Summary:

- Snowflake reported strong FY2Q25 results, raising revenue guidance for FY2025 while maintaining profitability guidance.

- The growth in high quality customers, two nine-figure deals achieved this quarter, and commentary about signs of a stable optimization environment point to strong execution by the go-to-market team.

- Management does not expect any impact from the cybersecurity incident and has taken a more proactive approach to discuss security issues with customers.

- Under the new leadership, in the first half of the year alone, Snowflake brought as much product to market as it did for the whole of last year.

- Most of the newer products will have some impact in FY2025, but a significant ramp for these products will come in likely FY2026.

D4Fish

Snowflake (NYSE:SNOW) reported its FY2Q25 results that beat on all fronts, resulting in a raise in revenue guidance for FY2025, while profitability guidance was maintained.

I think Snowflake is headed in the direction under the leadership of new CEO Sridhar Ramaswamy.

Since becoming the CEO of Snowflake, he has seriously increased the pace of product innovation and new product launches and also revamped the sales representatives’ incentives to ensure that they are aligned with new customer additions and consumption growth.

We are starting to see the early signs that the new incentives are driving quality customer growth, with the majority of the upside from the change in sales incentives to come in FY2026.

Also, with FY2025 being a big year for Snowflake in terms of new product launches, the company is heading in the right direction in terms of being competitive in the industry. There are more than 15 product capabilities being made generally available on the Snowflake platform, and the upside from the new products when ramped is also expected to materialize in FY2026.

In the meantime, though, for both initiatives to be successful, management needs to invest, and that has resulted in near-term lower margins in exchange for a larger market opportunity and improved long-term market position.

It is not the end for Snowflake.

This is the beginning of a new era for Snowflake under the leadership of Sridhar Ramaswamy.

I have written extensively about Snowflake on Seeking Alpha, which can be found here.

Let’s first look at the FY2Q25 quarter.

FY2Q25 results review

You would have thought that Snowflake missed badly on earnings when you saw the share price reaction after the quarter.

However, Snowflake managed to beat across the board, but it does seem that the market is expecting beats of a larger margin instead.

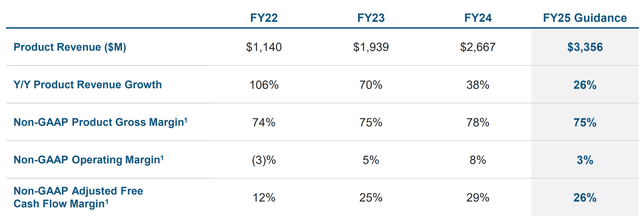

Product revenue grew 30% from the prior year to $829 million. This translates to a 2% beat against consensus expectations, but it does seem that the market is concerned that the beat is less than the 5% beat that Snowflake saw last quarter.

Profitability was a beat across the board.

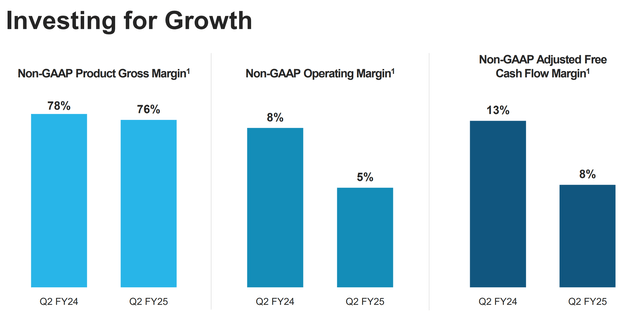

Product gross margin, operating profit margin and free cash flows came in at 76%, 5% and 7%, all beating consensus expectations by 130 basis points, 180 basis points and 200 basis points respectively.

While gross margins were better than expected, it is important to note that it is in-line with internal expectations and guidance for FY2025, as there were some GPU deployments that Snowflake is waiting for this quarter that have not yet come in.

While margins are lower than in the one-year ago period, Snowflake is investing in growth in the business, focusing on innovation and product delivery while implementing changes to the go-to-market. That said, I do expect this to re-accelerate growth and yield results, especially starting in FY2026.

