Summary:

- Snowflake’s decision to issue $2 billion in convertible notes to repurchase stock and for general purposes is seen as poor capital allocation.

- SNOW stock is not cheap, trading at 37x this year’s free cash flow, making the debt issuance even more questionable.

- Snowflake’s growth is decelerating, and Wall Street analysts are downgrading revenue growth estimates, further weakening the investment case.

- Paying a premium for a company with inconsistent profitability and poor financial decisions is unjustifiable; Snowflake’s prospects appear to be diminishing.

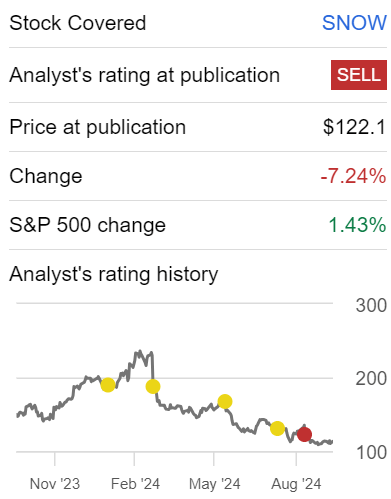

- This article follows from my previous sell recommendation back in August.

Ekaterina Chizhevskaya/iStock via Getty Images

Investment Thesis

Snowflake (NYSE:SNOW) announced that it’s going to issue $2 billion worth of convertible debt, to buy back $575 million of stock, with the remainder left for general corporate purposes.

This makes absolutely no sense. Snowflake had already repurchased more than $1.4 billion worth of stock at higher prices, and that hadn’t turned out to be a wise capital allocation. Why would Snowflake now go on to blemish its pristine balance sheet with convertible notes?

What’s more, its stock isn’t even that cheap, at approximately 37x this year’s free cash flow.

All in all, there are too many question marks to this investment thesis and I believe that in the coming months, its share price will be lower than the $110 that it trades for now.

Rapid Recap

Back in August, I said,

The issue is that Snowflake carries a premium valuation, while its profitability profile cannot match investors’ high expectations. More concretely, I charge that investors are paying too high a premium for Snowflake at 45x this year’s free cash flow.

Therefore, I downgrade my rating on Snowflake to a sell.

Author’s work on SNOW

Now, with Snowflake raising debt, and blemishing its immaculate balance sheet, I believe the bear case will start to gain further traction.

