Summary:

- Snowflake Inc.’s stock price took a hit despite beating market consensus due to concerns about a cyberattack in May.

- The cyberattack impacted some customers, but Snowflake’s platform was not breached; the incident is considered a one-time event.

- Snowflake reported strong booking growth driven by new customer acquisitions, AI investments, and high retention rates, with a one-year price target of $210 per share.

artisteer/iStock via Getty Images

I published my bull thesis for Snowflake Inc. (NYSE:SNOW) in March 2024, highlighting their expansion into data cloud, powering data sharing, analytics and marketplace listing and more. The company released its Q2 FY25 results on August 21st. Despite beating the market consensus, Snowflake’s stock price got a hit due to the concerns about the cyberattack occurred in May. I reiterate a “Strong Buy” with a one-year price target of $210 per share.

Impact From Cyberattack

As reported by the media in June, at least 100 Snowflake customers were confirmed to have impacted by the cyberattack, with around 165 businesses partially affected. Over the Q2 earnings call, the management indicated their platform was neither breached nor compromised, according to investigations by internal and excel cyber experts. Additionally, the management highlighted that there was no financial impact from the consumption standpoint. As discussed in my previous report, Snowflake is adopting a consumption-based pricing model.

My understanding is that the data breach may not have been entirely due to Snowflake’s platform. Some customers assessed the platform using only ID and password without multifactor authentication, which caused the cyberattack in May. Having said that, Snowflake’s system should make the login with multifactor authentication mandatory. In other words, Snowflake should bear some legal responsibilities for the incident. However, the issue is relatively easy to fix, and I trust Snowflake will enhance the security of their login system in the future.

All in, it is a one-time incident, and the damage from the cyberattack is quite limited. As a long-term shareholder, I am not worried about it.

Strong Booking Growth

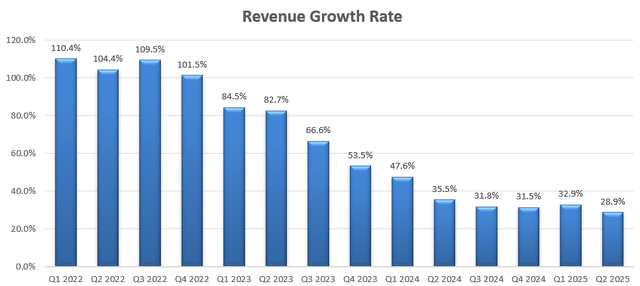

As indicated over the call, Snowflake delivered a strong growth in bookings, with 48% year-over-year growth in Remaining performance obligations (RPO). Meantime, the company reported 28.9% growth in revenue in Q2, as depicted in the chart below.

The strong growth in revenue and bookings is driven by:

- New Customer Acquisitions: Snowflake has adjusted their sales incentives to align with consumption and new customer acquisitions. The new compensation structure is designed to incentivize their sales force to approach new customers while maintaining a good relationship with existing customers. As disclosed over the call, the company signed two nine-figure deals in the quarter, which is quite remarkable.

- AI: Snowflake has been investing in their AI technology and machine learnings, embedding AI functionalities into their platforms. For instance, Snowflake Cortex AI builds generative AI applications with fully managed large language models, enabling analytics, search, and document processing tasks.

- High Retention: During the quarter, Snowflake achieved a 127% of net revenue retention. The high dollar retention rate enables the company to generate higher revenue from existing customers. It’s worth nothing that 80% of their customers pay annual fees in advance. The strong dollar retention rate is positive to Snowflake’s cash flow and balance sheet.

Outlook and Valuation

The management is guiding for 26% year-over-year growth in product sales in FY25, with 3% non-GAAP operating margin and 26% free cash flow margin.

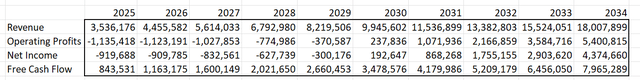

For the near-term growth, I calculate Snowflake will continue to grow its revenue by 25%, assuming:

- As Snowflake is operating as a consumption-based financial model, I forecast the existing customers will grow their consumptions by 15% year-over-year, driven by more AI workloads. AI training and inference requires tremendous data streams, and Snowflake’s platform could connect these data across the IT infrastructure, leading to higher consumptions.

- As the company incentivize their sales team to acquire new customers. I forecast new customers will contribute 5% to the revenue growth.

- Snowflake is investing in their R&D to develop more applications under their platform, and these new solutions could potentially increase the revenue retention rate, and further monetize existing customers. I assume these new solutions will add another 5% to the revenue growth.

As the company scales its business, I estimate the revenue growth will decelerate to 20% from FY28 onwards, as the new customers contribution begins to moderate.

Snowflake has been investing heavily in R&D and sales & marketing, which has affected their operating margin. I estimate the company will gradually increase its margin to 30%, aligning with the level of most mature software companies. The key drivers for margin expansion are:

- Gross margin expansion driven by new solutions, and increased consumptions from existing customers.

- Operating leverage from R&D and Sales & Markets expenses.

- Reducing ratio of stock-based compensation to revenue.

With these parameters, the DCF summary:

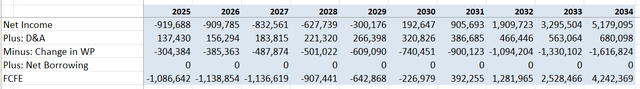

The free cash flow from equity is calculated as follows:

The cost of equity is estimated to be 14% assuming risk-free rate 3.8% ((US 10Y Treasury)); beta 1.5 (SA); equity risk premium 7%.

Discounting all the FCFE, the one-year target price is estimated to be $210 per share, as per my calculations.

Key Risks

The data storage business represents around 11% of Snowflake’s total revenue, and is inherently commoditized. Compared to Snowflake’s core platform, the storage business is more susceptible to migrating to other similar storage service providers. Additionally, customers tend to be more price-sensitive when it comes to storage. As such, Snowflake’s storage business might affect their full-year revenue growth in the near future.

Conclusion

I believe the cybersecurity incident was not directly caused by Snowflake’s platform, and I am confident in the company’s ability to enhance its login interface. I reiterate a “Strong Buy” with a one-year price target of $210 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.