Summary:

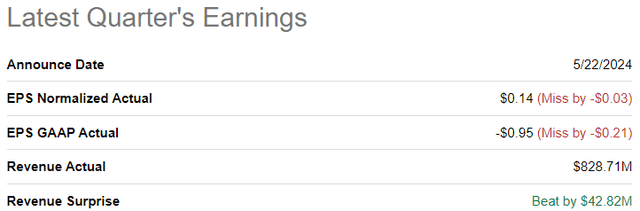

- For Q1 FY2025, Snowflake reported a mixed set of numbers, with a sizable beat on revenue intertwined with a glaring earnings miss.

- Driven by strength in its core business, Snowflake beat top-line expectations by 5.5%, and management raised full-year revenue guidance.

- However, Snowflake is experiencing some margin deterioration due to increased investments in AI and changes to its compensation model for sales reps.

- In reaction to this report, Snowflake stock has dropped back into the $150s.

Hill Street Studios/DigitalVision via Getty Images

Brief Review Of Snowflake’s Q1 FY25 Earnings

In my previous report on Snowflake (NYSE:SNOW), I labeled management’s FY2025 guidance as a welcome gift for their new CEO:

Despite the guided deceleration in SNOW’s business for 2024, I continue to see a path to $10B ARR by 2029-30. The new CEO – Sridhar Ramaswamy – comes with an incredible CV, and the guide for 2024 may well be an easy beat-and-raise setup for Ramaswamy (sort of a welcome gift from Frank Slootman, who’s still going to be the Chairman of the Board).

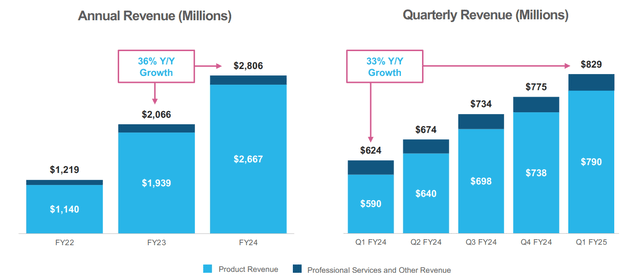

With Snowflake breezing past consensus revenue estimates for Q1 FY2025 and raising the full-year top-line guidance, we now have evidence to support that “sandbagged guidance” idea. In Q1 FY2025, Snowflake recorded quarterly revenues of $828.71M (up ~33% y/y), beating consensus street estimates by ~$43M (or ~5.5%).

Seeking Alpha

Snowflake Investor Relations

According to Snowflake’s leadership, this top-line strength was driven by higher-than-expected usage of their core data warehousing offering:

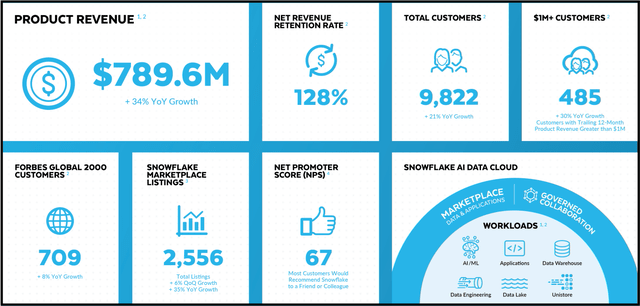

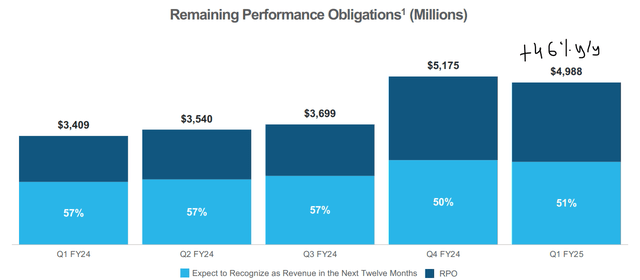

We finished our first quarter with strong performance across many of our key metrics. Product revenue was up 34% year-over-year at nearly $790 million, while remaining performance obligations were $5.0 billion, up 46% year-over-year. Our core business is very strong. Our AI products, now generally available, are generating strong customer interest. They will help our customers deliver effective and efficient AI-powered experiences faster than ever.