Bookings were strong this quarter. RPO growth accelerated to 48% growth in the FY2Q25 quarter, accelerating 46% from the last quarter. Likely due to longer duration contracts, the implies cRPO growth decelerated 1 percentage point.

Snowflake repurchased $400 million worth of shares in the quarter using its original $2 billion repurchase plan, with $492 million remaining through March 2025.

There is another $2.5 billion of stock repurchase that has been approved this quarter, which will last through March 2027.

This stock repurchase firepower will help manage dilution and improve shareholder value over time.

Outlook

Again, it is important to acknowledge that Snowflake forecasts product revenue based on observed behavior and that the FY2025 guidance contribution from Snowpark, does not include contribution from new product features, and it includes revenue headwinds associated with performance improvements.

Snowflake’s FY3Q25 guidance was ahead of consensus, while the FY2025 guidance was also raised.

FY2025 product revenue was raised by $56 million, compared to the $17 million beat in FY2Q25.

To me, this implies management sees an even stronger ramp in revenue in the second half of FY2025 and also confidence in the second half.

Profitability for FY2025 was maintained for FY2025, reiterating the 75% product margin, 3% operating profit margin and 26% free cash flow margins.

Again, as highlighted earlier, the lower margin profile is due to the investments Snowflake is making in its business for the long term.

For FY3Q25, the guidance for product revenue was a growth rate of 22%, 1% ahead of consensus expectations at the midpoint.

Operating profit margin for FY3Q25 was guided at 3%, which is in-line with consensus expectations.

Based on the FY3Q25 and FY2025 product revenue guidance, the implied FY4Q25 product revenue guide turns out to be in-line with consensus at around 20% growth from the prior year using the midpoint of the guidance range.

I think what happened here is that consensus expectations were elevated going into the print. Management is executing well here, with beats in the quarter translated to upward revisions in the guidance. However, it does seem that some of the consensus expectations were already getting ahead of themselves and have already priced in that upward revision in the guidance. In that sense, the upward revision in the guidance was not interpreted as a positive, but rather, neutral or slightly negative given that it merely was in-line with expectations.

However, in my opinion, the strong bookings along with the guidance raise suggests to me that significant downside is limited from here as the business fundamentals are trending in the right way.

The fact that Snowflake is able to achieve this despite the data breaches that happened with its customers is a positive in my view.

Cybersecurity incident

There was a cybersecurity incident that affected some of its customers that has been quite rampant on the headlines in the past quarter, which affected companies like AT&T and Live Nation.

As I have already explained before, Snowflake once again reiterated in the quarter that after multiple investigations by internal and external cybersecurity experts, there was no evidence that the Snowflake platform was breached or compromised.

Snowflake continues to reiterate to all businesses, whether they are Snowflake customers or not, to enable and enforce multi-factor authentication across the organization and ensure that network policies are strong. Snowflake reiterates that it has been supporting both since 2016.

It is super positive to note management comment that there was no impact on Snowflake from a consumption standpoint from the cybersecurity incident, and there has not been any noticeable impact from this in signing up new customers or getting existing customers to deploy new projects.

What is management doing apart from supporting both multi-factor authentication and strong network policies?

When it comes to new and existing customers of Snowflake, the company always point to the security capabilities that on the platform and is being more proactive about the security conversation. With regard to customers affected by the breach, Snowflake is working with them closely, talking to the security teams in Snowflake to ensure that best practices are carried out.

As a result, I do think the cybersecurity incident with Snowflake is somewhat overblown by the media.

Go-to-market and customers

Before highlighting some key go-to-market and customer metrics, I think it’s important to remember that Snowflake changed its sales incentives in FY2025 and readjusted its new customer acquisition motion.

The sales incentives in FY2025 were focused on driving consumption and new customer acquisitions by leveraging on and selling new product features and use cases over time.

In this quarter, there were multiple positives that showed that this new go-to-market strategy is starting to work.

