Summary:

- Snowflake Inc. reported strong earnings, but shares fell ~15% due to concerns around forward guidance and revenue growth deceleration.

- Stock-based compensation expenses are still too high, impacting profitability and shareholder value, while the company’s valuation remains unsustainable based on its forward P/E.

- Despite the potential of AI data cloud, Snowflake’s slowing growth, high costs, and unprofitable operations make it a strong sell.

AZemdega/E+ via Getty Images

Investment Thesis

Snowflake Inc. (NYSE:SNOW) reported earnings after the bell on Wednesday. Even with the software company delivering quarterly results that beat on both the top and bottom line, shares fell almost 15% on Thursday.

The data storage company’s forward guidance and deceleration in year-over-year revenue growth have raised alarms. This is something I have been pointing out since I last wrote on SNOW in May.

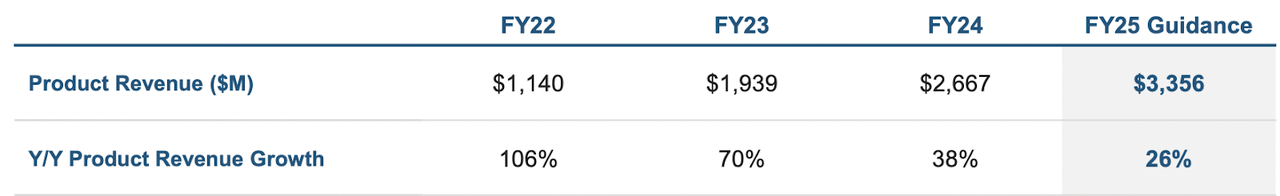

Snowflake’s forward guidance, while upped slightly, did little to calm concerns about the durability of their growth. Analysts from Morgan Stanley noted that while the results were solid, they were not enough to raise investor confidence (they definitely made me more bearish), since product revenue growth is slowing and GAAP losses are still heavy via their heavy stock-based compensation program.

Snowflake’s current valuation bakes in expectations of continued high growth, yet the forecasted revenue slowdown makes me really concerned about whether the high P/E premium makes sense here.

The company’s (P/E) ratio is still well above industry the sector median, but growth is now far less special than it was even just a few fiscal years ago.

With this in mind, I think Snowflake’s continues to be a strong sell. The disconnect between the company’s valuation and the growing risks associated with their maturing customer base makes the stock’s current valuation unsustainable.

Why I’m Doing Follow-Up Coverage

Since I last covered them in May, Snowflake’s stock has seen a steep drop-off, falling by 27.86%. Before earnings, a large portion of this drop reflected growing concerns among investors about Snowflake’s reliance on small and medium-sized businesses (SMBs), many of which are now struggling due to rising interest rates and an economic slowdown. Like their smaller clients, the company has been increasingly vulnerable to a slowdown and is now facing more headwinds as their net revenue retention rates have dropped—from 142% to 127% over the last few fiscal quarters. While this is still a solid NRR, the decline is concerning.

Despite raising their full-year guidance, Snowflake’s 2Q 2025 results did little to reassure the market. Analysts have pointed out that while there is a massive opportunity for the company to grow their AI-related products, this might not be enough to counterbalance the immense competitive challenges from larger cloud service providers like Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN). Snowflake is simply melting from an NRR perspective as competitors turn up the heat.

Again, the actual results were above expectations. Snowflake’s quarterly results appear strong initially, as the company beat both top and bottom-line expectations. The Non-GAAP EPS of $0.18 exceeded estimates by $0.02, and revenue came in at $868.82 million, surpassing forecasts by $18.67 million.

The quarter’s results, though technically a “beat” through revenue growth, have decelerated to growth of 30% year-over-year (growth was as strong as 106% YoY back in FY 22). I’ll talk more about this in the valuation section, but the company trades at a really high P/E for 30% growth.

This is why I’m doing follow-up coverage. The devil is in the details on this one. My goal is to point out the red flags and explain the problems before they metaphorically snowball.