– Sridhar Ramaswamy, CEO, Snowflake

Snowflake Investor Relations

Snowflake Investor Relations

What’s driving the re-acceleration in Product Revenue and RPO?

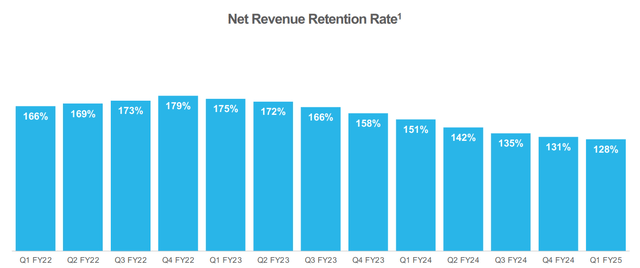

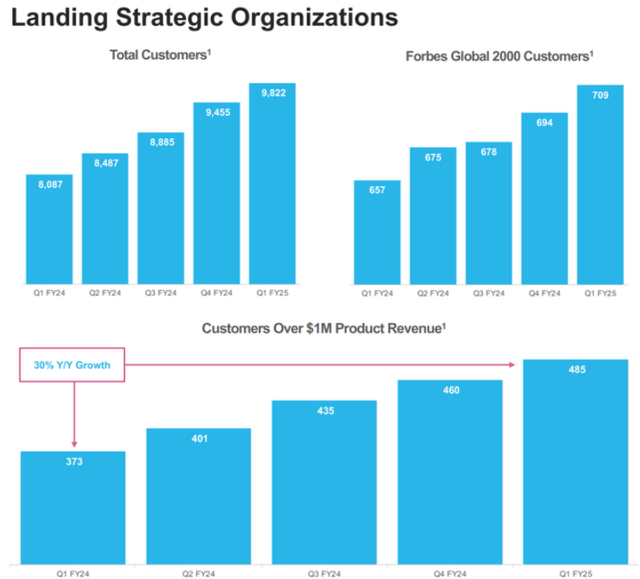

Despite experiencing spend optimization (driven partly by its own innovation – Iceberg), Snowflake is still extracting more revenues from its existing customers, as evidenced by net retention rates of 128%. Furthermore, Snowflake continues to land new customers at a healthy clip.

Snowflake Investor Relations

Snowflake Investor Relations

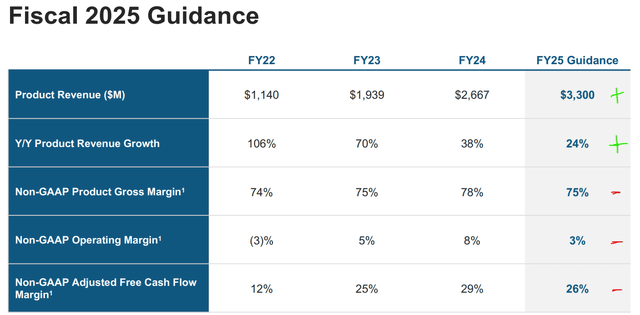

Based on Q1 strength and current consumption trends, Snowflake’s management lifted guidance for FY2025 Product Revenues to $3.30B (up from $3.25B), which implies +24% y/y growth in FY2025 vs. the previous expectation of +22% y/y growth. Yes, Snowflake’s growth rates are set to moderate significantly from last year’s +38% y/y growth; however, given the Q1 growth rate of +33% y/y, the updated FY2025 guide could also be sandbagged, i.e., the slowdown could be less pronounced than expectations.

