Summary:

- Snowflake Inc. achieved 48.5% growth since August, with $900M in Q3 product revenue and a 127% retention rate, but valuation remains high, requiring cautious investment.

- Q3 gross margin at 76% and partnerships with Nvidia and AWS enhance AI and data cloud leadership, though stock-based compensation pressures profitability.

- Stress-tested valuation suggests a 32.68%-47.91% margin of safety, justifying a Buy rating for high-risk, high-reward investors at a moderate portfolio weight.

Tetra Images/DigitalVision via Getty Images

Since my first Hold rating on Snowflake Inc. (NYSE:SNOW) in April, the stock has only achieved an 8.5% return. However, since my August Hold rating (where I noticed its more reasonable valuation but cautioned on potential further downward momentum and the long-term risk of the allocation), it has gained 48.5% in price. The company is still battling for profitability on the net margin level with high levels of stock-based compensation (also devaluing shares), but its non-GAAP free cash flow margin is now 9% as of Q3.

Though the company is growing very fast, its valuation (while much lower than post-IPO) is still high. Therefore, it’s best to proceed with moderation in this investment, as returns are high-reward but also high-risk.

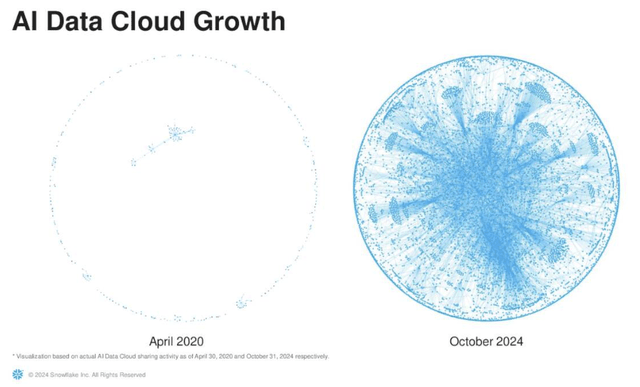

Visualization of actual AI Data Cloud sharing activity (Snowflake Q3 Earnings Presentation)

Q3 Earnings

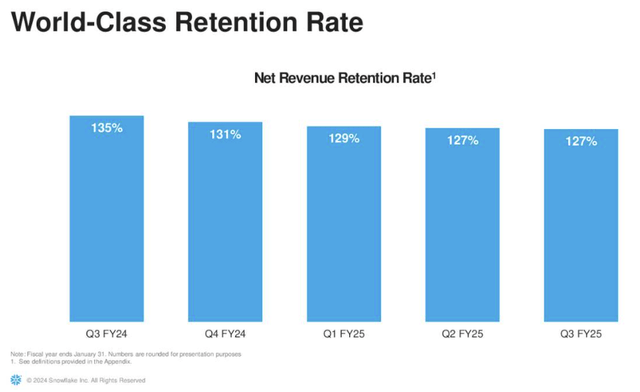

In Q3, Snowflake Inc. reported product revenue of $900 million, which is up 29% year-over-year, exceeding expectations. In addition, its remaining performance obligations reached $5.7 billion, with year-over-year growth accelerating to 55%. Its net revenue retention rate stabilized at 127% for the second consecutive quarter. These are all exceptional reasons to be bullish on Snowflake. Indeed, the company does offer a compelling position in a burgeoning market opportunity in unified data warehousing and access.

Snowflake Q3 Earnings Presentation

For FY25, management has provided guidance on product revenue being $3.43 billion, up 29% year-over-year.

This Q3 earnings report really affirmed that Snowflake is a special, well-managed, and well-positioned company. Indeed, significant partnerships, such as with Nvidia (NVDA) and Anthropic, have allowed for cutting-edge AI capabilities, and its Amazon (AMZN) Web Services (“AWS”) partnership generated $3.9 billion in bookings over the last four quarters, a 68% year-over-year increase.

We should also hone in on the company’s margins, where the gross margin of 76% proved stable sequentially. In addition, its non-GAAP operating margin was 6%, higher than its guidance due to cost management and operational efficiencies. Combining this stability and expansion with the non-GAAP free cash flow margin of 9% reported by management, this is a business one can quite confidently get behind as a small, high-return, high-risk investment. However, the major caveat to this remains the company’s valuation.

Valuation

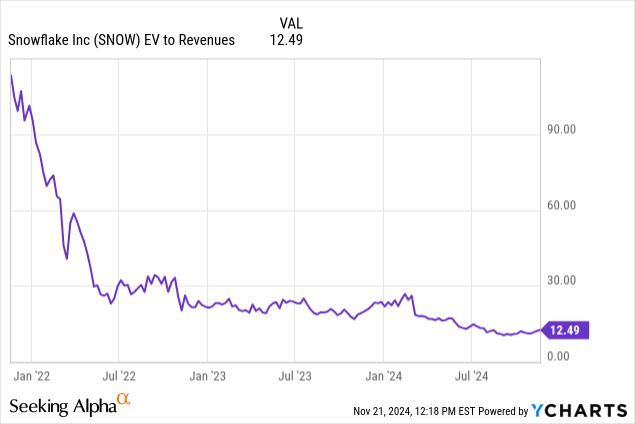

The company’s EV-to-revenues ratio has been in a medium-term decline. This may change (given we may be nearing the trough of negative sentiment related to its valuation). That said, it remains to be seen what EV-to-revenues ratio the market deems stable and suitable for Snowflake in the medium to long term.

