Summary:

- Snowflake’s share price remains under pressure due to its ongoing growth deceleration and rising competition.

- In particular, Databricks is growing rapidly and trying to drive adoption of the data lakehouse architecture.

- Snowflake’s new CEO is focusing on innovation, particularly in AI, but it’s too early to assess the impact of these efforts.

- While Snowflake’s valuation is now far more reasonable, this may not matter while the company’s growth continues to decline.

loops7

While Snowflake (NYSE:SNOW) continues to generate healthy growth, its share price remains under pressure due to an ongoing growth deceleration and concerns about competition. This has likely disappointed many investors, given the boost that generative AI is now giving to some software companies. After the exit of Frank Slootman, many investors also felt that guidance was deliberately sandbagged to set the new CEO up for success. In addition, recent RPO strength has been misleading as it has been driven by longer-term contracts.

I previously suggested that Snowflake’s growth decline was being driven by the macro environment and a lack of exposure to generative AI rather than competition. While I continue to think that Snowflake’s revenue growth would be much stronger under more favorable demand conditions, the company’s long-term competitive positioning is now less certain. Databricks is going from strength to strength as the two companies come into more direct competition, and its acquisition of Tabular suggests that the data warehouse market remains a priority.

Market Conditions

Expectations for cloud spending growth are now being driven by generative AI, with public cloud services spend expected to increase from 400 billion USD in 2023 to 2,300 billion USD in 2033.

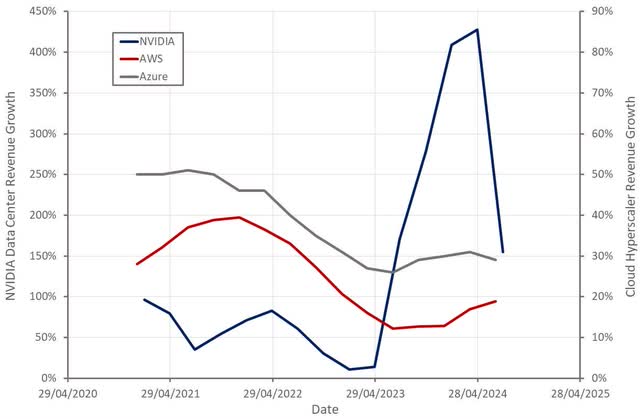

NVIDIA’s (NVDA) data center revenue continues to increase at a rapid pace, although growth was noticeably weaker in the second quarter. How much growth is currently being dictated by supply versus demand isn’t really clear at this stage though. Cloud hyperscaler revenue growth is generally accelerating, indicating that the benefit of generative AI is now flowing into the software infrastructure layer. Beyond this, the impact of AI remains far more narrowly distributed though.

Figure 1: NVIDIA Data Center Revenue and Cloud Hyperscaler Revenue Growth (source: Created by author using data from company reports)

While I don’t attribute much of Snowflake’s current situation to competition, I think that the company’s long-term competitive positioning has been undermined over the past few years. In particular, Databricks is benefitting from the surge in AI investment and is leveraging this to expand its platform across use cases.

Databricks’ ARR was expected to reach 2.4 billion USD by the middle of 2024, with sales growing in excess of 60% YoY. This compares to 1.6 billion USD revenue and 50% growth in the year ending January 31st, 2024. Databricks is also seeing success with its data warehouse product, which was launched in 2020 and is currently at a 400 million USD annual revenue run rate.

Databricks plans on acquiring Tabular, a data management company whose founders created Iceberg. Apache Iceberg is a high-performance format for large analytic tables that works with cloud object storage. It provides an abstraction layer and supports a data lakehouse architecture. It also decouples storage and compute, weakening Snowflake’s data gravity. Databricks’ Delta Lake format works in a similar manner. Databricks pioneered the lakehouse architecture in 2020 to enable the integration of traditional data warehousing workloads with AI workloads, with 74% of enterprises having now deployed a lakehouse architecture.

Delta Lake and Iceberg are the two leading open-source standards for lakehouse formats, although these formats have become incompatible due to independent development. Databricks and Tabular will now work together and make Delta Lake and Iceberg interoperable.

