Summary:

- Snowflake’s solutions have fallen behind its competitors offering more comprehensive AI/ML solutions.

- Snowflake’s management is pursuing a capital-intensive strategy to catch up with the competition, sacrificing profitability and positive free cash flows.

- At current prices, our assumptions suggest that Snowflake is not an interesting investment opportunity.

loops7

Executive Summary

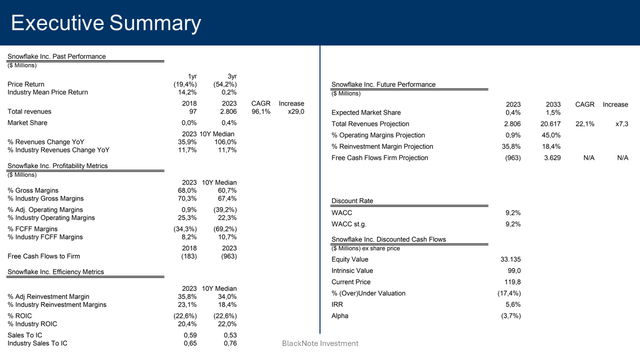

Snowflake (NYSE:SNOW) stocks are currently trading above their fair market price.

Despite having brought a breath of fresh air to the data industry, in recent times, Snowflake’s solutions have fallen behind its competitors, which heavily invested in more comprehensive machine learning solutions making it a natural fit for the advent of AI.

Lack of competitiveness and declining revenue growth, forced Snowflake’s management into pursuing a capital-intensive strategy to catch up with the competition, sacrificing progress towards profitability and cash flow generation, ultimately weakening Snowflake’s business model.

At current prices, our assumptions suggest that Snowflake is not an interesting investment opportunity.

Before deep diving into the valuation, it’s worth mentioning that the Sell rating we express is not, and never will be, an invitation to short-sell companies.

Rather, if you are not yet invested, it would be a suggestion to not buy the company at the current prices, or, if you are already invested, an invitation to re-evaluate your position in the company to check whether or not might it be worth it to cash in the profits and look for better investment opportunities.

Source – Analyst’s composition

Operation Overview

Snowflake is a cloud-based data platform offering data storage and data analytics solutions.

Snowflake’s products comprise a cloud-native data platform that permits its customers to access highly scalable compute and storage resources, unify data from different data silos to solve critical business problems, and share those data inside and outside their organizations allowing customers to blend existing data with new ones and monetize on internally-generated data.

Founded in 2012, Snowflake’s solutions were a breath of fresh air for the data industry, solving decades-long issues of data being trapped in the organizations’ departments where they originated, not permitting data specialists to blend data from different departments, or between business partners, to come up with richer insights.

However, despite their innovative approach to data cloud, nowadays, after the surge in popularity of generative AI and machine learning (ML) models, Snowflakes has fallen behind its competitors, namely Databricks – a privately owned firm – which instead of focusing on storage and compute solutions for data analytics, heavily invested into developing a platform for data scientists and ML engineers making it a natural fit for the advent of business AI.

Data warehouses – Snowflake core business – are a useful tool for storing large amounts of structured and semi-structured data – like tables, CVS files, and emails – for business analytics purposes. Data lakes instead – Databricks underlying architecture – can deal with even larger amounts of data, including unstructured data – like PDFs, images, and videos – and are widely used as training bases for ML and AI models.

Despite for most companies data warehouses being enough to come up with the insights needed to solve business problems, the sudden surge in AI demand – and the growth opportunities lying there – forced Snowflake’s management into increase capital investments in R&D and strategic acquisitions to catch up with the competition, inevitably delaying the path towards operational profitability and positive free cash flows.

Over the past two years, Snowflake introduced new AI-oriented solutions like Cortex AI, their proprietary generative AI model, and Snowflake ML, a set of tools to train, deploy, and run ML models. In addition, the firm concluded key acquisitions like Neeva, a company offering generative AI search solutions allowing the firm to implement intelligent search in its data cloud; and TruEra AI, offering an observability platform to monitor the performance of LLMs and ML models.

Other than falling behind in terms of AI capabilities, Databricks went down the opposite direction, stealing Snowflake’s market shares by starting to offer cloud data storage solutions on top of its already strong data engineering and data science platforms. An easier path than going from storage solutions to AI/ML solutions.

With that said, putting a word in favour of Snowflake, in the meantime, it ramps up its AI/ML solutions, its market share and growth performance can rely on a widely adopted and high-regarded data cloud platform, counting for more than 9’000 customers praising it for offering seamless experience and excellent data analytics capabilities.

Industry Overview

Snowflake, with its $2.8 billion in revenues in 2023, has established a niche presence in the software industry, representing 0.4% of the industry’s total revenues of $635.1 billion.

