Summary:

- Snapchat has underperformed its peers on both growth and profitability metrics.

- I analyze the company’s balance sheet and explain the nuances relative to peers.

- The stock valuation offsets the numerous issues due to the deeply discounted multiple.

- I am upgrading the stock after the substantial underperformance.

Guido Mieth/DigitalVision via Getty Images

This is supposed to be peak market conditions for tech stocks, with valuations recovering from the 2022 lows and interest rates set to fall. Snapchat (NYSE:SNAP) may have missed the memo, as the stock remains depressed even after clawing back some of its post-earnings losses. The company continues to show disappointing revenue growth rates relative to Meta Platforms (META) which in conjunction with fleeting profit margins makes for a poor outlook. However, the stock looks very cheap, and Wall Street may be underestimating the long-term value here once management truly reigns in cost discipline. I am now upgrading the stock to a buy rating due to the low valuation, but remind readers that this is a riskier story.

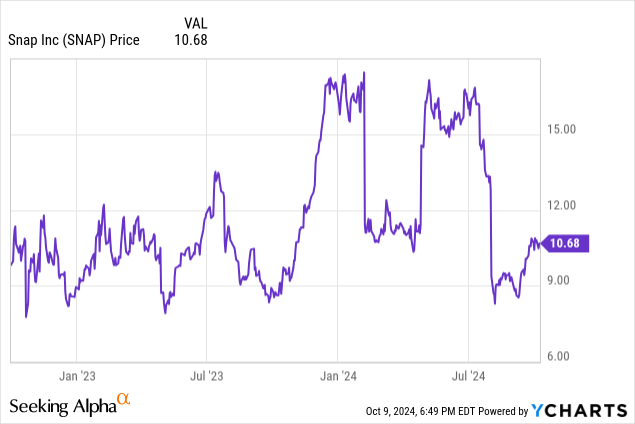

SNAP Stock Price

I last covered SNAP in December of last year where I urged caution amidst the then-surge in the stock price. The stock has since underperformed the broader market by well over 50%.

That relative underperformance has greatly improved the value proposition and has brought me back to the name.

SNAP Stock Key Metrics

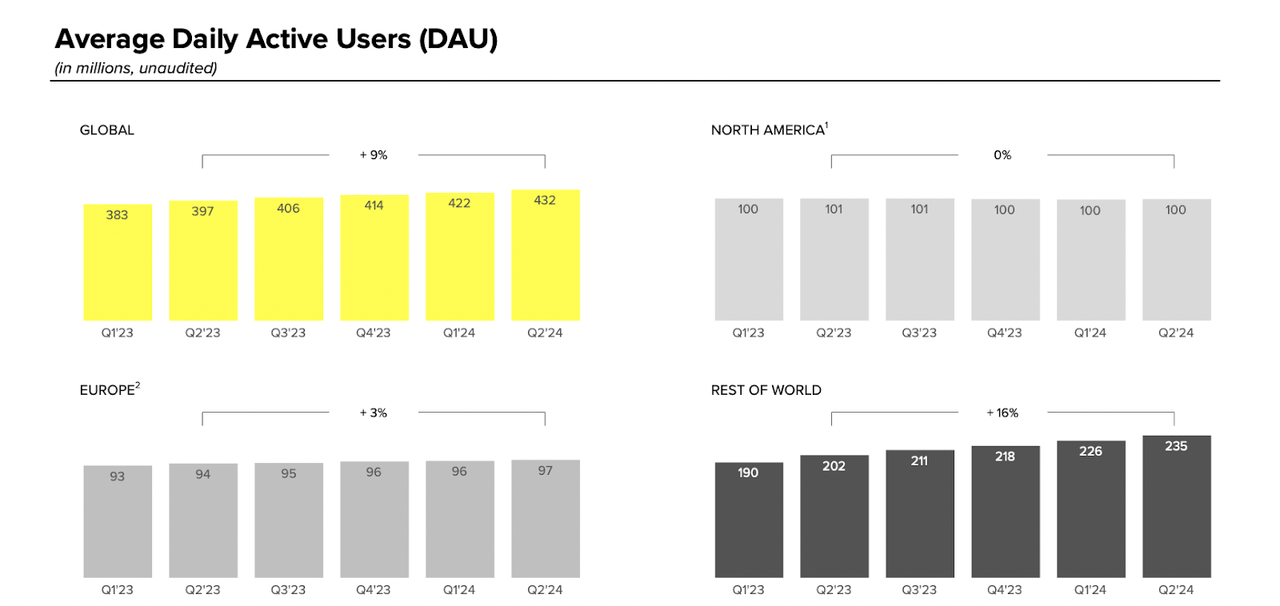

The social media company has not necessarily reported bad results in its own right, but the “grass is greener on the other side” mentality looms large here. While names like Reddit (RDDT) are showing stunning user growth, SNAP saw global users grow by only 9% YoY, including 0% YoY growth among the all-important North America user base. Technically, global users of 432 million exceeded guidance for 431 million.