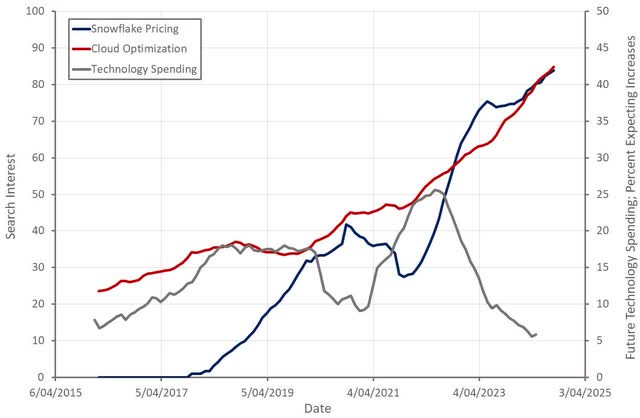

I tend to think that most of Snowflake’s current issues are driven by the soft macro environment and the company’s lack of exposure to generative AI tailwinds. Snowflake has suggested that it has seen signs of stabilization in terms of optimization efforts though, with 7 of its top 10 customers increasing spend sequentially in the first quarter. While a decline in interest rates could spur investment, if this coincides with a recession, investment is likely to remain weak going forward.

Figure 2: “Snowflake Pricing” and “Cloud Optimization” Search Interest and Planned Future Technology Expenditures (source: Created by author using data from Google Trends and The Federal Reserve)

Snowflake Business Updates

Innovation has become a focus area under Snowflake’s new CEO. In particular, Snowflake feels that it was behind in AI and is now investing aggressively to catch up. The company made nine new product announcements in the second quarter and brought more than 15 product capabilities to general availability.

Cortex AI and Iceberg were recently made generally available, both of which are gaining traction with customers. More than 400 accounts were using Iceberg at the end of Q2 and some of Snowflake’s largest customers have indicated that they will shift workloads to Snowflake as a result of its introduction. Cortex Search and Cortex Analyst are also expected to be generally available in Q3 and Snowflake Copilot is reportedly driving consumption by providing users with SQL query guidance.

Snowflake is also introducing Polaris Catalog, an open-source catalog implementation designed for Apache Iceberg. While open file and table formats can create interoperability, many interdependent limitations exist between engines and catalogs, which Polaris Catalog aims to address.

Some of Snowflake’s customers dealt with a cybersecurity threat in the second quarter that was related to the platform, although there was no evidence that this was Snowflake’s fault. The attack occurred in early June, with attackers accessing Snowflake customer accounts using stolen login details. Hundreds of Snowflake customer passwords were reportedly available online. CrowdStrike (CRWD) and Mandiant were unable to find evidence that the attack was the result of compromised Snowflake employee credentials or a platform vulnerability or misconfiguration though. While this has created some uncertainty for investors, it is difficult to see this being a material headwind for the company going forward.

Financial Analysis

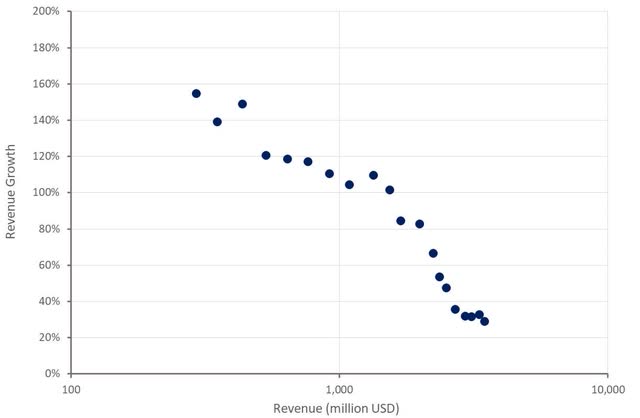

Snowflake’s product revenue was 829 million USD in the second quarter, up 30% YoY. The financial services and technology verticals were areas of strength in the quarter. Remaining performance obligations totaled 5.2 billion USD, an increase of 48% YoY.

While Snowflake beat guidance and increased its full-year revenue guidance, it was the weakest QoQ growth since the company has been public and Snowflake now appears to be on track for a mid to low 20% growth rate over the next few years. Iceberg tables are expected to weigh on storage revenue at some point, although this hasn’t really hit yet. Storage is currently responsible for around 11% of Snowflake’s revenue.

