Summary:

- Snowflake’s stock has notably underperformed the broader U.S. market since November 2023 after my previous cautious thesis.

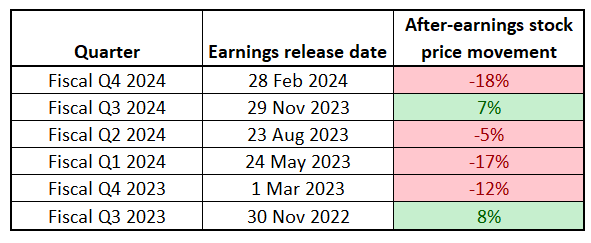

- In the last six quarters, there were four cases of after-earnings selloffs, and three of them resulted in double-digit-single-day stock price dips.

- My valuation analysis suggests SNOW stock is 30% overvalued.

Svetlana Krayushkina/iStock via Getty Images

Investment thesis

My previous cautious thesis about Snowflake (NYSE:SNOW) aged decently, since the stock significantly lagged behind the broader U.S. market since November 2023. The company reports its Q1 earnings this mid-week, and I want to warn readers that there are several reasons to be bearish and sell the stock before earnings. According to my valuation analysis, the stock is 30% overvalued. My analysis also reveals that the stock often experiences big selloffs after earnings releases. The company continues enjoying secular industry tailwinds, but the pace of revenue deceleration looks like another warning sign to me. All in all, I downgrade SNOW to “Strong Sell”.

Recent developments and Q1 earnings preview

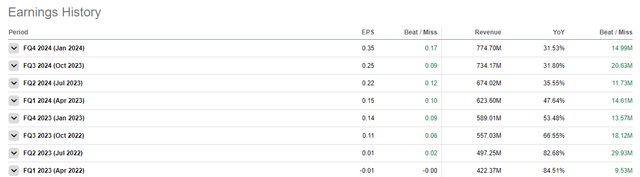

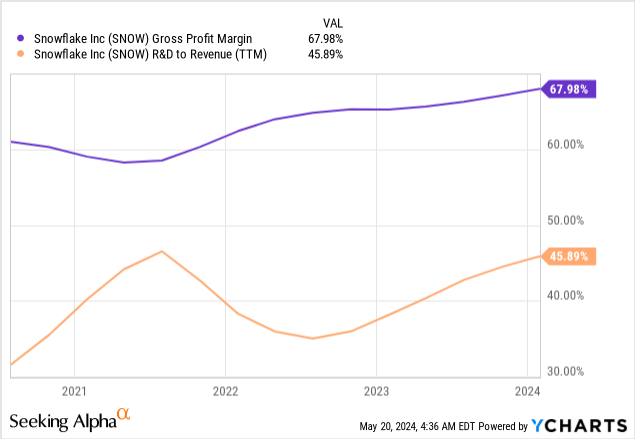

SNOW released its latest quarterly earnings on February 28 when the company topped consensus estimates. Revenue grew by 31.5% YoY, the adjusted EPS more than doubled, from $0.14 to $0.35. The gross margin expanded from 65% to almost 69%, a bullish sign. SNOW is still deeply unprofitable from the operating income perspective because it reinvests almost half of its revenue in R&D. Overall, the gross margin profile dynamic looks quite promising. The operating margin could have also improved significantly, but the company continues boosting R&D spending, which weighs on the overall profitability but looks like a temporary adverse factor to me.

Moreover, SNOW’s levered free cash flow [FCF] is positive even if I deduct the stock-based compensation [SBC]. This contributes to SNOW’s balance sheet, which is a fortress. SNOW had $3.8 billion in cash and equivalents as of the last reporting date. This is a vast amount compared to $288 million total debt.

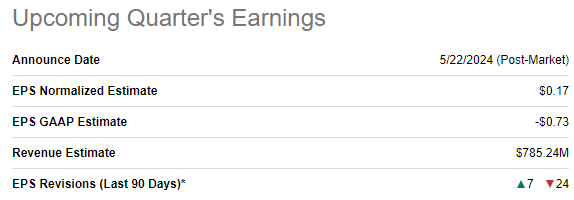

I do not want to pay much attention to the latest earnings because the next quarter’s earnings release is approaching. Q1 of fiscal 2025 earnings release is scheduled for May 22. Quarterly revenue is expected by consensus to be $785 million, indicative of a 26% YoY growth. The adjusted EPS is expected to expand YoY from $0.15 to $0.17.

Seeking Alpha

The warning sign is that there were 24 downward EPS revisions over the last 90 days. This indicates that the sentiment around SNOW’s upcoming earnings release is softening. On the other hand, lower expectations means that figures are likely easier to beat. Moreover, the company has almost flawless earnings surprise history.

