Summary:

- Snowflake stock is dropping after a tumultuous year, with a potential new normal price of around $120-$125 per share.

- Despite strong revenue growth and customer expansion, Snowflake faces challenges with profitability and margins, leading to a negative bias on the stock.

- The company must maintain at least 25% revenue growth to support its valuation, with the potential for the stock to reach above $100 in the near future.

- Can it grow into the valuation?

- There are two ways to trade this.

Fokusiert/iStock via Getty Images

The market is not reacting well to Snowflake Inc.’s (NYSE:SNOW) just-reported earnings. This comes after a tumultuous 2024 year-to-date performance for the AI-cloud company already. It looks set to drop heavily today, though the stock is up off the August 5th Japanese Yen Carry trade crash low. The stock recovered to $135 from its 52-week low of $107.93 on August 5th. Now, the thing is, despite a still sky-high valuation, and earnings that were good, but not good enough, we actually believe the downside is relatively limited from today’s drop. A lot has happened this year. It’s had a tough year so far, down nearly 40%.

Troubles really began brewing back on February 28th, when Snowflake announced that then-CEO Frank Slootman was leaving his role but continuing on as chairman. Sridhar Ramaswamy, from Neeva which Snowflake bought in 2023 to support its AI capabilities, took his place. Then it also lowered guidance for the next quarter and full year FY2025. The stock tanked following this. Then Snowflake surpassed fiscal Q1 2025 earnings expectations and provided higher guidance and announced several new initiatives, but the forecasts were still not good enough to get the stock going. Today, we are seeing more of the same. The stock looks destined to be repriced and revalued to a new normal of around $125 a share, and it is still very expensive. Can the company grow into this valuation? Yes, it can, but with the projected growth not exciting investors, it may be a few years. Yes, years.

You see, the adoption of new and novel products, particularly those involved in AI, is strong. We know there are thousands and thousands of customers using AI features already, and Snowflake certainly is raking in revenues. But despite its impressive growth, Snowflake faces operational challenges, particularly around sustained profitability and managing its customer expectations in a highly competitive market.

When you factor in the valuation, even though shares have corrected tremendously, it is still priced for perfection. Near perfection is also not good enough. The Street wants not just earnings beats, but sizable beats. And it wants to see continued guidance increases to boot. Now what we see here is that the company’s gross margins are pretty stable, but investors should keep a close watch on them. Increasing costs or sales-related spend could pressure margins. T3

he Street, having revalued the stock lower on growth that is not meeting the strict standards of perfection, could lead to the next leg of trading honing in on key metrics like margins. Something to keep in mind.

As we move forward, we also have to be on the lookout for potential impacts from broader economic conditions and a tough overall macro environment. All of this comes along with decelerating revenue growth despite expanding its product lineup. So what does the growth look like?

Well, the growth is still strong, but it is decelerating. Revenue for the quarter was $868.8 million, which was a strong 29% year-over-year growth, but no longer wildfire-like growth. Of course, comps to a higher and higher revenue base make big percentage year-over-year changes difficult to achieve. That is something to keep in mind in the context of deceleration in revenue growth. Product revenue constitutes the bulk of revenues for Snowflake, and for the quarter this revenue was $829.3 million, representing 30% year-over-year growth. On the back of this result, Snowflake raised its Q3 product revenue guidance for the year.

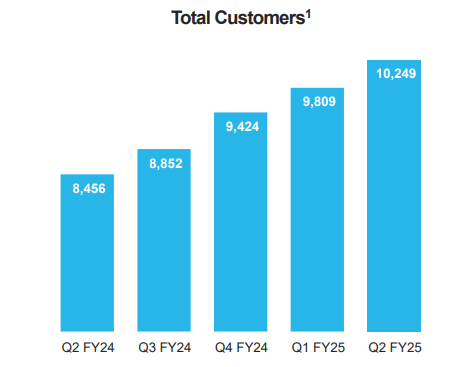

Another key metric to watch is the net revenue retention rate. This was 127% as of July 31, 2024. The company has grown its $1 million plus revenue customer club, too, and growing total customers.

Snowflake Q2 Presentation

The company now has 510 customers with the last 12-month revenue of $1 million representing 28% year-over-year growth. Further, as you can see, total customers are now well over 10,000. This is steady growth. Then there are the remaining performance obligations, or RPOs. The RPOs in the quarter were $5.2 billion, representing 48% year-over-year growth.

