Summary:

- Snowflake’s rapid growth deceleration has undermined investor sentiment and created concerns about competition.

- I continue to think that Snowflake’s problems are due to a soft demand environment and a lack of exposure to generative AI rather than competition though.

- While Snowflake’s stock still isn’t cheap, now could be a relatively attractive entry point given that new products are likely to begin driving growth over the next few years.

oxign

While investor sentiment towards Snowflake (NYSE:SNOW) has soured in recent quarters, the business continues to perform well by any reasonable measure. Investors seem to have lost sight of this due to a combination of lofty expectations, Snowflake’s high valuation and the rapid deceleration of the company’s growth over the past 2 years.

Snowflake has also been punished for not seeing an AI related tailwind, with this largely being attributed to competition. While it is reasonable to expect Snowflake to see some benefit as an analytic database vendor, this ignores the fact that the current surge in AI spending is very narrow and isn’t really relevant to what has historically been Snowflake’s core business.

I previously suggested that investors were incorrectly attributing Snowflake’s declining growth rate to company-specific issues rather than the macro environment, potentially creating an attractive entry point. I continue to think that this is the case, but Snowflake’s valuation means that this is not without risk.

Market Conditions

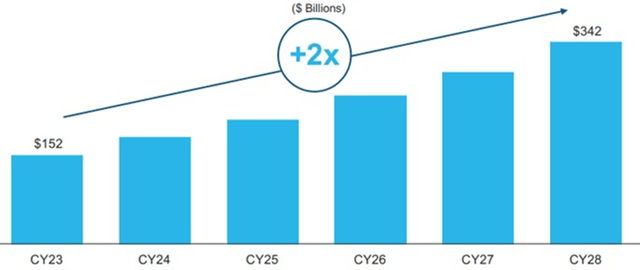

Snowflake’s TAM continues to expand as it introduces new features, and the company is still expecting fairly robust growth going forward. This is disappointing investors though, in large part due to Snowflake’s failure to benefit from AI spending.

Expectations for cloud spending growth are now being driven by generative AI hype, with public cloud services spend expected to increase from 400 billion USD in 2023 to 2,300 billion USD in 2033. While this could be expected to create a large tailwind for a company like Snowflake, there is considerable uncertainty around how much of this spend will eventuate and where it will be directed.

Figure 1: Snowflake Platform TAM (source: Snowflake)

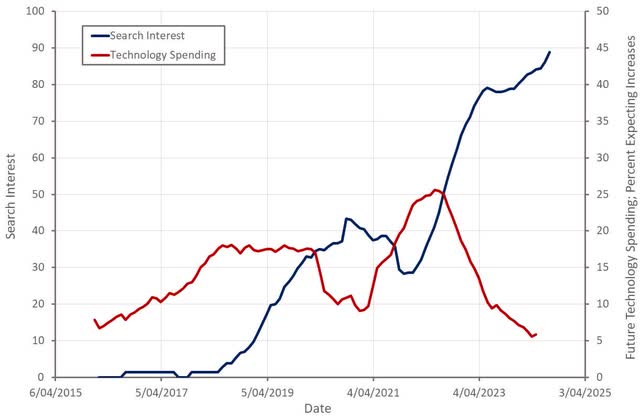

Snowflake’s rapid growth deceleration against an AI spending boom has naturally raised questions about the company’s competitive positioning. I think that continued consumption growth and a reacceleration of RPO growth suggest that competitive pressures are not that important at the moment. Snowflake’s problems appear to be more the result of macro headwinds and a platform which isn’t a natural fit for generative AI.

Snowflake has suggested that it has seen signs of stabilization in terms of optimization efforts, with 7 of its top 10 customers increasing spend sequentially in the first quarter. While this is a positive, most signs point toward a fairly soft demand environment.

Figure 2: “Snowflake Pricing” Search Interest and Future Technology Spending Expectations (source: Created by author using data from Google Trends and The Federal Reserve)

Over the past few years Snowflake has expanded from a cloud native analytical database for structured data to a more general-purpose data platform. Snowflake’s initial focus was on creating data gravity by enabling collaboration and the company has had success in this area, with nearly one third of Snowflake customers sharing data products as of Q1 2025, up from 24% 12 months ago.

