Summary:

- Snowflake is one of the few tech stocks still trading around all time lows.

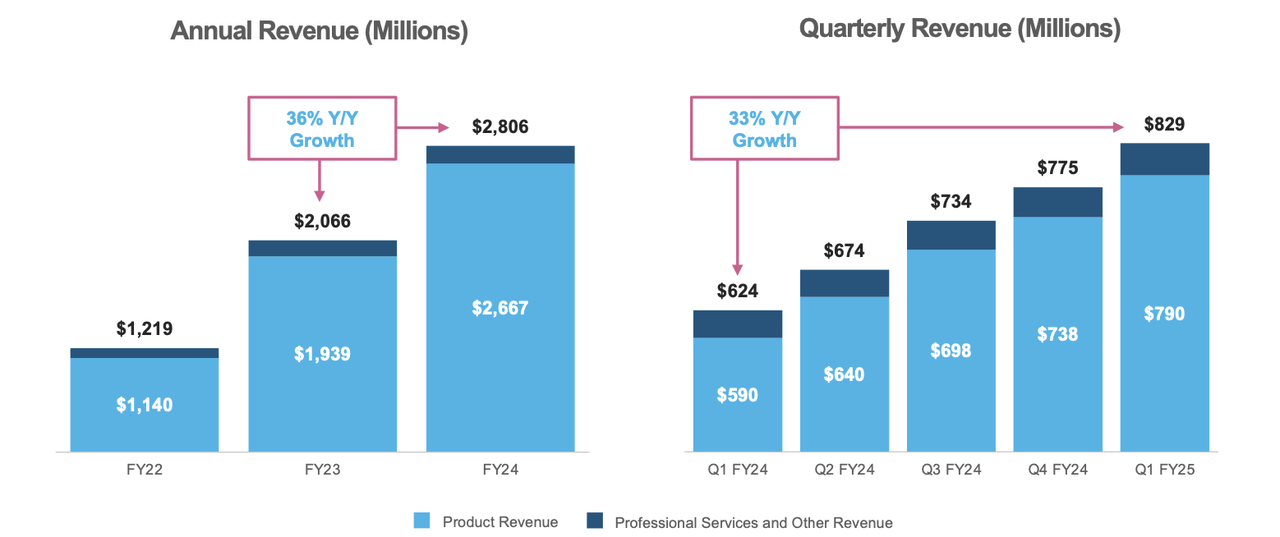

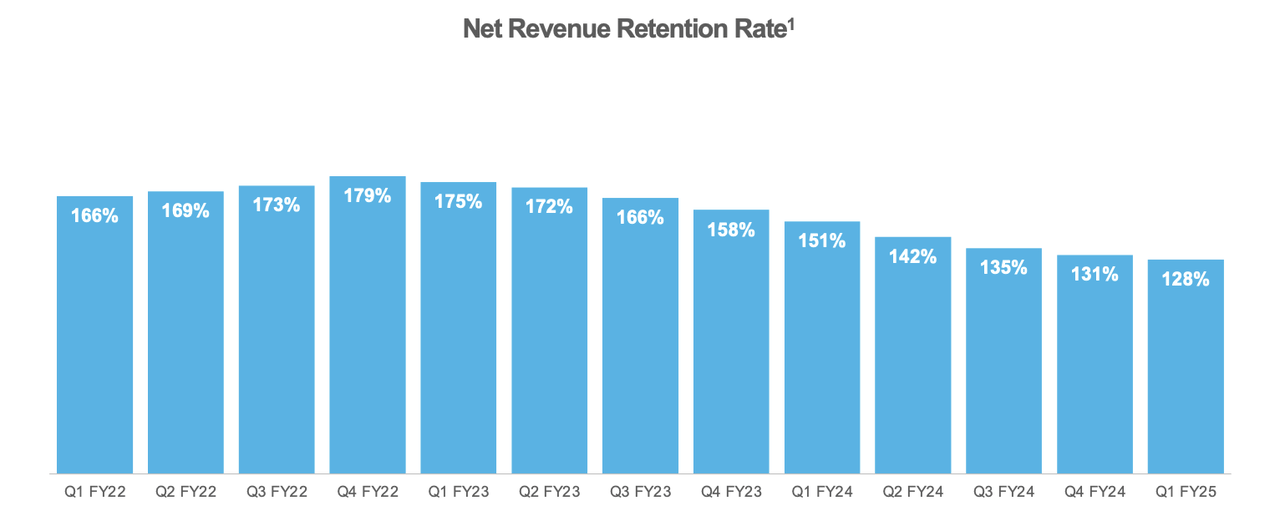

- Snowflake saw 33% YoY revenue growth in the most recent quarter, with a decelerating yet still incredible 128% net revenue retention rate.

- The stock looks attractive even without an acceleration in top-line growth.

- I am upgrading the stock to buy on the improved value proposition.

TothGaborGyula

With the generative AI hype cycle still somehow in full swing, Snowflake (NYSE:SNOW) is an important reminder that stocks in general cannot remain disconnected from their fundamentals forever. Many tech peers have bounced strongly from the 2022 lows, but SNOW is one of the few tech stocks still struggling around all time lows. Even here, the stock is still not obviously cheap, but it certainly is as cheap as it ever has been. The company maintains a net cash balance sheet and is generating positive free cash flow. Generative AI has not led to the anticipated payoff from the implied growth in