Summary:

- Snowflake Inc.’s Q1 2025 revenue outperformance continues to highlight improving consumption trends, reinforced by early observations of strong uptake for its upcoming AI/ML-focused product pipeline.

- The raised FY 2025 revenue guidance remains well-positioned for a further upside surprise, with the upcoming GA of Snowflake’s AI/ML-focused product pipeline being additive to its forward growth outlook.

- We believe Snowflake’s valuation correction observed earlier this year has been sufficiently de-risked for execution risks ahead pertaining to its AI roadmap.

Sundry Photography

Snowflake Inc. (NYSE:SNOW) stock continues to progress on a corrected valuation trajectory following mixed 1Q25 results. Recall that the stock has suffered from multiple compression after management retracted, earlier this year, Snowflake’s implied 30%+ multi-year growth outlook. Much of the tempered fundamental prospect was attributable to a slower-than-expected consumption backdrop for FY 2025 due to the combination of ongoing industry and company-specific headwinds.

And the company’s 1Q25 performance continues to corroborate earlier expectations, considering in line consumption trends with average volumes observed through FY 2024. Specifically, Snowflake’s 1Q25 revenue growth outperformed expectations, with favorable incremental contributions from the general availability (“GA”) of its proprietary AI product, Cortex, earlier this month to anticipated 2Q results. Resilient top-line expansion was offset by a higher-than-expected impact on profitability due to incremental GPU-related costs supporting the company’s ongoing AI initiatives.

The results reinforce confidence that there is opportunity for pent-up incremental demand ahead of the rolling GA of Snowflake’s upcoming new products. Specifically, the upcoming product pipeline is expected to transition Snowflake’s currently indirect foray in emerging secular opportunities as a data strategy enabler into a more direct participant in enterprise generative AI strategies.

Meanwhile, cross-cloud platforms like Snowflake boast a competitive advantage amidst increasingly structural optimization trends, especially with growing multi-cloud adoption. Stabilizing optimization headwinds observed through CY/2H23 to date also present as a tailwind to Snowflake’s business model.

Recall from our previous analysis that consumption-based business models are inherently recession prone, given their flexibility to scale up and/or scale down usage. Yet, they are also typically first to recover as demand returns with improving workload volumes. Taken together with the rolling GA of Snowflake’s upcoming AI/ML-focused product pipeline aimed at addressing acceleration in generative AI momentum, we expect multiple re-expansion in the back half of fiscal 2025.

Snowflake’s Competitive Advantage

Snowflake’s commitment to simplicity and accessibility continues to reinforce its long-term share capture prospects in the ~$300 billion data cloud solutions TAM. Specifically, Snowflake’s cloud-based data management solutions are now available across all three major hyperscalers, including Amazon Web Services (AMZN), Microsoft Azure (MSFT) and Google Cloud Platform (GOOG / GOOGL). This cross-platform availability does favorably with ongoing cloud spend optimization trends that are becoming increasingly structural despite easing macro constraints in the enterprise spending environment.

Specifically, the onset of cloud spend optimization trends has spurred multi-cloud adoption as well. In a recent industry sentiment check, close to 80% of corporate IT strategies have reported multi-cloud usage, with close to half using at least two public cloud vendors, about a fifth using three, and 14% using more than three. Incentives to adopt multiple cloud providers continue to be driven primarily by realizable cost efficiencies, in addition to considerations for “risk mitigation, reliability/redundancy, [and] functionality.” We view this set-up as a structural tailwind for Snowflake’s core product philosophy, which focuses on simplicity, interoperability and seamless integration to deliver value and efficiency gains for customers.

This also pairs favorably with Snowflake’s increasingly competitive total cost of ownership. Specifically, the company saw workload volumes grow by 62% y/y in FY 2024, while relevant revenue grew in the 30% range. Admittedly, this highlights an inherent risk of “efficiency cannibalization” for consumption-based business models, as we had previously discussed:

Efficiency cannibalization (Con). This brings us to the third inherent business risk introduced by consumption-based revenue models – efficiency cannibalization. Improvements made to platforms to enable improved usage and pricing efficiency could essentially result in a lower consumption requirement by customers, thus lower revenues for consumption-based service providers.