Snowflake Investor Relations

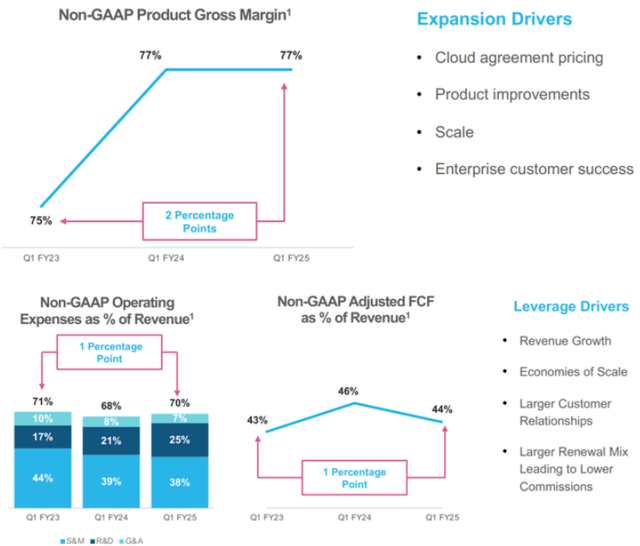

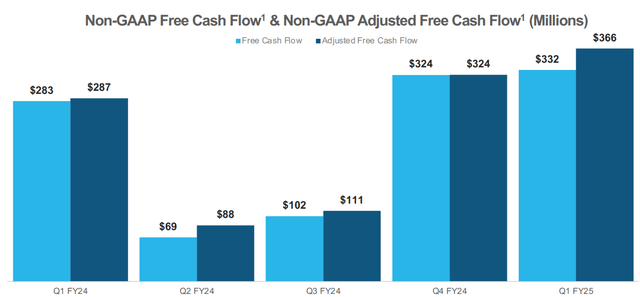

Now, while revenue and booking trends are heading in the right direction, Snowflake is experiencing some margin deterioration amid increased investments in AI and changes to the compensation model for sales reps (consumption-based commissions are now expenses upfront vs. being amortized over five years).

In Q1 FY2025, Snowflake’s Product gross margins held up at 77%. However, operating expenses rose two percentage points from the year-ago period, resulting in a decline in adjusted FCF margin from ~46% to ~44%.

Snowflake Investor Relations

Now, despite seeing margin contraction, Snowflake’s greater scale allowed the data cloud company to deliver record-high quarterly adjusted free cash flow of $366M in Q1 FY2025.

Snowflake Investor Relations

For FY2025, Snowflake’s management sees Product gross margins moderating slightly to 75% (down from the previous estimate of 76%), with non-GAAP operating margins now expected to come in at +3% (instead of +6%). Also, Snowflake’s projection for adjusted FCF margin has moved down to ~26% from ~29%. Overall, free cash flows will still come in higher than FY2024, but Snowflake’s margins are clearly moving in the wrong direction.

As a long-term investor in Snowflake, I’m not too concerned about temporary margin deterioration as investing in AI is of paramount importance and Snowflake will still be producing tons of free cash flow.

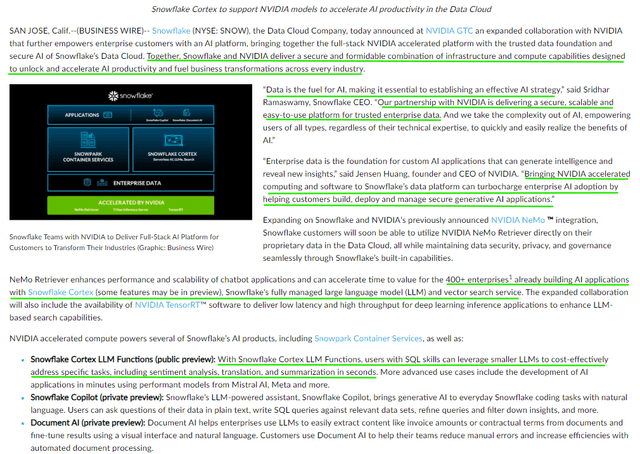

In the era of artificial intelligence, enterprises are rushing to formulate a data and AI strategy. As the leading Data Cloud platform in the market, Snowflake is well positioned to experience secular growth tailwinds for several years to come. As you may know, Snowflake recently announced an extended collaboration with Nvidia to provide its customers with a full-stack AI platform:

Snowflake Investor Relations

During recent quarters, Snowflake has strategically acquired data and AI companies like Neeva, Myst AI, and Samooha as it builds out an AI ecosystem. With its Q1 report, Snowflake announced its intent to acquire certain technology assets and hire key employees from TruEra, an AI observability platform that provides capabilities to evaluate and monitor large language model (LLM) applications and machine learning models in production.

