Summary:

- Snowflake’s stock has fallen 34% year-to-date following the retirement of its ex-CEO and a slowdown in revenue growth.

- The company’s new product roadmap and strategy, outlined in its Analyst Day presentation, indicate potential for increased data access per product module, leading to higher revenue generation.

- Despite commentary from Salesforce and MongoDB, Gartner still points to sustained spending in cloud software, indicating seasonality, which may have been priced in regarding Snowflake.

- Current pessimism discounts the opportunity for increased revenue gains sourced from the company’s revenue-per-query business model, creating upside in the stock.

eravau/E+ via Getty Images

Investment Thesis

Snowflake (NYSE:SNOW) finds itself in an unfamiliar place nowadays.

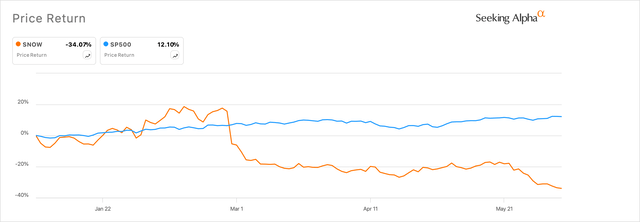

The maker of cloud data services and products has seen the pace of growth in its widely appreciated namesake cloud data product platform slow down drastically from its days of delivering almost 2x revenue with every quarter that used to go by. Then, in a shock announcement, its ex-CEO, Frank Slootman, announced his sudden retirement, zapping investors. Markets have not taken the recent developments kindly, with the stock down 34% ytd.

Markets have dumped Snowflake in H1 2024 (sa)

The company announced Sridhar Ramaswamy, the founder of Neeva, an LLM-based search technology product startup acquired by Snowflake around a year ago, would now lead the company in the next phase. But investors appear to shrug off the CEO transition as the stock falls, as indicated in the chart above.

To further exacerbate Snowflake’s plight is the cybersecurity-related incident last week.

There has been a lot for me to digest and analyze over the past several months. Snowflake’s recent FY24 Analyst Day provided enough information about their product roadmap & strategy. The commentary from Analyst Day last week did enough to support my analysis.

I recommend buying Snowflake’s stock here.

Snowflake’s Transition to a True Data Service Enterprise

In my inaugural coverage of Snowflake, I recommended a Neutral view on the stock and mentioned that “Snowflake has a lot to prove or lose in its next growth phase,” ironically, two weeks before the shock CEO transition. In that post, I said:

With automation and AI now taking center stage, every company in the world has reviewed its long-term strategy to stay relevant in a new world. Snowflake appears to be swaying toward increasing the modalities of accessing data on its platform.”

Their Analyst Day presentation seemed to address my prior expectation of increasing modalities of data access that I had talked about in my previous post.

First, I must reiterate Snowflake’s revenue-generating mechanism, which forms the basis of Snowflake’s product strategy outlined in Analyst Day and its anticipated revenue impact.

Snowflake is in the business of providing cloud-based solutions to harvest the customer’s data, which is made available to the customer on demand and regardless of the consumer’s location or infrastructure. But the important aspect to remember is that the company makes money not only with the volume of data stored, but also with the volume of data queried or transferred. The more data that is consumed from Snowflake’s servers, the more revenue Snowflake generates from their customers. Here is an excerpt from their latest 10-K:

We generate the substantial majority of our revenue from fees charged to our customers based on the compute, storage, and data transfer resources consumed on our platform as a single, integrated offering. For compute resources, consumption fees are based on the type of compute resource used and the duration of use or, for some features, the volume of data processed. For storage resources, consumption fees are based on the average terabytes per month of all of the customer’s data stored in our platform. For data transfer resources, consumption fees are based on terabytes of data transferred, the public cloud provider used, and the region to and from which the transfer is executed.

Hence, I find it highly critical for Snowflake to increase the avenues for customers to access their data stored on Snowflake.

So far, as Snowflake won over customers from legacy database systems, the customers would be focused on mostly cloud migration-type workloads – moving data from their legacy on-premise systems to Snowflake’s cloud storage. But the suite of products that Snowflake has lined up for FY25 looks very encouraging to me, keeping in mind their consumption revenue model.

