Summary:

- Snowflake Inc’s business growth has been slowing down over the past few quarters, putting it in a vulnerable position.

- The company’s net revenue retention rate has dropped, and operating costs are increasing, leading to negative EBIT and disappointing EPS.

- Despite plans to focus on AI and machine learning, Snowflake’s growth is expected to continue to slow, and margins will come under pressure.

- I believe SNOW is a highly overvalued company compared to its peers, while its growth rates should soon approach the industry average.

- I have therefore decided to rate the stock as a “Sell” today.

Jonathan Kitchen

Investment Thesis

In my opinion, the continued slowdown in Snowflake Inc’s (NYSE:SNOW) business growth over the past few quarters has put it in a rather vulnerable position: if growth stocks are no longer growing at the rate the market is pricing them in, there’s no reason to believe that the downtrend already in place will turn into an uptrend.

Why Do I Think So?

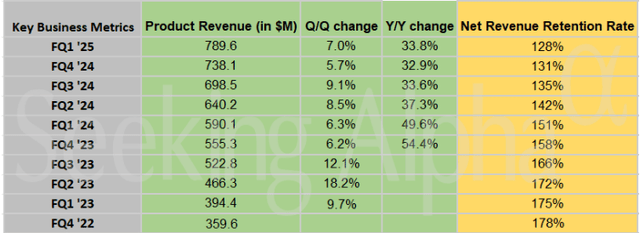

For Q1 FY2025 Snowflake reported product revenue of $789.6 million, a 34% increase YoY, contributing to a total revenue of $828.7 million, which grew by 33% YoY. The net revenue retention rate dropped to 128%, which looks good on an absolute basis (anywhere >100% is considered good actually), but compared to the previous quarters the slowdown on this front looks obvious.

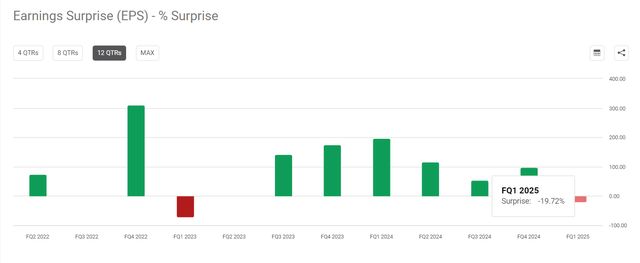

On a positive note, the gross margin widened in the first quarter of FY2025 compared to the previous year: there was an increase of around 70 basis points (from 66.42% to 67.12%). But when it comes to operating costs, SNOW is definitely struggling: While revenue growth is slowing, OPEX growth is not. In Q1, the sum of S&GA and R&A increased by 31.61%, leaving EBIT in negative territory, rising from -$273 million last year to $348.5 million this year. Consequently, even on an adjusted basis, SNOW’s EPS did not show the improvement that the market had hoped for: SNOW missed its EPS estimate by >19%.

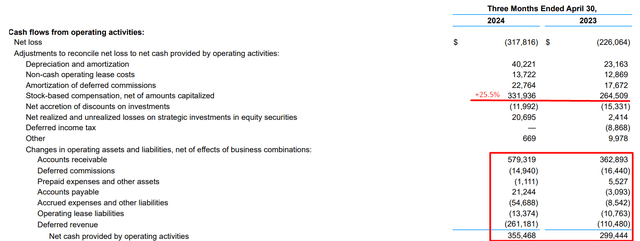

Cash flow from operating activities increased by 18.7% YoY and is positive. However, a significant part of this growth is due to the increase in stock-based compensation (+25.5% YoY), and the dramatic change in working capital.