Source: “Do You Really Understand Snowflake’s Revenue Model?”

Yet, these efficiency gains passed back to customers remain key to workload acquisition and retention at scale, especially given the increasingly competitive landscape. The set-up continues to underscore the importance for Snowflake to expand its TAM with new product innovation, which new management is prioritizing in their execution through FY 2025.

Incremental Revenue Opportunities

The upcoming GA of Snowflake’s AI/ML-focused product pipeline is expected to complement improving consumption trends. Specifically, management has reaffirmed that optimization headwinds have peaked, with consistently stabilizing consumption trends through FY 2024 and into early FY 2025. However, volumes have yet to return to pre-FY2024 levels, resulting in management’s continued conservatism in the raised FY 2025 guidance. Specifically, management has guided revenue growth of 24% y/y to $3.3 billion this year, up from the previous guidance of $3.25 billion. This represents not only substantial deceleration, but also keeps Snowflake’s $10 billion product revenue target by FY 2029 in the back burner.

These changes in our assumption impact our long-term guidance. Internally, we continue to march towards $10 billion in product revenue. Externally, we will not manage expectations to our previous targets until we have more data.

Source: Snowflake F4Q24 Earnings Transcript.

Yet anticipated contributions from the upcoming GA of new products have not been considered in the FY 2025 revenue guidance, which we consider as additive to Snowflake’s growth profile and should not be overlooked. For instance, Document AI – a feature embedded in Snowflake Cortex – has already garnered hundreds of customers waiting for access when the product enters GA. Meanwhile, other products in limited private preview have also been “very well received”. Specifically, Cortex, which went into GA earlier this month, is already benefitting from impressive adoption across customers – more than 750 customers are already using the newly introduced product, thanks to resulting efficiency gains. We believe these observations continue to provide tangible validation over uptake rates for the new products when they enter GA.

Expectations for additive growth from the upcoming GA of new products is further corroborated by Snowpark Container Services’ robust growth contributions expected in FY 2025 following its public preview on AWS. Specifically, Snowpark contributed about $35 million to FY 2024 revenue (~1% mix), and is expected to represent 3% of guided FY 2025 product revenue following its anticipated GA slated near the company’s Data Cloud Summit in June. This implies top-line contribution of close to $100 million in FY 2025, representing 65% y/y growth.

And the results are reinforced by robust adoption of the service through 1Q25, with more than 50% of Snowflake’s customers already using Snowpark. Much of customers’ feedback received to date have alluded to Snowpark’s competitive economics, performance, simplicity and data interoperability between platforms. This effectively reinforces the value proposition of Snowflake’s core product philosophy, as discussed in the earlier section.

Looking ahead, the rolling GA of Snowflake’s AI/ML-focused product pipeline could accelerate its catch-up game, furthering direct penetration of enterprise generative AI opportunities. This is expected to complement its currently indirect opportunity realized through its data solution advantage.

- Snowflake Cortex – Cortex represents Snowflake’s primary product for direct penetration into enterprise generative AI opportunities, in our opinion. Cortex, a fully managed AI/ML all-in-one solution for Snowflake customers, has entered GA earlier this month. More than 750 Snowflake customers are already using the product. Cortex is a critical product in Snowflake’s AI roadmap, encompassing fundamental data solutions in direct support of customers’ generative AI developments, spanning Document AI, Copilot and Universal Search. In addition to efficiency gains realized through simplicity of use and interoperability, the product is also expected to further scalability for customers in their respective generative AI strategies. This will, inadvertently, reinforce the value proposition of Snowflake’s system amid secular opportunities ahead.

- Document AI – Document AI leverages Snowflake’s proprietary Arctic-TILT large language model (“LLM”) to generate insight and information from customers’ documents. The product is format-agnostic, and can infer insight from both text and images. Document AI highlights Snowflake’s focus on simplicity of use, particularly in addressing the growing volume of unstructured data across customers. The product is currently in public preview at AWS and Azure, with the company prioritizing its GA soon to address already robust customer demand.