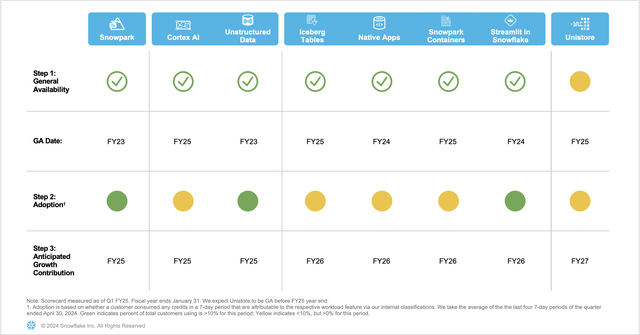

Exhibit A: Snowflake’s product lineup for FY25 and beyond to add more consumption revenue ramp (2024 Analyst Day, Snowflake)

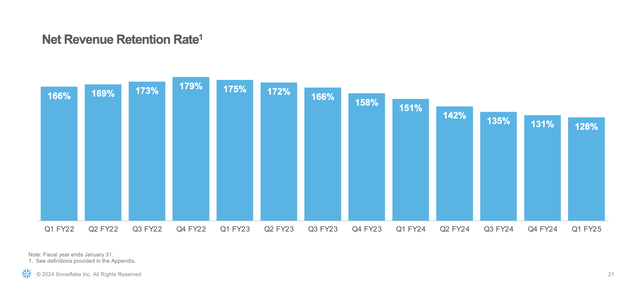

What really impressed me were some management comments about how they designed the products around data consumption. Products such as Cortex AI, Iceberg, Unstructured Data, Snowpark as listed in Exhibit A above, are all designed with heavy query-type workloads, leading to higher usage volumes, while others are meant for lighter queries, expanding the dimensionality of the use cases for which the customer’s data sitting on Snowflake can be used. I wouldn’t be surprised if the company’s industry-leading NRR (net retention rates) starts to move back higher as the company’s products move through the adoption curve of their respective product lifecycles.

Exhibit B: Snowflake’s Net Retention Rates by quarter (Q1 Presentation, Snowflake)

Until now, cloud migration workloads have mostly dominated the types of workloads on Snowflake as the cloud data company kept winning over customers from legacy database software. But with the launch of Snowflake’s new products, I believe Snowflake is widening the scope of use-cases and adding the options for customers to run a wider range of workloads, especially those geared around AI, applications, and collaborative workloads.

To me, this indicates that the Land-and-Expand model can really start to yield even higher results for the company, as the revenue-per-query strategy is set to pave the way for a stronger consumption revenue ramp. I also note that the current product roadmap is largely in line with the new CEO’s vision. The new CEO was a former Google executive who also founded his own GenAI-based search company, Neeva, that was acquired by Snowflake last year.

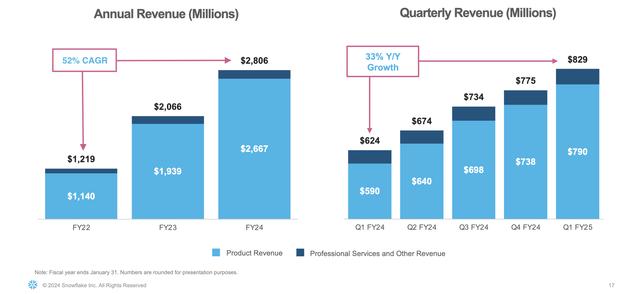

So far, Snowflake has demonstrated a +50% CAGR in revenue, as illustrated in Exhibit C below. But as the company gets larger, I expect that growth to normalize to around 25-26% CAGR over the next 3 years, slightly higher than the 24% CAGR rates that I had originally assumed per my prior coverage of Snowflake.

Exhibit C: Snowflake’s revenue trends by year and quarter (Q1 Presentation, Snowflake)

I believe that higher product adoption and the expected uptick in NRR should result in higher consumption and eventually benefit the company as it grows at these rates.

Growing TAM despite recent software spending slowdown talk

Recent commentary from cloud software companies such as Salesforce (CRM) and MongoDB (MDB) has further weighed down on Snowflake’s stock in May as the narrative for slower enterprise cloud spend builds momentum.

At the same time, it is interesting that Gartner updated their public cloud spending report a few days before Salesforce’s dreaded Q1 FY25 earnings report. Gartner’s updated H1 2024 cloud spend report pointed to marginal gains in 2024 versus their prior H2 2023 report. In fact, the expected spending in SaaS + PaaS is expected to be mostly unchanged when compared to Gartner’s H2 ’23 report.

Circling back to the wider commentary from the earnings reports of other cloud companies, I believe that investors generally may have gotten too optimistic about cloud companies in Q1. At the same time, Q1 generally tends to be a slower quarter for most cloud companies, in my view, and markets have been ignoring trends given the optimism stemming from GenAI.

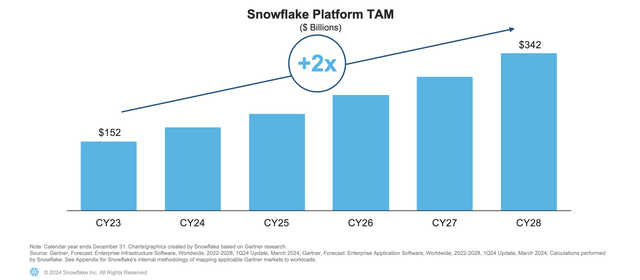

Plus, on Snowflake’s Analyst Day, management updated their TAM based on the product roadmap and the general availability of those products, as detailed in Exhibit A.

I have added management’s updated TAM in Exhibit D below.

