Summary:

- Snowflake’s recent earnings beat and AI advancements have likely stunned pessimistic investors.

- Its attempt to catch up with its peers has paid off. While the post-earnings surge is remarkable, can it continue to outperform from here?

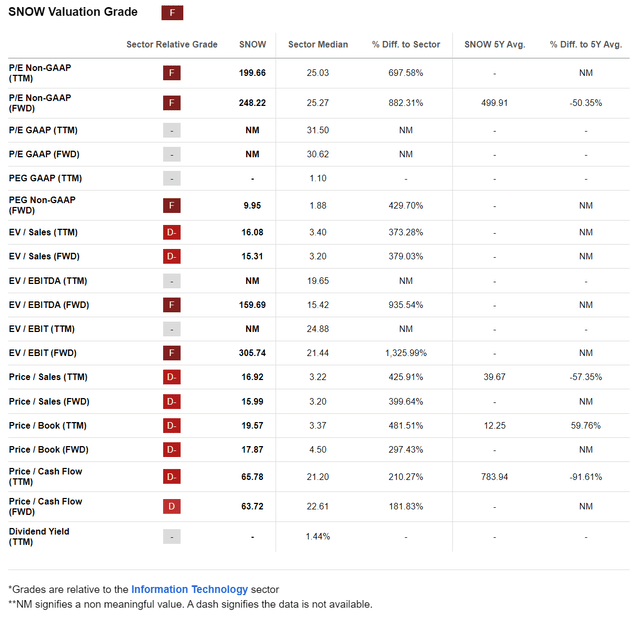

- SNOW’s forward adjusted PEG ratio of almost 10 underscores the extremely bullish proposition baked into its valuation.

- I explain why betting on SNOW’s outperformance hasn’t paid off when compared to a broader set of software peers.

- Investors who are considering risking capital on SNOW must reassess whether it makes sense to buy a stock valued at a forward P/E of more than 200x.

Sundry Photography

Snowflake: “Triple” Beat Assured Investors

Snowflake Inc. (NYSE:SNOW) investors have enjoyed a remarkable recovery as the stock of the data cloud company surged after its recent earnings scorecard. Accordingly, SNOW has recovered to levels last seen in May 2024, as investors lost confidence in its ability to execute well against its AI rivals, affecting its operating performance. In my previous Snowflake article, I downgraded the stock as I assessed increased execution risks, given its highly demanding valuation metrics. However, my cautious assessment has not panned out, as SNOW has outperformed the market markedly since then. What has spurred the return of buying sentiments recently that lifted its outperformance against the market?

In Snowflake’s fiscal third-quarter earnings release, the data lake and data warehouse company regained the market’s confidence. Accordingly, SNOW managed a “triple-beat,” outperforming Wall Street’s estimates on revenue and adjusted EPS. The company also trumped analysts’ forward guidance as Snowflake seeks to regain the mojo with investors. Therefore, its recent resurgence is justified, suggesting the market was too pessimistic previously.

Snowflake Making Gains In AI To Catch Up

I assess that Snowflake has demonstrated its resolve to catch up with its AI-centric peers in the rapidly evolving Generative AI landscape. The company strengthened its partnership with Anthropic, integrating Claude LLMs into Snowflake’s data cloud. I assess that it has corroborated Snowflake’s multi-cloud capabilities while augmenting its Agentic AI growth prospects through the partnership.

In addition, the company also acquired Datavole, underscoring the “strategic” nature of the deal. Hence, Snowflake has astutely capitalized on the improved market confidence in AI monetization as the “next phase” of AI takes center stage. Moreover, Snowflake’s multi-cloud ecosystem has afforded the company to leverage on AI hyperscaler growth momentum through AWS (AMZN) and Microsoft Azure (MSFT) while furthering its data integration with leading enterprise SaaS company ServiceNow (NOW). Hence, these improvements should position Snowflake more effectively as it aims to compete against data analytics arch rivals such as Databricks.

I assess that SNOW’s revised go-to-market strategy under the leadership of CEO Sridhar Ramaswamy seems to have paid off, given the recent stock recovery. The company has consolidated its more profitable projects while focusing more intensely on cutting costs. Management underscored the company’s “more rigorous approach to cost management.” It has also accelerated its product improvements and launches to justify its aggressive growth premium. Therefore, it should help mitigate the market’s concerns about its competitiveness with Databricks as Snowflake bolsters its AI capabilities.

