Summary:

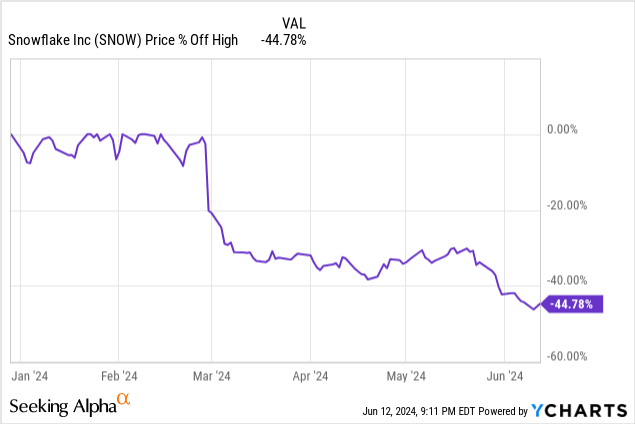

- Snowflake Inc. is trading at -44.8% off year-to-date highs.

- Our assessment of Snowflake’s prospects suggests that the company should further extend its market leadership over competitors due to its superior product ecosystem.

- Despite Snowflake’s aggressive spending in recent quarters, its fundamentals remain healthy, and we estimate Snowflake will turn a profit within the next three years.

- For short-term traders, we also think that the stock is in oversold territory and could be due for an imminent rebound.

- Accordingly, we initiate our coverage of Snowflake with a “Buy” rating.

alexsl/E+ via Getty Images

Snowflake Inc. (NYSE:SNOW) stock has been under severe selling pressure since the company reported mixed FYQ1 results on 22 May. Some Wall Street analysts have also expressed doubts over Snowflake’s AI roadmap under the leadership of its new CEO, Sridhar Ramaswamy. Given that almost every technology company is investing heavily in AI, it is no wonder that Snowflake’s delayed push into developing its own AI initiatives has hurt its stock price performance this year.

In addition, recent reports that 165 Snowflake customers were exposed to cyberattacks that led to the theft of corporate data stored on the company’s cloud platform further exacerbated the sell-off. Although Snowflake has since clarified that the cyberattacks were not due to vulnerabilities in its systems and that only customers who did not deploy multi-factor authentication were affected, the damage had already been done.

At the time of writing, SNOW was trading at -44.8% off year-to-date highs.

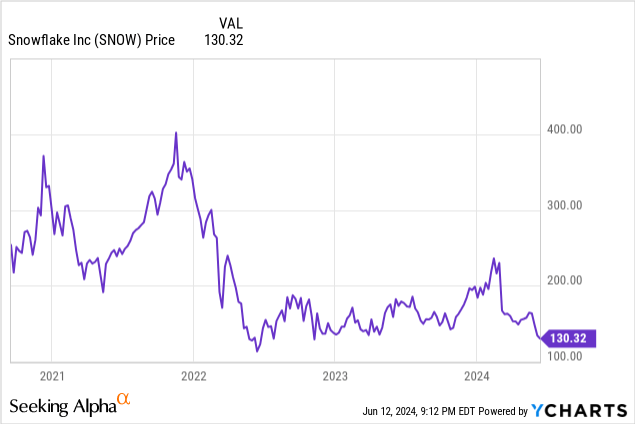

The stock has also languished since the company went public in September 2020. Although SNOW’s IPO was initially priced at $120 a share, the stock debuted at $245 a share. At its peak, SNOW traded as high as $400 back in November 2021.

Following a brief and sharp rally between November 2023 and February 2024, the stock has once again fallen back to near-all-time lows and close to its initial IPO price of $120.

Lemon Or Undervalued Gem?

Although cybersecurity risks are likely to remain a recurring threat to Snowflake (as well as to any other cloud technologies), Snowflake continues to be widely regarded as one of the most secure and robust platforms available in the market today. This is achieved by the company’s highly integrated platform architecture and multi-layered built-in security features. Not only do we think that the latest cybersecurity scare will have a negligible negative impact on Snowflake, but we also see renewed efforts by the company to enforce multi-factor authentication as a positive outcome that will enhance the platform’s resilience to future attacks.

Snowflake’s financial performance since its IPO may perhaps resemble that of an unprofitable or struggling company. However, our assessment of Snowflake’s prospects suggests that the company will not only continue to benefit from the rapid digitization of the global economy, but its superior product ecosystem should further extend its market leadership over competitors.

It is worth noting that many technology companies offering a less compelling product mix and facing more intense competition than Snowflake are trading at more demanding valuations. This suggests to us that Snowflake is relatively oversold at current levels and that the pessimism is mostly driven by fearful sentiment rather than fundamentals.