Looking at its main competitor, Databricks, with its $1.6 billion revenues registered in 2023, achieved a market share of 0.3%. As for the 2024 fiscal year, Databricks expects revenues in the $2.4 billion range, while Snowflake’s guidance sets 2024 revenues at $3.5 billion.

As reported by Foundation Capital in its Databricks vs Snowflake article, the outburst of Gen AI brought enterprise data companies to “racing to adapt as value migrates up the stack toward dynamic systems of models and tools built on top of their offerings” as growth opportunities and profitability likely reside in being able to offer AI-powered applications capable to process the enormous amount of data stored in data lakes and data warehouses and come up with critical business insights.

Industry Forecasts

Having a look at the broader software industry, as previously discussed in my analysis of ServiceNow:

From 2013 to 2023, the software industry’s revenues grew at a CAGR of 10.4%, increasing 2.7 times from $235.3 billion to $635.1 billion.

Software Industry Past Revenues (in $millions)

Year Revenues 2013 235,340 2014 246,722 2015 259,124 2016 266,770 2017 289,731 2018 323,616 2019 378,425 2020 428,603 2021 568,567 2022 498,727 2023 635,157

The blossom of the internet at the beginning of the 21st century and the mass adoption of cloud computing have been two major drivers for the rapid expansion of the software industry. Nowadays, given the ongoing digitalization trends and sprout of AI technologies, software solutions are embedded in enterprise environments more than ever.

Considering the collective investments made by software companies through the years, to support future growth, the 2024 expected growth rate for the industry is 14.07%. We projected the industry’s expected revenues 10 years from now, applying the expected growth rate of 14.07% and allowing it to slowly decline as the industry approaches the economy’s perpetual growth rate, represented in this case by the USD risk-free rate.

By 2033, the software industry revenues are expected to reach $1.4 trillion, increasing 2.2 times from the $635.1 billion registered in 2023 at a CAGR of 8%.

Software Industry Future Revenues (in $millions)

Year Revenues 2023 635,157 2024 724,543 2025 813,741 2026 901,377 2027 986,296 2028 1,067,581 2029 1,144,548 2030 1,216,732 2031 1,283,861 2032 1,345,824 2033 1,402,645

Company Growth Forecasts

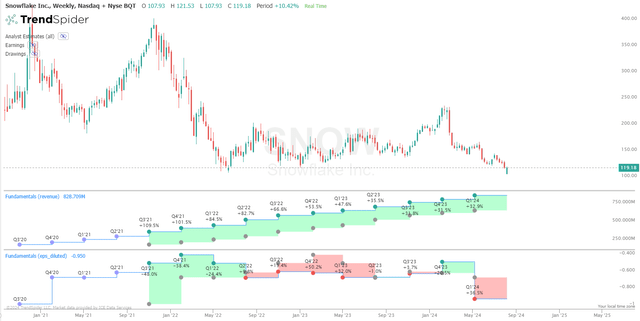

Over the period 2018-2023, Snowflake’s revenues grew at a staggering CAGR of 96.1% increasing 29 times from $97 million to $2.8 billion.

Snowflake Revenues & Market Share (in $ millions)

|

After Sridhar Ramaswamy – ex-Google and co-founder of Neeva – stepped in to become the new CEO it had one goal, ramping up Snowflake AI capabilities to drive revenue growth. As reported during the Q1 earnings call:

…The world of AI is rapidly evolving, and we’re investing in that because we do think there’s a massive opportunity for Snowflake to play there. And it will have a meaningful impact on future revenues

Over its brief life span, Snowflake has been growing revenues at a median rate of 106%, however, as the firm gets bigger and bigger, revenue growth rates will inevitably settle for more sustainable levels, and it’s already happening, with management expecting revenues to grow around 24%-25% in 2024 as the newly introduce AI/ML solutions will require more time before having a meaningful impact on the top-line.

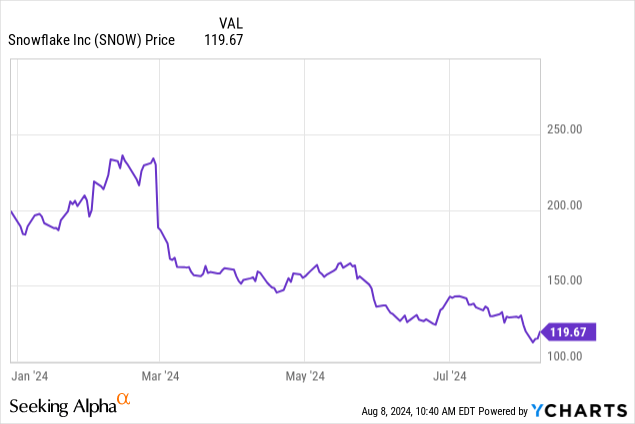

Lower revenue growth, along with falling behind competition, are the main reasons for the poor stock performance registered YTD, with Snowflake being down (42%), while the majority of AI-related stocks are up significantly in 2024, even after the recent tech sell-offs.