data, but perhaps investors need to be patient as more AI applications are built moving forward. I doubt many investors still have confidence in the previously aggressive financial targets laid out by management, but at these valuations, that might not be necessary for satisfactory returns. I might end up being early, but I am now upgrading the stock to buy as I see market-beating potential over the long term.

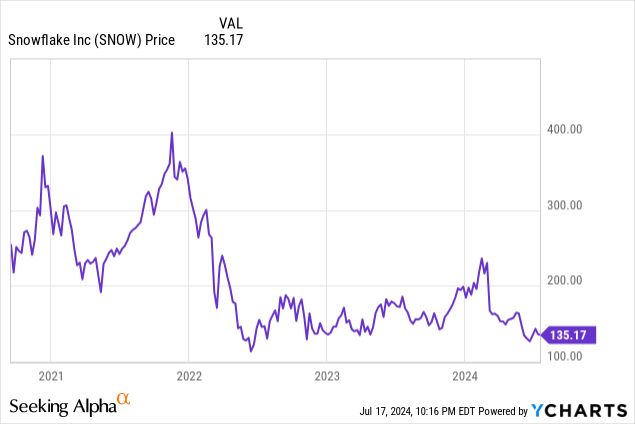

SNOW Stock Price

I last covered SNOW in May, where I reiterated my hesitance in spite of the ongoing correction. The stock has underperformed the broader markets by over 20% since then, and nearly 50% since I first downgraded the stock in January.

While these calls proved timely, my profitable bullish calls leading up to these downgrades look like pure luck in hindsight. There’s no reason to “back up the truck here,” but the stock looks as interesting as it ever has on a valuation basis.

SNOW Stock Key Metrics

SNOW is a data warehouse offering data storage and analytics services, sometimes known as “data as a service.”

