Summary:

- The streak of negative news continued at Snowflake after the company reported somewhat softer-than-expected FY25 Q2 results.

- The bear thesis centered around increasing competitive threats, decreasing margins, slowing revenue growth, rich valuation, and high stock-based compensation gained significant traction recently.

- I believe investors became overly pessimistic towards the company, disregarding its strong growth prospects and placing too much emphasis on not well-supported threats.

- Current valuation levels reflect extreme pessimism, in my opinion, providing a good risk/reward opportunity for buying the shares at current levels.

John M Lund Photography Inc

Introduction and Investment thesis

Snowflake (NYSE:SNOW) continued its streak of disappointing quarterly results as the shares of the Sridhar Ramaswamy led data cloud company tanked 15% following the FY25 Q2 earning release. Sentiment has already been negative going into the release, resulting from a cybersecurity incident where data from millions of Snowflake users have been compromised. The fact that this didn’t result from the breach of Snowflake’s security systems provided significant relief, although it was enough for generating negative publicity. This has been worsened by increasing competitive threats as top competitor Databricks announced impressive growth numbers for the first half.

Reporting somewhat softer quarterly numbers than expected under such circumstances couldn’t go without consequences. I’ve been arguing for quite some time that this year’s negative streak should soon come to an end and the shares of Snowflake shall rise again. However, it seems this keeps postponing. After re-assessing my thesis around the company, I concluded that bearish arguments like slowing topline growth, decreasing margins, high stock-based compensation, expensive valuation, and increasing competitive threats are not strong enough to outweigh the bull case for the company. This is centered around the stabilization of the core business, the pace of new product launches and their increasing contribution to revenues, strong bookings, and the change in sales compensation plan to support consumption.

In the light of the somewhat softer than expected Q2 earnings print, I downgrade my previous Strong Buy recommendation to a simple Buy, as it shows some uncertainty around the timing of a possible turnaround. However, over the long run, I remain confident that Snowflake will remain the number one cloud data warehouse benefiting from the ongoing transition to the cloud. This core service is extended by an increasing number of additional ones, which could contribute to revenue growth meaningfully in FY26, providing a strong setup for the company for the close future. With all the bad news hopefully out, I believe investor sentiment toward Snowflake has reached peak pessimism, which could also support a turnaround for shares.

Q2 earnings: A small hiccup in the middle of a turnaround

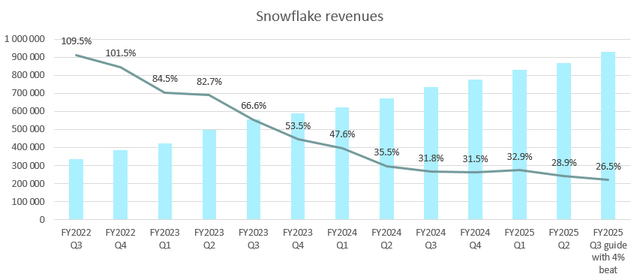

Following FY25 Q1 earnings, I have been optimistic that Snowflake will be able to turn the tide and reaccelerate its revenue growth rate after a prolonged downtrend. With Q2 numbers out I’ve been somewhat disappointed that this trend didn’t continue and based on management’s Q3 guidance it could take more time. Snowflake reached revenues of ~$869 million in its most recent quarter, beating the average analyst estimate and management’s previous guidance by roughly 2%. As management admittedly considers a beat of 3-5% a good beat, this hasn’t been accomplished in the Q2 quarter. On the top of that, the yoy revenue growth rate declined to 28.9% from 32.9% in the Q1 quarter, questioning a possible turnaround. Based on the guidance for Q3, assuming a good beat of 4%, the yoy revenue growth rate would slip further to 26.5% as presented below:

Created by author based on company fundamentals

In the light of the fact that the large cloud providers experienced reacceleration in their businesses recently, just like several SaaS companies, this is somewhat frustrating. Due to Snowflake’s consumption-based revenue model, this kind of volatility can be regarded as normal, but it is unfortunate that there has been a setback after the previous strong quarter. What could be encouraging for the second half is that management raised its full-year product revenue guidance by $56 million, which is more than twice the Q2 beat of $22 million. This signals some optimism, just like management commentary from the Q2 earnings call, that recent consumption trends continued to be satisfying as companies finish their cost optimization cycle.

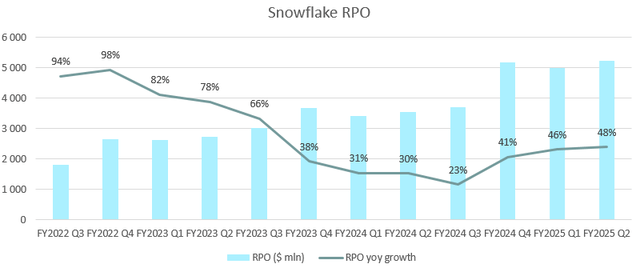

Looking at total customer commitments, they continued to remain strong in Q2, growing 48% yoy:

Created by author based on company fundamentals

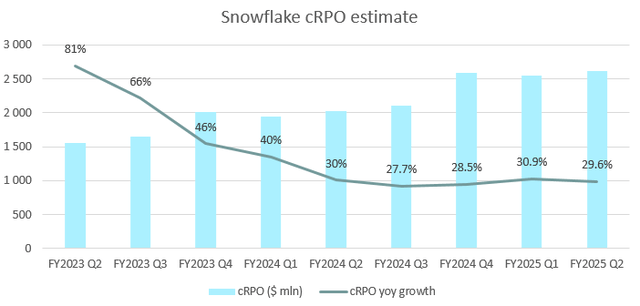

There have been a few large, longer-term deals, which inflate total remaining performance obligations (RPO) to some extent, but focusing on those obligations, which are committed for the upcoming year we can still see a growth rate of ~30% yoy:

Created by author based on company fundamentals

I believe these bookings provide a strong foundation for revenue growth for the second half and beyond.

Snowflake vs Databricks

Another important point to factor in for the second half is the introduction of Iceberg tables for all customers. This functionality allows customers to run Snowflake’s services on data that resides outside of the platform, a crucial step in bridging the gap to Databricks’ services. In the short run, it’s possible that customers will move out some of their data from the Snowflake platform, thereby decreasing storage revenues. However, over the medium-term this provides Snowflake access to a significantly larger data pool, which will result in increasing consumption.

Management decided to factor in a net negative impact on revenues for the second half, but if customers didn’t pull out as much data as management expected (like it happened in Q2) this could provide possible upside. Thanks to the recently modified sales incentives that prioritize consumption, I believe as Iceberg tables ramp it could provide meaningful upside for revenues in FY26, but already some positives could be witnessed in the second half of FY25.

Beside Iceberg tables, Snowpark could be the other major contributor to reaccelerating revenue growth. It was initially aimed at migrating Spark workloads to the Snowflake platform, thereby enabling customers to build secure and scalable data foundation required for AI/ML workloads with significantly reduced operational complexity. Quickly, it transformed into a platform for traditional Python-based ML workloads that has been the home playground for Databricks over the past years. Snowpark revenues are on track to reach $100 million this year, with significant further growth potential for FY26.

Another step in targeting ML workloads, Snowflake launched Snowflake Notebooks, which will hit general availability soon and is already in use by ~15% of customers in public preview. This offering is a direct competitor to Databricks’ core tool for creating data science and machine learning workflows and has the potential to open up an entirely new market for the company.

From the three examples above (Iceberg tables and Snowpark) it can be clearly seen that Snowflake tries to catch up to Databricks in those areas, where it has traditionally lagged before. At the same time, Databricks is doing the same, as its SQL-based data warehousing service, mimicking Snowflake’s homegrown solution, reached annualized revenues of $500 million in the first half of the year.

As the services the two companies offer are increasingly converging, competition will surely heat up between them. However, I believe this will result in accelerating revenues for both companies over the upcoming years, as they typically don’t replace each other, rather they penetrate existing customers with an extended product offering more quickly. Two dominant players for such a large market with cloud transition only in the early innings provide a strong setup for both companies in my opinion. Although hyperscalers are lining up with their own cloud-based data warehousing and data engineering solutions, these are lagging Snowflake and Databricks currently by a wider margin.

Currently, the main distinction between Snowflake and Databricks is that the solutions of Snowflake emphasize ease of use by providing a wide range of managed services, while the ones of Databricks target more tech-heavy use cases requiring higher expertise in data science and data engineering. Databricks usually offers more optionality for a given workload and makes it possible to perform it a reduced cost compared to Snowflake. However, this requires manual work from data engineers, which increases the total cost of operation. The question is what the customer prefers.

I believe most analytical workloads like combining marketing, sales and financial data and drawing conclusions upon them don’t require high technical expertise. Data analysts who are proficient in SQL queries can manage these workloads comfortably with the help of Snowflake. However, in the case of more complex data sets, including ML and data science workflows, the solutions of Databricks are preferred. So, the recent proliferation of AI clearly favors Databricks, but Snowflake with its new CEO, Sridhar Ramaswamy is working hard to catch up. Making 9 new product announcements in Q2 and bringing 15 product capabilities to general availability speaks for itself.

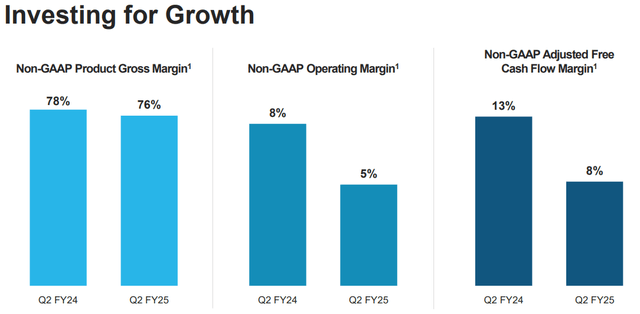

Based on this, I believe that the core cloud-based data warehousing business of Snowflake could fuel continued strong topline growth over the upcoming years, and recently emerging new opportunities provide a nice upside to this. It’s no wonder that the company heavily invests into these opportunities, which is evidenced by GAAP R&D expenses as % of revenues reaching 51% in the most recent quarter. As for comparison Databricks CFO, Dave Conte recently shared that Databricks has spent 33% of revenues on R&D in recent fiscal years, although it hasn’t been specified whether on a GAPP or non-GAAP basis. It’s true that Snowflake’s significant investments impact profitability in a negative way in the short run, but over the medium term they ensure the continued high growth profile for the company even at a scale of $3 billion product revenue for FY25. Based on this, I believe that those bearish arguments, which criticize decreasing margins are not well-supported as these short-term sacrifices are required for long-term success:

Snowflake FY25 Q2 investor presentation

Based on the above, the deterioration in margins is obvious compared to the previous year, but that’s how investment mode at an R&D-oriented company looks like.