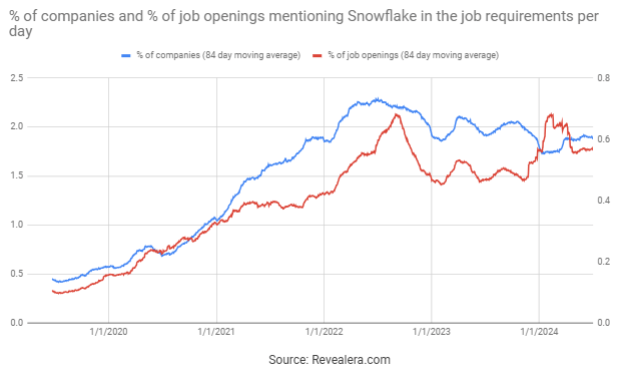

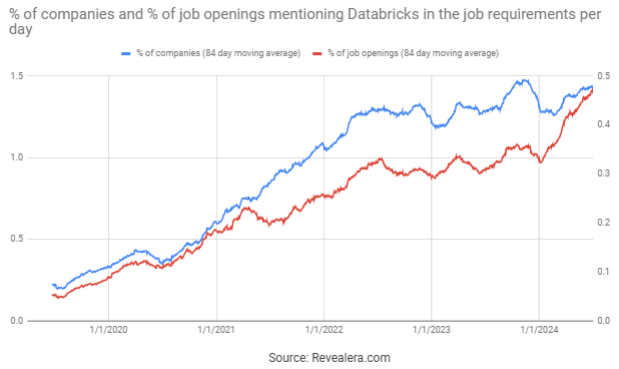

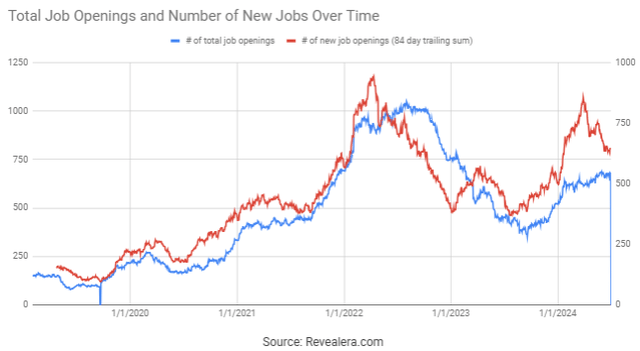

Snowflake then began pitching itself as an application development platform, introducing products like Streamlit and Unistore. With the current hype around AI, Snowflake is now focused on enabling AI use cases, which makes sense for an analytic database vendor. Snowflake’s specialty is structured data though, leaving it poorly positioned to capitalize on generative AI relative to Databricks. Databricks’ business is far stronger at the moment, which can be seen from the number of job openings mentioning each of the companies in the job requirements. Snowflake continues to downplay direct competition with Databricks, suggesting that it is only broadly competing for workloads.

Figure 3: Job Openings Mentioning Snowflake in the Job Requirements (source: Revealera.com) Figure 4: Job Openings Mentioning Databricks in the Job Requirements (source: Revealera.com)

There are very few software companies seeing a tangible demand boost from AI anyway. Palantir (PLTR) has benefited from increased demand, but for most other companies it is less clear. The hyperscalers are also performing well as they have direct exposure to LLM training and inference workloads. Microsoft (MSFT) is likely seeing some benefit in areas like Copilot but it is not clear that this is going to live up to internal or investor expectations.

Some of the reason for this is probably because most organizations are simply not prepared. For example, there is a talent shortage and data infrastructure is likely a bottleneck for many companies. This is an area where Snowflake should be seeing some benefit. The fact it hasn’t so far should be something of a concern, although this could just be a timing issue. The actual business case for generative AI is also likely to be fairly weak in many organizations.

Snowflake Business Updates

Snowflake has shifted its focus to AI and is making significant investments in support of this, with a particular focus on efficiency and security for enterprise AI. A large part of this is improving support for unstructured data and enabling more sophisticated analytic capabilities. Roughly 40% of Snowflake’s customers are now processing unstructured data on Snowflake, with the company adding over 1,000 customers in this category in just the last 6 months.

