Summary:

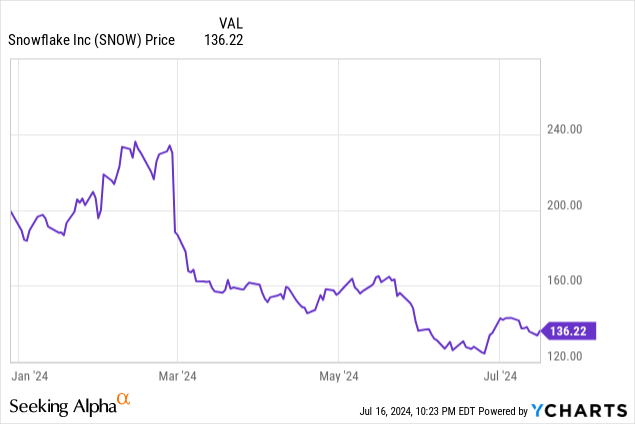

- Snowflake stock has dropped nearly 30% year to date due to decelerating growth rates and slowing net revenue retention rates.

- Despite concerns, Snowflake’s sales momentum in Q1 and potential for expansion within existing customer base make it more appealing as a rebound play.

- We should continue to be wary of potential deceleration in Q2 as well as higher expense ratios.

- I’m upgrading Snowflake to neutral, and will buy confidently when the stock slips to $120.

suwadee sangsriruang

While the overall stock market has continued to race to all-time highs, some former high-flying market darlings are struggling to regain their fleeting momentum. Sitting in this bucket is Snowflake (NYSE:SNOW), the cloud data warehousing company that was once one of the hottest trades in the pandemic era.

Year to date, shares of Snowflake have cratered nearly 30%. Investors have decried the company’s decelerating growth rates, its lack of faster progress in profitability due to aggressive hiring, and in particular its slowing net revenue retention rates. But as the stock continues to dive, we should take a step back and assess if there’s an opportunity to step in at a good price.

I last wrote a bearish article on Snowflake in May, when the stock was trading near $160 per share. At the time, I had called out Snowflake’s high valuation amid decelerating growth to be core concerns for the company. I also mentioned that $120 would be my ideal entry point into the stock.

Today, the equation has changed somewhat. First, Snowflake has continued to fall – and while it hasn’t hit <$120 yet, the stock is inching closer to a comfortable buy point for me. At the same time, the company has demonstrated incredible sales momentum in the first quarter, driven in part by a revitalized FY25 sales compensation plan for its field organization. With this in mind, I’m upgrading my viewpoint on Snowflake to neutral.

At these latest prices, I see a more balanced bull and bear case for Snowflake. On the positive side for this company:

- Powerful expansion engine. Unlike many software companies, Snowflake stresses that it is not SaaS, nor is it a subscription company. As its customers’ data volumes grow, so does its billings; which positions Snowflake for tremendous expansion potential within the existing customer base.

- Secular tailwinds in both cloud adoption and data volume growth. Snowflake straddles two important trends in computing: the moving of technology assets into the cloud, as well as data volumes exploding as companies seek to understand everything they can about their customers. Snowflake’s usage-based pricing model helps the company to capture tremendous upside here.

- Large and growing TAM. Snowflake estimates its overall cloud data platform TAM at $342 billion by 2028, which is double the market size of 2023. This also suggests that at its current scale of ~$4 billion in annual revenue, Snowflake is barely more than 1% penetrated into this market.

We should be aware of the main risks here, however:

- Aggressive hiring. Snowflake continues to add heads in all departments, most of all sales and marketing. In a time when many of Snowflake’s peers have turned their attention to cost reductions, Snowflake’s lack of faster margin expansion has caused many investors to lose patience.

- Consumption model reduces visibility. Snowflake prides itself on being a consumption-based software company, versus a SaaS subscription model. While this allows the company to grow as usage grows, the same can be said in reverse: and in a cost-conscious environment like today, we’re seeing net expansion rates slow dramatically. As a result, revenue is lumpy and not as visible as subscription companies’ top lines.

All in all, while I don’t think Snowflake’s correction is out of the woods just yet, I think it’s appropriate to start adding Snowflake back to your watch list and be ready to pull the trigger when the stock slides into the $120s.

Q1 acceleration

We will again emphasize the fact that because Snowflake is not a subscription company, its quarterly revenue trends are very lumpy and far less stable than typical SaaS companies. That being said, Snowflake’s Q1 was a blowout quarter that provided much fundamental relief (though the stock has barely moved in response to good results).

