. I see this as a hidden gem upside that could add serious upside potential to the stock.

In other words, I view the stock as asymmetric.

Risk To Thesis

As I mentioned before, I believe the biggest risk to the company’s business (and valuation) is the instability of ad revenue (ARPU has declined and the business seems more vulnerable to global shocks). If the ad revenue from the business takes a hit before Snapchat+ revenue takes a bigger hold, I think investors would continue to punish the stock.

On this point, however, I believe the company is able to navigate this well. While ARPU has declined per user, the increasing size of their DAU and MAU (monthly active user) base has been able to offset this. The company seems to do well when competing social media apps like TikTok are banned in a region such as in India. This is something they are talking about doing here in the US but is far from a guarantee.

I believe this increase in users can likely offset any declines in ARPU until the Snapchat+ subscription base takes a bigger hold. In the meantime, the company trades at approx. ½ the relative valuation multiples of companies like Meta and Reddit meaning I think a lot of this risk is priced in.’

What A TikTok Ban Could Be Worth To Snap

Since this is not by any means a guarantee of happening, I am not going to include any potential US TikTok ad revenue or user base that is pivoted from TikTok in the US to Snapchat as a part of my fair value assumptions. I see this as an asymmetric upside opportunity that acts as a bonus for investing in the stock.

According to research firm Bernstein, Snapchat could be one of the primary beneficiaries in the US if TikTok is banned. It’s estimated that over $7-8 billion in ad revenue is generated by TikTok in the US annually and most of this ad spend would be diverted between Snapchat, Meta, and YouTube. The firm noted that Snapchat’s Spotlight feature for short form video content could be a winner from this ban. I agree.

While I personally do not believe a TikTok ban will result in the firm changing its strategy, I do think they could get a lift in Ad revenue. By some estimates, the company has anywhere from a 20-29% market share of adults in the US who use their app. Given this, I think the firm grabbing 20% of the ad dollar spend up for grabs would be fair.

If they could capture just 20% of the ad revenue from TikTok given they are no longer serving US users, this could result in Snapchat getting a $1.4-$1.6 billion lift in additional revenue annually. Not bad for a company that does $4.6 billion annually currently.

Takeaways

In an attempt to grow user revenue and diversify their revenue streams, Snapchat’s Snapchat+ is beginning to have an effect on company revenue, potentially signaling a silver lining to their ad sales dilemma and offering ways to increase upside in both user revenue and the company’s stock price.

While Snapchat+ offers asymmetric opportunity to the company through a partnership with a photo cloud storage provider such Google Photos to monetize user’s Snapchat memories gallery, I am bullish on the stock even with the current business model. And at the current valuation, I think there are multiple routes for the company to experience share price appreciation. In other words, I believe it to be a strong buy (rating upgrade).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the Managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.