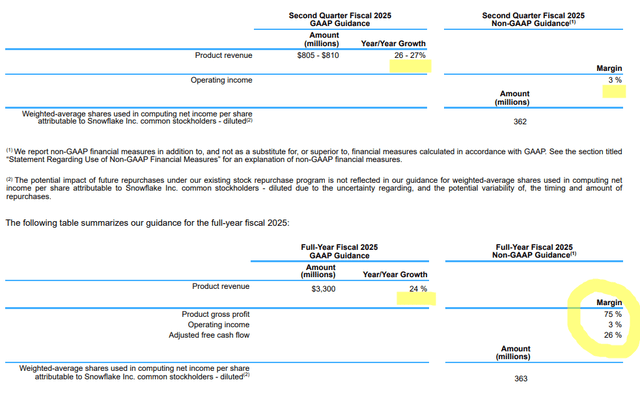

SNOW’s 8-K, the author’s notes

I tried to find the reason for the rapid decline in receivables in the press release and the 8-K, but I did not find this information there. A significant drop in receivables may indicate a) better collections or b) a decline in demand or problems with the company’s sales strategies – two completely opposite conclusions. I don’t undertake to draw any definite conclusions about this. We only know that Snowflake now has 485 customers generating over $1 million in TTM product revenue, marking a 30% increase, and 709 Forbes Global 2000 customers, an 8% rise YoY, according to the press release. I therefore see no major problems with demand for the company’s products. However, SNOW may have offered customers early payment discounts or other incentives to induce them to pay faster. Or maybe they tightened credit policies. The first option may put pressure on margins, and the second may slow forwarding growth rates. We don’t know for sure and can only guess. But judging by management’s guidance for Q2 and full year 2025, SNOW’s growth will continue to slow in the coming quarters and margins will also come under pressure (non-GAAP operating margin was 4% in the first quarter – 3% is now expected for the second quarter):

SNOW’s 8-K report, the author’s notes

In Q1, Snowflake announced plans to acquire technology assets and key employees from TruEra, an AI observability platform, to “enhance their capabilities in evaluating and monitoring AI and machine learning models.”

Apparently, the company has decided to shift more of its development focus to AI because a) management sees it as a good addition to revenue growth and b) it’s still a hype topic and a single announcement about AI overshadows all other news, including the negative (which I believe was the Q2 guidance). But that didn’t help SNOW stock: the quotes continued to fall lower, consolidating below the 52-week moving average and testing the lower support line of the overall downtrend:

TrendSpider Software, SNOW weekly, the author’s notes

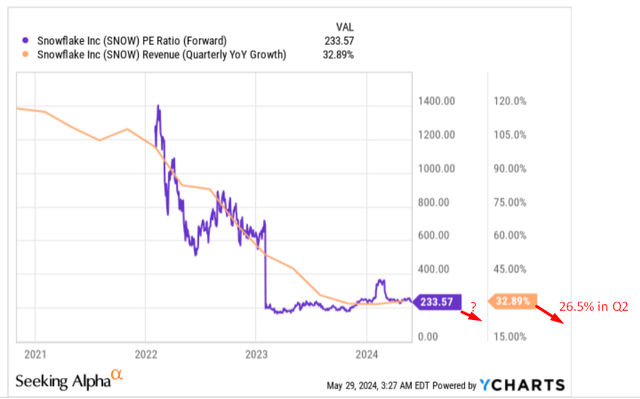

I think the selling pressure SNOW has experienced since its Q1 FY2025 announcements (and earnings call comments) will not simply stop – and it’s not just about technicals. In itself, a slowdown in sales growth is a logical, natural phenomenon for any growth company as it matures. But the “normality” of this phenomenon is only maintained if we simultaneously see another very important process – multiple contraction (preferably amid margin expansion). It is logical to think that as growth slows, and the company breaks into profit, the company’s valuation multiples should also fall. In SNOW’s case, this is just not happening as expected:

YCharts, SNOW, the author’s notes

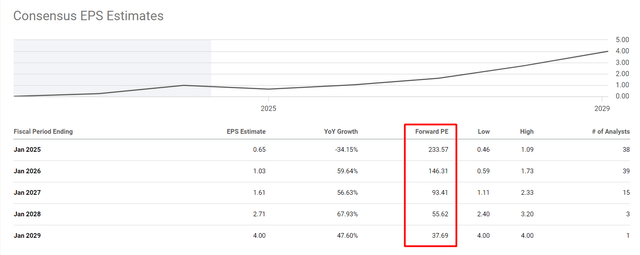

I mean, given the slowdown in sales growth we see today, I see no logical explanation as to why SNOW should continue to trade at 233.5x of forwarding P/E. It is clear that future P/Es in such cases are very sensitive to any change in EPS, no matter how small, when a few cents more in EPS can radically change the whole picture. But the management itself has told us that in Q2 and FY2025 the EBIT margin will most likely be worse than in Q1 – today I see no reason to doubt that. If the EBIT margin is 3%, how can SNOW reach $0.65 for FY2025, as the consensus still hopes? This is a big puzzle to me – as is the puzzle of why SNOW should have such high valuation multiples over the next few years, even allowing for the forecast of strong earnings growth driven by the low-base effect.