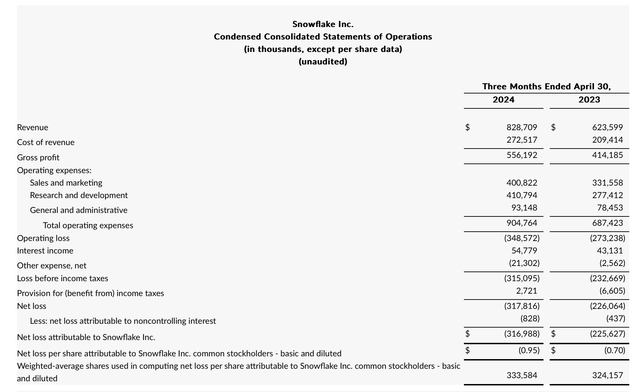

Take a look at the Q1 earnings summary below:

Snowflake Q1 results (Snowflake Q1 earnings deck)

Revenue soared 33% y/y to $828.7 million, which blasted past Wall Street’s expectations of $785.9 million (+26% y/y) with a seven-point beat. Revenue growth also accelerated two points versus 31% y/y growth in Q4.

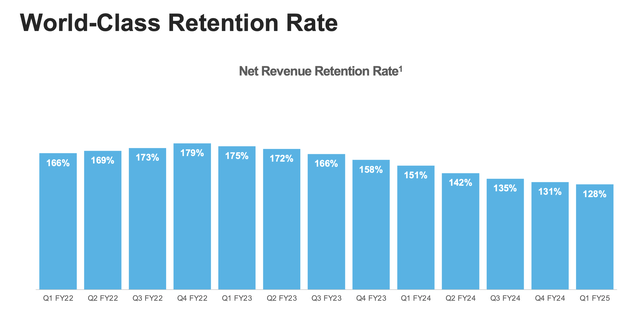

Net revenue retention rates did continue to soften, as they have since late 2022 (a function of IT budget optimization and greater deal scrutiny, a sentiment that has been echoed throughout the software sector): but the sequential decline has slowed. Net retention rates of 128% in Q1 were only three points lower than 131% in Q4; and in my view, the company will find stability in the low-mid 120% range.

Snowflake net revenue retention rates (Snowflake Q1 earnings deck)

The company attributed strong Q1 results to incredible deal momentum and an energized sales force that is now benefiting from the company’s new FY25 sales compensation plan. It did warn, however, that while February and March trends were strong, April trends were weaker, which suggests that Q1 may be an anomaly and a potential slowdown may be ahead if May through July (Q2) exhibit the same trends as April. Per CFO Mike Scarpelli’s remarks on the Q1 earnings call:

Inter-quarter, we saw strong growth in February and March. Growth moderated in April. We view this variability as a normal component of the business. Excluding the impact of leap year, product revenue grew approximately 32% year-over-year.

We continue to see signs of a stable optimization environment. Seven of our top 10 customers grew quarter-over-quarter. Q1 marked the first quarter under our FY ’25 sales compensation plan. Our sales reps are executing well against their plan. In Q1, we exceeded our new customer acquisition and consumption quotas.”

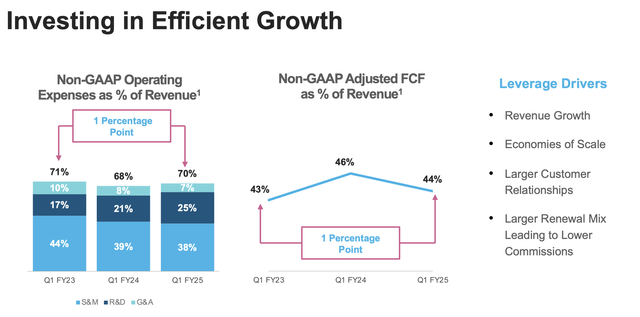

Another area to be very watchful on: Snowflake’s aggressive hiring has pushed up its expense ratios. As shown in the chart below, pro forma operating expenses slid up to 70% of revenue, up two points y/y from 68% in the year-ago Q1.

Snowflake opex trends (Snowflake Q1 earnings deck)

As a result, pro forma operating margins fell from 5% last year to 4% in the most recent quarter: which is a red flag when many software companies are taking the softer macro conditions as an opportunity to run a tighter ship and improve margins.

Valuation and key takeaways

At current share prices near $136, Snowflake trades at a market cap of $45.60 billion. After we net off the $4.46 billion of cash on the company’s most recent balance sheet, Snowflake’s resulting enterprise value is $41.14 billion.

Meanwhile, for the current fiscal year FY25, Wall Street analysts are expecting Snowflake to generate $3.49 billion in revenue (+24% y/y); and for FY26 (the year ending for Snowflake in January 2026), consensus is calling for $4.31 billion in revenue (+24% y/y). We note that consensus estimates for FY25 already bake in growth decelerating versus Q1 for the remainder of the year.

This puts Snowflake’s valuation multiples at:

- 11.8x EV/FY25 revenue

- 10.0x EV/FY26 revenue

I continue to view $120 as a more attractive entry point (~8.5x EV/FY26 revenue), but investors can wade in with confidence anywhere in the mid-$120s. There are enough long-term growth drivers here to help position Snowflake for a medium-term rebound.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.