Snowflake is acquiring certain technology assets and hiring key employees from TruEra, including the TruEra AI observability platform. This will help Snowflake bring LLM and ML observability to the cloud, and evaluate and monitor models and apps across both development and production. Snowflake ventures has also invested in observability companies, highlighting the company’s appreciation of this segment. In addition to supporting AI, observability is an important capability for Snowflake’s application platform ambitions.

Cortex is now generally available, with over 750 customers using these capabilities. Cortex is a managed service that offers machine learning and AI solutions to Snowflake users. It also has an LLM powered assistant and brings semantic search capabilities to the Snowflake platform.

Snowflake has expanded its features significantly in recent years, although this is yet to have a real impact. While newer features are not meaningful revenue contributors yet, Snowflake has suggested that demand is healthy. Iceberg, Snowpark Container Services, and Hybrid Tables will all be generally available later this year. Snowpark, Cortex AI and Unstructured Data are expected to be growth drivers in FY2025. Iceberg Tables, Native Apps, Snowpark Containers and Streamlit in Snowflake are expected to be more meaningful contributors in FY2026. Unistore isn’t generally available yet and is only expected to contribute to growth in FY2027.

Figure 5: Snowflake Expansion Products (source: Snowflake)

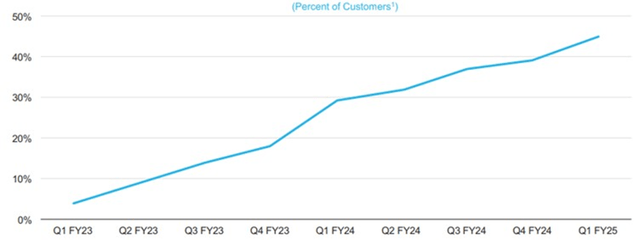

Over 50% of customers are now using Snowpark. Snowpark is the programmability platform for Snowflake and takes the platform more in the direction of Databricks. Snowpark generated around 35 million USD revenue in 2023 and is expected to generate around 100 million USD revenue in 2024.

Snowpark Container Services are expected to be generally available in the second half of the year. Snowpark Container Services is a managed container solution that enables customers to deploy and manage containerized services, while benefitting from Snowflake’s security and governance capabilities and avoiding data movement. This supports long-running services, like front-end web applications. Partners are already building solutions that will leverage container services to serve their end customers.

Figure 6: Snowpark Adoption (source: Snowflake)

Iceberg is important feature as it helps to expand Snowflake’s footprint. Over 300 customers are using Iceberg in public preview. Many customers have also reportedly indicated that they will now utilize Snowflake for more workloads as a result of this functionality.

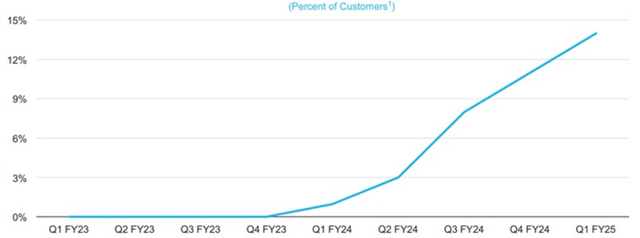

Snowflake’s application platform ambitions are supported by Native Apps, Unistore and Streamlit. Snowflake enables app development and distribution, with monetization through Snowflake Marketplace. Native apps run natively within an organization’s data platform, bringing the application code to the data. Native apps allow developers to focus on application development as Snowflake takes care of things like security and deployment. Unistore unifies analytical and transactional data, negating the need to move data from an operational database to an analytic database. Unistore is expected to become an important contributor to Snowflake’s business long-term, but it will take time to ramp. Streamlit is a framework for data scientists to create applications and experiences for AI and ML. It enables developers to build apps using their preferred tools, with simplified data access and governance.