Snowflake continues enjoying industry tailwinds as the digital world continues migrating to cloud. The demand for cloud computing is boosted by new generative AI capabilities, which is evident from Q1 performance delivered by the three largest cloud infrastructure companies: Amazon (AMZN), Microsoft (MSFT), and Google (GOOG). According to Canalys, global cloud spending grew by 21% YoY in Q1 2024. This is a notable acceleration compared to a 19% YoY growth demonstrated by the industry in Q1 2023.

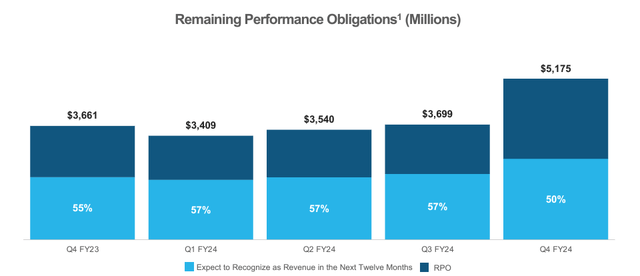

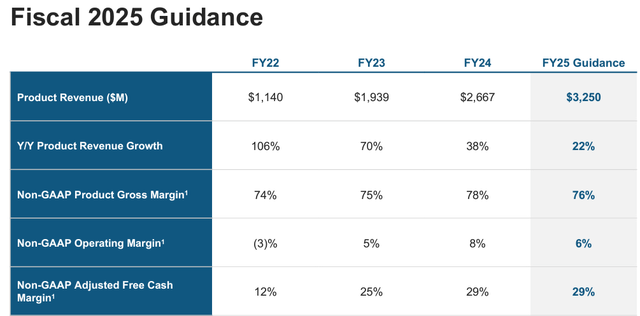

SNOW’s latest earnings presentation

On the other hand, despite massive AI and cloud tailwinds, SNOW’s revenue showed notable revenue deceleration in every quarter of fiscal 2024 compared to 2023. Each quarter’s YoY revenue growth was notably slower compared to the same comparative quarter. While decreasing revenue growth is natural as the company faces larger comparatives, the pace of deceleration might be a warning sign. However, there is a chance to return to the accelerated revenue growth trajectory. As I mentioned earlier, the company reinvests almost half of its revenue back into R&D. Of course, there is no guarantee that R&D spending will convert into financial success, but the rapidly improving gross margin profile suggests that the business model is sound and scaling up leads to greater profitability. To me, this is an indication that the company’s innovations have been quite successful so far.

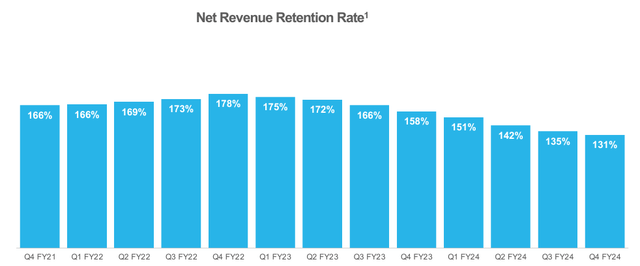

In its recent release about SNOW, BofA Securities analysts lowered the stock’s target price from $212 to $200. Apart from decelerating revenue growth, BofA’s analysts also emphasized SNOW’s substantially decreased net revenue retention rates. Indeed, this metric demonstrates a warning trend and shrunk significantly over the last two years. This is a warning sign because it likely indicates diminishing ability to maintain and grow revenue from existing customers.

SNOW’s latest earnings presentation

Furthermore, according to the management’s FY 2025 guidance, it expects full-year revenue growth to be 22%. While it is an impressive revenue growth without context, it is a significant deceleration compared to FYs 2024 and 2023. Should this deceleration trend sustain, the company’s revenue growth can sink to single digits within the next couple of years.

SNOW’s latest earnings presentation

Last but not least, let me emphasize how usually the markets behaved after SNOW’s earnings releases. It seems that expectations around the company’s performance are inherently high and overly optimistic because after-earnings selloffs occur much more frequently with SNOW’s stock than rallies. In the last six quarters, there were four cases of after-earnings selloffs, and three of them resulted in double-digit-single-day stock price dips. Therefore, investors considering buying SNOW before earnings should be aware of this substantial risk of a selloff.