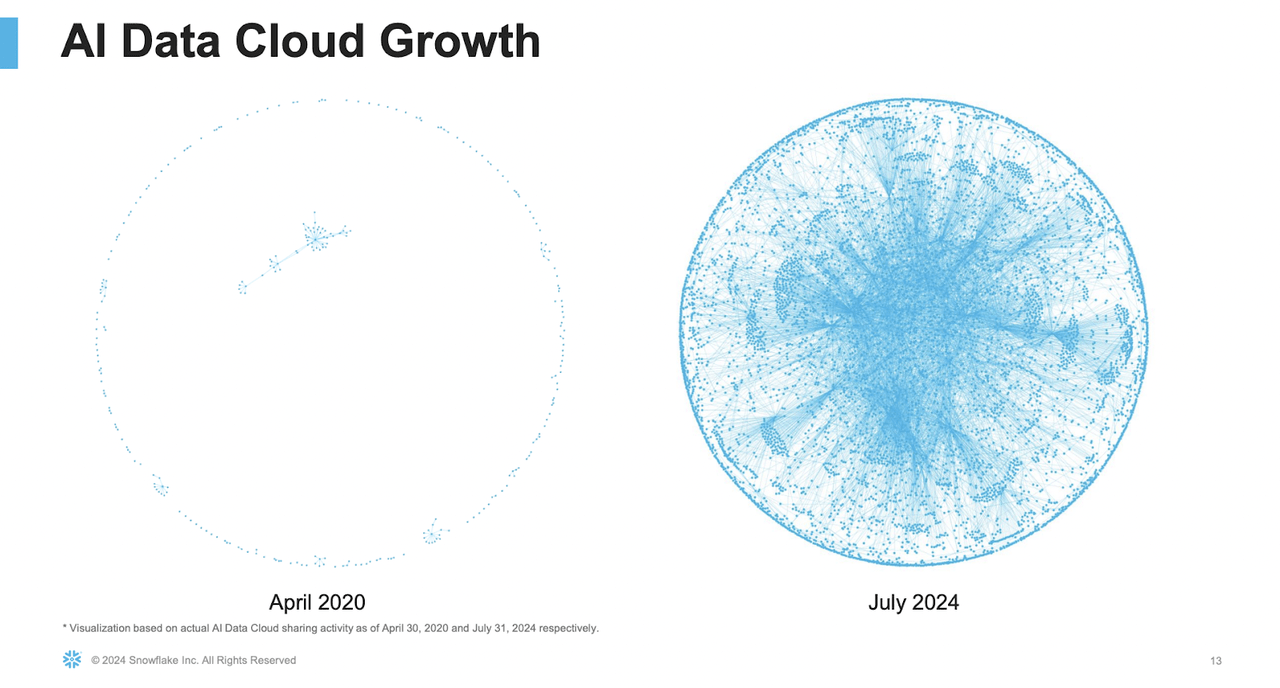

What The Market Did Not Like In The Quarter

Snowflake’s stock-based compensation, or SMB, has seriously hurt the credibility of their financials. The company reported $356 million in stock-based compensation, increasing from $299.7 million in the same period last year, up 18.78% YoY! Although this is common in the tech industry, the compensation remains high and represents approximately 38% of Snowflake’s operating expenses. Ouch.

Cash-Flow Statement (Snowflake)

While Stock-based compensation helps in attracting and retaining top talent, it’s also a burden when it comes to profitability and shareholder value because it dilutes existing shareholders and adds to operating losses.

With the stock priced for perfection based on their forward P/E, investors are a little uneasy about forward guidance for the next year. This is a stark contrast to the company’s earlier rapid expansion. During the earnings call, CFO Mike Scarpelli said that the company is projecting that 3Q 2025 product revenue would be between $850 million and $855 million.

The company’s non-GAAP operating margins are projected to decline from 8% this year to just 3% the following year due to what, I believe, is the exorbitant level of stock compensation being awarded.

When the stock-based compensation is annualized, Snowflake is paying over $1.4 billion (with a B) against their $3.3 billion in yearly revenue, or roughly 42% of their total earnings. This is an unsustainable percentage that dilutes shareholders like crazy and also pressures the company’s margins. I don’t see why this is necessary.