- Copilot – Snowflake Copilot is a generative AI assistant aimed at simplifying the data analysis process for its customers. Copilot applies onto customers’ workflows within Snowflake to extract valuable information. It can also assist in the end-to-end data analysis process by recommending and refining SQL queries for optimized performance. The resulting output could be further integrated across Snowflake solutions, such as Streamlit, without further configuration, highlighting efficiency gains realized through seamless integration. Copilot is currently in public preview on AWS in the U.S. and Central Europe.

- Universal Search – Universal Search is a natural language generative AI-enabled search tool curated for the Snowflake ecosystem. It helps customers track down relevant information across their data sets within Snowflake, Snowflake Marketplace, Snowflake Documentation, and other Snowflake Community Knowledge Base material. The product is currently in preview across certain AWS and Azure regions in the U.S., Europe and Asia Pacific.

- Snowpark – As previously discussed, Snowpark helps customers securely import and deploy non-SQL workloads into Snowflake’s SQL-native Data Cloud without incremental configurations. This accordingly reduces deployment time and costs, enabling efficiency gains for customers. Snowpark Container Services further enables customers to link their data directly with LLMs without further code configuration. This accordingly helps improve customers’ optimize model training and inferencing as generative AI deployments scale.

- Iceberg Tables – Iceberg Tables was recently introduced by Snowflake to enable seamless integration between Apache Iceberg table formats into the company’s platform. Apache Iceberg table formats are currently the industry standard for “procession on large datasets stored in data lakes.” Iceberg Tables allows customers to leverage Snowflake’s solutions with their data stored in an external cloud, such as AWS S3, Google Cloud Storage and/or Azure Storage, without incremental configuration. This accordingly reduces the occurrence of additional ingestion costs for customers, while also simplifying use by turning Snowflake into an integrated solution. Iceberg Tables is currently in public preview across AWS, Azure and GCP, and has already garnered more than 300 customers. Feedback received to date implies net consumption gains, as larger customers are indicating interest in leveraging Snowflake for more workloads as a result of interoperability functionality enabled by Iceberg Tables. This accordingly provides confidence in further uptake, with GA anticipated in June.

- Arctic LLM – Snowflake introduced the Arctic LLM in late April. Dubbed as an “enterprise grade” LLM, Arctic is the latest and greatest in the Snowflake Arctic LLMs family and exhibits competitive performance and TCO. The company calls Arctic “truly open”, with an open Apache 2.0 license that enables ungated use across commercial, personal and research settings. Arctic LLM is expected to further Snowflake’s direct participation in generative AI opportunities across the enterprise segment, given its deep integration across popular hyperscalers and within Snowflake Cortex itself. The cost and performance efficiencies enabled by Arctic will directly address the “expensive and resource-hungry” nature of building enterprise-grade LLMs, which effectively enables scalable deployment for its customers.

Taken together, Snowflake’s upcoming slate of AI/ML-focused products is expected to reinforce its direct capture of opportunities stemming from enterprise generative AI developments. More importantly, we believe these new products will be key drivers of incremental workloads to the platform. This will result in additive growth by complementing the rise of consumption stemming from legacy IT infrastructure migration observed in recent quarters.

Financial Considerations

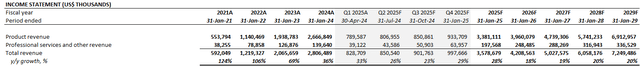

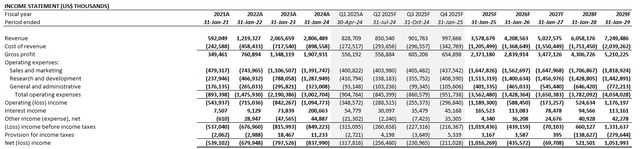

Adjusting our previous forecast for Snowflake’s actual 1Q25 performance and raised outlook considering the foregoing analysis, we expect the company to grow FY 2025 revenue by 28% y/y to $3.6 billion.

The forecast considers management’s continued expectations for a 6% revenue headwind stemming from company-specific impacts, such as the recent introduction of tiered storage pricing and upcoming GA of Iceberg Tables. As mentioned in the earlier section, increasing efficiency realized by Snowflake’s technological advancements have inherently resulted in revenue cannibalization for the company as they are passed back to customers.