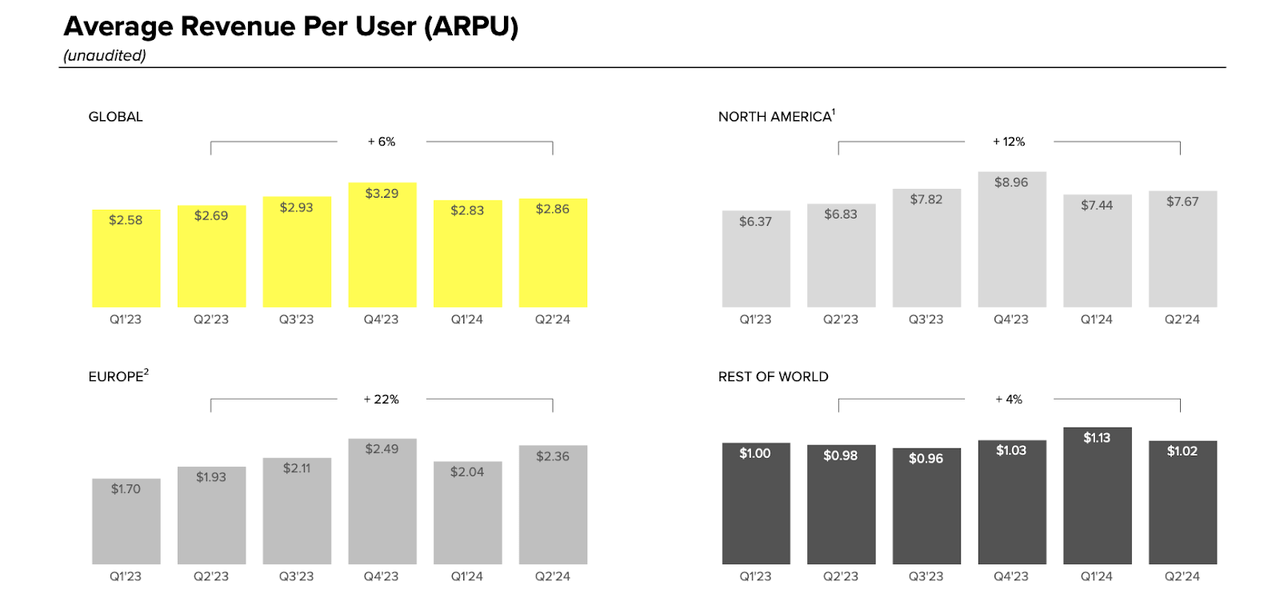

SNAP saw average revenue per user (‘ARPU’) grow at just 6% YoY due to the fast-growing segment in the rest of the world seeing just 4% growth.