However, despite Wall Street concerns, Snowflake’s business model can still rely on widely adopted data platforms to deliver double-digit growth rates, while as regards market shares, even with higher competitive pressure, there is still plenty of room for growth for both Snowflake and Databricks, as the enterprise-data-cloud segment is still a young and underpenetrated market.

In addition to that, even though Databricks’ solutions might be more comprehensive for those customers looking for AI-oriented data clouds, it is worth mentioning that given their more complex nature – when compared to Snowflake’s ones – they come with additional human costs, as customers need data engineers and data scientists to fully implemented and use its solutions, inevitably driving up the total adoption costs. On the other hand, Snowflake is known for its low-code and easy-to-use solutions, without the necessity to have well-paid data engineers and data scientists.

Given its more user-friendly and cost-effective products, Snowflake can attract a greater number of clients just looking for a powerful tool with a friendly user experience that their employees can use to obtain useful business insights.

For such reasons, we expect Snowflake’s market share to continue improving, benefiting from the growing demand for enterprise data solutions, reaching 1.5% of total software industry revenues by 2033.

With these assumptions, Snowflake’s revenues are projected to reach $20.6 billion by 2033, representing an increase of 7.3 times from the 2023 revenues of $2.8 billion at a CAGR of 22%.

Snowflake Future Revenues & Market Share (in $ millions)

|

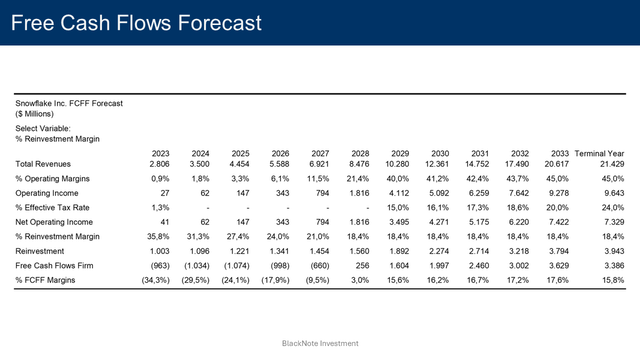

Free Cash Flows Forecasts

Although Snowflake’s business model can deliver growth, when it comes to profitability and cash flow generation is a different story. The firm still has to achieve GAAP profitability, and given the investments needed to ramp up AI solutions, the path to profitability is deemed to be inevitably delayed as reported during the Q1 earnings call:

Turning to margins, we are lowering our full-year margin guidance in light of increased GPU-related costs related to our AI initiatives. We are operating in a rapidly evolving market, and we view these investments as key to unlocking additional revenue opportunities in the future. As a reminder, we have GPU-related costs in both cost of revenue and R&D.

When treating R&D as operating expenses, Snowflake’s 2023 operating margin sits at negative (39%), however, when treating R&D as capital expenditures – as they generate returns in future years – the 2023 operating margin timidly adjusts to a positive value of 0.9%, still a very disappointing result.

We believe Snowflake’s business model has the potential to deliver adjusted operating margins in line with the ones of other AI-oriented software companies we recently covered like Palantir and ServiceNow, for which we assumed adjusted operating margin in the 40%-45% range.

However, in the next 3 to 5 years, we expect Snowflake to continue to deliver depressed margins as they require significant investments to support revenue growth, negatively affecting free cash flow generation.

When treating R&D as capital expenditure, the adjusted median reinvestment margin jumps to a whopping 34%, higher than the industry median value of 18.4%.

For such reason, we expect the reinvestment margin to remain above industry median values in the next 3 to 5 years – as the company needs to invest in its new AI-focused strategy – to then settle around 18.4% as the investments hopefully start to pay off and the firm reduces its reinvestment needs for future growth.

In 2023 Snowflake registered negative FCFFs of ($936) million, calculated as adjusted net operating profit minus net Cap. Ex., acquisitions, net R&D expenses, and plus changes in WC capital, equal to a FCFFs margin of negative (34.3%).

Due to the poor operating margins and high re-investments, we expect the FCFFs margins to remain negative for the next 3 to 5 years, to then turn positive by 2027 and sit around 16%-17%, assuming the firms improve its profitability and lower the reinvestment needs entering a more mature state.

With these assumptions, Snowflake’s FCFFs are projected to reach $3.6 billion by 2033.