For instance, the upcoming introduction of Iceberg Tables will address demand for seamless integration, particularly across larger customers embracing a multi-cloud strategy. However, this will also inadvertently hamper storage demand within Snowflake. The degree of storage churn or lost storage opportunities stemming from the roll-out of Iceberg Tables remains uncertain, but an adverse impact is inevitable. We believe much of management’s conservatism in the FY 2025 growth guidance offered reflects the relevant impact, considering storage accounts for more than 10% of Snowflake’s annual product revenue.

However, the rolling GA of upcoming AI/ML-focused products such as Cortex will be additive to FY 2025 growth, nonetheless. And incremental revenue contributions are expected to become more evident thereafter with scaled deployment across the newly introduced solutions.

Meanwhile, we expect Snowflake’s cost structure to remain largely stable. Despite the anticipated P&L impact from Snowflake’s recent switch to consumption-based commissions, they are not expected to alter free cash flows underpinning the company’s valuation. Much of the anticipated y/y cost increase is expected to complement Snowflake’s growth trajectory in the current year, with an incremental impact stemming from ongoing AI investments – particularly GPU-related costs.

We believe the establishment of Snowflake Ventures in 2020 was prescient in ensuring Snowflake’s participation in speculative growth investments without compromising its financial performance. Specifically, corporate venture capital investments into adjacent technologies have been on a rapid rise recently. The strategy allows companies to invest and partake in innovative growth investments, without bearing material implications on the parent’s P&L. This has also been largely incentivized lately, as investors’ preference shift from “growth at all costs” to sustained profit expansion.

And Snowflake’s implementation of said R&D strategy through its venture arm is evident in its early investment in Reka AI during a 2023 investment round. Although recent speculations of an acquisition has fallen through, it represents an example in which Snowflake Ventures is extending the company’s reach into innovative growth investments. The continued leverage of Snowflake Ventures in safeguarding Snowflake’s participation in innovative opportunities while reducing its corporate R&D exposure will remain an accretive factor to bottom-line expansion, in our opinion.

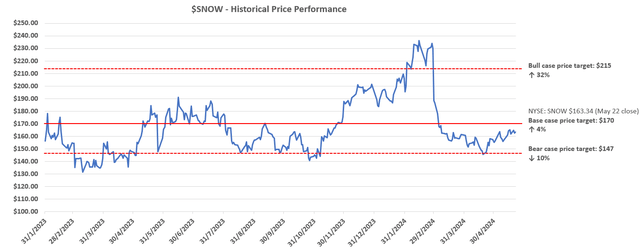

Price Considerations

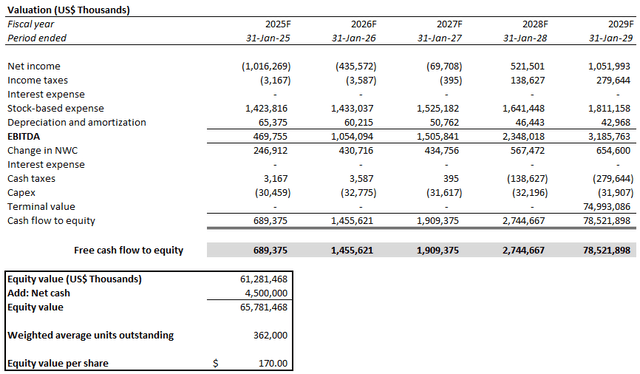

In addition to execution risks pertaining to the upcoming GA of its AI/ML-focused product slate, such as uncertain uptake rates and consumption trends, Snowflake also faces intensifying competition that could thwart its growth efforts, nonetheless. We believe $170 remains an appropriately de-risked price target for near-term execution risks at Snowflake as its new slate of AI/ML-focused products enter deployment.