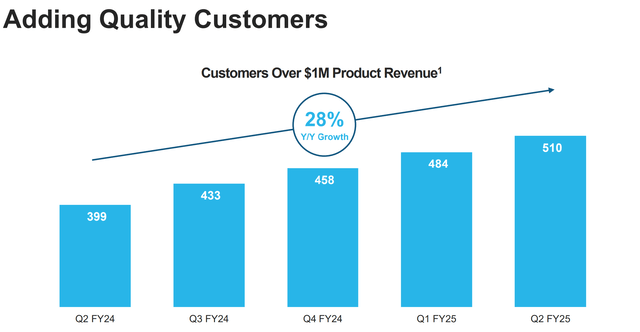

Firstly, as can be seen below, the FY2Q25 customer base that has at least $1 million in product revenue grew by the same margin as in the prior quarter, continuing to show solid and consistent growth in quality customers. This showed that the new sales incentive is helping to drive new quality customer acquisition.

Secondly, management highlighted that it signed two nine-figure deals in the quarter. These were existing customers that, upon renewal, decided to expand workloads on Snowflake and these two customers plan on doing even more with Snowflake. In the quarter, the financial and technology verticals drove growth in the quarter.

Thirdly, while it does appear that others like Microsoft Azure are seeing a tough environment, Snowflake seems to buck the trend. From Snowflake’s point of view, it continues to see signs of a stable optimization environment, with the largest customers contributing to product revenue growth in-line with historical trends. With the bookings that it achieved in the quarter, along with the deals closed in the quarter, Snowflake does not see things being any worse than before. In fact, Snowflake reiterates that the customer buying pattern has been very stable, and that even consumption trends right up to this earnings call day continues to be stable. As such, it does seem that based on what Snowflake is seeing with consumption and new customer acquisition, it is faring better than others in the industry.

Lastly, customers continue to speak highly about the Snowflake platform. New CEO Sridhar Ramaswamy spent time with more than 100 customers of Snowflake, and he continues to hear the consistent theme across the C-suite that he is meeting that Snowflake continues to deliver ease, efficiency and reliability to their businesses.

Snowflake expects that this change in sales incentives will drive meaningful revenues over time, and that as its new customer acquisition motion is ramping, there will be a more material impact in FY2026. What this means is that with the solid quality customer acquisition in the quarter highlighted above, these new customers will be a meaningful impact on revenue next year, and with sales reps being paid based on consumption, they are driven to drive new workloads on the Snowflake platform, which will also have a positive impact in FY 2026.

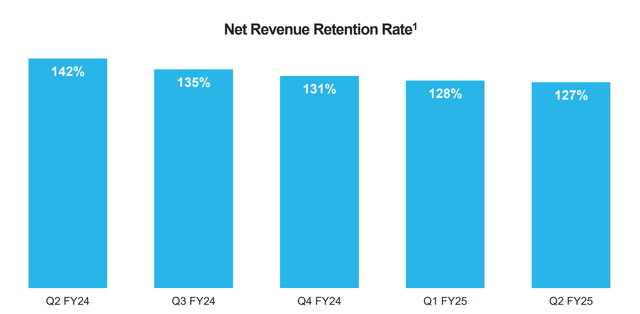

Net revenue retention rate (“NRR”) fell slightly by 1 percentage point sequentially, but it appears to be stabilizing. Management does not guide NRR but points to the expectation that it will converge with revenues over time, and that they are happy with the NRR given its revenue growth and expects stabilization to come.

Net revenue retention rate (Snowflake)

New product delivery and innovation

Under the new leadership, in the first half of the year alone, Snowflake brought as much product to market as it did for the whole of last year.

And while launching many new products is great, these products are also being adopted by Snowflake’s customers at an incredible pace.

In the FY2Q25 quarter, Snowflake made nine net new products announcements and launched more than 15 new product capabilities to general availability.

I think it is encouraging to see management reiterate that they are seeing broad adoption of Snowflake’s products across its customer base.

Two key products which highlight the innovation and momentum Snowflake is bringing are both Cortex and Iceberg, both of which are now generally available and have already gained lots of momentum with customers.