Figure 7: Streamlit Adoption (source: Snowflake)

Financial Analysis

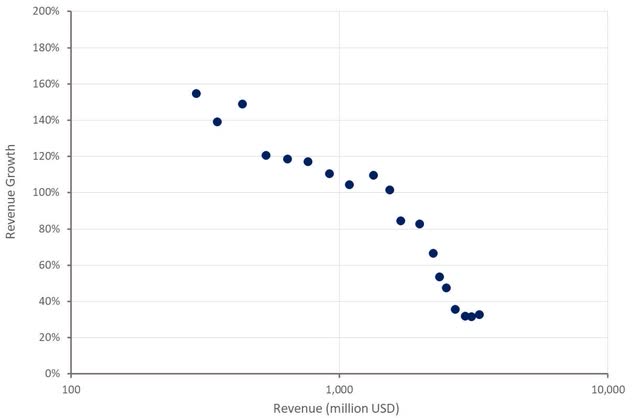

Snowflake generated 829 million USD revenue in the first quarter, an increase of roughly 33% YoY. Product revenue was 790 million USD, up 34%. Excluding the impact of leap year, product revenue only increased around 32% though. Snowflake suggested that tiered storage had a negative impact of around 6-8 million USD in the quarter.

Based on the solid first quarter, Snowflake raised its product revenue outlook for the year. Product revenue is expected to be between 805 and 810 million USD in the second quarter, Snowflake anticipates full year product revenue of 3.3 billion USD, representing 24% YoY growth. This guidance has a considerable level of conservatism baked in though, as newer products like Cortex and Iceberg, which will be made generally available later in the year, have not been included in guidance. These should begin contributing later this year, while Snowflake Container Services and Streamlit should start driving growth next year.

Figure 8: Snowflake Revenue Growth (source: Created by author using data from Snowflake)

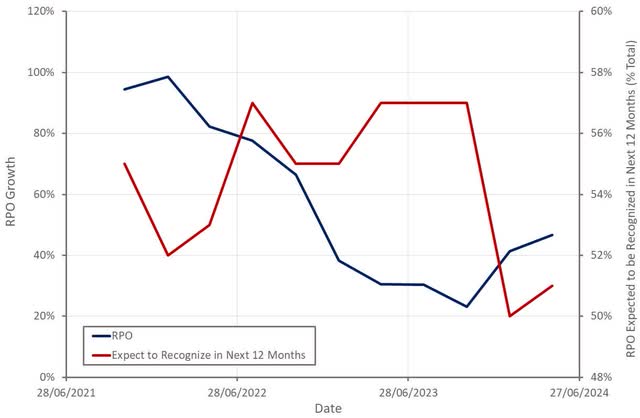

Remaining performance obligations increased 46% YoY in the first quarter to 5 billion USD, indicating that customers are returning to longer-term contract expansions. While this is a positive, the current portion of RPO has declined, meaning that this isn’t really indicative of an imminent growth reacceleration.

Figure 9: Snowflake RPO Growth (source: Created by author using data from Snowflake)

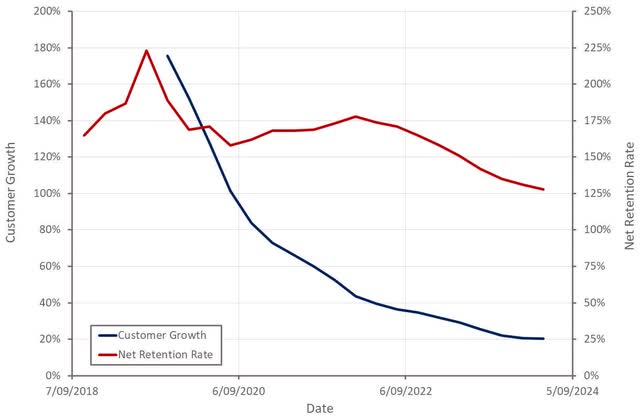

Snowflake’s net retention rate and growth of the company’s customer base continue to moderate.

