Summary:

- Snowflake investors endured a steep bear market decline from the stock’s February highs.

- Snowflake’s fiscal first quarter earnings release is viewed with caution, given the withdrawal of its long-term outlook.

- Given its potentially more robust AI capabilities, Databricks is confident it will gain market share against Snowflake.

- Snowflake investors need management to proffer more confidence in its enterprise AI roadmap.

- The stock has consolidated constructively since March, priming SNOW well for a further post-earnings recovery.

Sundry Photography

Snowflake Stock Fell Into A Bear Market

Snowflake Inc. (NYSE:SNOW) investors who bought into its optimism since the stock topped out in mid-February 2024 have faced significant downward volatility. Accordingly, SNOW peaked close to the $240 level and dropped nearly 40% through its late April lows. I reiterated my caution on SNOW stock in early March, as I assessed the hammering was deserved. Given the withdrawal of Snowflake’s long-term product revenue guidance, the market turned more skeptical in justifying SNOW’s highly expensive valuation.

Despite that, there are reasons to be cautiously optimistic as we head into its upcoming earnings call. Snowflake’s first fiscal-quarter earnings release is scheduled to be delivered on May 22. While SNOW has continued to underperform the S&P 500 (SPX) (SPY) since my previous March article, most of the decline happened between late February and early March. In addition, SNOW stock has held above the $150 level over the past four weeks, suggesting a possible consolidation zone. I assessed that SNOW dip-buyers must continue holding above the pivotal $140 support zone (October 2023 lows) to help SNOW bottom out, leading to a potentially more robust post-earnings recovery.

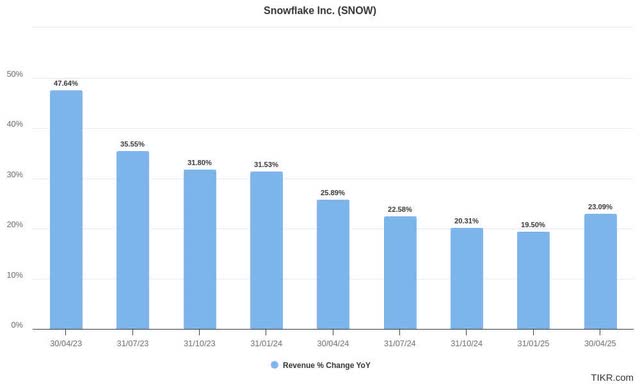

Snowflake forward revenue estimates (quarterly) (TIKR)

Snowflake’s disappointing FY25 guidance was likely baked into the current levels as investors reassessed its upcoming FQ1 update. Accordingly, the leading cloud data platform is expected to post a marked decline in its YoY quarterly revenue growth rates, as Wall Street penciled in its revised estimates. In addition, Snowflake’s adjusted EBITDA growth is also expected to be flat YoY in FY25, suggesting more aggressive investments to address its growth normalization.

Snowflake’s AI Turnaround Is Gaining Momentum

I believe the caution is justified, as Snowflake needs to reignite its revenue growth cadence to appeal to growth investors on its secular bullish thesis. New CEO Sridhar Ramaswamy has hit the ground running since taking over the reins from Frank Slootman. Snowflake has strengthened its partnership with Nvidia (NVDA), aiming to “leverage the full-stack Nvidia accelerated platform, enhancing infrastructure and compute capabilities for AI productivity.” Snowflake has also introduced its 480 billion parameters enterprise grade LLM named Snowflake Arctic. Snowflake trained the open-source LLM under a $2M budget in less than three months. In addition, Snowflake reported that its LLM is highly efficient, activating “only 17 out of 480 billion parameters at a time, achieving industry-leading quality with unprecedented token efficiency.”

In addition, the company highlighted that Snowflake Arctic was developed with “one-eighth the cost of similar models,” underscoring its ability to achieve superior economics in model development and cost-effectiveness. Snowflake has demonstrated superiority in its LLM, “surpassing industry benchmarks in areas such as SQL code generation and instruction following.” Snowflake also referenced arch-rival Databricks’s enterprise AI model DBRX, underscoring Snowflake Arctic’s competitiveness in performance benchmarking.

