Summary:

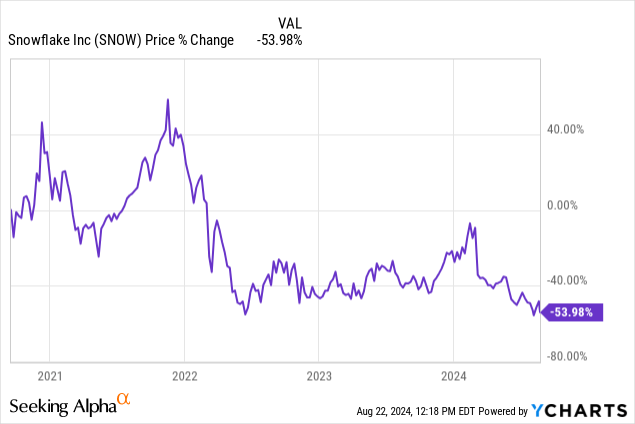

- Snowflake’s stock has fallen 25% since my last analysis; while more reasonably valued, slowing growth rates and negative revisions suggest potential continued downward momentum.

- Snowflake’s multi-cloud strategy, AI investments, and partnerships (e.g., with NVIDIA) are growth drivers, but margin pressures and high SBC spending pose profitability challenges.

- Snowflake faces competitive risks, particularly from Databricks, and international expansion challenges, raising execution risks despite its strong operational positioning and free cash flow growth.

merrymoonmary/E+ via Getty Images

I last covered Snowflake (NYSE:SNOW) in April; I allocated a Hold rating at the time, and since then, the stock has fallen 25% in price, including a substantial drop in price following its Q2 earnings results. Now, I consider the stock more reasonably valued, indicating a potential long-term opportunity, although I consider this to be high-risk, so my personal rating is a Hold. Primarily, I think that while the valuation is more appealing today, it is still high, and its growth rates are slowing down, which indicates potential ongoing downward momentum, which is further supported by negative revision trends.

Operational Profile, Major Competitors, and Growth Drivers

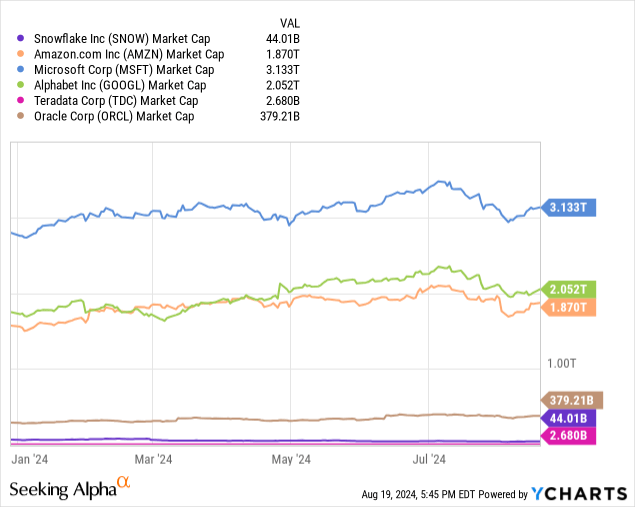

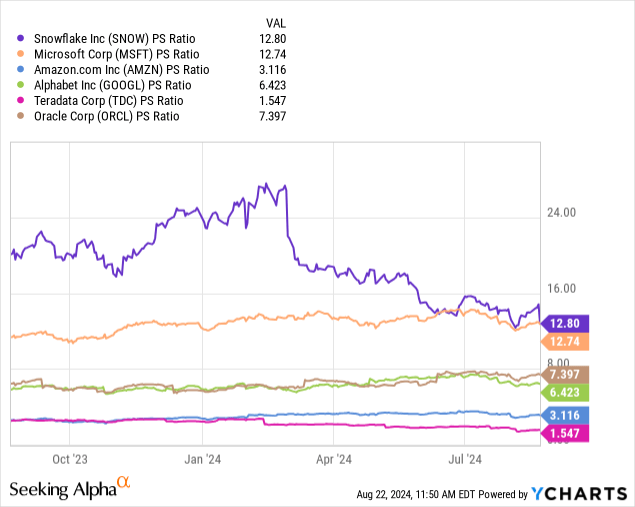

As I mentioned in my previous analysis of Snowflake, it offers data warehousing, lakes, engineering, science, and applications and faces significant competition from companies like Amazon Web Services (AMZN), Microsoft Azure (MSFT), Google BigQuery (GOOGL) (GOOG), Teradata (TDC), and Oracle (ORCL).

Snowflake benefits from a multi-cloud strategy, which allows it to operate seamlessly across the major cloud players, Amazon Web Services, Microsoft Azure, and Google Cloud. I believe this is the big selling point for Snowflake, and it does differentiate it significantly from its big tech competitors.

Also, the company structures its pricing based on consumption, where customers pay for the actual amount of computing and storage they use, making it more attractive to many customers and opening up a wider addressable market. For example, startups, smaller companies, or businesses with unpredictable workloads can benefit from this model-it allows them to start small and scale as their data needs grow.