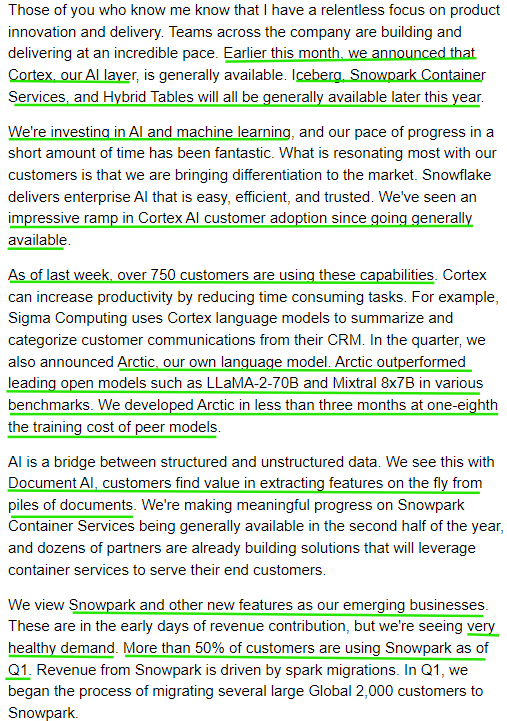

In addition to the inorganic expansion of its AI ecosystem, Snowflake is also innovating rapidly. For example, Snowflake developed its Arctic LLM model in just three months at 1/8th the cost of peer models:

Snowflake Q1 FY2025 Earnings Transcript

Overall, Snowflake’s Q1 report was somewhat of a mixed bag. While Snowflake missed bottom line expectations and reduced profit guidance for FY2025 primarily due to margin pressures from increased AI investments, Snowflake’s core data warehousing business is driving better than expected top-line growth and forward guidance. As the leading data cloud company, Snowflake remains well positioned to thrive in the era of AI. Despite the guided deceleration in SNOW’s business for FY2025, I continue to see a path to $10B ARR by 2029-30. While margins are in deterioration mode, ~75% Product gross margins and ~26% adjusted FCF margins are nothing to scoff at. And in my view, these margin headwinds are temporary.

Let us now re-evaluate SNOW’s long-term risk/reward to see if it’s a good investment at current levels.

Snowflake Fair Value And Expected Returns

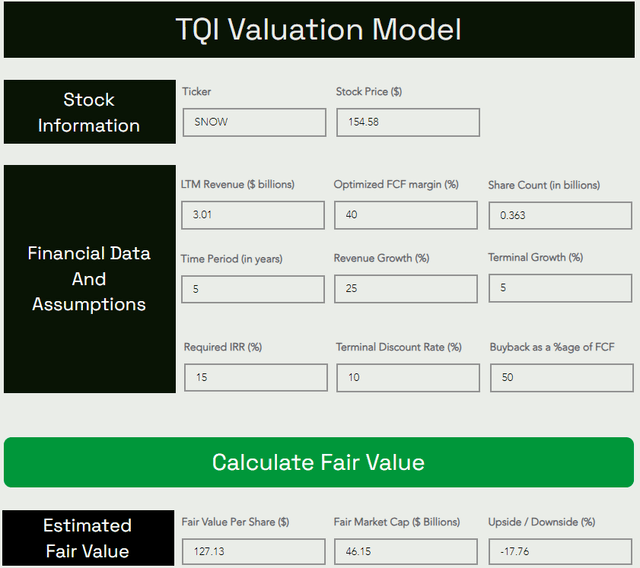

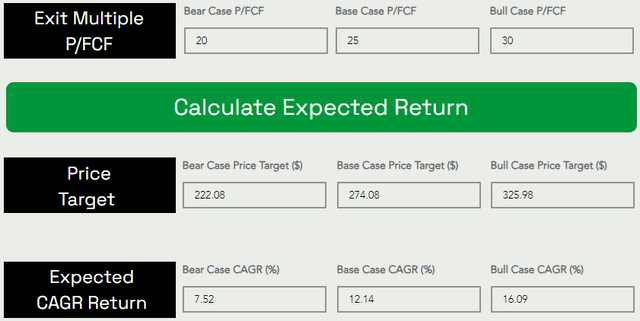

TQI Valuation Model (Free to use at TQIG.org)

TQI Valuation Model (Free to use at TQIG.org)

As per our model, Snowflake is worth ~$127 per share, or $46B in market capitalization. Assuming an exit multiple of 25x P/FCF, I can see SNOW stock rising from ~$127 to ~$274 per share at a CAGR rate of 12.14%. Since Snowflake’s five-year expected CAGR return falls short of our investment hurdle rate of 15%, it’s still not a “Buy” under our valuation methodology.

