Summary:

- Snowflake beat expectations on both the top and bottom-line this quarter, as its core business remains very strong.

- The company raised its product revenue guidance for FY2025 and lowered margin guidance as a result of its investment into AI.

- The new CEO, Sridhar Ramaswamy, has prioritized customer engagement, execution, and product innovation, since taking over one quarter ago.

- He has been successful in accelerating the product innovation at Snowflake, with multiple new features to be generally available in the second half of the year.

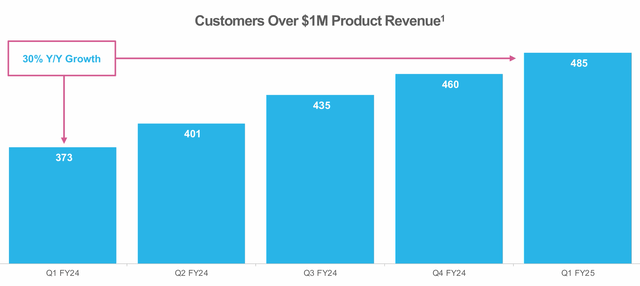

- Snowflake also continues to grow with its largest customers, with the number of customers contributing more than $1 million in product revenue, growing 30% from the prior year.

D4Fish

Snowflake (NYSE:SNOW) has reached new lows recently after recent announcements, along with a data breach that added more uncertainties.

I must say that my confidence in the new CEO Sridhar Ramaswamy has improved given what he has achieved in his first quarter as CEO, his speed of execution and urgency, and this is setting Snowflake up for a strong future indeed.

Management commentary was positive for its core business in the FY1Q25 quarter:

As evidence of our Q1 results, our core business is very strong. We’re still in the early innings of our plan to bring our world class data platform to customers around the globe. And in the first quarter alone, we saw some of our largest customers meaningfully increase their usage of our core offering. The combination of our incredibly strong data cloud, now powerfully boosted by AI, is the strength and story of Snowflake.

I have written extensively about Snowflake on Seeking Alpha, which can be found here. I see the selloff in Snowflake as a buying opportunity because the company’s focus on innovation and go-to-market will drive fundamental improvement, while my conversations with the company on the data breach found that market concerns are overblown.

FY1Q25

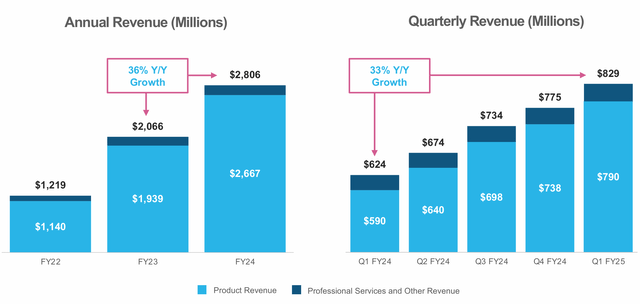

FY1Q25 total revenues came in at $829 million, beating consensus expectations by 5%.

FY1Q25 product revenue came in at $790 million, growing 34% from the prior year.

The largest growth drivers for the quarter came from a media entertainment Global 2000 and a large retail and consumer goods company, along with other smaller accounts outside of the Global 2000.

Within the quarter, management commented that they saw strong growth in February and March, but some moderation in that growth in April, which is a normal part of its business.

In terms of the market environment, Snowflake continues to see a stable optimization environment.

Out of the top 10 customers of Snowflake, seven of them grew quarter-over-quarter.

The FY1Q25 quarter was also the first quarter under the FY2025 sales compensation plan, and the sales representatives are executing well against their own plans.

This has resulted in Snowflake exceeding its new customer acquisition and consumption quotas.

Non-GAAP product gross margin was down slightly to 76.9%, as a result of increased GPU-related costs that were in-line with expectations as Snowflake invests in its AI initiatives.

Snowflake’s non-GAAP operating margin and non-GAAP adjusted free cash flow margins came in strongly at 4% and 44% respectively as a result of the outperformance in revenue.

Non-GAAP adjusted free cash flows margins beat consensus expectations of 41% despite the higher GPU-related costs mentioned above.

As of the end of FY1Q25, Snowflake has $4.5 billion in cash and investments on its balance sheet.