Management is also heavily investing in AI and machine learning, which are seen as key growth areas. Partly as a result of these AI initiatives, it has also raised its FY25 guidance product revenue to an anticipated 26% YoY growth. The company has also strengthened its collaboration with NVIDIA to integrate advanced AI tools into its platform, including using NVIDIA’s NeMo for containerized AI model development and NIM for API enhancements, which simplifies model training and deployment for developers.

Furthermore, Snowflake recently showcased its Telecom Data Cloud, which includes AI and ML innovations and partnerships with leading telco companies, aiding smart capex optimization, predictive network maintenance, and data enrichment. Over 70 global ecosystem customers, including major telecom players like AT&T and Virgin Media Ireland, are using Snowflake’s Telecom Data Cloud to drive innovation and operational efficiency.

These are all reasons to be bullish on Snowflake, but there are also valid concerns at the moment that the company’s valuation is too high. In my opinion, despite its strong operational positioning, Snowflake is vulnerable to further downside momentum (it has fallen over 50% in price in the last 5 years). This is primarily a result of valuation factors but also negative revisions.

Q2 Earnings, Valuation, and Financial Analysis

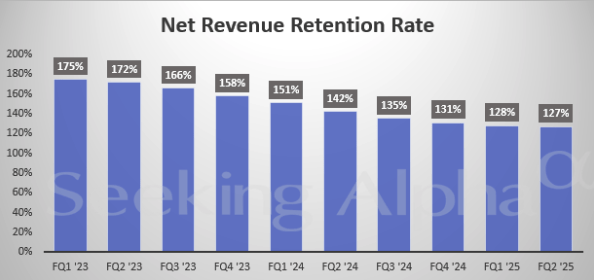

In Q2, Snowflake reported YoY revenue growth of 29%, and it beat the EPS normalized estimate by $0.02. Product revenue was also a 30% increase compared to the previous year, and it maintained a strong net revenue retention rate of 127%. The company raised its full-year product revenue guidance to reflect an anticipated 26% YoY increase. For Q3, Snowflake expects product revenue between $850M and $855M, which represents 22% YoY growth.

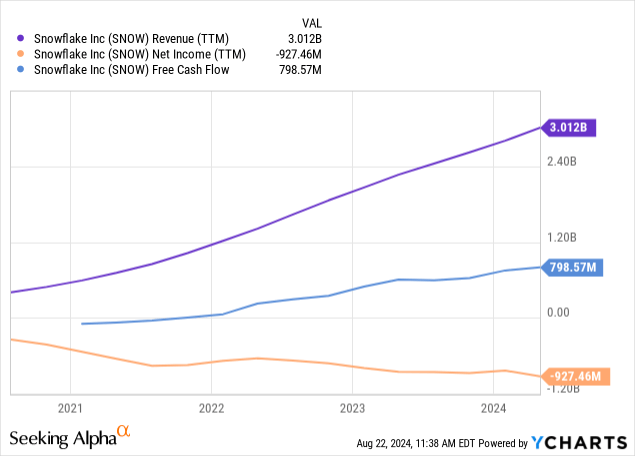

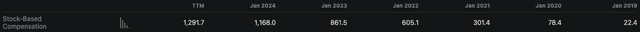

Snowflake is primarily not profitable at the moment because it is paying out high amounts of SBC, which is beneficial to attracting and retaining talent and arguably bodes well for the company as it is growing its free cash flow so substantially.

Seeking Alpha

Furthermore, its revenues are growing fast, but they have slowed down recently, with YoY revenue growth of 32.85% versus 102.26% as a 5Y average.

The decline in growth here can be outlined in the net revenue retention rate decline over the years:

Seeking Alpha

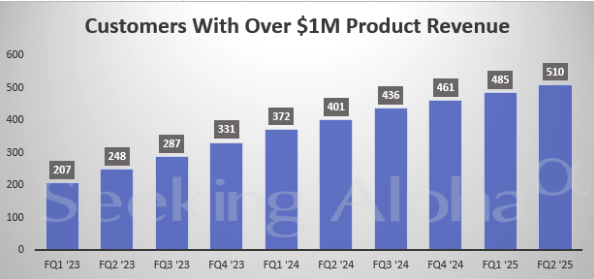

That being said, growth is still robust and, despite slowing down, is showing continued accretion to SNOW overall.