Concluding Thoughts: Is SNOW Stock A Buy, Sell, Or Hold?

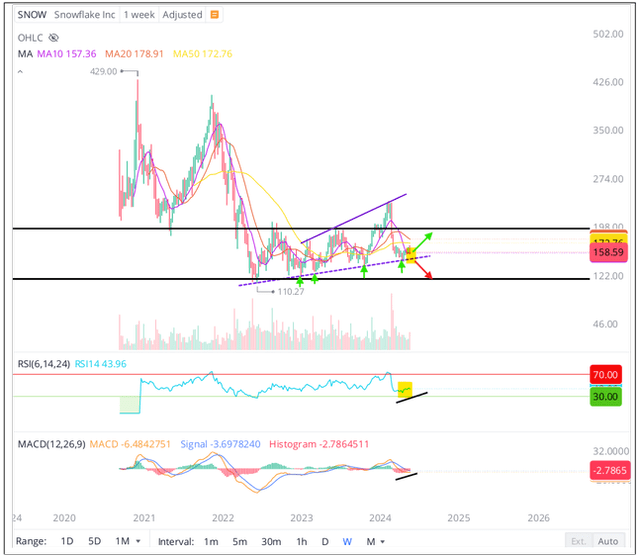

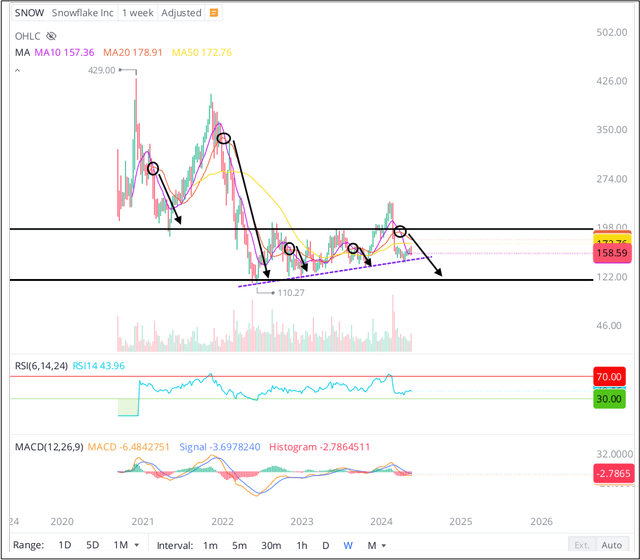

From a technical perspective, Snowflake’s stock chart is finely poised, trading smack in the middle of a wide Stage-I accumulation base ($110-200 range). Since striking a bottom in late 2022, Snowflake has been trending upward, with a series of higher highs and higher lows appearing to form a bullish megaphone pattern (marked in purple lines).

After rocketing up to ~$230 per share in early 2024, Snowflake suffered a sharp pullback to the mid-$100s in light of its Q4 2023 report, and that’s where SNOW has treaded water over the last three months.

WeBull Desktop

Today, Snowflake stock is testing its 10-week moving average, and there’s further support at the lower trendline of the megaphone pattern (at ~$150 per share). As long as these supports hold, Snowflake could take another swing at ~$200 (breakout level of the Stage-I accumulation base) in the next 6-12 months. However, on the flip side, a breakdown of these support levels could easily trigger a slide down to the lower end of the Stage-I base [~$110], given SNOW’s technical momentum is currently negative (with the 10-week undercutting the 20-week moving average just a few weeks ago – a signal that has driven big drawdowns in SNOW stock in the past).

WeBull Desktop

While we already own a position in SNOW, I want to build a bigger position in this business for the AI era. In my view, paying a reasonable premium to buy a high-quality business like Snowflake is not the worst idea right now, so restarting accumulation here is fine for investors willing to accept a 12% CAGR return. That said, based on technicals, Snowflake could move by $40-50 in either direction over the next 6-12 months, depending on the outcome of the test of the $150 level. Given our existing long position, I prefer to wait and observe for now.

Key Takeaway: I continue to rate Snowflake a “Hold” at $155 per share, with the idea of resuming slow, staggered accumulation if the stock pulls back another 15%-20% to fair value (price correction) or intrinsic value catches up to the stock price in the next 6-12 months (time correction).

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.