For Cortex AI, Snowflake highlighted that Penske Logistics has multiple use cases for Cortex AI, including using it to consume performance metrics for the transportation business, aiming to improve performance and enhance truck driver retention, while one of the largest financial services companies is using Cortex AI to improve their customer support experience by analyzing unstructured text data and running sentiment analysis on call center transcripts.

For Iceberg, Snowflake cited that more than 400 accounts are using Iceberg as of the end of FY2Q25, with many of Snowflake’s largest customers saying that they will use Snowflake for more workloads due to Iceberg.

Specifically, Snowflake highlighted that one of the largest consumer services and hospitality companies is using Iceberg to accelerate their migration to the cloud.

While still in public preview, Snowflake’s Notebooks offering already has more than 1,600 accounts using it, strong traction for an offering currently only in public preview and key for market opportunity expansion within data science.

Of course, this product innovation and delivery is not slowing down, with Snowflake expected to bring new features to the market in the second half of FY2025. Both Cortex Search and Cortex Analysts are expected to be generally available in FY3Q25.

With regard to revenue contribution, in the guidance for FY2025 at least, the only new product included is Snowpark, which is assumed to be about 3% of revenue or $100 million, and that is progressing well so far in the first half.

While other newer products are not yet factored into FY2025 guidance, I expect that they will have an impact this year, but it is not included in the guidance because these newer products have a limited history, but in FY2026, this will likely be when the newer products ramp more significantly.

Valuation

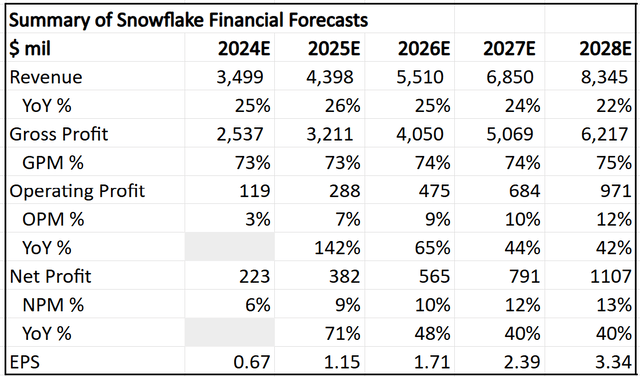

I am adjusting the financial model for the $56 million raise for FY2025 revenues (note that I am using calendar years below), and maintaining the 75% product margin, 3% operating profit margin and 26% free cash flow margins.

There could be upside to the forecasts if management delivers a stronger than expected beat due to newer products, or if the environment shifts from stable to more positive.

My 5-year financial forecasts for Snowflake (Author generated)

My intrinsic value for Snowflake is $161, which is based on 80x 2028 terminal multiple and 12% cost of equity.

My 1-year and 3-year price targets for Snowflake are $169 and $237 respectively.

They imply 65x FY2025 and 55x FY2027 P/FCF multiple respectively.

Conclusion

I actually think Snowflake is headed in the right direction and that this was a positive quarter, highlighting its ability to innovate and launch new products, and also deliver changes in the sales incentive structure to drive revenue growth.

I do find the market reaction puzzling, given that the earlier guidance would have already implied a deceleration in the second half, and with an upward revision in guidance, this implies that things are better than before.

But as I mentioned earlier, it is likely that the market was pricing in larger beats through the year as they were expecting management to have guided conservatively.

With the beat this quarter being smaller than the market expected, it is likely that the upward revision was also seen as slightly disappointing by the market.

However, I think of businesses in the long-term and not by quarters, and to me, Snowflake is in a better position fundamentally and competitively.

The new CEO leading Snowflake is prioritizing customers, driving innovation and accelerating product delivery, and implementing positive changes to the go-to-market team.

In the FY2Q25 results, we saw evidence of all three making significant progress, and I do think that the market is overreacting here as I expect that the new products to ramp more materially in FY2026 and contribute to the revenue growth profile for Snowflake.

It is not the end for Snowflake.

This is the beginning of a new era for Snowflake under the leadership of Sridhar Ramaswamy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.