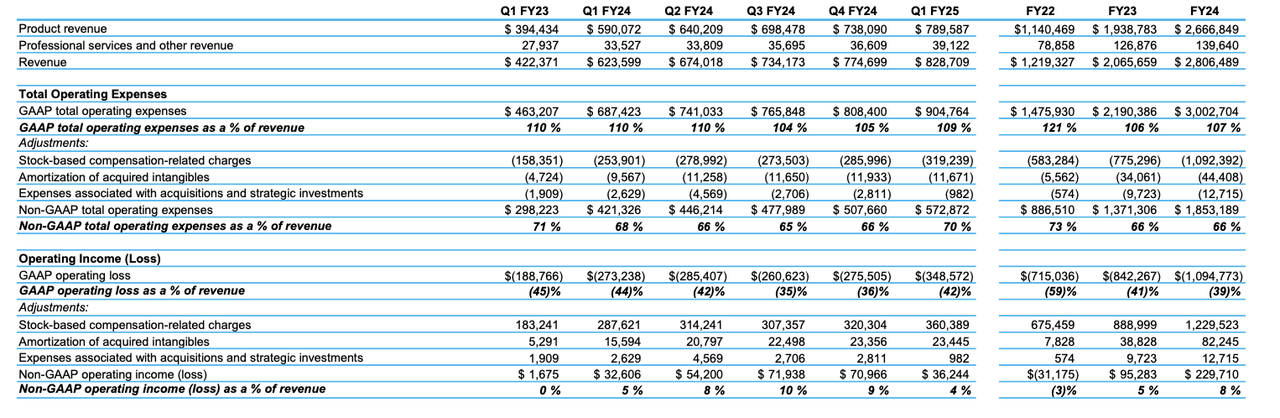

In the most recent quarter, SNOW generated 33% YoY revenue growth to $829 million, including 33.9% YoY revenue growth in product revenue (coming ahead of guidance for $750 million). I note that the 33% YoY growth rate was a slight acceleration from the 32% rate posted in the sequential quarter, however management’s guidance implies that the acceleration will be short-lived at least in the near term.

The company saw its net revenue retention rate decelerate sequentially to 128%, marking a continued step decline since pandemic levels, but still representing a high watermark for the tech sector.

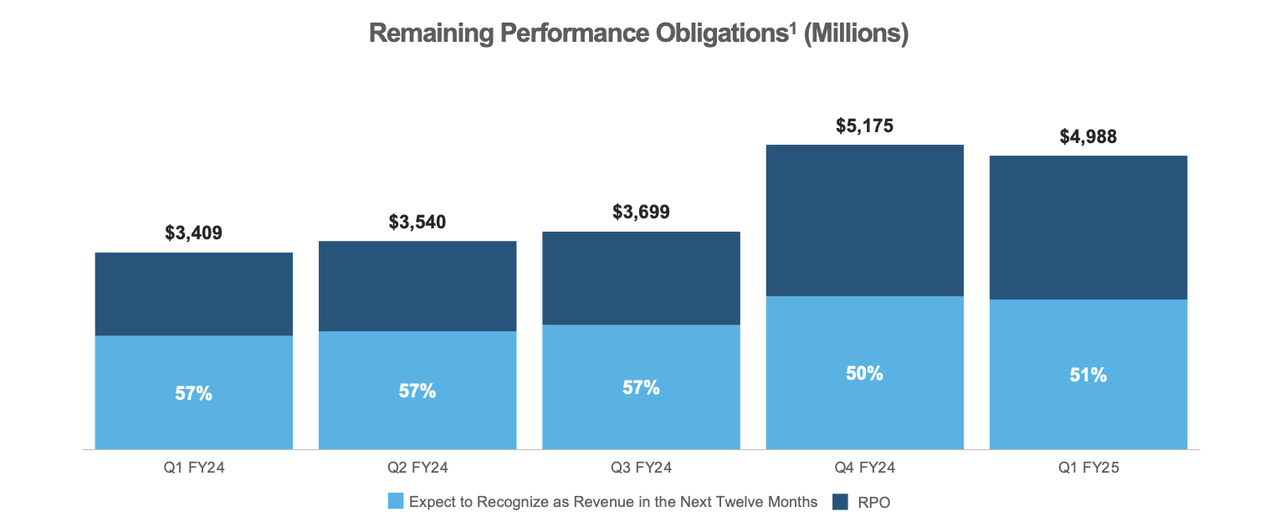

SNOW saw remaining performance obligations grow 46% to $4.998 billion, including 30.9% YoY growth in cRPOs. On the conference call, management noted that a large $100 million deal helped drive the growth, which accelerated from 41.4% in the sequential quarter (and 28.5% cRPO growth).