The company repurchased $516 million in shares in FY1Q25, representing 3 million shares at an average price of $173.14. The company continues to have $892 million remaining under its initial $2 billion authorization.

Guidance

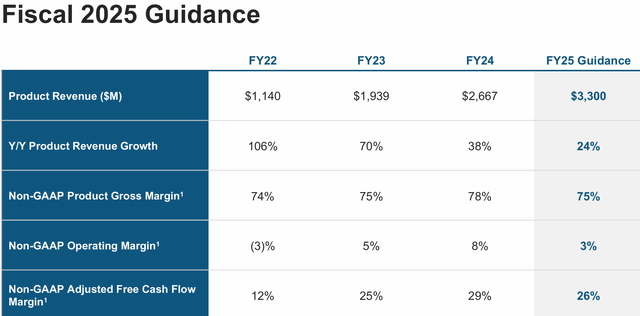

Management raised FY2025 product revenue guidance by 1.5% to $3.3 billion, representing growth of 24% from the prior year.

For FY2Q25, management expects product revenues between $805 million and $810 million, beating consensus expectations by 3% at the midpoint.

That said, Snowflake is also intending to invest more into its AI initiatives, which brings higher GPU-related costs into the equation, along with an acquisition of technology assets and key employees of Truera.

As a result, management expects non-GAAP operating margin for FY2Q25 to be 3%.

For the full year FY2025, management revised margins expectations down, and expects 75% non-GAAP product gross margin, 3% non-GAAP operating margin and 26% non-GAAP adjusted free cash flow margin.

This compares against the earlier 76% non-GAAP product gross margin, 6% non-GAAP operating margin and 29% non-GAAP adjusted free cash flow margin.

Snowflake continues to be prudent in its guidance methodology, only forecasting revenues that it has visibility into observed behavior. This means that the FY2025 guidance includes contribution from Snowpark but does not include revenue contribution from newer features like Cortex until there is more material consumption patterns, and Iceberg, which will be generally available later this year.

In addition, revenue headwinds are also embedded into the guidance, which includes the headwinds from movement of data out of Snowflake and into Iceberg storage, which is expected to be in the second half of the year.

Investments

The new CEO Sridhar Ramaswamy has made clear about his thinking around investments.

Apart from the GPU-related costs mentioned above that are tied to its AI initiatives, Snowflake is also bringing in new talent, particularly those in the AI field.

Snowflake announced that it intends to acquire technology assets and hire key employees from Truera, which is an AI observability platform that brings to Snowflake the capabilities to evaluate and monitor large language model applications and machine learning models and production. With this, Truera’s 35 employees are also moving to Snowflake.

This transaction has also been reflected in the lower margin guidance in the outlook.

While there is a higher level of investments made today into not just GPUs but also talent, the question here is whether the company is investing too much.

Clearly, Sridhar Ramaswamy is comfortable with the current level of investments that they are making.

Compared to the other big tech players, Snowflake has a modest AI budget, and with that scarcity and discipline mindset in the company, I think we are seeing efficient innovation from Snowflake.

The other important point CEO Sridhar Ramaswamy made was that the strategy here is not to create the newest technology or be at the very cutting edge of innovation, but rather to be a fast follower on the key areas that matters to Snowflake.

This has an important implication for Snowflake because as a fast follower, Snowflake can then be more efficient with the modest AI budget that it has.

New CEO executing

As Sridhar Ramaswamy’s first quarter as CEO, he has laid out three clear priorities for himself.

The first is to listen to and learn from customers, the second is to drive execution and alignment within the Snowflake go-to-market teams, and the last one was to fuel the innovation and product delivery engine of Snowflake.

I think that Sridhar Ramaswamy has done well in the first quarter as CEO and while it may still be too early to judge his long-term impact to Snowflake, I think he has gotten a good start.

He has already talked to more than 100 customers since stepping into this new role and I think this will help him get a better view about what customers really want, and drive that across in the next two priorities.

The focus for the go-to-market teams has been to focus on consumption and new customer acquisition, with the team building an end-to-end cadence for both. With that, new sales motion has been developed in specific workloads like AI and data engineering.

I think Snowflake could see more growth from these go-to-market initiatives as the team continues to execute.

Next, on product innovation and delivery.

Production innovation and delivery

I think one of the very clear impacts of Sridhar Ramaswamy as the new CEO is that we are seeing an acceleration in product innovation and delivery.