Seeking Alpha, SNOW, the author’s notes

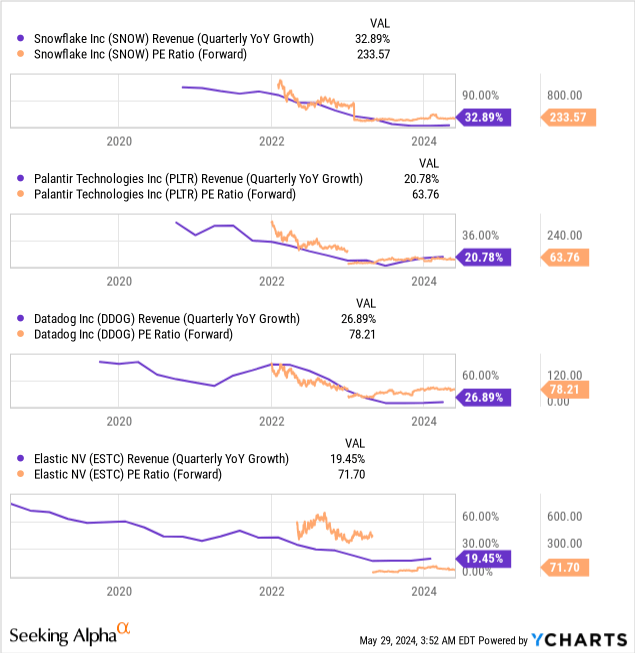

For context, it’s important to understand the background against which the SNOW valuation exists. If we look at some of the closest peers in the SaaS industry such as Palantir (PLTR) or Datadog (DDOG), we will see that SNOW’s multiples are on average 3x higher, while its revenue growth rate is not as stellar and clearly does not outpace its peers by 2-3x. If we also consider that SNOW’s management predicts a slowdown in growth (from 33% to 26.5%), then SNOW’s Q2 revenue growth rate will be roughly in line with Datadog’s Q1 revenue growth – with a 3x difference in multiples.

Of course, to meet the market norm, SNOW needs to fall further, and I suspect the potential dip could be massive given the discrepancy in valuation compared to other peers.

Concluding Thoughts

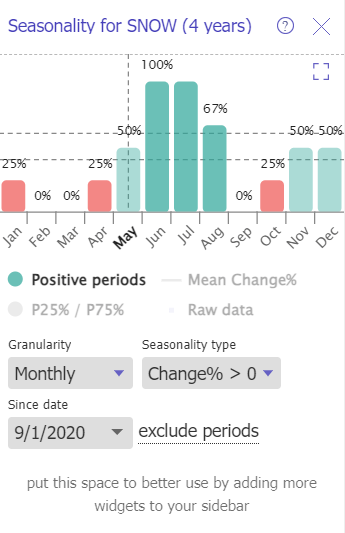

Of course, I could easily be wrong in assuming that SNOW will continue its decline. Perhaps the company will find the strength to restore its growth rates, and management’s forecasts are proving too pessimistic compared to what the Snowflake business is really capable of. Since I mentioned technical analysis above, it’s also worth noting that approaching the trendline may indicate a potential buying opportunity on the dip if SNOW manages to hold its strong support level. Furthermore, the seasonal factor should not be neglected: According to TrendSpider, June and July had a good track record for buyers:

TrendSpider Software, SNOW

However, I still tend to think that SNOW is a highly overvalued company compared to its peers, while its growth rates should soon approach the industry average. This is a very bad starting point for investors. I have therefore decided to rate the stock as a “Sell” today.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!