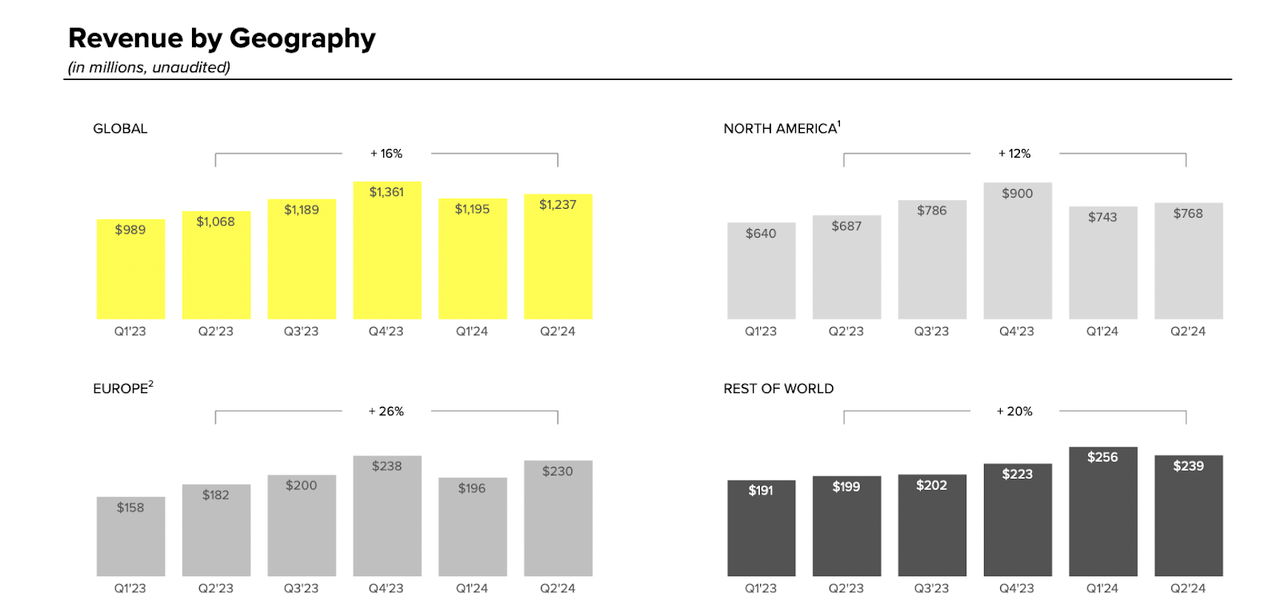

These led the company to post 16% YoY revenue growth, which in itself might not seem so bad, but it is hard to ignore the 54% growth at RDDT and 22% growth at META. The latter might be the more concerning comparable given that META is operating at a much larger scale at $38.7 billion in Family of Apps revenues in the latest quarter. Revenue of $1.237 billion fell in the middle of guidance for $1.225 billion and $1.255 billion.

