Summary:

- Despite a 47.57% drop in shares, I remain bullish on Snapchat due to its potential for ARPU growth and innovative ad formats.

- Snapchat’s focus on direct response advertising and AR investments is expected to drive higher ARPU, despite current market skepticism and competition from Meta Google, and ByteDance’s TikTok.

- The market is overly bearish on Snapchat’s ad model; management’s strategic focus on AI and AR is starting to show promising results.

- Snapchat’s unique approach to the ad market, combined with Snapchat+’s growth, presents a high-risk but highly favorable risk-to-reward investment opportunity in my opinion.

Rob Kim/Getty Images Entertainment

Investment Thesis

Snapchat’s (NYSE:SNAP) stock has had a steep selloff since my last writeup in July, with shares dropping by 47.57%, driven by what many investors saw as a lukewarm quarter.

Investors are grappling with the company’s slower than competitor growth in advertising revenue. This weak growth is concerning for many in the investor base as Snapchat continues to struggle to compete for ad dollars with larger rivals like Meta (META) and Google (GOOGL), which both dominate the digital advertising market through their larger user traffic and more established relationships with advertisers through their unique ad generation engine.

I understand why these investors are concerned but I think this misses a big point. Snapchat is going after unique ad dollars, which has been slower to grow but I think offers a unique set of promises for them. With this, I think there is still a ton of room for improvement in their average revenue per user (ARPU), one of the benchmark gauges for how well their ad revenue is performing.

Snapchat’s focus on direct response ads—those that encourage users to take actions like making purchases in app—will likely help drive ARPU higher. These ads have higher conversion rates compared to brand awareness campaigns, so they are more lucrative, and Snapchat’s camera first approach with their app is key to this.

Despite the market’s overall bearish sentiment and the hefty drop in shares, I am still a strong buy on Snap. Their potential for significant ARPU growth, given the 3-year consolidation in ARPU rates, as well as innovative ad formats and AR investments, presents a really compelling opportunity.

Why I’m Doing Follow-Up Coverage

Like any Bull, I am bummed at how many shares have moved down since the last time I covered them in July, even as the S&P 500 has drifted down 2.95% during the same period.

CEO and Co-Founder Evan Spiegel has openly acknowledged that the company’s slower ad growth (compared to competitors) is a notable concern for investors.

Snapchat has faced mounting pressure as other social media platforms, such as Meta’s Instagram and ByteDance’s TikTok, have managed to capture a larger share of the advertising market. He admitted that Snap’s advertising business is not expanding at the pace needed to match market expectations.

To this same point, the market has been skeptical of Snapchat’s long-term profitability, given the company’s reliance on financing and heavy operating losses. While they have made a lot of progress on innovation, particularly in their AR and ML-driven ad placements, these efforts have not yet translated into a return so far.

I have personally been bullish on Snapchat because I think Snapchat+ with its growth will start to overpower concerns around ad revenue. However, the market hasn’t acknowledged this yet, and is hyper-fixated on ad revenue.

The purpose of this follow-up coverage is to show that both revenue paths have opportunity, especially ads since the market is so bearish.

Path To Higher ARPU

Over the last three years, Snapchat’s ARPU has stagnated. While the ad market, particularly in the US, has become more challenging, this alone does not explain the company’s performance.

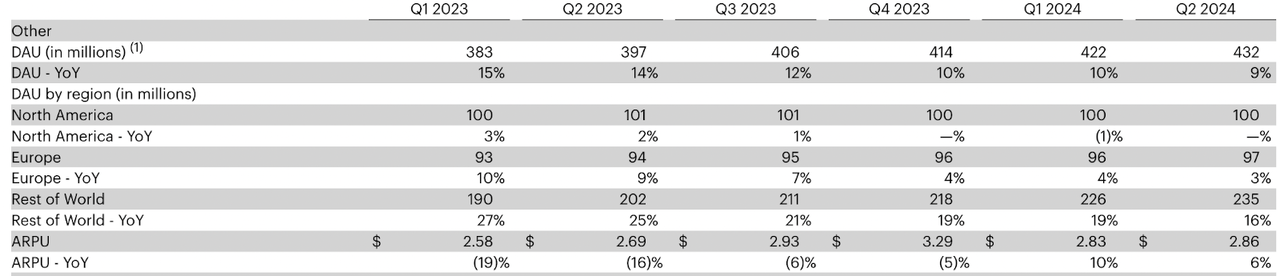

On the surface, it appears that ARPU has stagnated in the mid $2 dollar range, and this reinforces the concerns a lot of Wall Street analysts have about stagnating advertising.