A Growth Stock Without the Growth

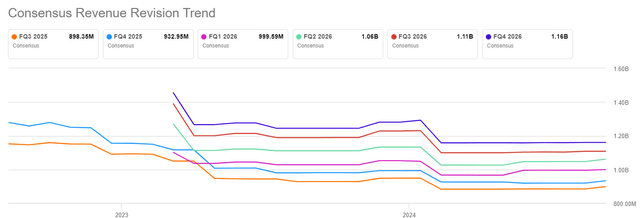

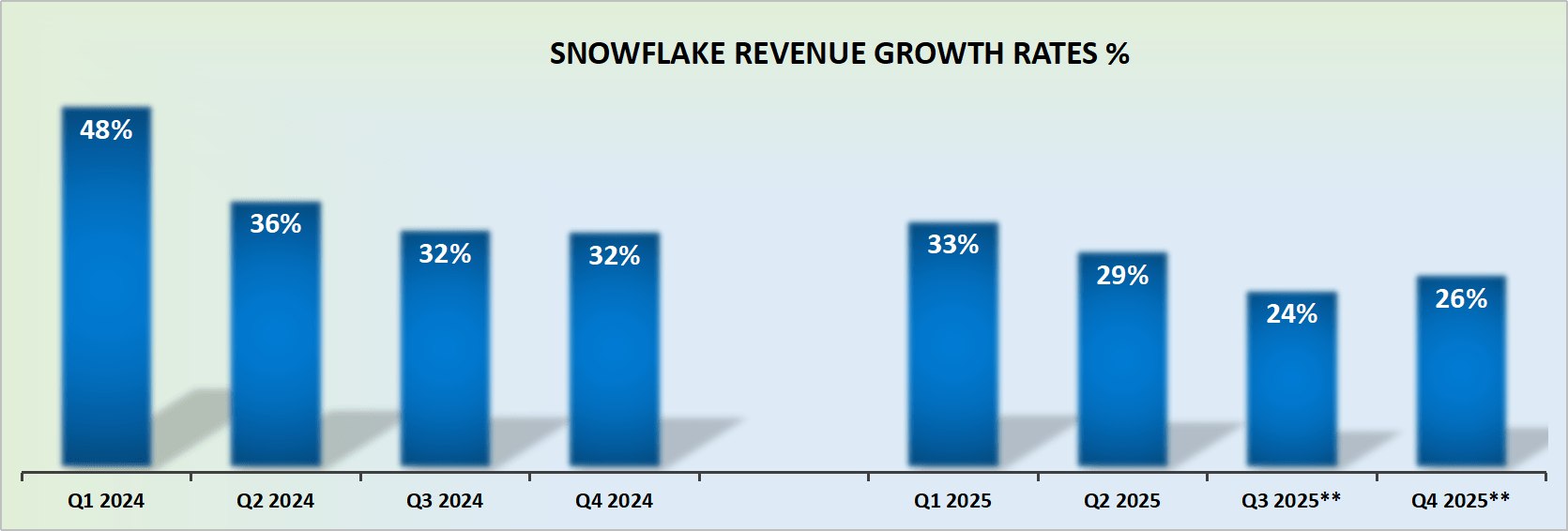

SNOW revenue growth rates

What I like about investing, is that the market is very straightforward. Simple, you may say. So why do investors keep tripping over themselves and backing companies with super high expectations but weakening prospects?

Here are the facts for what they are, Snowflake is no longer delivering hypergrowth. Hypergrowth is growth rates that can be sustainably and predictably counted to deliver 30% CAGR.

Even if we presume that management is lowballing its guidance and adjust for this possibility, the next couple of quarters are going to be decidedly below 30% CAGR.

What’s more, I will always discuss this with my subscribers, don’t back companies where Wall Street analysts are busy downgrading their revenue growth rate estimates. And that’s exactly what you can see below.

Investing is difficult enough. You don’t want to back half-baked ideas. Even in a bull market.

With that in mind, let’s now turn our focus to discussing Snowflake’s convertible note.

Latest Development: Capital Allocation Discussed

Yesterday, Snowflake announced that it will issue $2 billion in convertible notes ($1 billion maturing in 2027, and $1 billion in 2029), with up to $300 million in additional purchase options in each series.

Snowflake plans to use the money raised to repurchase up to $575 million of its own stock (I’ll return to this soon).

As I will always tell my subscribers, don’t chase just “any” idea, simply because the company has a compelling narrative.

Always, look first on the company’s balance sheet, as this is a lot more indicative of the company’s future prospects, rather than what the CEO promises he or she will do.

For Snowflake’s part, up until last quarter, fiscal Q2 2025, whatever negative narratives were swirling around when it came to Snowflake, at least investors could make the claim that yes, the stock is expensive, but the business carries no debt on its balance sheet.

Now, when future investors look at Snowflake’s balance sheet, they’ll see $2 billion worth of debt. And what makes this investment setup even more bizarre is that Snowflake already carried more than $3 billion of cash and cash equivalents. So, Snowflake had no immediate need to raise debt to buy back stock.

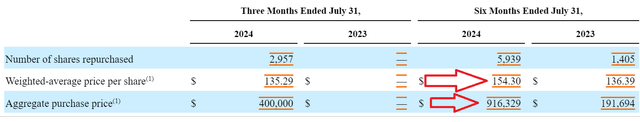

But the real aspect that is even most confounding for shareholders is that Snowflake had already repurchased more than $900 million worth of stock in the past 6 months!