FYQ1 Results Not As Bad As It Seems

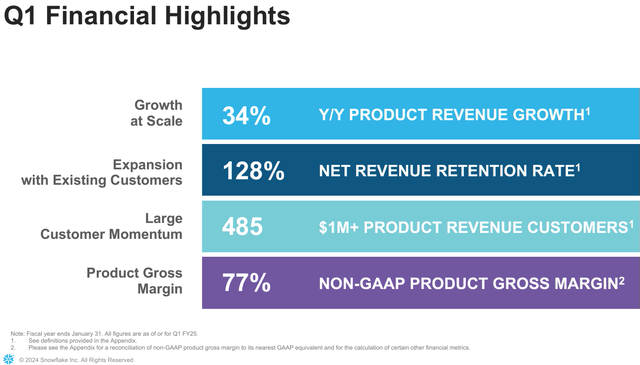

Crucially, we think Snowflake’s latest FYQ1 results continue to reflect a constructive long-term outlook.

One of the most common complaints from investors is that Snowflake’s growth is slowing. This is a valid concern as Snowflake has yet to turn profitable, and slowing revenue growth only means that the company will burn more cash before it ever makes a profit. Without positive earnings, or at least a reliable estimate of future earnings, valuation metrics such as P/E and PEG ratios are pretty much meaningless.

The good news, however, is that Snowflake’s revenue does not seem to be slowing down due to market saturation. If that is the case, we would typically see a sustained decline in profit margins as companies offer discounts to sustain revenue growth or defend market share.

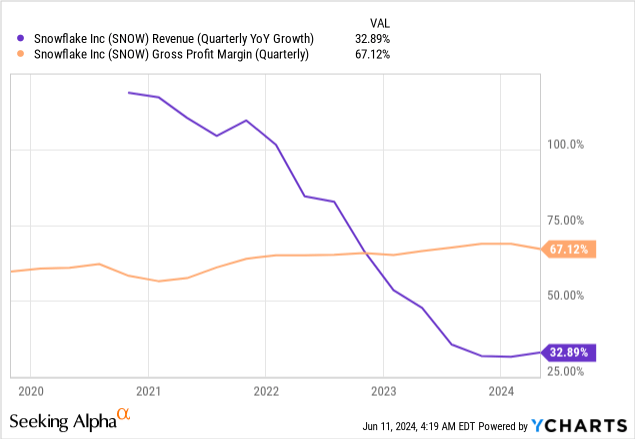

We view Snowflake’s revenue slowdown as a perfectly healthy and normal phenomenon. As the accompanying chart shows, Snowflake’s quarterly revenues were simply expanding at an unrealistic pace (>100% annually) when it went public in 2020. Although it is quite normal for smaller companies to double their revenues every year during the early stages of growth, it is simply not realistic to expect Snowflake, with a US$42 billion market cap and US$2 billion in annual revenues, to sustain that kind of steep growth trajectory.

This revenue slowdown is entirely normal and should be expected. In fact, Snowflake’s revenue growth has recently stabilized at around 33%, which still exceeds revenue growth for the cloud computing segments of leading technology companies such as Alphabet (GOOGL), Amazon (AMZN), and Microsoft (MSFT).

We expect Snowflake’s revenue growth to continue to track growth across the broader cloud computing sector, which we foresee running at a healthy pace of 20%-30% over the next five years before moderating towards 10%-15% over the longer term.

Another point to note is that Snowflake’s gross profit margins are exceptionally high at 67% and have been rising gradually over time. We are surprised at how resilient Snowflake’s gross margins have been over the years despite rising costs. We attribute this to Snowflake’s superior product ecosystem, which explains the company’s strong pricing power and a high net revenue retention rate of 128%.

Snowflake Investor Q1 FY25 Presentation

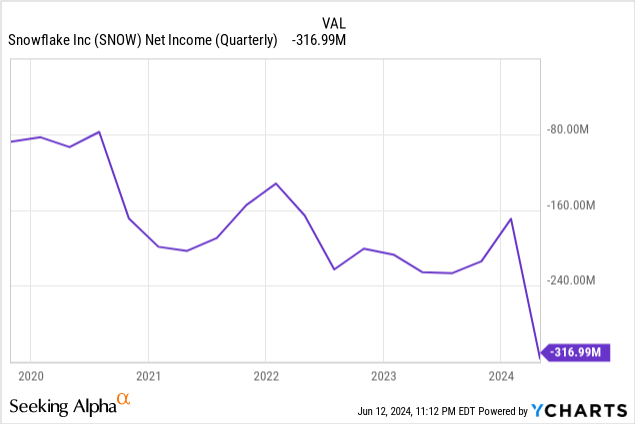

Another major complaint from investors is that Snowflake’s quarterly losses are growing and that it is burning cash. This must be especially worrying for investors, given that cash generates a decent return of around 4%-5% today.

