Summary:

- Snowflake’s stock has deflated nearly 20% this year and remains down over 50% from pandemic-era highs, but further downside is likely ahead of the company’s earnings report.

- SNOW is expected to report Q1 results on May 22. Read-through from other software companies suggests a disappointing quarter is likely.

- Other high-growth software companies like Palantir and Datadog have also experienced declines, indicating a challenging environment for the industry.

- The Company’s net revenue retention rates are declining, while the company also continues to add more headcount and expects margin contraction this year.

- The stock is still expensive at ~14x this year’s revenue estimates. I’d wait until a ~20% further dip to the $120s before buying in.

IR_Stone

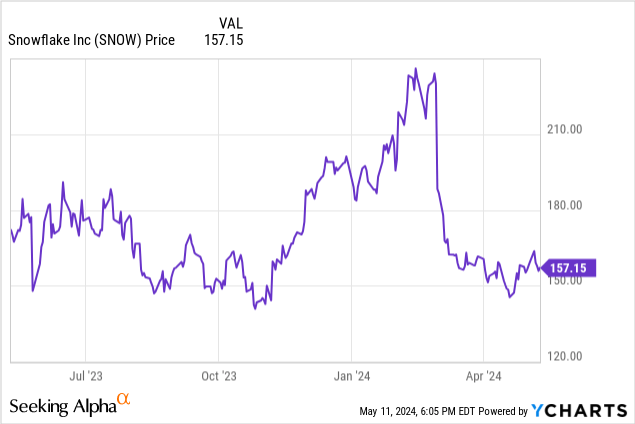

Even though AI hype has lifted many software stocks to new highs this year, many former high-flying stocks remain underwater. Snowflake (NYSE:SNOW) is a big example here: the cloud data warehousing company has suffered all year due to slowing growth rates.

Year to date, shares of Snowflake have deflated to the tune of nearly 20%. The stock also remains down more than 50% relative to pandemic-era highs just below $400, when it was once one of the most popular trades in the tech sector. As we look ahead to Snowflake’s all-important Q2 earnings print, due on May 22, the question we have to ask ourselves is: does Snowflake have room to rebound?

I last wrote a neutral opinion on Snowflake earlier this year in February, downgrading it from a prior bullish view, when the stock was still trading closer to $240. Since then, the stock has tanked on disappointing Q4 results that showed a sharp deceleration in customer growth as well as net revenue retention rates.

The truth here: enterprise buying patterns are still at a low, as IT departments balance the need for budget cuts with buying ahead to support AI and automation. In spite of the supposed tailwinds from the pickup in generative AI workloads, Snowflake is still falling victim to its own scale and seeing slowing growth.

Amid all of these negative factors, and despite the lower share price since the start of the year, I’m downgrading Snowflake again to bearish as we wait for the company’s Q1 earnings release on May 22. I’d recommend selling this stock before yet another disappointing quarter takes Snowflake down further.

Negative read-through from other high-growth software companies

Snowflake is reporting Q1 results relatively late in the earnings season, so we have the benefit of reading through other similar companies’ results.

One of the best public stock comps to Snowflake, in my view, is Palantir (PLTR). Though Palantir’s big data-mining software is neither adjacent nor a competitor to Snowflake’s cloud data warehousing products, I view both companies as similarly sized, larger-cap software stocks that are still growing at a rapid clip.

Palantir, unfortunately, fell ~10% after earnings. The primary issue was the company’s Q2 guidance, shown below:

Palantir outlook (Palantir Q2 earnings release)

The $651 million midpoint of Palantir’s guidance (+22% y/y) fell one point short of Wall Street’s $653 million (+23% y/y) expectations. The core point here: even though Palantir technically had a beat and raise quarter and isn’t even implying deceleration in its current-quarter outlook, the Street still tanked the stock. This is a reflection of the fact that valuations are creeping upward, and in a high interest rate environment there’s little room for error outside of perfect results and guidance.

Palantir is hardly the only software stock to decline double-digits this earnings season. Datadog (DDOG) also tanked more than 10% last week on its own earnings release, despite its current quarter outlook slightly outpacing the Street.

Olivier Pomel, Datadog’s CEO, noted on Datadog’s recent Q1 earnings call last week that while budget constraints continue to be a big theme with some customers, usage patterns are normalizing:

Now let’s discuss this quarter’s business drivers. In Q1, we saw usage growth from existing customers that was higher than in Q4, and this usage growth in Q1 was similar to what we experienced in Q2 and Q3 of 2022. As a reminder, that was a period when we started to see a normalization of usage following the accelerated growth we had experienced in 2021. Overall, we saw healthy growth across our product lines. And as usual, our newer products grew at a faster rate on a smaller base.

While some of our customers are continuing to be cost-conscious, we are seeing optimization activity reduce in intensity. As an illustration, the optimizing cohort we identified several quarters ago did grow sequentially again this quarter. We also see that customers are adopting more products and increasing usage with us.”