Exhibit D: Snowflake’s TAM has expanded to $342 billion in 2027, per management (2024 Analyst Day, Snowflake)

As seen in Exhibit D above, the company’s TAM is now expected to grow at a CAGR of 17.6% over the next five years. If I compare this to the company’s previous TAM detailed in their FY23 Analyst Day slide deck (slide 41), the TAM CAGR has expanded by 1.9%.

To me, this indicates a larger market footprint for Snowflake to acquire, given the now-wider usage dimensionality of their products.

Upgrading Snowflake’s Price Target

I now have confidence based on the management’s product roadmap and general market expectations to believe that Snowflake is poised for some upside.

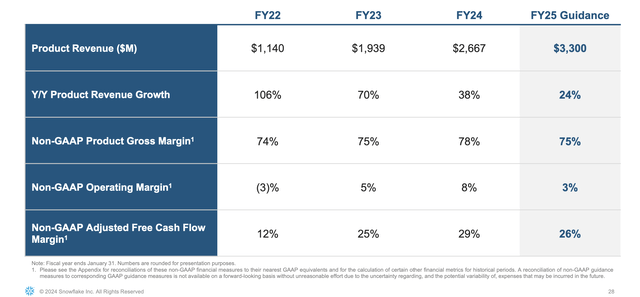

Exhibit E: Snowflake management’s FY25 guidance (Q1 Presentation, Snowflake)

Here are my assumptions for Snowflake:

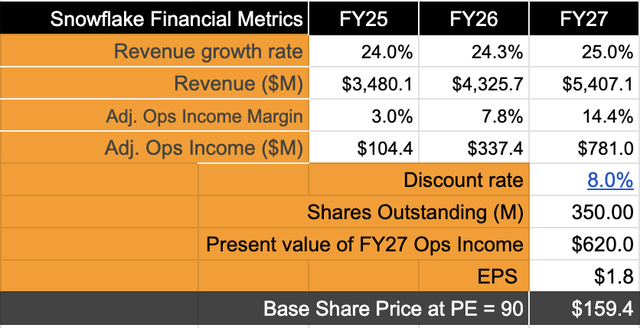

- For revenue, I have already stated my assumptions for 25-26% compounded growth in the earlier section. I have raised these expectations from my prior assumption of a long-term 24% CAGR.

- In terms of adjusted operating margins, management is guiding for adjusted margins to drop to 3% in FY25. This is because the company is operationalizing the cost of the GPUs acquired, in contrast to capitalizing on the cost as most of its peers do. But with ownership of these GPUs, management indicated that they aim to deploy them for inference workloads. This one-time hit to opex would result in significant margin expansion down the road, in my view. Per my estimates, I believe the company would see adjusted operating income grow ~50% CAGR.

- I have assumed a share dilution CAGR of ~2.5%, while discount rates are based on calculations here.

Exhibit F: Snowflake’s valuation model shows upside (Author)

Based on these, I believe the company now warrants a forward earnings multiple of ~90x, more than half of the +200x forward PE it trades at today.

This implies at least a 20% upside from current levels.

Risks and other factors to consider

Databricks is considered the most formidable peer to Snowflake. The company reported FY24 sales of $1.6 billion, growing 50% y/y. While the operating leverage profile of the startup is unclear, Databricks has an advantage over Snowflake purely in terms of revenue growth if I compare the 36% revenue growth demonstrated by Snowflake in the same reporting year. This would be a key area to note moving forward because Databricks would compete for investor capital while also targeting Snowflake’s target market. The data startup is widely expected to go public soon.

I also want to address the risk posed by the Snowflake hack I mentioned earlier. At this point, with the information I have at hand, I do not believe this is material to Snowflake. The hack seems to be an error at Snowflake’s customer’s end who did not turn on their MFA. Google’s Mandiant also has a diagram about how the attacker gained unauthorized access to the exposed Snowflake instance via an infiltrated device of a customer’s end-user account. This indicates a security lapse at Snowflake’s customer’s end or in the security policies that Snowflake’s customers should have implemented. In my opinion, this incident does not point to any lapse at Snowflake’s end. This may however bear on the stock in the immediate short-term period and assuming no further updates on this front, I expect no material impact to Snowflake.

Note: Databricks is expected to launch their own products at a product reveal event in San Francisco on June 10-13 this week.

Takeaway

There are quite a few reasons for investors to be pessimistic about Snowflake. The company has seen sales slow down while the ex-CEO suddenly left the company, which may have left investors with the feeling of being left “high and dry” while holding shares at relatively higher valuations.

I do expect valuation premiums to further fall over time based on my model, but the decrease in premiums is expected to be supplemented by stabilized growth in the top line and stronger growth in the bottom line, driven by an impressive product line-up that takes advantage of the company’s core consumption-driven revenue model.

I am encouraged by the insights revealed from Snowflake’s Analyst Day to upgrade the stock to a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNOW over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.