Source – Analyst’s composition

Valuation

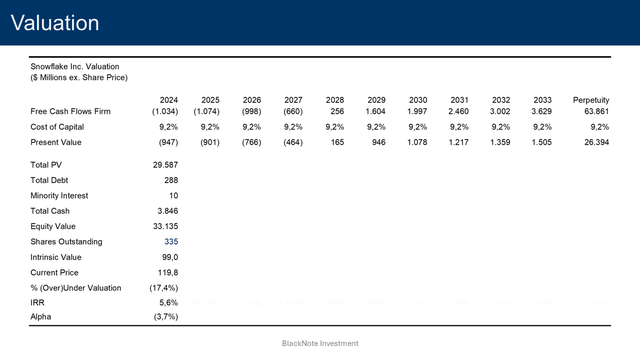

Applying a discount rate of 9.2% for the next 10 years and in perpetuity, we obtain that the present value of these cash flows – after adjusting for debt and cash on hand – is equal to $33.1 billion or $99 per share.

Compared to the current prices, Snowflake’s stocks are overvalued by 17.4%.

To justify current stock prices, the implied rate of return would be equal to 5.6%.

It implies investing in Snowflake at the current prices would deliver a negative alpha of (3.7%) as it would generate lower returns compared to the actual return investors should expect – equal to the cost of equity of 9.2% – given the assumption on cash flows and risk made so far.

Source – Analyst’s composition

Discount Rate

To determine the appropriate discount rate, we employ the WACC method, which considers both the cost of equity and the cost of debt.

The cost of equity – 9.2% – is derived using the USA equity risk premium of 4.5% – as of August 2024 – the current USD risk-free rate of 3.9%, and the company’s beta of 1.119. The company’s beta is based on the software industry’s unlevered beta of 1.13.

The cost of debt – 4.6% – represents the expected return demanded by debt holders and is influenced by the company’s specific risk profile and the broader market conditions. It is computed considering the current USD risk-free rate of 3.9%, the company’s default spread of 0.69%, and the USA default spread of 0%.

With a current Equity to EV of 99.5% and a Debt to EV of 0.5%, the discount rate for the next 10 years is 9.2%. In perpetuity, the discount rate is still 9.2%.

Wall Street Sentiment

The street target for Snowflake – based on 37 different analyst expectations – is sitting at $191 per share, as of the 8th of August 2024, with 21 street recommendations expressing the rating “Buy”.

Wall Street appears to be far more optimistic about Snowflake, however, the key to explaining such a gap in price expectations is the way free cash flows are calculated. Wall Street is known for adding back stock-based compensations – mostly due to R&D employees – to estimate free cash flows, however, by doing so it severely understates the reinvestments needed to support future growth, inflating both FCFs and companies’ valuation.

We believe our approach is more transparent and representative of the real abilities of a company to generate free cash flows and ultimately create value for its investors.

Conclusion

The recent turmoil in the tech sector highlighted the weakness of a market that excessively relies on future revenue growth to justify current prices, and when such growth is not delivered – whether due to unsustainable growth rates or macroeconomic issues – the results are massive sell-offs.

Although we believe Snowflake has the potential to continue delivering growth rates above 20%, in our opinion, the decision to support growth at expenses of already weak profitability and free cash flow generations, severely weakens Snowflake’s business model, especially as the management itself doesn’t expect meaningful impacts from the recently introduced AI solutions in the short-term.

If revenues growth falters, due to the more than anticipated difficulties to catch up with competitors’ AI and ML solutions, without an underlying profitable business model, Snowflake investors might be exposed to severe price corrections.

Snowflake has yet to report its Q2 earnings, and given the recent tension in the tech segment, and the poor stock performance YTD, Snowflake needs very strong Q2 results to turn around in the second half of the year.

Historically, Snowflake has usually delivered revenue growth above analysts’ expectations. However, the crucial role will be played by any update on the 2024 guidance, as the lowering of the FY24 guidance was one of the reasons for its poor YTD performance. As regards EPS instead, Snowflake has often come short of analysts’ expectations. It goes without saying that a mediocre Q2, featuring low growth, due to difficulties in ramping up AI/ML products, and deteriorating operating margins, will negatively impact the stock price.

Conversely, if Snowflake shows a great capacity to quickly scale up its new solutions, requiring fewer re-investments to support future growth and the development of AI solutions, our assumptions and intrinsic value must be revised upward.

In conclusion, at current prices, our assumptions suggest that Snowflake’s risk-reward profile does not represent a good investment opportunity. However, if you are looking for interesting opportunities in the software industry we suggest checking out our recent coverage of ServiceNow, Palantir, and Salesforce which have far better risk-reward profiles than Snowflake.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.