Valuation and SBC

Finally, the last two topics that are usually highlighted by bears when it comes to Snowflake are high stock-based compensation (SBC) and rich valuation. Regarding SBC, it’s true that Snowflake awards employees hundreds of millions of dollars in the form of restricted stock units each quarter, but this is compensated by share repurchases on the other hand. In Q2 Snowflake incurred SBC-related charges of $373 million, meanwhile it repurchased shares worth of $400 million, effectively canceling the effect of dilution for the quarter. Of course, this is not the case each quarter, but it shows the company’s commitment to maintain annual dilution around 2%, which is not a big sacrifice for shareholders in my opinion in the case of a high growth SaaS company.

Furthermore, the Board recently authorized the additional repurchase of shares worth of $2.5 billion, which complements the previous authorization of $2 billion, where $0.5 billion is still open for repurchases. The company’s strong cash position ($3.3 billion in cash and short-term investments) and cash generating ability ($810 million free cash flow in FY24) enables them to maintain these buybacks over the long run. This should compensate shareholders for SBC, so investors shouldn’t fear excessive dilution in my opinion.

Looking at the valuation of shares they trade currently at 11.2x FY25 sales, which could seem rich compared to the 2.6-2.7x multiple for the S&P500. However, if we factor in the expected growth differentials over the upcoming years this valuation gap could close rapidly. Assuming a CAGR of 30% for Snowflake for the upcoming 3 years, while 10% for the S&P500 the forward P/S multiple of Snowflake would shrink to ~5, while it would be ~2 for the S&P500. This shows that it’s important to take the variation of future growth prospects into account, when comparing valuation multiples with each other. Based on this, I believe the shares of Snowflake are not overvalued at the moment.

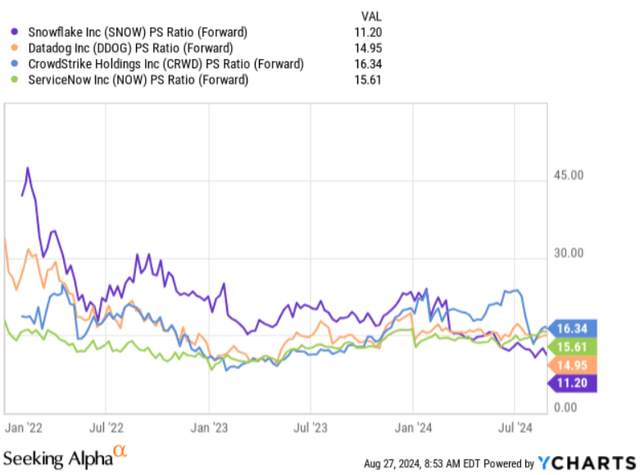

Looking at valuation from another angle I compared the forward P/S multiple of Snowflake with other leading SaaS companies with similarly strong fundamentals:

Seeking Alpha – YCharts

Other leading SaaS companies like Datadog (DDOG), CrowdStrike (CRWD) or ServiceNow (NOW) trade at a forward P/S multiple of 15-16, while Snowflake’s valuation is lagging this peer group by 34-45%. Based on the Rule of 40 metric (revenue growth rate + FCF margin) there is no significant difference between these companies when looking at CY2024 estimates (Snowflake – Rule of 52, ServiceNow – Rule of 53, Datadog – Rule of 55, CrowdStrike – Rule of 62 but expected to be lowered due to outage). This confirms my initial thesis that investor pessimism towards Snowflake could have reached its peak.

Once the streak of negative news dies down and positive ones claim their place, I believe there could be significant upside for shares. Based on my analysis above this should be close on the corner. Simply a re-rating that restores the company’s valuation to its peer group described above could result in an upside of 30-40%. Investors who want to take this reward must face the risk of short-term uncertainty regarding the timing of a fundamental turnaround. I believe that materially improving growth prospects for FY26 seem likely, so the upcoming 1-2 quarters bear much of these risks in my opinion.

Conclusion

Snowflake shares experienced significant correction in 2024 resulting from a delay in revenue growth reacceleration, decreasing margins, rising competitive threats and rich valuation. Looking at these threats in more detail reveals to me that none of them should hinder the company’s growth turnaround over the upcoming quarters, especially going into FY26. As the valuation of shares reflects increased investor pessimism towards the stock I believe the current setup provides a good risk/reward opportunity to buy Snowflake’s shares at current levels for the medium/long-term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.