As you can see above, Snowflake hasn’t been shy when it comes to repurchasing its own stock. It has already been buying back a lot of stock when the share price was at an average price of $154.30.

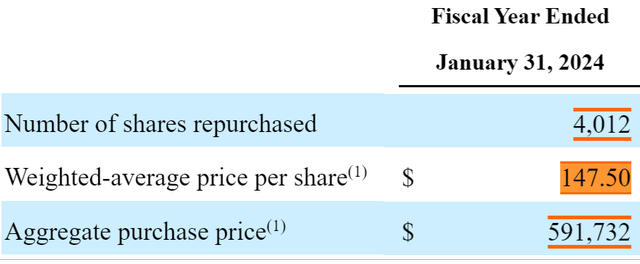

Furthermore, if we look back to the previous year, Snowflake had repurchased nearly another $600 million worth of stock at a price not too dissimilar to the repurchases made in the last 6 months.

So, they repurchased about $1.4 billion worth of stock in the last 18 months, and now are raising $2 billion of convertible notes?

This simply doesn’t strike me as astute capital allocation. What’s more, it’s difficult to make the case that the stock is cheap.

SNOW Stock Valuation – 37x Forward Free Cash Flow

This is what I said in my previous analysis,

Snowflake is sacrificing profits for revenues and chasing growth.

[…] Now, I no longer believe that Snowflake will even deliver $1 billion of free cash flow. But let’s go with $1 billion for the sake of our discussion, and note that this would require a particularly strong fiscal H2 2025 period from Snowflake for its free cash flow to go from approximately $430 million to $570 million.

This means, that if everything goes right for Snowflake, the stock is priced at 37x this year’s free cash flow. Yes, I recognize that Snowflake has superior technology, but the volatility in its profitability profile raises the question of just how sustainable are its future profits?

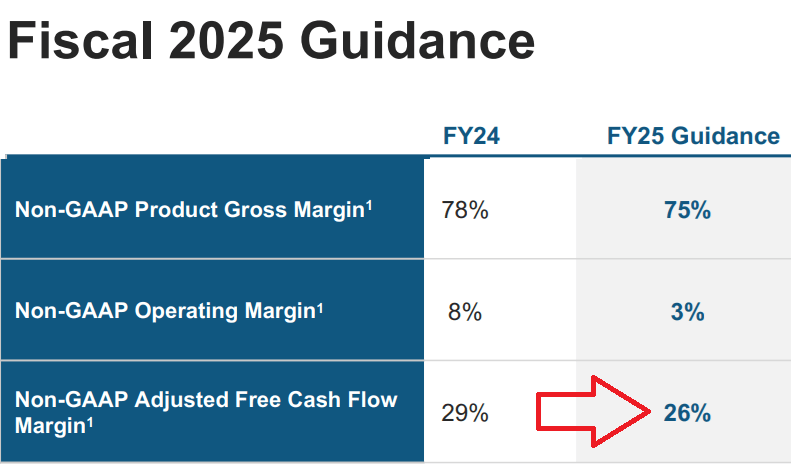

SNOW fiscal Q2 2025

As you can see above, Snowflake is guiding for weaker free cash flow margins for fiscal 2025 than fiscal 2024. Even if management is being conservative, it doesn’t detract from the fact that the business is not showing much in terms of positive operating leverage.

The Bottom Line

Paying 37x forward free cash flow for Snowflake makes little sense, especially when management has repeatedly demonstrated poor capital allocation.

The decision to raise $2 billion in convertible debt just to buy back stock, after having already repurchased $1.4 billion worth of shares at higher prices, shows a lack of financial prudence.

This move unnecessarily burdens the balance sheet with debt while the stock remains overpriced. It’s hard to justify such a premium for a company with decelerating growth and inconsistent profitability.

In the end, it seems like Snowflake’s prospects are melting away.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.