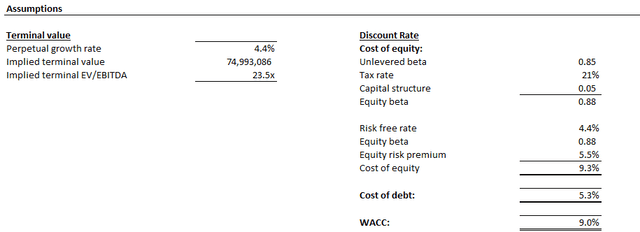

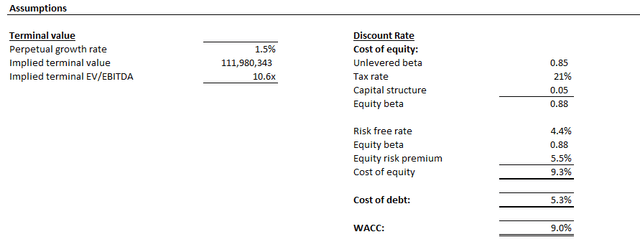

The price is derived from the discounted cash flow method that considers cash flow projections taken with the fundamental analysis discussed above. The analysis applies a 9% WACC in line with Snowflake’s debt-free capital structure and risk profile. An implied perpetual growth rate of 4.4% is considered on FY 2029E EBITDA to determine the terminal value.

We believe this valuation premium is warranted, considering Snowflake’s sustained double-digit percentage growth profile underpinned by an expanding total addressable market, or TAM, amid additive generative AI opportunities. The terminal value assumption applied is also equivalent to a 1.5% implied perpetual growth rate applied on FY 2034E EBITDA, which we believe to be reflective of steady-state cash flows in the long-run. This is in line with the pace of estimated economic expansion observed across Snowflake’s core operating regions and normalized end-market demand environment in the longer-term.

Upside Scenario

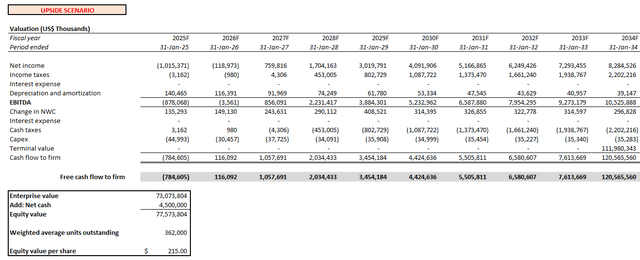

The analysis compares to our upside scenario price of $215, which assumes restored 30%+ annual growth implied from management’s previously issued $10 billion product revenue target by FY 2029. We believe a return to said growth trajectory can still be realizable should new product revenue contributions hit a similar rate of acceleration as recent deployments, such as Snowpark. The upside scenario price is computed by applying the same valuation assumptions as the base case (i.e., 9% WACC; terminal value based on 1.5% perpetual growth rate on FY 2034E EBITDA) to upside scenario cash flow projections that reflect a five-year product revenue CAGR of 26% through FY 2029.

Conclusion

While Snowflake’s latest 1Q25 results continue to corroborate a modest outlook for FY 2025 consumption trends, we remain confident that its performance in the back half of FY 2025 will be a telling tale and potentially an inflection point for the stock. The anticipated back-to-back roll-out of its AI/ML-focused product pipeline around the Data Cloud Summit timeline in June is expected to optimize leverage of Snowflake’s integrated advantage. Specifically, Snowflake’s heightened focus on simplicity of use, interoperability, and integration for its product pipeline bodes favorably with the enterprise spending segment’s continued demand for optimization without compromising their respective generative AI developments.

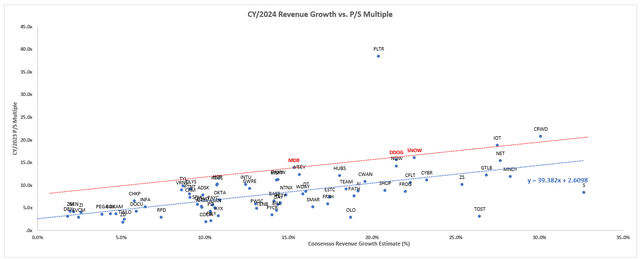

This makes the upcoming GA of Snowflake’s new products around the mid-year timeline a potential valuation-altering event for the stock. More importantly, the new products will inevitably be additive to the company’s guided growth outlook, as they bolster Snowflake’s direct participation in ongoing AI momentum and drive incremental consumption and workloads. For now, the stock trades at 15x estimated sales. While this represents a premium to Snowflake’s broader software sector peers, they remain in line with its data rivals such as Datadog (DDOG) and MongoDB (MDB) on a relative basis to their respective growth profiles. With additive growth expected from the upcoming GA of Snowflake’s new products, Snowflake Inc. stock will likely benefit from further multiple expansion from current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!