Snowflake expects 850-855 million USD product revenue in the third quarter, an increase of 22% YoY. The company is now guiding to 3.356 billion USD product revenue for the full financial year, representing a 26% YoY increase. This figure is likely to prove conservative, as Snowpark is the only newer product that has been included in full-year guidance. Snowpark is expected to provide around 100 million USD revenue in FY25. While other new products are expected to have an impact, this is likely to be more meaningful in FY2026.

Figure 3: Snowflake Revenue Growth (source: Created by author using data from Snowflake)

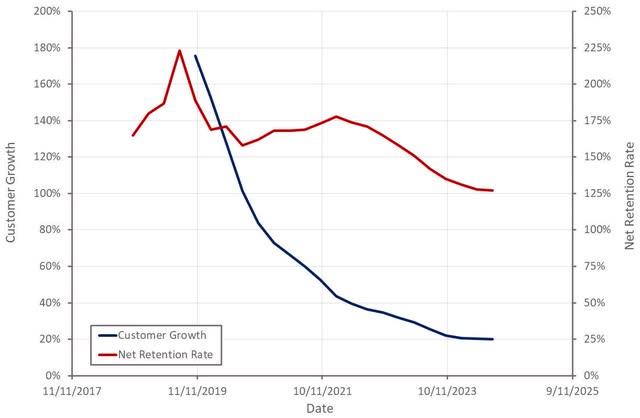

Growth of Snowflake’s customer base and the company’s net retention rate have shown signs of stabilization in recent quarters. While optimization (both internal and external) is still a headwind, Snowflake is seeing broad adoption of some of its newer products. For example, 2,500 accounts were using Snowflake AI at the end of the second quarter. There are also 1,600 accounts using Snowflake Notebooks.

Snowflake’s sales incentives are now prioritizing consumption and new customer acquisitions. The company’s new customer acquisition motion is ramping as a result, although the impact is expected to be more material in FY26.

Figure 4: Snowflake Customers (source: Created by author using data from Snowflake)

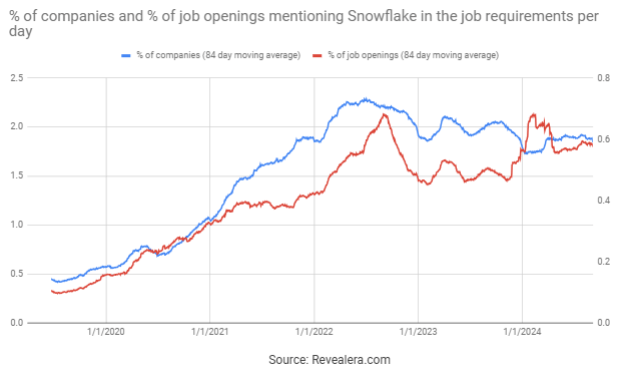

The number of job openings mentioning Snowflake in the job requirements doesn’t point towards a material drop in demand, but it doesn’t suggest that demand is rapidly growing either.

Figure 5: Job Openings Mentioning Snowflake in the Job Requirements (source: Revealera.com)

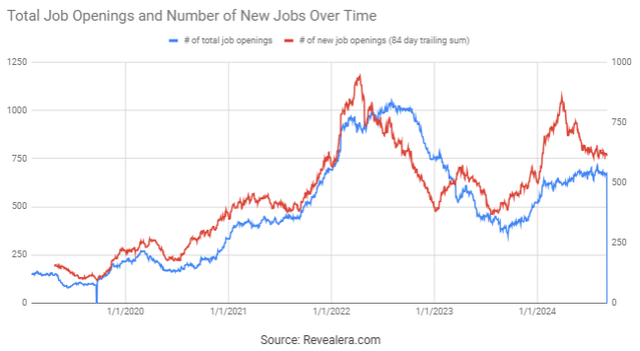

Similarly, the number of Snowflake job openings suggest that the company expects to continue growing, even if at a more muted pace than in the past.