The Snowflake team has clearly been hard at work in not only building but launching new innovations and features at a very fast pace.

Snowflake Cortex, a fully managed service that enables access to industry-leading large language models, was made generally available earlier this month.

In the second half of the year, we will see Iceberg, Snowpark Container Services, and Hybrid Tables all be made generally available.

With Snowflake’s Document AI helping customers extract data from their documents, we are seeing Snowflake leverage AI to bridge structured and unstructured data.

In addition, Snowpark Container Services is expected to be made generally available in the second half of the year, with dozens of partners already developing solutions that will leverage container services to serve their end customers.

Also, with Snowpark, more than 50% of customers are already using Snowpark, and in FY1Q25, multiple large Global 2,000 customers moved to Snowpark.

Iceberg, to be made generally available in the second half of the year, is also expected to help Snowflake address a larger data footprint. There are already more than 300 customers using Iceberg in public preview, and many of its larger customers are saying that they will use Snowflake for more workloads due to Iceberg.

Snowpark and these other new features to be made generally available are expected to be the next growth driver for Snowflake, and they remain in their early days of revenue contribution, but the company has already seen very healthy demand.

Achievements in AI

Snowflake has not been shy in announcing that they are focused on investing in AI and machine learning.

The progress made in a very short period of time is admirable in my view.

As mentioned earlier, Cortex was made generally available earlier this month.

Snowflake has already seen a rather strong ramp in Cortex AI customer adoption since then, with more than 750 customers using these capabilities.

Cortex cam help customers improve productivity by reducing time consuming tasks, with an example given about Sigma Computing using the Cortex language models to help summarize and categorize customer communications from their customer relationship management.

In the FY1Q25 quarter, Snowflake also announced their own language mode, Arctic.

Arctic is very unique because it was developed in less than three months at just one-eighth the training cost of peer models.

Let that sink in.

Just three months and only one-eighth the cost of peers.

And the performance exceeds leading open models like the Llama 2 70B and Mixtral 8x7B across multiple benchmarks.

I think before Sridhar Ramaswamy joined as CEO, there was this fear that Snowflake may be left behind in the AI race.

As evident by his comments about the AI opportunity for Snowflake, he sees this as a key acceleration for the company and the team has been making remarkable progress in this area:

What is exciting about AI is that it can turbocharge our capabilities and growth on all three layers. It also helps democratize access to all the amazing enterprise data in Snowflake, massively increasing our reach. The progress we’ve made in AI for the last year, culminating in the past quarter is remarkable. We believe AI is going to continue to fuel our platform, helping our customers perform and deliver customer experiences better than ever.

I think with Sridhar Ramaswamy at the helm, the company is now on track to bring enterprise AI to its customers in a highly efficient manner and bring new features and innovation at a much faster pace than before.

Operational metrics

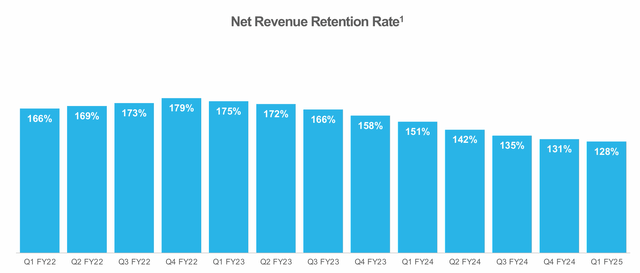

We continue to see operational metrics remain strong with Snowflake’s net retention rate at 128% for the FY1Q25 quarter.

Net retention rate (Snowflake)

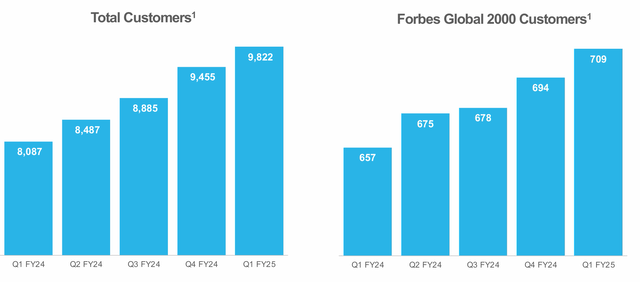

More impressively, the number of customers contributing more than $1 million in product revenue grew 30% from the prior year.