Seeking Alpha

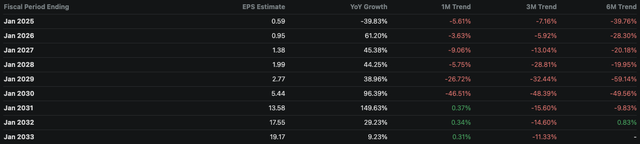

Margins are also improving for Snowflake, with the levered FCF margin currently at 38.6%, up from 24.74% as a 5Y average, and the net income margin up from -73.79% as a 5Y average to -30.80% as of the latest data aggregated by Seeking Alpha. Therefore, it is fair to assess that the company is moving in the right direction, albeit the rate of its advance is slowing down. The thesis that negative sentiment is due to slowing growth rates is further supported by its consensus EPS revision trend:

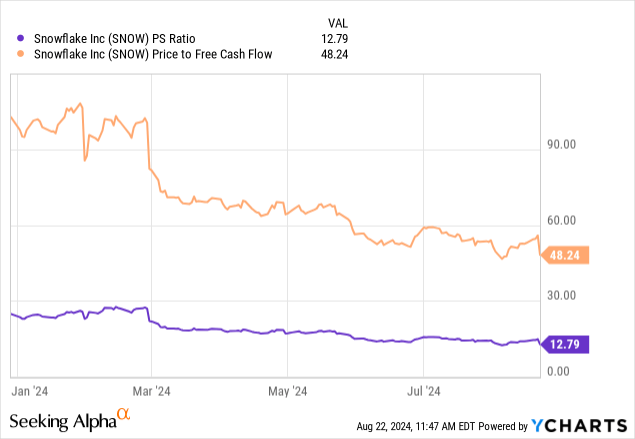

Therefore, the valuation for SNOW stock is very high and could be deemed not sustainable, despite the fact that the valuation is lower than it has ever been since its IPO.

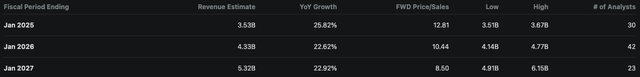

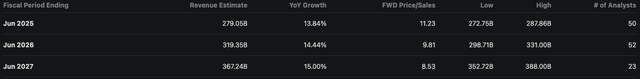

As Microsoft is the most highly valued firm below Snowflake, it is worth comparing both of their future revenue growth estimates. Due to the fact that MSFT is expected to deliver substantially lower revenue growth than SNOW over the next couple of years, SNOW’s valuation looks slightly more tolerable in light of this.

SNOW Revenue Estimates (Seeking Alpha) MSFT Revenue Estimates (Seeking Alpha)

However, because of the contraction in estimated growth rates compared to historically, I think the valuation for SNOW is currently a high-risk factor. I believe that despite the fact that SNOW is currently arguably fairly valued, further downward momentum and valuation multiple contractions are potentially likely as a result of reduced growth rates lowering sentiment, even if this is potentially unwarranted now that it is valued almost equally to Microsoft.

I believe SNOW’s PS ratio could expand to 13.5 over the next 12 months in a base case based on sentiment expanding after the current downward momentum from Q2 results, indicating a potential market cap of $58.05B in roughly 12 to 18 months’ time if the January 2026 revenue estimate of $4.3B is priced into the stock early.

Short-Term Margin Pressures, International Execution, and Databricks Competition

Snowflake revised its margin expectations downward in Q1, lowering its non-GAAP operating margin guidance from 6% to 3% and its adjusted free cash flow margin from 29% to 26% for FY25. In Q2, it maintained its operating margin guidance, and it generally performed well, but the stock falling following the results indicates continued issues with investor sentiment, potentially a result of its high valuation. The margin pressures have, in part, been the result of increased spending on AI initiatives, which are likely to mean short-term profitability pressure but long-term margin expansion as long as the company can effectively capitalize on the partnerships, investments, and AI capabilities.

Furthermore, Snowflake is expanding overseas, which opens up execution risks in how its offerings are adopted in new markets, particularly in Asia, where needs and tastes are widely different from those in the West. As well as integration risks, Snowflake is likely to face ongoing competition from well-established local players, and I believe JVs and collaborations in its diverse markets are foundational to its ongoing success abroad. To adopt and drive success, Snowflake is appointing local leadership. For example, HyoungJun Kang is the Country Manager for Korea.

It’s also arguably wise to be aware of another, smaller company than the big tech firms in my operational competitive analysis above, which, I believe, is arguably the biggest competitive threat from a smaller company. Databricks is not publicly traded, but it offers a unified analytics platform that combines data engineering, data science, and machine learning, which directly competes with Snowflake’s offerings. Databricks integrates the best features of data lakes and data warehouses in its “lakehouse” architecture, and it has a strong emphasis on AI and ML with strategic cloud service providers like Microsoft Azure. Therefore, Databricks is undoubtedly one of the companies to keep an eye on that could take market share from Snowflake if competitive pressures move in its favor.

Conclusion

Snowflake is arguably at an inflection point based on valuation, especially after Q2 results. However, this only really looks good based on its PS ratio, as its profitability on the income statement is still weak. That being said, this is largely a result of its SBC, meaning it does have strong free cash flow. Despite the upside potential here, I do think there are sentiment risks that come with the contracting growth rates at the moment, which could mean that even though the valuation looks reasonable right now, it still falls in price. Therefore, as I think the risk is too high, my rating is a Hold instead of a Buy at this time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.