Figure 6: Snowflake Job Openings (source: Revealera.com)

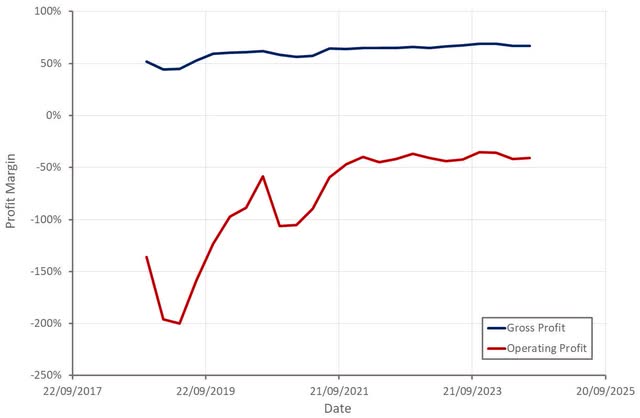

Snowflake’s non-GAAP gross margin was 76% in Q2, with the decline attributed to GPU related costs. The headwind was less than anticipated though as Snowflake is still waiting for GPU availability in some regions (Asia, some parts of Europe).

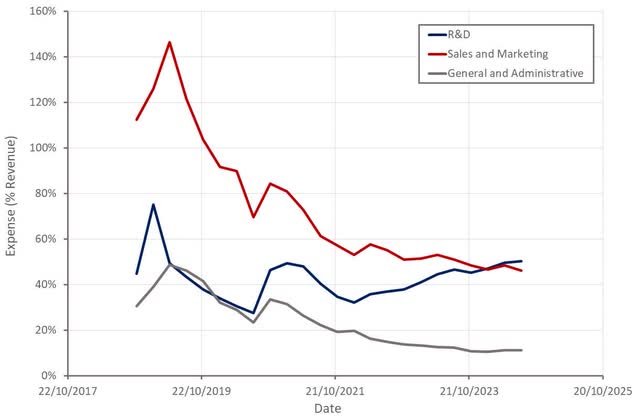

Snowflake’s non-GAAP operating margin was 5% in the second quarter, with the YoY decline attributed to R&D and go-to-market investments. R&D has driven Snowflake’s operating expenses over the past few years, as the company has tried to expand the capabilities of its platform (unstructured data, analytics, transactional workloads) and catch up on AI.

While Snowflake’s GAAP operating losses are still quite large, the company’s free cash flow margins are in the mid 20% range. Cash flow margins haven’t improved over the past few years though. The difference is dominated by SBC and Snowflake receiving cash from customers upfront. Roughly 80% of Snowflake’s customers pay annually in advance.

Figure 7: Snowflake Profit Margins (source: Created by author using data from Snowflake) Figure 8: Snowflake Operating Expenses (source: Created by author using data from Snowflake)

Conclusion

Macro headwinds are still weighing on Snowflake’s business, although after several difficult years, investors probably need to start treating this as the new normal. Snowflake’s growth is still strong for a company its size, but this is little comfort while growth continues to decelerate.

Snowflake is also suffering from comparisons to companies like Databricks and Palantir (PLTR), which are seeing real AI tailwinds. Databricks’ growth continues to accelerate, and the company is positioning itself for success in data warehousing. Even if this isn’t causing problems for Snowflake at the moment, it will limit the amount of market share the company can ultimately capture. Snowflake is rapidly expanding its AI product portfolio, but it is too early to tell how this will impact the company’s financial performance or competitive positioning.

The large decline in Snowflake’s share price over the past few years, along with the company’s strong growth, has seen its revenue multiple compress to more reasonable levels. Current analyst projections have Snowflake’s revenue multiple declining to around 2x within the next decade. Longer-term revenue projections continue to be revised lower at a fairly alarming rate though.

Snowflake holds roughly 10% of its market capitalization in cash, cash equivalents and investments. The company’s free cash flow yield is also nearly 3%. Valuation is likely to provide support at some point, but I think it could still be too early for this. Snowflake will likely need to stabilize its revenue growth and demonstrate further progress in areas like Snowpark, unstructured data and native apps before investors become more forward-looking again.

Figure 9: Snowflake EV/S Multiple (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.