Datadog and Snowflake both rely on usage-based revenue models. Usage trends have been sour for Snowflake lately, so we’d hope for some of the normalization / improvement that Datadog is seeing. Still, Snowflake is fighting an uphill battle against the high expectations that are anchored to its similarly high valuation.

Softer trends heading into Q1

Stepping away from some of Snowflake’s comps in Q1, we should remember that Snowflake itself has seen weakening trends heading into the quarter.

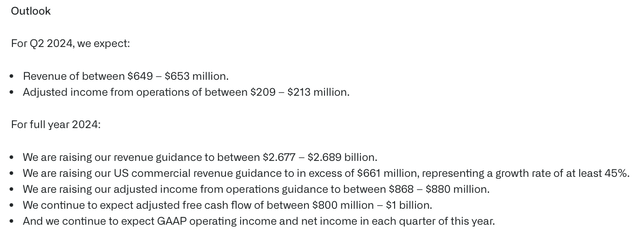

From the company’s Q4 results, note that Snowflake’s net revenue retention rates, a function of customers’ usage and consumption trends, continued to decelerate.

Snowflake retention trends (Snowflake Q4 earnings deck)

As shown in the chart above, retention rates peaked in the fourth quarter of 2022, and has been decelerating for eight straight quarters.

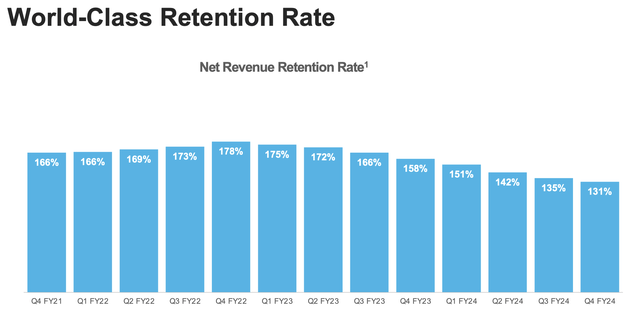

Furthermore: Snowflake has also slowed down in its ability to add large customers. The count of customers that bill over $1 million in annual revenue slowed to 25 net-new adds in Q4, from 35 in Q3:

Snowflake customer trends (Snowflake Q4 earnings deck)

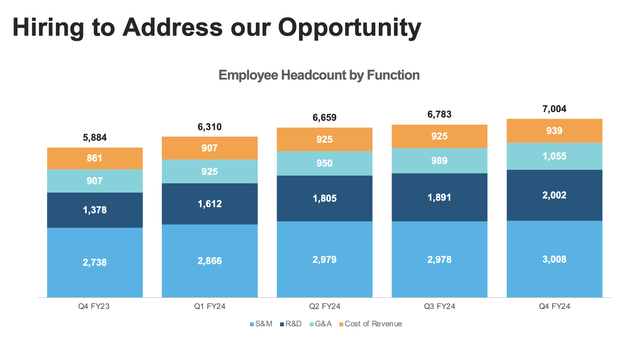

Revenue growth has slowed to the low 30s over the past two quarters, versus >50% growth in Q1 of FY24. And note as well that Snowflake is guiding to only 22% y/y product revenue growth in FY25. But in spite of this growth slowdown, the company has completely avoided mass-scale layoffs like many of its peers; in fact, the company continues to add to its headcount, hiring over 200 net-new employees in Q4 alone:

Snowflake headcount (Snowflake Q4 earnings deck)

It’s worth noting that Snowflake’s guidance calls for just 6% pro forma operating margins, two points worse than FY24: a reflection of steady opex growth amid decelerating revenue growth.

Valuation and key takeaways

A slowing top line, heightened expenses and margin contraction, and read-throughs from other software companies that don’t inspire much confidence in a positive earnings reception: there’s little reason to stay invested in Snowflake through earnings.

Despite these risks, the stock isn’t even remotely cheap. At current share prices just above $150, the company trades at a $52.52 billion market cap. After we net off the $4.76 billion of cash on Snowflake’s most recent balance sheet, the company’s resulting enterprise value is $47.76 billion.

Against consensus revenue expectations of $3.43 billion in FY25 (+22% y/y) and $4.23 billion in FY26 (+23% y/y), Snowflake trades at 13.9x EV/FY25 revenue and 11.3x EV/FY26 revenue – rich double-digit valuation multiples for a software company whose growth is expected to slow to the 20s. Note as well that unlike software peers that deploy a SaaS business model, Snowflake’s revenue is not recurring and can be more volatile based on usage (which is an argument for a lower valuation multiple versus SaaS peers).

I’d be a more enthusiastic buyer of Snowflake if the stock fell to $120, a price target that represents an 8.5x EV/FY26 revenue multiple and ~20% downside from current levels. In my view, earnings weakness could quickly take Snowflake there. Watch this stock closely, but don’t buy before it falls further.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.