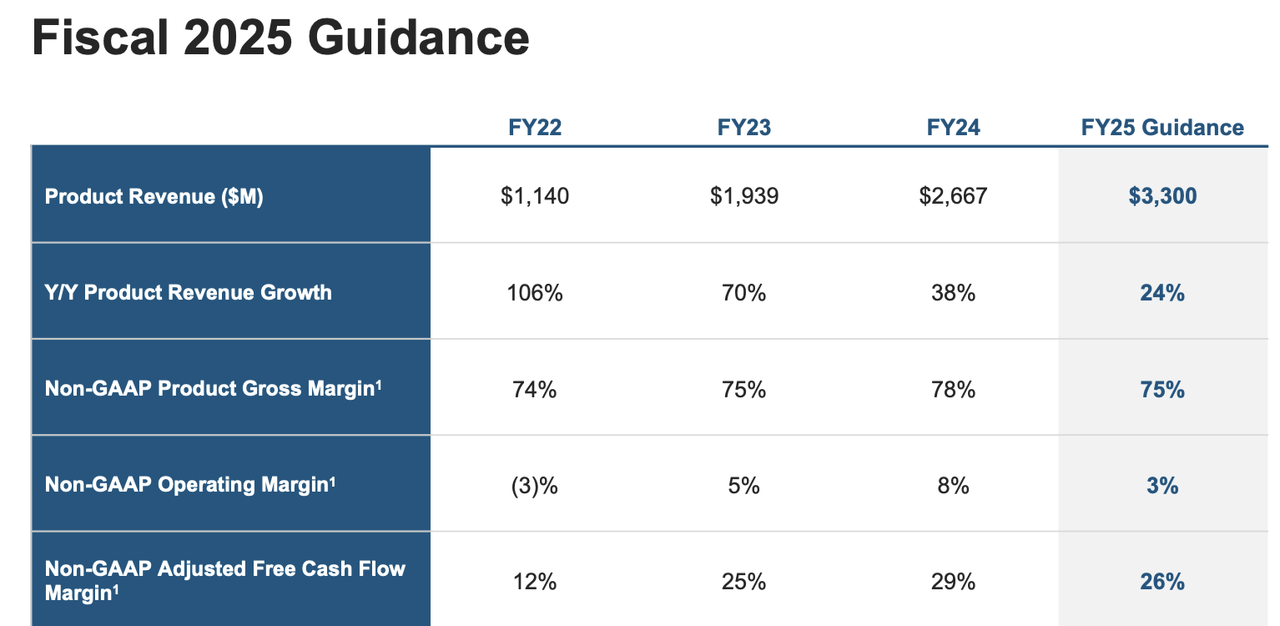

The company posted a 4% non-GAAP operating margin, slightly exceeding guidance for 3%. This represented a 400 bps improvement YoY and the company has maintained non-GAAP profitability for five straight quarters.

SNOW ended the quarter with $4.5 billion of cash versus no debt, representing a bulletproof balance sheet.

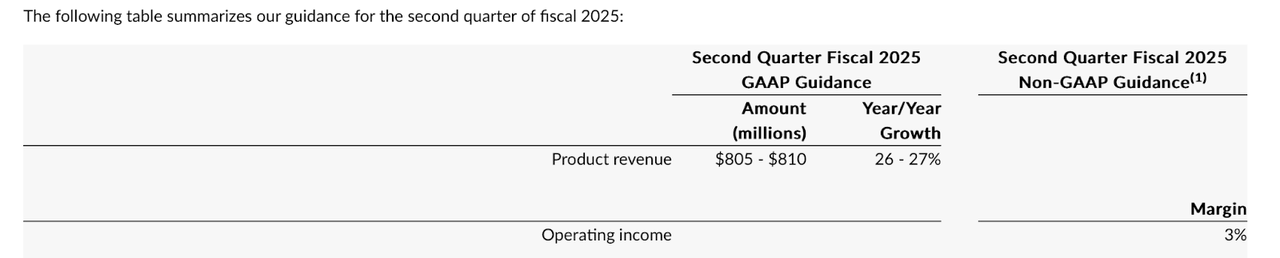

Looking ahead, management guided for the second quarter to see up to 27% YoY product revenue growth, representing some sequential deceleration.