Quality customer growth (Snowflake)

The number of customers and the number of Forbes Global 2000 customers continued to grow at 21% and 8% respectively. I think this and the above graph shows the success Snowflake is having with increasing consumption amongst its existing customers, as it continues to bring in more new customers.

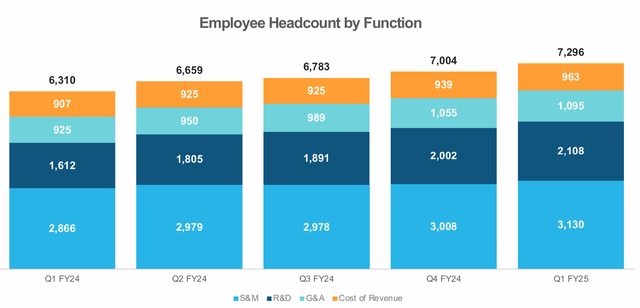

Snowflake has been hiring aggressively, with headcount growing 16% from the prior year, with the R&D team growing 31% from the prior year and the sales and marketing team growing just 9%.

Employee headcount (Snowflake)

This shows a very clear intent and priority by Snowflake’s new management team to accelerate the product innovation and launch new features.

Customers hacked

According to Bloomberg, about 165 customers have been hacked and their data stolen from a hacking group called UNC5537.

Snowflake engaged cybersecurity experts, CrowdStrike and Mandiant, to investigate, and found that this was not caused by vulnerabilities or a breach into the Snowflake platform or due to compromised credentials of current or past Snowflake employees.

In fact, the hackers targeted users with single-factor authentication and used credentials bought from info stealing malware.

While the hackers obtained credentials to a demo account of a former Snowflake employee, this did not contain sensitive data and it was not connected to Snowflake’s corporate and production systems.

Since the attack, Snowflake is moving towards requiring its customers to implement more advanced security controls such as multi-factor authentication or network policies.

In addition, Snowflake CEO also said that they are moving towards rolling out multi-factor authentication by default.

After the threat attack, I had a call with the investor relations team at Snowflake and they assured me that there is no expected impact from this event.

In fact, they also said that they do not expect any changes to its guidance.

All in all, I think while the cyber threat is unfortunate, its positive that the company’s systems were not breached and that this was a result of single-factor authentication from the customer end. That said, it is definitely puzzling that a company like Snowflake does not yet enforce multi-factor authentication for all its customers, but with this incident, it is now likely to be enforced.

Valuation

With a strong FY1Q25 reported, I am reiterating my intrinsic value of $229 from my earlier article, which assumes a 2028 80x P/E multiple and 12% cost of equity.

In addition, my 1-year and 3-year price targets remain intact at $245 and $346 respectively. They imply an 80x and 65x 2024 and 2026 P/FCF respectively. These P/FCF multiples are reasonable for Snowflake, in my view, because of the huge market opportunity and leadership position of the company. The multiple is also in-line with the average of its comparables, which includes other high quality software names like CrowdStrike and Datadog, since they trade at an average of 80x 1-year forward P/FCF ratio.

As I have mentioned in the earlier article, with Snowflake being a quality software company with not just growth but also profitable growth, the valuation of Snowflake is almost never at a steep discount, so the focus here is more in determining a fair value for the company.

As mentioned in the previous article as well, I have embedded deceleration in 2024, but also pricing in that Snowflake will beat its guidance for the next few quarters given the conservatism in the guide.

Conclusion

While there really is not much to be negative about Snowflake with the recent FY1Q25 results, the recent threat attack and growing investments into AI could pose as some near-term risks.

Revenues came in ahead of expectations, as Snowflake continues to grow amongst existing customers and bring in new customers.

As a result, margins also came in strong, but with additional investments needed in AI, this will come in weaker for the short-term for Snowflake to leverage on the AI opportunity to bring in higher long-term margins.

The number of new features becoming generally available in the second half of the year has clearly not yet been included in the guidance, which provides a nice set up for continued beat and raise in the second half, in my view.

Of course, the new CEO has been showing that he is suited for the top job, bringing a focused and disciplined execution to the company while accelerating innovation and product delivery.

With AI becoming increasingly important for Snowflake, his expertise in this area will be another key differentiator as we see Snowflake become a serious contender in the AI space.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 70% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!