However, arch-rival Databricks CEO Ali Ghodsi claimed that Snowflake lacks a coherent AI strategy (subscription needed) in its development. Notably, Ghodsi claimed that “AI is an afterthought” for Snowflake. In addition, Ghodsi indicated that Snowflake’s recent CEO switch validates his observation, suggesting Snowflake “went through a CEO change now just to try to fix that.” Databricks believes that AI is deeply infused with its internal software capabilities from the onset, and its “core products are integrated with Spark.” As a result, Databricks highlighted that the recent surge in enterprise AI interest and possibly broader AI adoption could expose Snowflake to “disruption in lakehouse pattern and AI capabilities.” Databricks generated $1.6B in revenue last year, well below Snowflake’s FY24 revenue base of $2.81B. Therefore, the potential for Databricks to gain market share at the expense of Snowflake could be detrimental to SNOW’s growth prospects. The assessed slowdown in its long-term revenue growth could be attributed to more intense competition by its multi-cloud competitors.

However, Wall Street remains confident that the increased momentum toward multi-cloud adoption benefits Databricks and Snowflake. Consequently, a faster go-to-market led by Ramaswamy could propel renewed interest in Snowflake’s AI capabilities as it vies with Databricks to maintain leadership as the leading data cloud platform. Therefore, platform stickiness is assessed to remain robust. Notwithstanding the normalization phase, Snowflake still recorded a net revenue retention rate of 131% in the previous fiscal quarter, corroborating my observation.

Is SNOW Stock A Buy, Sell, Or Hold?

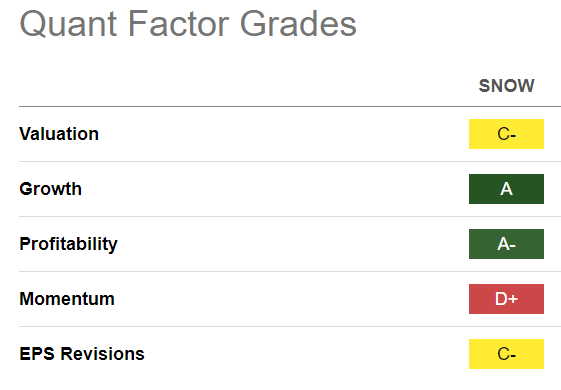

SNOW Quant Grades (Seeking Alpha)

SNOW’s “C-” valuation grade has improved from the “D” grade assigned three months ago. As a result, SNOW’s relative overvaluation is assessed to have been lowered. Moreover, SNOW is still evaluated to have a best-in-class “A” growth grade, underscoring Wall Street’s confidence in Snowflake’s growth opportunities. However, SNOW’s “D+” momentum grade indicates the tepid buying sentiments currently, suggesting investors must be prepared for further downside volatility if Snowflake reports a worse-than-anticipated FQ1 earnings release.

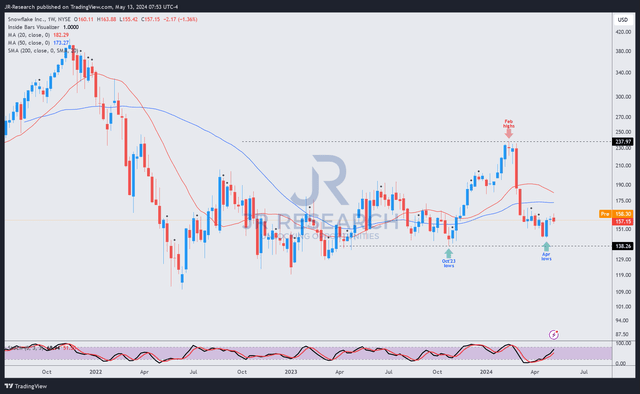

SNOW price chart (weekly, medium-term) (TradingView)

As seen above, SNOW stock has hovered above the $150 zone since March 2024. Although a brief selloff nearly re-tested SNOW’s October 2023 lows, buyers returned quickly to help stem a further decline.

As a result, it seems like SNOW has pretty solid buying support at the current levels, which is auguring well for SNOW investors as we head into its upcoming earnings scorecard.

Therefore, I assessed a tactical/speculative buy opportunity that may have emerged for SNOW investors looking to capitalize on its current pessimism. The company has drummed up support for Snowflake’s upcoming Investor and Developers Day in June, including a fireside chat with Nvidia CEO Jensen Huang. As a result, a more robust AI turnaround momentum could lead to a valuation re-rating as the market regains confidence in Snowflake’s long-term revenue modeling.

Rating: Upgrade to Speculative Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!