Now, here is where we see problems. It comes back to margins, and then free cash flow. The company has expanded margins year after year, but looking at this quarter versus a year ago, there was a contraction, and the guidance suggests a contraction as well.

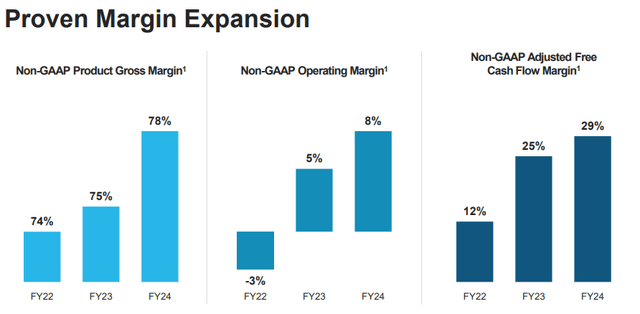

As you can see, product gross margins have expanded to 78% from 74% in fiscal 2024 versus 2022. Operating margins swung from -3% to positive 8% in the same time frame, while free cash flow margins expanded from 12% in 2022 to 29% in fiscal 2024. All of that is in the past, however. Take a look at this quarter’s margins versus last year.

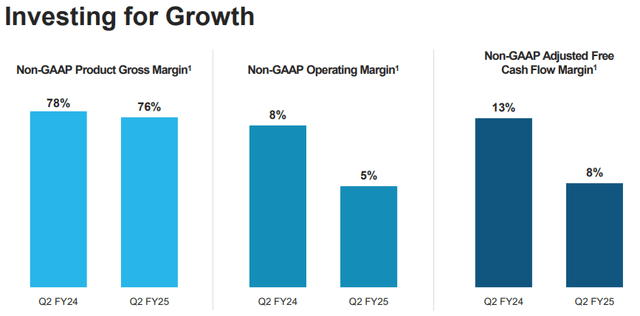

This is billed as “investing for growth” in the slide title, which may very well be true, but as we alluded to earlier, the margin story is likely to become more and more important as revenue growth has normalized some. All margin metrics were down from last year. Moreover, margins for the fiscal year 2025 will show a contraction.

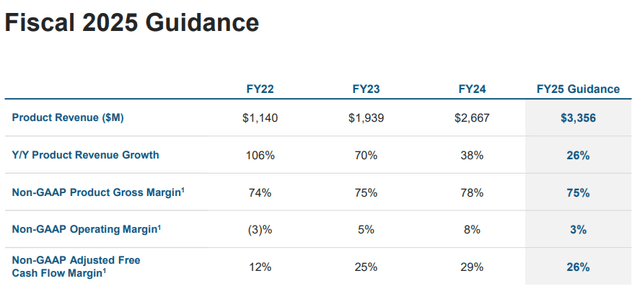

As you can see in table form, we have not just decelerated revenue growth on a percentage basis but also gross margins that are now contracting for the year, operating margin is contracting, and free cash flow margin is contracting.

Looking Ahead

As we look ahead for the company, there is no doubt the growth is still very respectable in terms of customers and revenue. There is a massive global opportunity and the company is hiring to address its expansion. However, Snowflake cannot allow itself to slow down much. It must keep growing revenues, and from here we would think that 25% revenue growth is the bare minimum to keep the stock above $100, especially when even their operating margins will be 3% for the year. From a trading perspective, you could easily see the stock valued at 8-10x sales until margins start to meaningfully expand, and free cash flow grows meaningfully. We question whether free cash flow margin will even hit 26% this year.

Further, the company must continue to retain customers. The net retention is well over 100% which is fantastic, but has trickled lower. Overall, we think SNOW is a highly overvalued company relative to its peers, but it can grow into this valuation. However, that caps the upside for the stock. There is not much justification to expand the already stretched valuation from here. Growth is strong, despite decelerating, but it is more than priced in. We think the best course of action is to either have a very long-term view, or to swing trade this, as it has great opportunities to do so long and short. Currently, however, we have a negative bias and think the stock is heading back below $120, and will make a run toward $100 in the upcoming weeks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for our highest conviction trades?

Start WINNING TODAY! Grow your portfolio by embracing a blended trading and investing approach at our premier service!

We activated our Labor Day Deal ahead of other services, so you can lock in our best price in 5 years. Join Seeking Alpha’s premier service while spots remain at the 2018 founding rate! It’s available to the first 3 subscribers ONLY. Come trade and learn from the best.

Enjoy a money back guarantee if you aren’t satisfied (you will be). Start WINNING today. Get in the game!