Management raised full-year guidance to 24% YoY product revenue growth to $3.3 billion, up from the prior guide of $3.25 billion. A guidance raise is welcome, but I suspect that many investors may be growing impatient waiting for the “inevitable” generative AI-induced acceleration in growth.

Management noted that 40% of their customers “are processing unstructured data on Snowflake,” helping to, among other things, drive growth through collaboration. Management cited their strategic collaboration with customer Fiserv, in which the company earned 20 Fiserv financial institutions and merchant clients as customers, due to them wanting to “enable secure direct access to their financial data and insights.” Investors may have been eager to hear more discussion on Iceberg, which has been blamed for some of the slowdown in revenue growth. While management acknowledged the impact, they reiterated their view that these headwinds would be short term and weighted to the second half, with expectations that it may eventually become an accelerator for long-term growth.

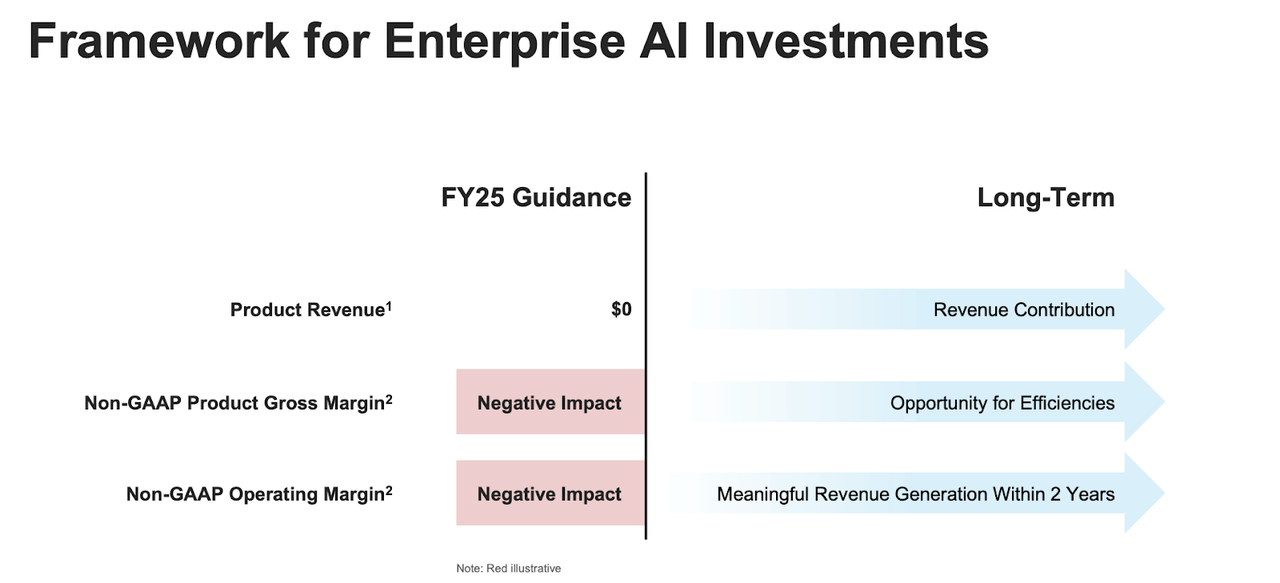

At their 2024 Investor Day, appeared to suggest that their investments in AI may have a negative near term impact on margins but lead to “meaningful” revenue generation over time.

I suspect that at this point, many investors need to see a sustained acceleration in revenue growth before believing again in the growth story.

Is SNOW Stock A Buy, Sell, or Hold?

