Summary:

- Snowflake Inc.’s shares have been in the penalty box over the year, but the publication of Q3 earnings changed the picture.

- The company’s core data warehousing business and emerging products like Snowpark, Cortex AI, and Iceberg tables are gaining traction, driving future growth.

- Despite the 30% post-earnings surge, SNOW’s shares trade discounted compared to some high-growth SaaS peers, indicating room for further upside.

PM Images

Introduction and investment thesis

Making a profit by investing in Snowflake Inc.’s (NYSE:SNOW) shares could have seemed a fool’s errand over the year for most investors. The share price has halved from its ~$235 February peak at the beginning of September as the company kept posting disappointing quarterly earnings. Meanwhile, key competitor Databricks surprised the investing community with robust fundamentals.

Despite a slower-than-expected turnaround and the continuously dropping share price, I kept my bullish stance. My view has been supported by the quick pace of new product launches, the long-awaited stabilization of the core business, strong bookings, the change in the company’s sales compensation plan, and the seemingly conservative management guidance for the year. At the beginning of July, I thought all the bad news was out, and the share price should begin to recover (Snowflake: Fool Me Once, Fool Me Twice). However, the publication of FY25 Q1 earnings delivered another setback.

This has been followed by a still soft FY25 Q2 earnings print, where I believe many investors lost their faith that a material turnaround will happen anytime soon. I’ve called this phase peak pessimism (Snowflake: Peak Pessimism) and came away with the conclusion that the risk/reward of investing in Snowflake’s shares hasn’t been so attractive for a long time: another mediocre earnings print wouldn’t do much additional damage, but a positive turnaround could ignite a relief rally.

I think this is precisely what happened after the publication of FY25 Q3 earnings, when shares gained more than 30% following the release. And all this, with just a slightly larger beat than usual combined with stronger guidance and a nicely increasing backlog, but nothing really extreme.

Improving numbers and positive management commentary could have raised expectations going forward, but at current valuation levels, I think shares are still a good investment. However, no more hiccups are allowed from this point.

Q3 earnings: Finally, a positive surprise

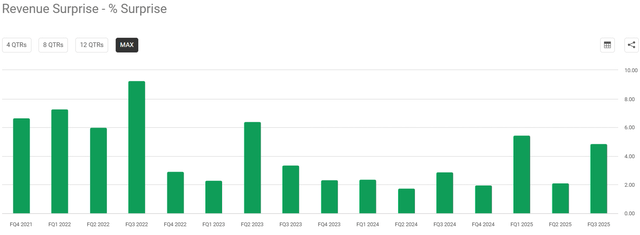

Snowflake reported revenues of $942 million for the recently closed FY25 Q3 quarter, beating the average analyst estimate by almost 5%. This has been the second largest beat over the past two years, signaling confidence of a looming turnaround:

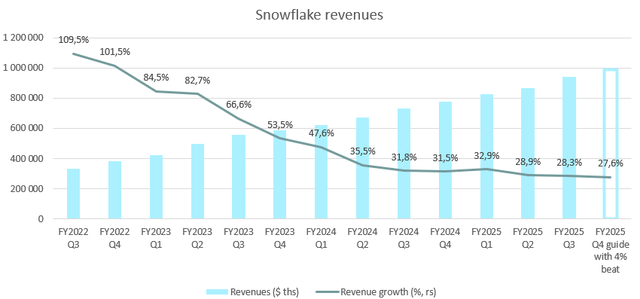

Last time the company reported a similar beat, it was accompanied by a surprisingly soft forward guidance. Luckily, this hasn’t been the case this time as management guided for product revenue of $906-$911 million for Q4 (equaling ~$988 million total revenue), 2% above the $891 million analyst estimate. Assuming a 4% beat for the upcoming quarter, this would result in a YOY total revenue growth rate of 27.6% close to this quarter’s 28.3%:

Created by author based on company data

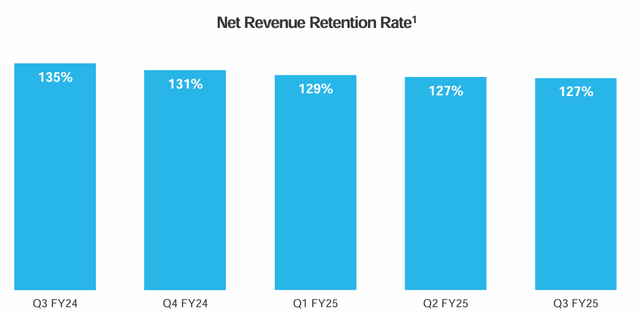

Although we are still not talking about a re-accelerating top line growth rate, the stabilization of top line growth is visible. The main driver behind this has been the improvement in the company’s core data warehousing business, which is reflected in the stabilization of Snowflake’s net retention rate at 127%:

Snowflake FY25 Q3 earnings presentation

The company’s data warehousing business is strongly linked to the transition of enterprises to the cloud. As evidenced by the recent earnings prints of large cloud providers, the negative impact of cloud cost optimization continues to recede, providing important fundamental momentum for many SaaS companies.

On top of that, Snowflake’s emerging product lineup continues to gain traction. Snowpark (Snowflake’s own development framework) is on track to reach 3% of product revenues for FY25, while Cortex AI (managed service for building AI apps easily), dynamic tables (helps customers simplify data engineering processes), and notebooks (creating data science and ML workloads) are on track to go down the same path. Currently, more than 3,200 accounts use some of Snowflake’s ML or AI features with more than 1,000 different deployed use cases, which could be further strengthened by the inclusion of Anthropic’s models in Snowflake’s data platform.

The recent introduction of Iceberg tables should also be a critical driver of revenue growth re-acceleration, especially in FY26. This functionality, currently used by ~500 accounts, allows customers to run Snowflake on data that resides outside the platform, increasing the company’s reach by several times. On the flip side, this could result in customers moving their data out of Snowflake’s storage, but the negative impact of this has been minimal for now.

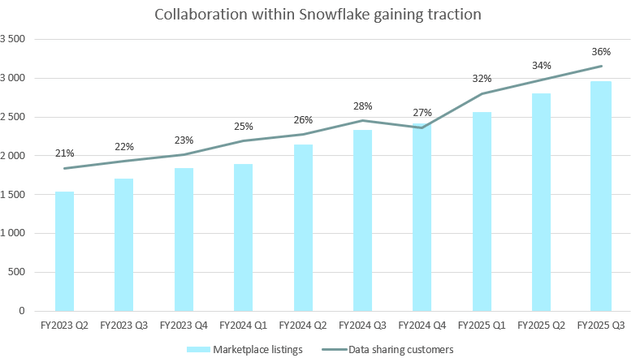

Finally, the share of data-sharing customers continued to increase in Q3 combined with an uptick in marketplace listings leading to further strengthening collaboration within the snowflake ecosystem:

Created by author based on company data

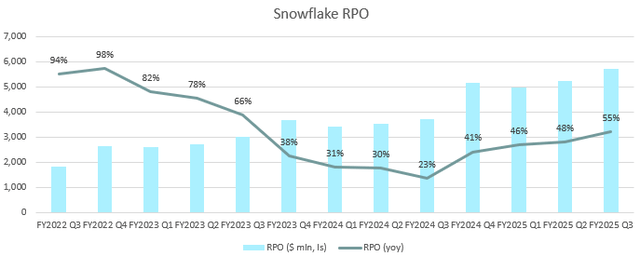

Looking ahead, Snowflake reported a significant increase in its backlog, which bodes well for the upcoming quarters. Remaining performance obligations (RPO) reached $5.7 billion, growing ~$0.5 billion from the prior quarter, recording a 55% YOY increase:

Created by author based on company data

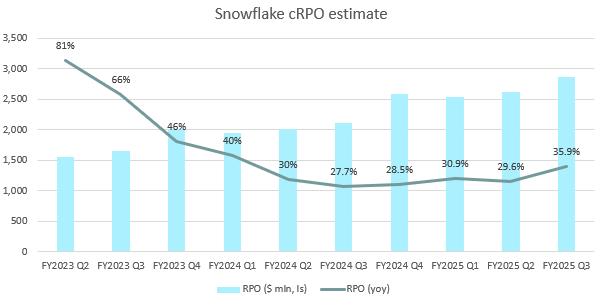

The strong YOY growth rate hasn’t been the result of unusually large long-term commitments over the quarter, as the company’s cRPO figure has also increased nicely to ~$2.8-$2.9 billion:

Created by author based on company data

This has been a ~36% YOY increase after ~30% over the previous quarters. I believe, this shows that Snowflake’s new products are gaining traction, which should translate into reported revenue figures soon.