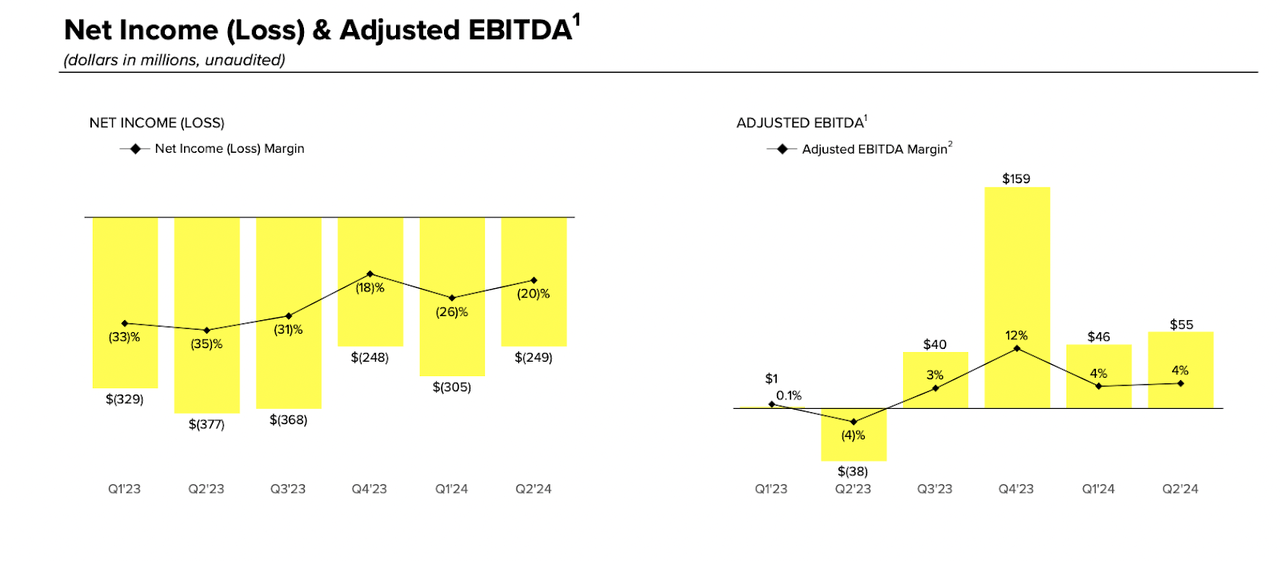

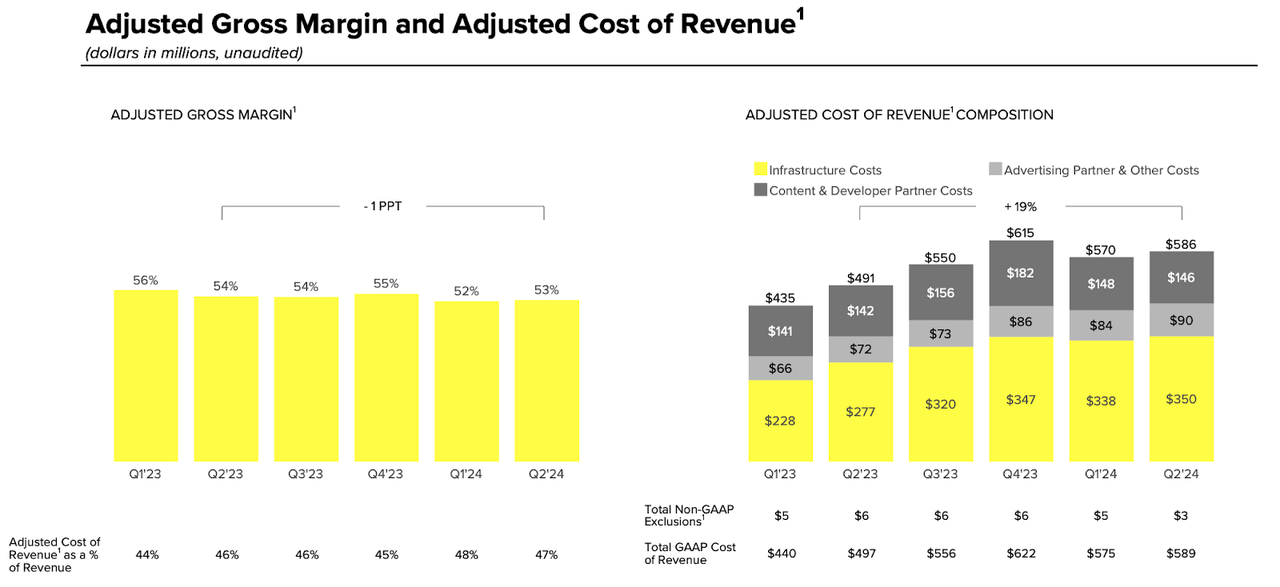

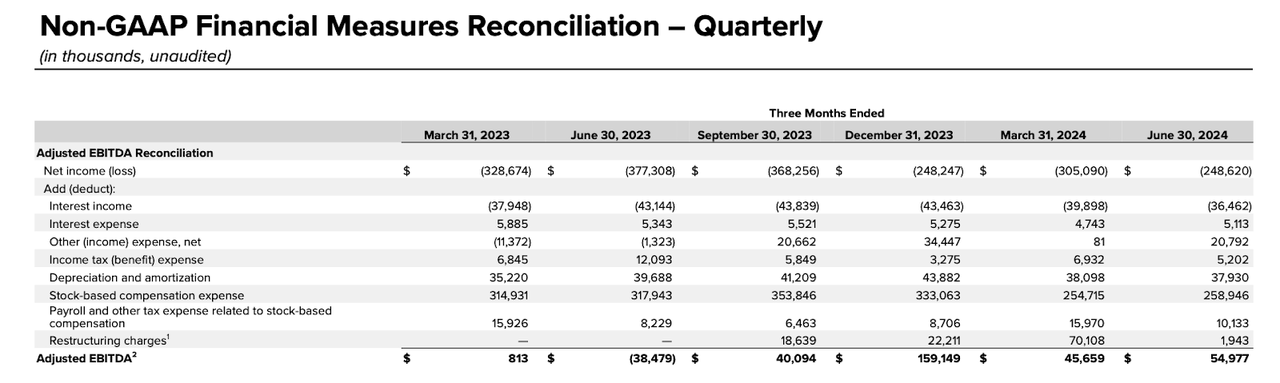

The company continues to be deeply unprofitable, posting a 20% GAAP net margin loss. Adjusted EBITDA margin jumped 800 bps to positive 4%, but Wall Street might be concerned that margins have not inflected higher amidst the slowdown in growth. The already aforementioned RDDT saw its GAAP net margin loss decline to just 3.6% and META continues to show 50% operating margins in its Family of Apps business. Again, investors might have been easier on SNAP had it not been for the public comparables.

It is possible that some of the reason for the disparity in margin profiles is due to the lower gross margin, which stood at just 53% in the quarter. I note that Alphabet is a highly profitable machine in spite of also having lower gross margins at 57%, but perhaps this is a poor comparable in this context given the wider scale. My guess is that SNAP’s platform, which is primarily video form and a messaging service, may face structurally different challenges with regard to profitability.