Snowflake Needs To Accelerate Operating Leverage

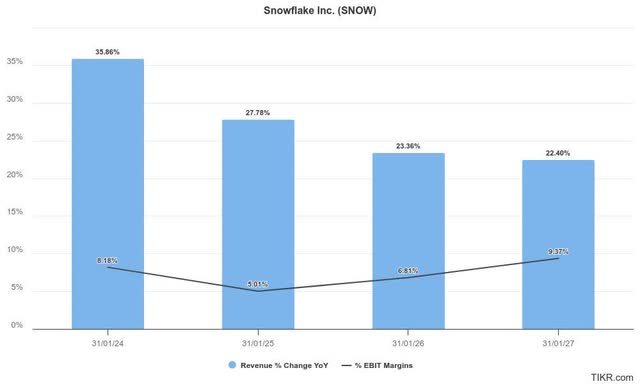

Wall Street’s estimates on Snowflake have been upgraded, corroborating the market’s confidence in Snowflake’s revamped AI strategy. Therefore, investors have demonstrated their support for management’s updated guidance for FY2025.

Notably, Snowflake sees improved adoption for its growth solutions (Snowpark, Cortex AI), critical to underpinning its operating leverage gains moving ahead. As a result, Snowflake’s profitability growth could accelerate through FY2027, even as revenue growth is expected to decelerate further. Its solid execution in FQ3 has validated the changes made to Snowflake’s business model. Investors have likely reflected higher confidence in the company’s ability to accelerate its growth momentum from here, although questions must still be asked about its highly expensive valuation.

SNOW: Valuation Is “Absurdly” High

SNOW Quant Grades (Seeking Alpha)

SNOW’s “F” valuation grade suggests that much optimism is reflected in its bullish thesis. While I’m not bearish on its ability to recover from its malaise, I believe caution is still appropriate. Snowflake’s unique positioning as a multi-cloud provider with its data cloud has regained traction, as seen with the recent achievements with AWS, ServiceNow, and Microsoft Azure. Also, the company has strengthened its focus on AI with the CEO change. It has also accelerated its product iteration to compete more effectively with its arch-rivals.

Despite that, it’s also increasingly clear that the market expects Snowflake to justify a more significant improvement in operating leverage, given that topline growth is expected to slow. While the company’s net revenue retention rate has stabilized at 127% in the recently reported fiscal quarter, it remains well below the 135% metric achieved in the previous year. Moreover, the volatility in its revenue recognition due to its consumption-based pricing model must also be considered. Although the pricing model is increasingly relevant as AI costs are expected to increase, an unanticipated slowdown in consumption could hamper the market’s confidence in its ability to monetize AI.

As a result, I find it challenging to justify SNOW’s forward-adjusted PEG ratio of almost 10, well over its tech sector (XLK) median of 1.88.

Is SNOW Stock A Buy, Sell, Or Hold?

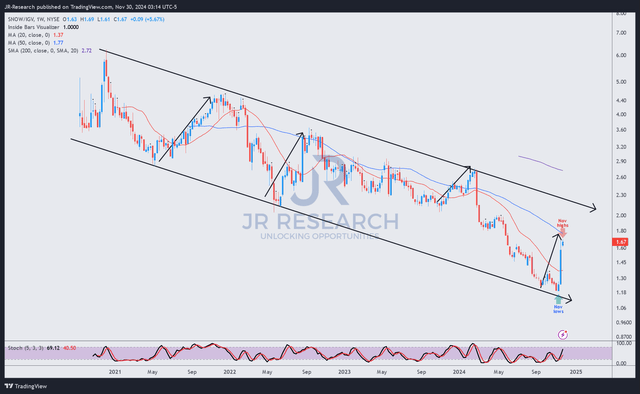

SNOW/IGV price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, the price chart of SNOW/IGV doesn’t lie. While I wouldn’t consider Snowflake a typical “software” stock, analysts have juxtaposed their assessment with other leading analytics software platform companies. Hence, it might be appropriate for investors also to consider SNOW’s performance relative to its SaaS peers represented in the iShares Expanded Tech-Software Sect ETF (IGV).

As seen above, the structural downtrend in SNOW/IGV is unmistakable. The series of lower-highs and lower-lows price structures have beset SNOW/IGV over the past few years. While mean-reversion opportunities (upward arrows in the chart) have occurred from time to time, the structural downtrend bias has consistently reasserted itself over time.

IGV is assessed at a forward P/E valuation of 33.8x, well below SNOW’s 248x. Therefore, I cannot conjure feelings of optimism on the stock, notwithstanding its recent outperformance. I also beseech bullish investors to reassess why they think Snowflake can continue to outperform expectations, given the level of bullishness already baked into the stock. Unless management can afford a much more robust forward outlook for FY2026, SNOW’s relative underperformance against IGV seems likely to continue.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, NOW, IGV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!