Compiled by the author

Valuation update

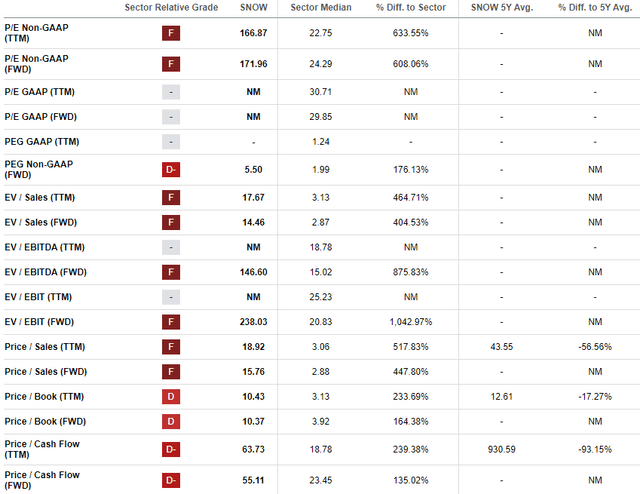

The stock declined by 7% over the last twelve months and 2024 has also been bumpy so far with a 19% YTD share price decrease. SNOW’s valuation ratios are sky-high. On the other hand, the company’s revenue outpaces cloud industry’s growth, and its profitability ratios are expanding consistently.

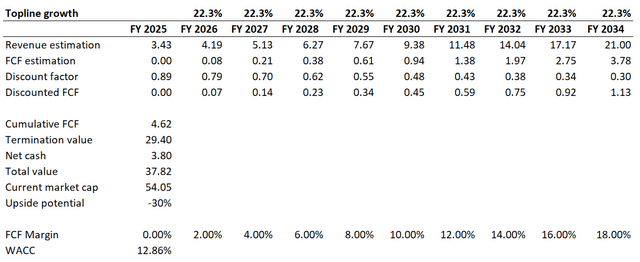

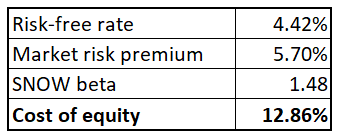

Since looking at ratios is likely insufficient for a company like SNOW, I must simulate the discounted cash flow [DCF] model. I want to calculate the discount rate by myself. Given the company’s extremely low average, I use cost of equity as the discount rate. Risk-free rate is 4.42%, which is the U.S. 10-year Treasuries yield. According to Seeking Alpha, 24-months beta is 1.48. U.S. equity risk-premium is 5.7%.

Author’s calculations

With all the above assumptions, the discount rate for my DCF model is 12.86%. My DCF’s FY 2025 revenue is based on consensus estimates. For the years beyond, I implement a 22.3% topline CAGR. SNOW’s TTM FCF ex-SBC margin is slightly below zero. However, since SNOW’s profitability metrics are consistently improving, I expect zero FCF margin in FY 2025. My FCF expansion trajectory usually correlates with the expected revenue growth. Therefore, for a 22.3% revenue CAGR, I think that a two-percentage point FCF margin yearly expansion is fair.

Please also keep in mind that the company reinvests around 50% of its revenue into R&D. As revenue is expected to ramp up with an aggressive CAGR, the R&D to revenue ratio is poised to moderate. This will positively affect the company’s FCF margin. Moreover, we see that there is a strong correlation between revenue growth and the gross margin expansion. That said, projecting an aggressive FCF margin expansion is fair.

My DCF simulation suggests that the stock is 30% overvalued, despite aggressive revenue growth and FCF expansion assumptions. Therefore, the stock looks significantly overvalued.

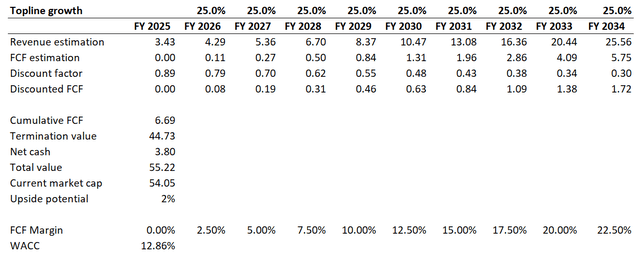

Risks to my bearish thesis

A growth company’s valuation is all about the future growth potential. Valuations are based on consensus growth projections. If the management persuades Wall Street analysts during the earnings call that it can sustain its staggering revenue growth for longer. A 25% revenue CAGR for the next decade together with a 250 basis points yearly FCF expansion justifies current SNOW’s valuation. These are extremely aggressive assumptions, but not unrealistic. Therefore, in case Wall Street analysts boost their expectations around SNOW’s long-term growth potential, this might be a big positive catalyst for the stock price.

Snowflake reports its fiscal Q1 earnings on the same day with Nvidia (NVDA). Therefore, there is a possibility that Nvidia’s stellar earnings release might add optimism to the whole market and especially growth stocks. Since SNOW also has an exposure to AI, this stock might become one of the beneficiaries of Nvidia’s potentially robust Q1 performance.

Bottom line

To conclude, SNOW is a “Strong Sell” before the earnings release. The stock is significantly overvalued, and the last six quarters suggest that SNOW frequently experiences massive after-earnings selloffs. This does not appear to be a bullish pair of catalysts before the upcoming earnings release. SNOW is an interesting company and I expect that it will become more attractively valued after earnings.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.