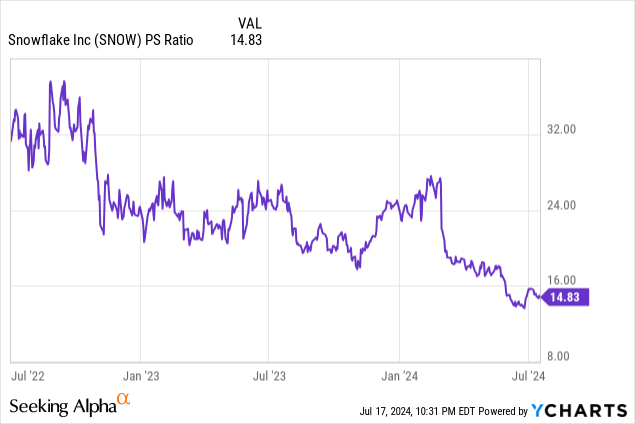

SNOW has been in the headlines on news of a cybersecurity breach, though it appears to have been cleared of any deficiencies on their own part. It is not clear if SNOW may nonetheless suffer any reputational impact from the cybersecurity incident. At Seeking Alpha’s inaugural investing summit, fellow analyst Joe Albano made the case for “downstream AI software plays” to eventually benefit as AI applications are built for future use cases. That certainly appears to have been the investing thesis over the last many quarters, but it is possible that some investors have lost patience waiting for that projected acceleration to take place. Even after the poor recent stock price action, SNOW still finds itself trading at around 13x sales. Consensus estimates call for an eventual and sustained acceleration to the 30% range.

Recall that it was just last quarter, in which management formally withdrew their $10 billion product revenue target for fiscal 2029 (but indicated that they were still “internally” driving towards that goal). With consensus estimates expecting $8.8 billion in FY29, it looks like analysts have come to accept that SNOW will not be crushing that previous guide. SNOW trades at just around half of its 2020 opening day price, but that distinction does not fully capture the multiple compression here. SNOW now finds itself trading at among its lowest price to sales multiples since it came public.

The interesting point here is that even if SNOW only generates 20% YoY annual revenue growth over the next 5 years, the stock may still generate solid returns. The company might be generating around $8.7 billion in revenue under this scenario, with the stock trading at around 5x FY30e sales. Because of SNOW’s ever-growing importance to its enterprise customers in a world of data, I can see the stock sustaining at least a 30x earnings multiple by then, supported by double-digit revenue growth and the net cash balance sheet. Based on my projection for 30% long-term net margins, that implies a 9x sales multiple by then, or roughly 13% annual return potential over the next 5 years. I still remain hopeful that SNOW eventually does see a tick-up in revenue growth, which may make the potential upside even more attractive, but stunning outperformance is no longer needed to make this story work.

SNOW Stock Risks

As I noted previously, SNOW stock remains richly valued even after the poor price performance. The stock might not deliver the anticipated returns for a multitude of reasons, including a poor macro environment and increasing competition. Databricks is a notable competitor which recently reported 60% ARR growth to $2.4 billion. These two companies do not have a direct overlap, but it might be concerning that Databricks is able to show much stronger top-line growth rates even at scale. It is possible that Databricks or other competitors release products that disrupt SNOW, which may impair the growth thesis as well as the target valuation multiple. SNOW is not yet profitable on a GAAP basis, which may subject it to greater volatility in periods of market distress, even if the stock has not seen so much volatility in the past. It is possible that the company never sees the projected generative AI-induced acceleration in revenue growth, at which point the stock might re-rate lower as investors grapple with the new growth reality.

SNOW Stock Conclusion

SNOW continues to trade among the richest valued among tech peers, but its relative premium has declined to a low point during its limited history as a public company. The stock looks quite buyable here even if revenue growth does not accelerate, and I am of the view that the company may eventually see an inflection in growth as more generative AI use cases are fleshed out. Due to the improved value proposition, I am upgrading the stock to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!