Figure 10: Snowflake Customer Growth (source: Created by author using data from Snowflake)

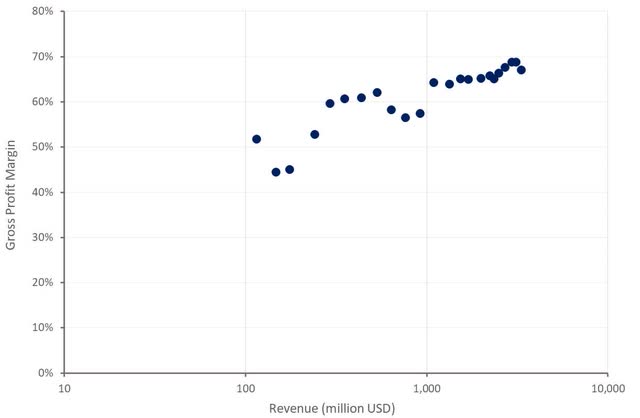

Snowflake’s gross profit margin declined slightly in the first quarter, which was attributed to GPU- related costs as the company invests in AI. Infrastructure is a large part of Snowflake’s costs, and if AI workloads become a more meaningful part of the business, it could drive margins significantly lower.

Figure 11: Snowflake Gross Profit Margin (source: Created by author using data from Snowflake)

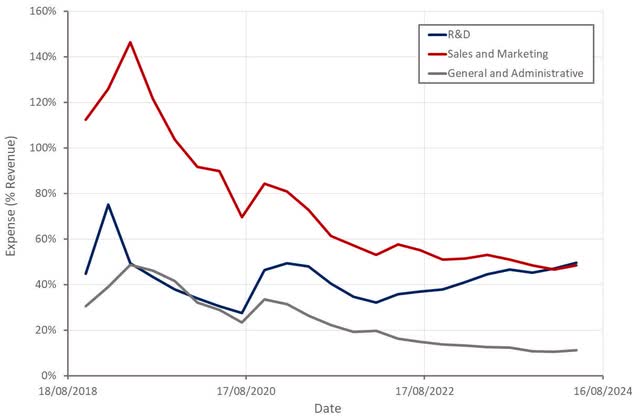

Snowflake’s operating expenses continue to be driven by increased investments in R&D to try and capitalize on the generative AI opportunity. While Snowflake has probably earnt the right to make these types of bold investments, it has made little progress towards profitability in recent years. Snowflake is generating solid cash flows, but stock-based compensation more than offsets this. With growth slowing, and the company’s valuation under pressure, stock-based compensation could become more of an issue going forward.

Figure 12: Snowflake Operating Expenses (source: Created by author using data from Snowflake)

Snowflake’s hiring surge in late 2023 and early 2024 was likely driven by expansion of its salesforce and attrition. The number of Snowflake job openings has moderated in recent months though, which should be supportive of margins going forward. It also potentially suggests that the demand environment has continued to soften.

Figure 13: Snowflake Job Openings (source: Revealera.com)

Conclusion

While Snowflake’s revenue growth has stabilized in recent quarters, the company’s GAAP losses are still large, and I believe there is a risk that financial performance will disappoint later in the year. Snowflake’s current problems appear to primarily be a result of the macro environment more so than competition though. Despite this, Databricks recent success could eventually undermine Snowflake’s business.

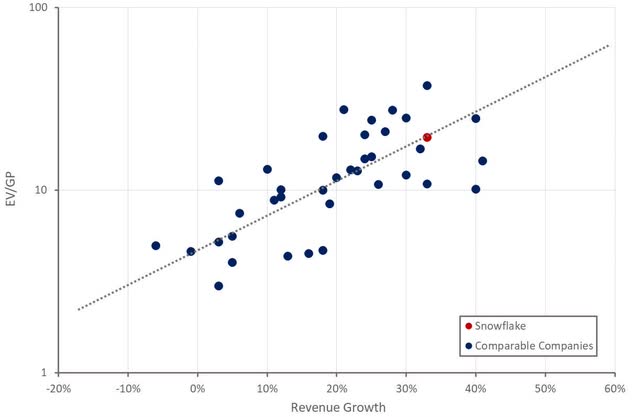

Snowflake’s share price has rebounded somewhat in recent weeks, although sentiment remains fairly poor. As a result, this could be a fairly attractive entry point, particularly given that new products are likely to begin driving growth over the next few years. Snowflake is still far from cheap though, making this is risky proposition.

Figure 14: Snowflake Relative Valuation (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.