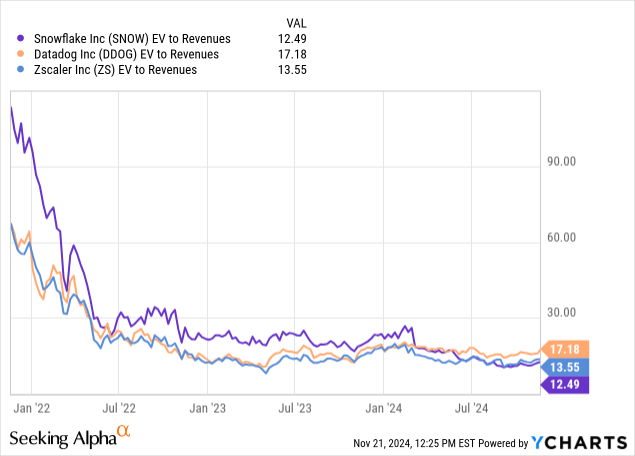

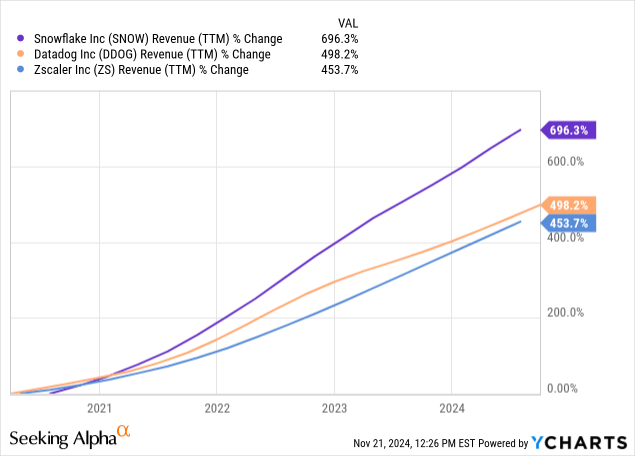

The following charts are for investment sentiment analysis, not operational peer analysis.

For conservatism, I will be using a terminal EV-to-revenues ratio of 14 in my valuation model, which is approximately the average of the three companies I have used in my investment sentiment peer analysis. The charts also show that among the companies, sentiment has begun to stabilize somewhat, making a moderate EV-to-revenues expansion possible in the medium term.

|

January 2028 Revenue Estimate |

$6.9 billion |

|

EV-to-Revenues Terminal Multiple |

14 |

|

January 2028 Enterprise Value Estimate |

$96.6 billion |

|

Current Enterprise Value (November 2024) |

$39.67 billion |

|

Enterprise Value CAGR |

32.45% |

|

Weighted Average Cost of Capital |

7.8% |

|

Discounted Implied Current Intrinsic Enterprise Value |

$76.15 billion |

|

Margin of Safety |

47.91% |

- Snowflake’s weighted average cost of capital is 7.8%, with an equity weight of 98.7% and a debt weight of 1.3%, with equity costing 7.898% and debt at 0.0916% (after tax).

Management

Given that I am bullish about this company, it’s worth getting a good understanding of the company’s management to ensure that invested capital is guarded well.

Sridhar Ramaswamy serves as the CEO, with a background in AI and leadership at Google (GOOGL, GOOG). He joined Snowflake in 2023 after co-founding Neeva. Michael Scarpelli, the CFO since 2019, has extensive experience in financial leadership, including a role at ServiceNow (NOW). Christian Kleinerman, the Senior VP of Product, has over 20 years of expertise in database technologies and product management.

Looking at the Board of Directors, Frank Slootman, the Chairman of the Board, was the former CEO of Snowflake until 2024 and was instrumental in scaling the company during his leadership. Having his oversight as Chairman of the Board provides stability and consistent vision alongside the active CEO role being filled by Sridhar Ramaswamy. Mark McLaughlin is the former CEO of Palo Alto Networks (PANW), bringing cybersecurity expertise to the boardroom. Additionally, the Board of Directors includes Mark Garrett, who previously served as CFO at Adobe (ADBE), Jayshree Ullal, who is President and CEO of Arista Networks (ANET), and Jeremy Burton, who has had leadership and marketing roles across major tech firms, including at Dell (DELL).

Given the extensive range of executive leadership and governance, I’m very confident in my Buy rating. Even at the present valuation, the likelihood of this being sustained with continued growth and net revenue retention is quite high, in my opinion.

Risks

Indeed, the greatest risk to this thesis is that the market does not sustain the present sentiment for the company. Key catalysts that would contribute to this include missing guidance due to market dynamics proving less lucrative than expected, struggles with achieving a reliable net income over the long term, and too heavy a reliance on stock-based compensation (“SBC”) for too long, deteriorating the value of shareholders’ equity.

We may stress test my valuation model with a much more conservative estimate of $6.5 billion in total revenue for Fiscal 2028. At an EV-to-revenues ratio of just 11.5, this would lead to a January 2028 enterprise value of $74.75 billion. As the current enterprise value is $39.67 billion in November 2024, the implied enterprise value CAGR is 22.15%. In addition, when discounting back $74.75 billion at a discounted rate of 7.8% (equal to the company’s weighted average cost of capital), we arrive at an implied intrinsic enterprise value of $58.93 billion. As the current enterprise value is $39.67 billion, the implied margin of safety for investment in this conservative model is still a high 32.68%. Therefore, Snowflake remains a Buy even when stress-tested for risks.

Conclusion: Buy

Snowflake Inc. is a well-governed company with a distinct market position in the very high-growth data industry. While its valuation is high, this may be sustainable, given my investment peer analysis and the company’s robust growth horizon. Due to the volatility risk, my rating is a Buy and not a Strong Buy, but I consider this to be quite a wise investment at a moderate weight in portfolios based on my reanalysis.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.