ARPU Data (Snapchat)

But under the surface, this is an averages game, like I mentioned before.

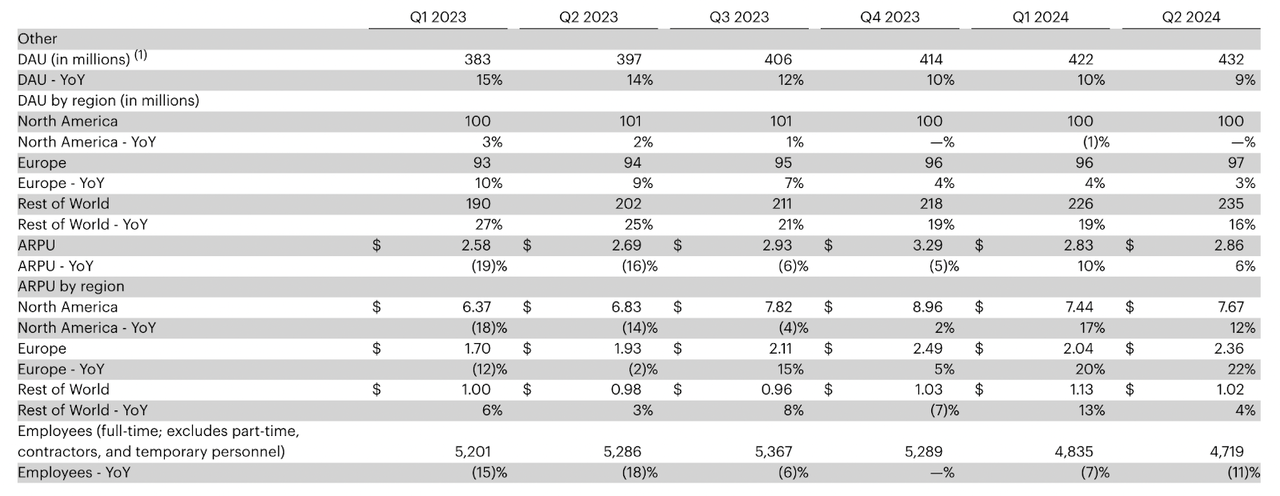

ARPU By Region (Snapchat)

If we cut the data by region, we can see that ARPU per user in all major regions has grown since the start of 2023. What has changed is that the proportion of users that are in high ARPU zones (the US) has declined, while the proportion in developing countries has increased.

In essence, the company’s total ARPU appears weaker due to the growing share of international users, but their performance within the U.S. remains strong. The U.S. market remains vital to Snapchat’s long run plan to be profitable, where advertising demand is higher, and the ARPU has been more robust.

During Snapchat’s Q2 earnings call, management went over several strategies to increase ARPU. Spiegel discussed the company’s efforts to optimize their advertising platform, particularly focusing on direct response (DR) advertising. The DR business, which saw 16% year-over-year growth, has been a driver in ARPU improvement, benefiting from innovations like the 7-0 Pixel Purchase Optimization model.

He noted:

We continued to make progress on three foundational advertising platform initiatives, including larger ML models, improved signals, and more performant ad formats. Our 7-0 optimization for purchases continues to drive encouraging results for advertising partners. For example, Ridge, an everyday essentials e-commerce company, continued to lean into Snap’s DR best practices to drive success. Leveraging 7-0 Optimization, Conversions API, and our ML-based Auto-Bidding, Ridge drove a 73% higher ROAS compared to their prior campaign strategy.

We also expanded 7-0 Optimization to app install and app purchase and, after testing showed consistent improvement in cost-per-install and cost-per-purchase, we recently began scaling these products with our advertising partners. We are encouraged to see that a number of gaming app clients, including Roblox, are seeing a 30–50% improvement in ROAS on Snapchat -Q2 Call.