However, fast-growing technology companies running large losses while being valued at seemingly ridiculous multiples is a rather common phenomenon.

Growing To Dominate

During the initial growth phases, these companies typically adopt an aggressive go-to-market strategy that often requires heavy spending to build up a sales force and marketing campaign to grow revenues. Simply put, such strategies aim to fast-track growth to dominate the market before the competition is able to catch up.

There are various benefits that come with obtaining a “first-mover advantage“: securing and occupying the most profitable market segments, establishing strategic partnerships with key suppliers, achieving early economies of scale, and increasing entry barriers for new entrants.

These companies are also usually in a rush to build a leading ecosystem of products or to develop and educate their target market in an attempt to secure market share and lock in new customers. The faster these companies grow their platform and portfolio of customers, the greater the network effects and the more valuable and competitive the brand becomes.

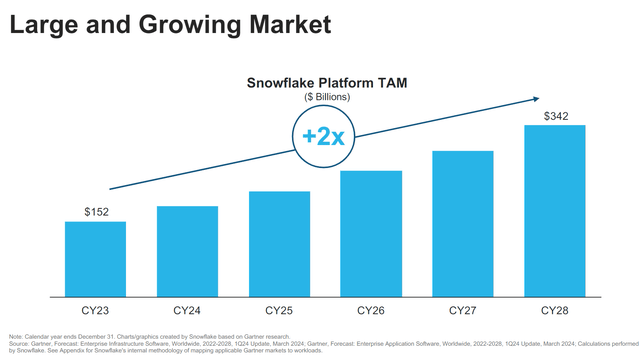

Thus, we believe that investors may be overreacting to Snowflake’s growing quarterly losses. Given the blistering pace at which Snowflake is still growing its revenues (30%+) and that there is ample room for growth with an estimated Total Addressable Market (TAM) of US$342 billion by 2028, we see little reason to worry.

Snowflake Investor Day Presentation

From our perspective, Snowflake’s heavy spending is absolutely critical if the company is to extend its lead over the competition. As Snowflake further entrenches itself as the leading data cloud platform, the company will be able to redirect its focus from growth to profitability, something that we expect is likely to happen much sooner than most investors think.

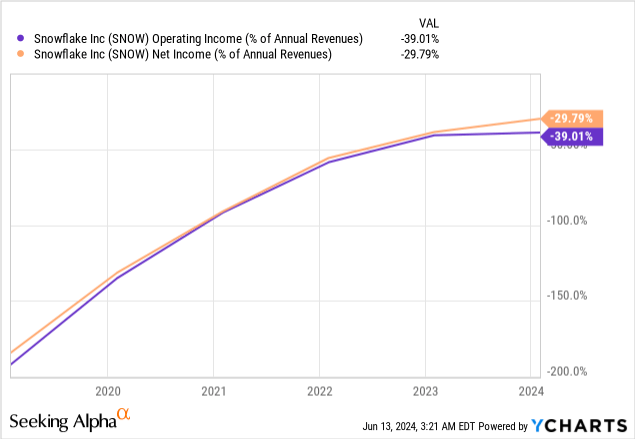

One way to judge whether a company is spending aggressively to grow or spending to fail is to look at operating income and net income in proportion to revenue. As the accompanying chart shows, although Snowflake has been spending aggressively and recording larger losses (in dollar terms) every quarter, revenues have been growing faster. The result is narrowing losses as a percentage of revenues.

YCharts

This suggests to us that despite Snowflake’s aggressive spending in recent quarters, its fundamentals remain healthy, and we estimate Snowflake will turn a profit within the next three years.

In Conclusion

Since last year, we have consistently avoided AI-related themes and expensive technology names because the risk-to-reward potential for these ideas has generally been unattractive.

However, the recent sell-off in Snowflake has presented a rare opportunity to pick up a growth stock that is at the core of the AI revolution at a deeply discounted price. Given Snowflake’s robust growth potential over the next couple of years, we view current levels as a compelling opportunity for long-term investors to accumulate.

Even for short-term traders, we also think that the stock is in oversold territory and could be due for an imminent rebound. We see the potential for a forceful 10%-20% rebound from current levels, followed by a recovery back to the previous peak of $233 by the end of the year.

Accordingly, we initiate our coverage of Snowflake with a “Buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.