Valuation

I think Snowflake’s valuation is increasingly difficult to justify, particularly in light of their forward P/E ratio, which is at 193.84, much higher than the sector median of 23.2. The market is pricing in incredible future growth, but the company’s growth metrics are already showing signs of heavy deceleration. Snowflake’s forward revenue growth is projected at 27.99% compared to the sector median of 6.52% according to metrics from Seeking Alpha. Again, remember revenue used to grow at 106% YoY in FY 22.

On the profitability front, I am concerned about the company’s margins. The company’s net income margin is seriously negative, standing at -31.73%, largely attributed to the extensive stock-based compensation that drags on their bottom line.

Even after the 28% drop since I covered them in May, I think there is even more room to fall. If shares were to come down to a forward P/E of even 50 (this is still over double the forward P/E) this would represent a 74.20% downside from where shares are at today (and even after their precipitous fall).

Bull Thesis

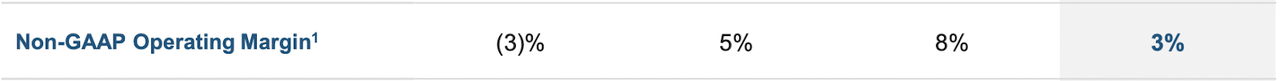

In their 2Q investor presentation, the company highlighted how AI data cloud connectivity is important since AI cannot function effectively without a data strategy. Snowflake, since the space has grown exponentially in the past 4 years, has a ton of market opportunities they can grab.

Snowflake’s AI data cloud, as the company claims, is designed to enable data sharing and integration.

Don’t get me wrong, Snowflake’s AI data cloud’s growth metrics are compelling, with a 34% year-over-year increase in customers utilizing data-sharing capabilities.

According to Sridhar Ramaswamy during the earnings call:

In the first half of this year alone, we brought as much product to market as we did all of last year. We are making Snowflake the best cloud for computation, collaboration, and application of all data. And we are leveraging the power of AI to make all of these easier to create, maintain, and use. This is what our team is aligned around. And I can tell you, that our customers are adopting the new capabilities at an incredible base.

We are also seeing broad adoption of our products across our customer base. As of the end of Q2, more than 2,500 accounts were using Snowflake AI on a weekly basis. We expect that option to continue to increase and revenue contribution to follow.

We’re continuing to responsibly invest in AI and machine learning to deliver enterprise AI that is easy, efficient, and most of all, trusted.

Snowflake estimates their total addressable market (TAM) is projected to reach $342 billion by 2028 (earnings presentation), showing a considerable potential to capture growth in the data cloud and AI-driven analytics sectors. However, even with this enormous TAM, I think that Snowflake is not executing at a level that justifies their high valuation and growth expectations. A great TAM is only part of making money off an opportunity. You have to actually create value for customers and then capture it. I don’t think they are doing this as effectively given their slowing growth.

The AI revolution is just starting and at a $3.3 billion run rate you should not be slowing down (look how big Microsoft’s AI business is). I think this is an execution issue. Despite a leadership change earlier this year, the company continues to grapple with the same issues—high costs, slowing growth, and unprofitable operations after stock comp which management controls. I think this raises questions about whether the new management can steer the company toward sustainable growth while effectively managing expenses.

I think competitors like Palantir Technologies Inc. (PLTR) are also capitalizing better on the opportunities in the data analytics and AI space than Snowflake. Palantir, for instance, has successfully integrated their platforms with AI and data-driven decision-making processes for better growth and profitability firm-wide. Palantir’s commercial enterprise growth is accelerating. Snowflake’s is slowing. I think the stock is melting. That is a fairly unique phenomenon in AI right now.

Takeaway

Snowflake’s recent quarter highlights many investors’ concerns regarding the tech company’s long-term growth and profitability. Despite their strong market potential, the company’s high costs, slowing revenue growth, and unprofitable operations, as well as excessive stock-based compensation, make their current valuation difficult to justify, in my view. Competitors like Palantir are outpacing Snowflake and leveraging market opportunities far more effectively.

Unfortunately, I am skeptical about the company’s future because of their inability to control costs and improve profitability despite their large TAM. I think Snowflake’s current valuation just does not make sense.

Given these challenges, Snowflake remains a strong sell. In my opinion, the company’s growth prospects are melting despite what appears to be a relatively solid quarter on the surface.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN,PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.