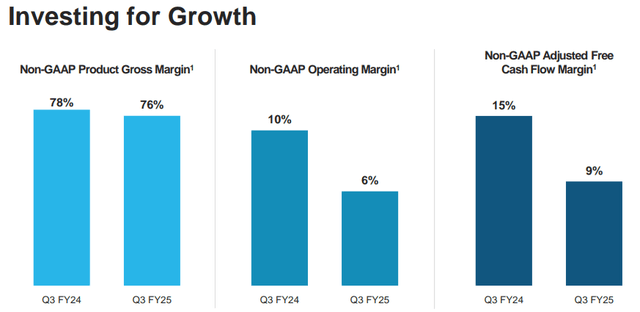

Besides encouraging top line growth trends, Snowflake also managed to improve its bottom line over the Q3 quarter, which has been an increasingly important concern for investors. While non-GAAP gross margin stabilized at 76%, non-GAAP operating margin increased to 6% from 5% in Q2 thanks to more rigorous cost management (e.g., removing redundant management layers). However, this wasn’t enough to increase margins YOY, as the company has been investing heavily in future growth:

Snowflake FY25 Q3 earnings presentation

2024 has been a year of heavy spending for Snowflake, partially resulting from increasing expenses for renting GPU capacity, not to mention YTD headcount growth of more than 11%. As these investments pay off next year and expense growth moderates, margins should continue to widen in my opinion. The first step in this process could have been evidenced this quarter.

Valuation still lagging peers

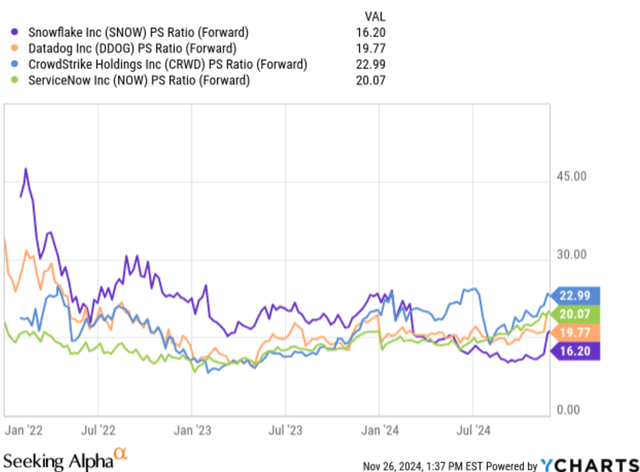

Although the valuation of Snowflake’s share increased significantly after the +30% post-earnings surge, they’re still trading discounted compared to high-growth SaaS peers:

The shares of Snowflake trade at a forward Price/Sales ratio of ~16, while companies with similar fundamentals measured by the Rule of 40 metric trade significantly higher. Snowflake is projected to close FY25 as a Rule of 52 company, similar to ServiceNow (NOW) (Rule of 53) or Datadog (DDOG) (Rule of 55). However, these two companies trade at a forward P/S ratio of ~20 at a 20%+ premium compared to Snowflake. On top of that, there is CrowdStrike (CRWD) with a P/S ratio of 23 combined with a Rule of ~60 metric, which is surrounded by uncertainties resulting from the global outage.

Based on this comparison, I believe there is still too much pessimism baked into the valuation of Snowflake’s shares, leaving room for further outperformance among high-growth SaaS companies.

Conclusion

Snowflake managed to positively surprise investors with its Q3 earnings print after a series of disappointing news, leading to a relief rally in shares. The valuation shows that investors are still questioning whether the company can regain its former glory, which leaves room for further upside in case the fundamental turnaround takes hold. I believe that the stabilization of the company’s core business accompanied by several emerging growth drivers will take care of this sooner than later.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.