Summary:

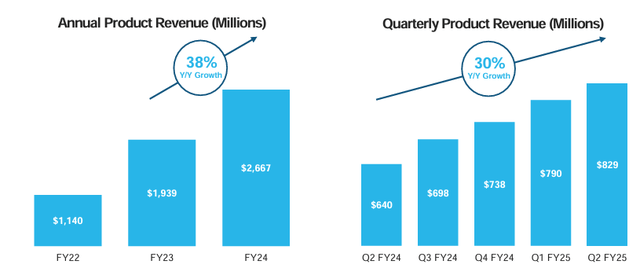

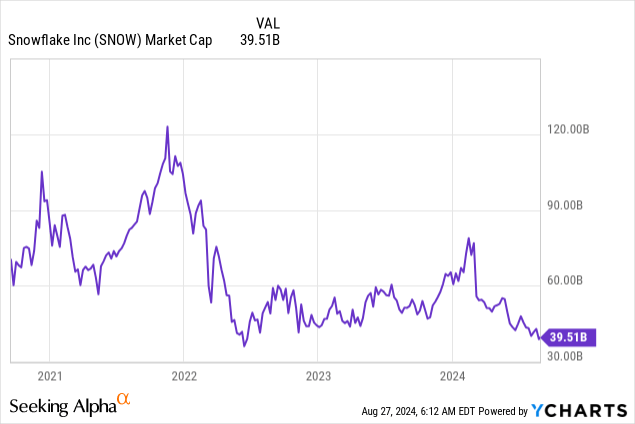

- Snowflake has seen 30% YoY revenue growth but a 40% YTD stock decline, raising concerns about its growth and profitability.

- Despite beating revenue estimates, Snowflake’s margins are under pressure, and buybacks mainly offset stock-based compensation dilution, limiting stock price impact.

- Valuation remains high at 11x next year’s sales, while its path to profitability is questionable. The fair value may be at best at today’s levels.

- Given the uncertain growth dynamics and questionable catalysts, I rate Snowflake stock as a “Hold” despite the recent price dip.

Steven Errico/DigitalVision via Getty Images

My Thesis

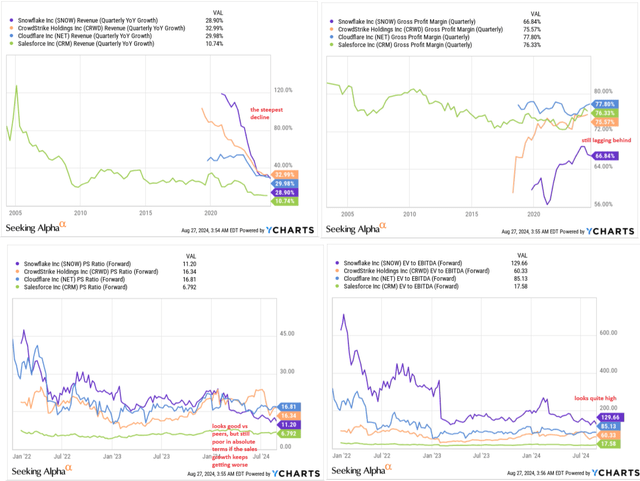

Snowflake (NYSE:SNOW) has become something of a controversial stock lately: the company has continued to grow revenue by about 30% on a YoY basis, but at the same time, the stock is down more than 40% YTD. This scenario could tempt some investors and analysts to buy this heavy dip. They could be right, but given recent trends, I see no reason to take risks now – we need confirmation that sales growth has bottomed out and that bottom-line profitability will indeed increase at least as much as the very optimistic consensus forecasts promise today.

My Reasoning

As Seeking Alpha’s news team cited Morgan Stanley’s analysts, SNOW’s Q2 2025 results “were good, but perhaps not enough” to prevent the post-earnings negative reaction (the stock was down – 14.70% following the Q2 earnings release). The product revenue reached $829 million, which is a 30% YoY expansion that was enough to beat both the management’s guidance and the consensus estimate. As the management noted during the Q2 earnings call, this exceptional growth was driven by “strong demand across key verticals such as financial services and technology, with notable contributions from major clients like Capital One (COF) and Pfizer (PFE).” The firm also signed 2 nine-figure deals during the quarter, indicating “massive potential when other customers’ workloads go into production”, as Morningstar analyst Julie Bhusal Sharma noted (proprietary source).

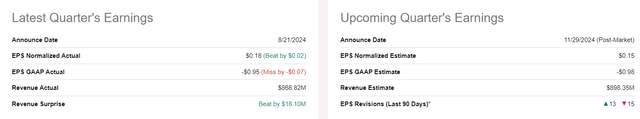

Despite the top-line continued expansion, SNOW reported a non-GAAP product gross margin of 76%, which was slightly down YoY. The management explained it through “increased GPU-related costs as Snowflake expanded its product offerings to meet customer demand”, but I don’t think that’s a valid justification. If demand is increasing as much as management claims, why can’t SNOW adjust pricing upwards and offset the negative effects? Anyway, the GAAP EBIT margin exceeded guidance at 5% but was down YoY. The resulting unadjusted EPS (GAAP) of -$0.95 missed the consensus despite beating on the adjusted basis. Snowflake’s management maintained the full-year margin guidance: 75% in non-GAAP product margin and 26% in non-GAAP adjusted FCF margin, but Wall Street’s earnings revisions were net negative for the next quarter, according to Seeking Alpha:

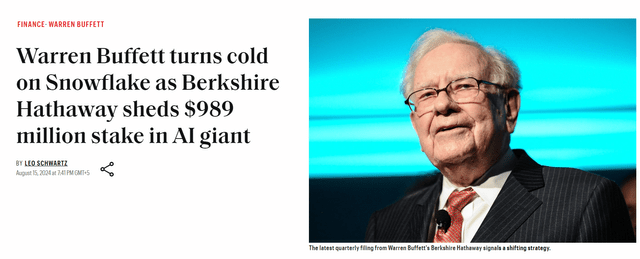

As some analysts note, the poor reaction of the stock on the relatively good Q2 figures was likely influenced by overall concern that volatility in the firm’s lock-in free consumption-based revenue model brought on by the weaker macro environment will have long-term implications – maybe that’s what made Berkshire Hathaway recently shed Snowflake shares.

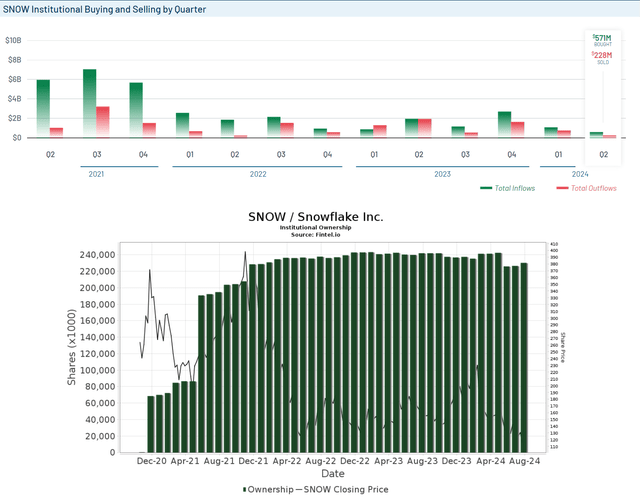

I have seen the opinion on the internet that against the backdrop of the price fall and Buffett’s exit, many institutional investors – the so-called smart money – have started to buy the dip. However, if we look at the dynamics of their buying/selling, we will see that these dip purchases are not in fact of a mass nature. The institutional ownership is still below the 2022-23 levels:

MarketBeat, Fintel data, Oakoff’s compilation

Another “recovery catalyst” that many people cite as a reason to buy the dip is SNOW’s buybacks. The CFO Mike Scarpelli announced they spent $400 million to repurchase 3 million shares during the quarter, with $492 million remaining under the current plan through March 2025 (plus an additional $2.5 billion authorized for buybacks through March 2027). These buybacks theoretically should positively impact stock prices, but in SNOW’s particular case, the whole sum primarily serves to manage dilution from SBC rather than from issuing new shares for capital. Over recent quarters, Snowflake’s stock-based compensation has increased by about 18.8% YoY, contributing to a rise in diluted shares outstanding from 300 million to 356 million between 2022 and August 2024 – an 18.7% increase. So the repurchase program seems to be more about offsetting dilution from SBC rather than significantly reducing the overall share count – the net impact on the stock price may be limited. So I consider the whole catalyst quality to be questionable.

What worries me about SNOW stock is the valuation. Despite the 40% drop in its share price since the beginning of the year, SNOW trades at 11 times next year’s sales figure, which looks like a pretty moderate multiple compared to its peers, but given that Snowflake’s revenue growth rate is falling the fastest and gross profit margins leave something to be desired, I don’t think there’s much reason for the multiple to widen. Furthermore, while the P/E ratio of nearly 130x is not a reliable thing to look at while valuing stocks like SNOW, it still prices in a fast path to profitability, which SNOW could struggle with in the medium term, as we have seen from the lower-than-expected margins in the second quarter.

YCharts, SNOW vs. peers, Oakoff’s notes

Attempts to realistically calculate the fair value of Snowflake lead to conclusions about a huge overvaluation of the stock. For example, look at what an analyst calculates on X who arrives at an IRR of just 0% for potential investment at today’s price level:

If you assume $10 Bn revenue for SNOW in 2028 (estimates $8.5 Bn) and 10% EBIT margin (~50 percentage point margin expansion), you would make 0% IRR assuming 55x exit EBIT multiple

Indeed, a lot of time has passed since that tweet, and if we try to update the numbers, we will find that the forecasts haven’t changed much – today the consensus is for $6.71 billion in revenue by FY2028 ($8.6 billion for calendar 2028). While the main drop in EPS is expected to occur in the current financial year only, I think it may be far from the truth in case the margins don’t improve. If we take the current revenue consensus as the best estimation we may have, then keeping the same 55x exit EBIT multiple in place and assuming just 8.5% in EBIT margin instead of the 10% assumed by the author above, we’ll get a fair value of just $40.2 billion, which is only 1.7% higher than SNOW’s market cap today.

Your Takeaway

The main conclusion I want to draw in my article is that Snowflake stock does not inspire much confidence right away. Warren Buffett may have sold his stake for precisely this reason, as the dynamics of the company’s growth and the quality of that growth (expressed through margins) raised questions. The catalysts that are very often cited as the main reasons by buyers of the dip are insufficient in many ways, in my opinion. While the company’s valuation multiples have fallen significantly in recent months, they are still not deep enough to call SNOW an undervalued growth story. For this reason, I have decided to give the company a “Hold” rating today.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.