Summary:

- SNOW is increasingly punished, thanks to the change in its go-to-market strategy, impacted retention rate, and declining remaining performance obligations.

- Combined with the bloated operating expenses, underwhelming bottom-lines, and inflated SBC expenses to revenue ratio, we are unlikely to see bullish support materialize anytime soon.

- SNOW remains overly expensive compared to its peers as well, attributed to the slower AI monetization and delayed AI capability launches through H2’24.

- As a result, investors may also want to temper their near-term expectations, since its turnaround to high-growth may be prolonged.

- Interested investors will be better off observing for a floor to materialize first, before establishing their position and/ or dollar cost averaging. Do not chase this stock to the bottom.

IncrediVFX

We previously covered Snowflake (NYSE:SNOW) in March 2024, discussing how it had dramatically lost much of its Enterprise Value despite the double-beat FQ4’24 earnings call.

Much of the headwinds were attributed to the introduction of lower-margin tiered storage pricing and the increased adoption of the open-source Iceberg Table formats, which triggered the management’s underwhelming FY2025 guidance and the implication of decelerating growth.

Combined with the supposed increase in its SBC expenses and overly expensive FWD P/E valuations, we had preferred to rate the stock as a Hold (Neutral) then.

Since then, SNOW has continued to lose -22.4% of its value, well underperforming the wider market at +3.5%. It is apparent that bullish support has evaded the stock, despite the growing customer count and expanding top-line in FQ1’25.

With the change in its go-to-market strategy from a subscription-based pricing model to consumption-based, it is unsurprising that the lower customer retention rate and declining remaining performance obligation have triggered further pessimism in its intermediate term prospects.

Combined with its slower AI monetization and deteriorating balance sheet, we prefer to prudently maintain our Hold (Neutral) rating here.

SNOW’s Investment Thesis Remains On Thin Ice – Too Expensive Here

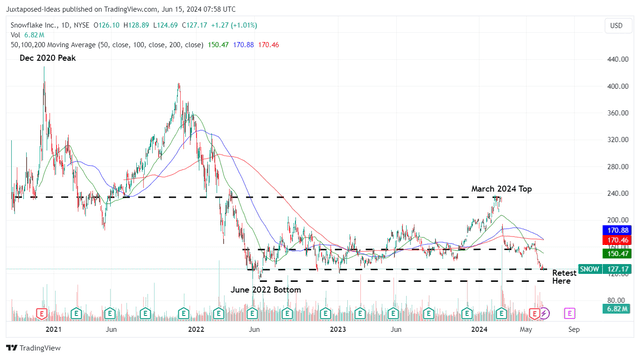

SNOW 3Y Stock Price

For now, SNOW continues to chart lower lows and lower highs since the March 2024 top, with the stock naturally trading well below its 50/ 100/ 200 day moving averages.

This development is not surprising indeed, since the company has failed to partake in the ongoing generative AI boom observed in multiple leading SaaS players, such as Palantir (PLTR), OpenAI, Oracle (ORCL), and Microsoft (MSFT).

The same slower AI monetization has also been observed in Adobe (ADBE) and Salesforce (CRM), implying that SNOW is not alone here, especially since it is uncertain if it may benefit from the second wave of generative AI SaaS boom.

SNOW’s Performance Metrics

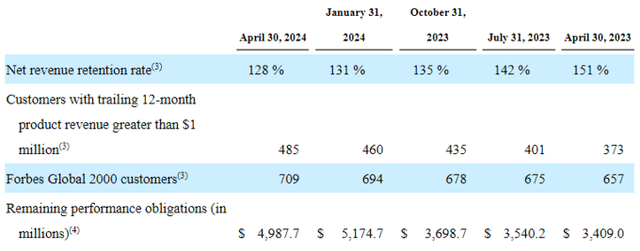

The same has already been observed in SNOW’s declining multi-year Remaining Performance Obligations of $5B on a QoQ basis (-3.6% QoQ/ +46.4% YoY), especially worsened by the moderating Net revenue retention rate of 128% in FQ1’25 (-3 points QoQ/ -23 YoY).

The same headwind has also been observed in the decelerating increase in its new Customers with TTM product revenues greater than $1M at 485 (+5.4% QoQ/ +30% YoY) and Forbes Global 2000 customers of 709 (+2.1% QoQ/ +7.9% YoY). This is compared to the two segments’ robust growth of +13% QoQ/ +80.1% YoY and +1.7% QoQ/ +15% YoY reported in FQ1’24, respectively.