Management has also reiterated their investments in AI-powered features that enhance user engagement and advertising potential through advanced AR lenses and AI Snaps. I think this really shows how far Snapchat has come in creating richer, more interactive experiences.

Our sponsored AR advertising solutions offer marketers the opportunity to leverage unique and engaging augmented reality experiences that lift the measurable performance of their brand campaigns. Specifically, research has shown that campaigns that pair AR Ads with Video Ads on Snapchat deliver 1.6x ad awareness lift when compared to Video Ads alone.

Research from our partnership with OMD and Amplified Intelligence found that Snapchat campaigns that include AR in their mix drive 5x more active attention compared to industry peers. In order to expand the reach and impact of our AR advertising solutions, we recently launched AR Extensions for businesses, which extend our AR advertising products beyond the camera to all of our ad surfaces, including our Dynamic Product Ads, Snap Ads, Collection Ads, Commercials, and Spotlight -Q2 Call.

CTO Bobby Murphy previously touched on Snapchat’s Lens Studio—enhanced with AI—that enables faster and more complex AR content creation, which can be leveraged for advertising purposes.

The big takeaway from all of this: the advertising situation is not nearly as bad as the market thinks it is. They are making all the right investments (in my opinion) and I think these are going to pay off. ARPU looks strong under the surface too. The trick from here will be raising the average with a higher percentage of users in countries that have lower ARPUs. I think they’ll be able to do it.

Valuation

Part of the reason the market continues to depress Snapchat’s shares has been concerns over their dual-class structure that leaves Evan Spiegel and the other founders in control. What this means is that the market knows that due to this voting structure, activist investors cannot get involved in Snapchat to push for change from the outside. It will have to be the team that’s in place (or a team that is blessed by the current management) that gets the job done.

Even with this restriction, I disagree with the market’s sentiment. I’m confident in the team.

The company is still making the right investments, with a focus towards AI and AR that I think offers opportunities for real growth. With planned AI investments reaching $1.5 billion annually, I think they have a lot of room to help improve their ads engine.

Currently, Snapchat’s forward P/S multiple stands at 2.67, above the sector median of 1.25 but significantly below the P/S multiple of Meta (7.83) and Reddit (RDDT) (7.92). The market and Wall Street analysts feel much better about both Meta and Reddit monetizing their users than they do about Snapchat as evidenced by the higher Price to Sales ratio. To be clear, I am bullish on both Meta, Reddit, and Google for this matter, but I think the % upside is highest here for Snapchat.

I think we should see Snapchat trade at a Price/Sales closer to 6 here. This is driven by an ads platform that is in much better shape than what I think the market is pricing in, and the Snapchat+ platform that is growing at an impressive rate.

If we saw shares move up to this Price/Sales of 6, this would represent 124.72% upside.

I know this may sound like an exaggeration, but the market is really bearish on the stock right now. I think it has room to run.

Risks

One of the big concerns around their Ads platform is many on Wall Street view the Snapchat ad service as less sophisticated than what Google or Meta can produce because they each have a large AI team in-house to help each create strong ad platforms. I understand this concern.

But I disagree with this sentiment overall, and would like to reiterate Snapchat’s own efforts in AI, and their niche focus on AR as being key pillars to overcoming this perception. These efforts have been paying off, with the company partnering with Amazon in 2023 to show how their unique AR angle will help companies like Amazon promote and sell their products in unique settings.

Any startup or non industry incumbent stands a better chance to niche down and focus on dominating one part of a market (in this case digital ads) before branching out. Snapchat is doing that. The efforts are starting to pay off.

Bottom Line

I think the market is too bearish on the current state of Snapchat’s ad model, with Management honing in on increasing ARPU through creative content channels while Snapchat+ scales toward impressive ARR. While ARPU has stagnated over the past three years, I think this statistic is being distorted by Snapchat’s strong growth in emerging markets. Markets you just entered typically tend to be less lucrative than markets that are developed. I expect APRU to grow from here.

Don’t get me wrong, it’s definitely a high-risk investment, but I think the risk-to-reward ratio here appears highly favorable. With this, I continue to believe shares are a strong buy. There is solid upside available for investors willing to tolerate the risk of Snapchat’s unique approach to the ad market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNAP, META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.