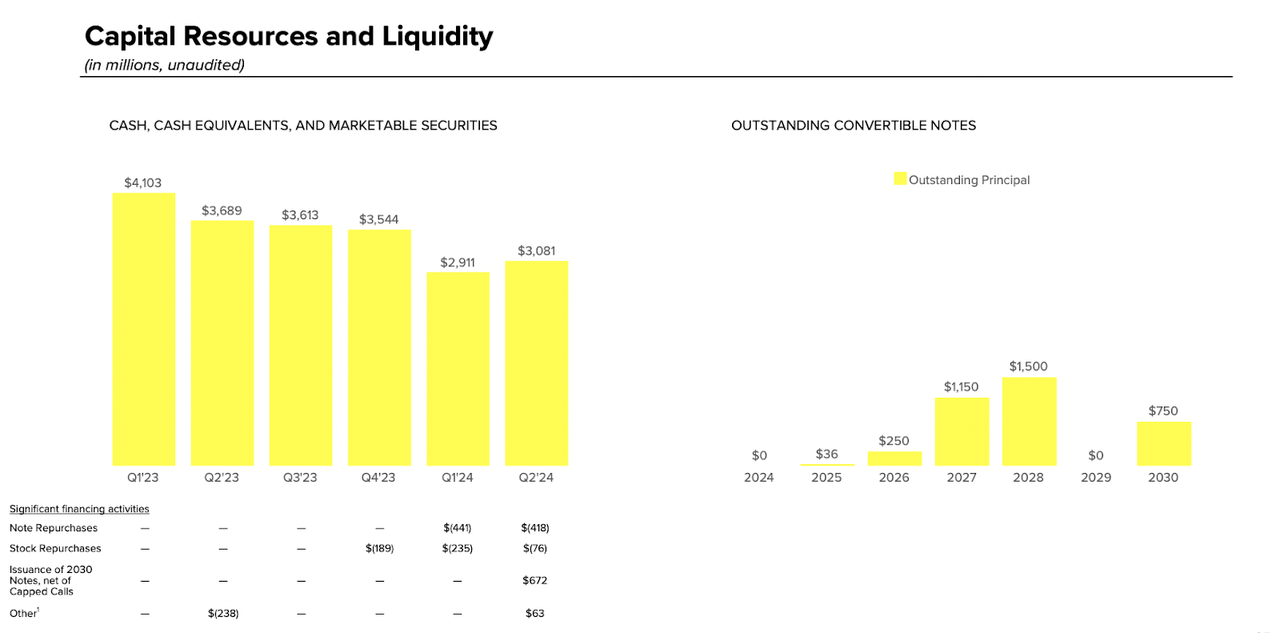

SNAP ended the quarter with $3.1 billion of cash versus $3.6 billion of convertible notes, making it the only name among the larger social media peers to have a net debt balance sheet. That said, the perk of the convertible notes is the low interest rate coupons, which have helped the company generate substantial net interest income (though still not quite enough to offset the stock-based compensation).

These convertible notes mature largely starting in 2027, and it is admittedly unclear if the company will be able to refinance the notes at comparable interest rates given the continued struggles with profitability.

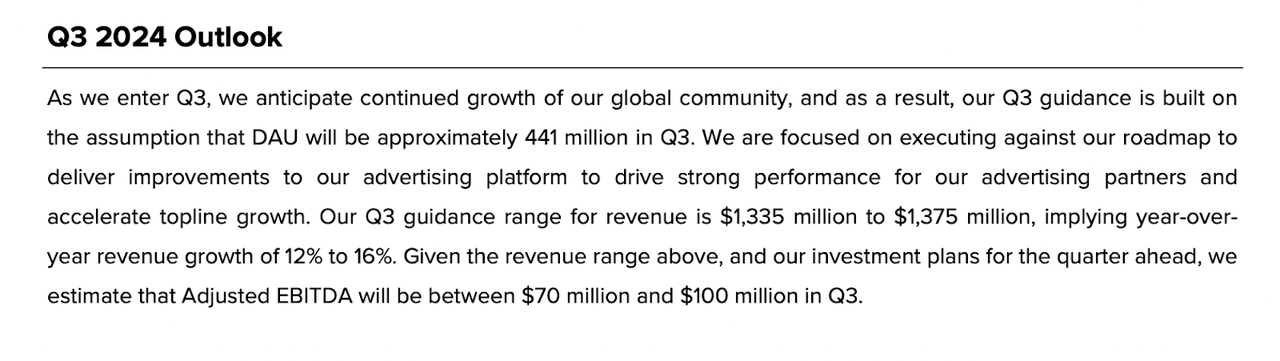

Looking ahead, management has guided for the third quarter to see up to 16% YoY revenue growth, which is again lower than peers (consensus estimates calls for $1.36 billion, or 14.4% YoY growth). The more potentially concerning metric was that of daily active users, which management expects to come in at around 441 million, representing the company’s first sequential decline since 2018.