These developments imply SNOW’s inability to increasingly monetize its existing customer base while growing acquisition, despite the ongoing enterprise AI boom.

Therefore, while the management continues to offer a relatively decent FQ2’25 product revenue guidance of $807.5M (+2.2% QoQ/ +36.8 YoY) and FY2025 product revenue guidance of $3.3B (+24% YoY), well exceeding the consensus estimates of $787.5M (inline QoQ/ +23% YoY) and $3.26B (+22.5% YoY), respectively, we can understand why the market has rotated SNOW for other high growth SaaS stocks, as observed in the stock’s consistent declines thus far.

At the same time, SNOW has failed to translate the robust top-line growth into its bottom lines, as observed in the moderating FQ1’25 adj operating margins of 4.5% (-5.1 points QoQ/ -1 YoY) despite the relatively rich gross margins of 76.9% (-1.1 points QoQ/ inline YoY).

It is apparent that the management has yet to optimize costs as growth decelerates, as observed in the relatively bloated adj operating expenses of $578.87M (+14% QoQ/ +35.9% YoY).

As a result, we concur with the pessimistic market sentiments, especially due to the deterioration observed in the SaaS company’s balance sheet at net cash situation of $4.13B (-4.6% QoQ/ -10.2% YoY), though well balanced by its inherent lack of debt.

Moving forward, readers may want to pay attention to SNOW’s execution from FQ2’25 onwards. This is attributed to the slower AI monetization, despite the release of its AI layer, Snowflake Cortex AI, in late 2023, with the rest, including Iceberg, Snowpark Container Services, and Hybrid Tables, only to be “generally available later this year (H2’24).”

While the management has highlighted that over 750 customers are using the Cortex AI as of May 2024, it is apparent that the SaaS company’s top/ bottom lines/ RPO growth have yet to be “turbocharged,” since its AI products are only “generating strong customer interest” instead of contributing to its financial performance.

As a result, SNOW investors may also want to temper their near-term expectations, since its turnaround to high-growth may be prolonged.

So, Is SNOW Stock A Buy, Sell, Or Hold?

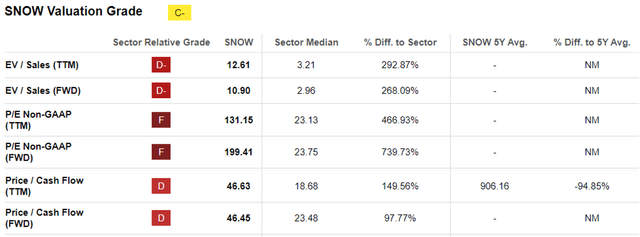

SNOW Valuations

Despite the drastic corrections thus far, it is apparent that SNOW remains overly expensive at FWD EV/ Sales of 10.90 and FWD P/E valuations of 199.41x, especially due to the uncertain growth prospects at a top/ bottom line CAGR of +23.9%/ +17.5% through FY2027, respectively.

This is compared to its other AI-related data analytics SaaS peers such as C3.ai (AI) at 7.88x/ NA, BigBear.ai Holdings, Inc. (BBAI) at 2.33x/ NA, and PLTR at 19.46x/ 71.40x, based on their top/ bottom line growth prospects at +20.8%/ NA, +15.6%/ NA, and +19.9%/ +23.2%, respectively.

These comparisons imply that SNOW remains expensive compared to its peers based on the growth projections, offering interested investors with a minimal margin of safety.

Readers must also note that its Stock Based Compensation expenses continue to accelerate to $331.93M (+8.6% QoQ/ +25.4% YoY) as the share count increase to 333.58M (+2.51M QoQ/ +9.43M YoY), with SBC expenses comprising an eye-watering 43% of its FQ1’25 revenues (+1 points QoQ/ -3 YoY).

This is compared to its SaaS peers, such as AI at 65.5%, BBAI at 15.5%, and PLTR at 19.8%, implying SNOW’s inclination to consistently erode its future EPS and book value per share growth for its long-term shareholders.

Lastly, with no bullish support observed thus far, it appears that the SNOW stock may be on its way to retest the June 2022 bottom of $108s, implying a possible downside of -15% from current levels.

As a result of the potential capital losses, we do not recommended anyone to add here. Interested investors will be better off observing for a floor to materialize first, before establishing their position and/ or dollar cost averaging.

Do not chase this stock to the bottom.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.