On the conference call, management touted the improvements they have made to their ad network and products, but failed to sufficiently explain why their company was underperforming on a growth basis relative to META in spite of the size differential. Investors may be wondering if the relative underperformance may be hinting at long-term risks for the company, namely deteriorating relevance amidst competition from TikTok and the age of generative AI.

Is SNAP Stock A Buy, Sell, or Hold?

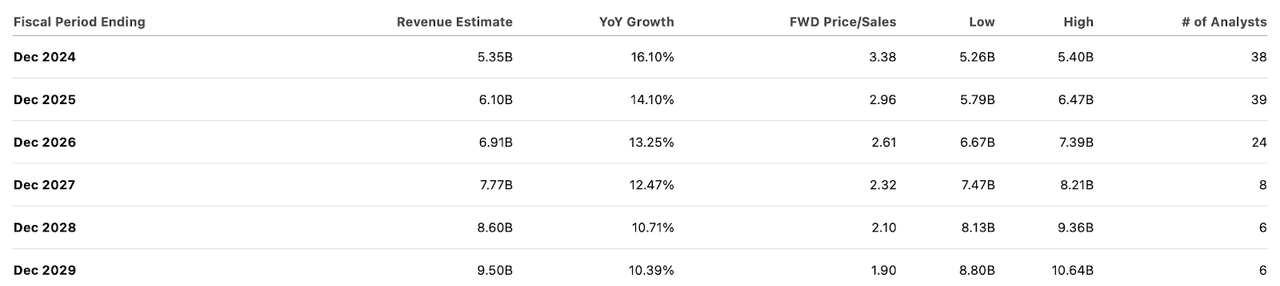

Every stock might be buyable at the right price, and that might be true here, with the stock trading at around 3.5x sales. Consensus estimates call for double-digit revenue growth over the next handful of years.

While SNAP remains far from GAAP profitability, I am still of the view that profit margins can scale sharply higher over the long term. I again point to the 50% operating margin seen at META’s Family of Apps businesses. Even if we assume just 25% net margins, that would place the stock at around 14x long-term earnings. In spite of the competitive headwinds, that would still be too conservative of a valuation given the double-digit top-line growth rates and modest leverage profile. Of course, we must account for the ongoing GAAP losses, which total around 5.6% of the current market cap annually. As the company makes further progress on profitability, the annual drag from losses should dissipate. Yet between the forward double-digit growth profile and low price to sales multiple, the price looks right for the stock even inclusive of the current loss profile. It is difficult to assign a price target given the shaky growth story and continued lack of profitability, but I could see this name re-rating to 7x sales if management can right the ship in terms of growth and profitability. Even without such an aggressive re-rating, the stock might still be able to deliver market-beating returns if it can settle at around 4.5x sales or higher, as the ongoing revenue growth should be more than enough to offset the ongoing losses.

SNAP Stock Risks

It is possible that the company is losing market share to peers and that growth is about to slow down more rapidly than consensus implies. This would impede the company’s ability to rely on operating leverage to drive margin expansion. The company’s net debt balance sheet does not give it much financial flexibility to handle such a situation, and thus the low valuation on a price to sales basis might not offer much margin of safety in the traditional sense. It is admittedly looking like a “winner takes most” market as META’s innovations in artificial intelligence appear to be paying off, and the stock would not look exciting at all if the growth story crumbles.

SNAP Stock Conclusion

There are a lot of reasons to prefer the stocks of faster-growing and more-profitable peers, but SNAP trades at a deep discount to compensate for that. It is unclear if growth rates will inflect upwards or lower, but I am hopeful that management will show further cost discipline moving forward in light of the poor growth performance (making “lemons out of lemonade”). The stock trades at cheap valuations and stands to perform well as the growth and profitability story improves. I am upgrading the stock to a buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, RDDT, SNAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset (and recovery!), the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!