Summary:

- Snowflake Inc. has seen a significant drop in stock price, but risks outweigh rewards for investment at this time.

- The company’s revenue growth has slowed, profitability is still a concern, and competition from major cloud platforms poses a threat.

- Stock-based compensation, slowing growth numbers, and high valuation are key factors keeping me from investing in SNOW at this time.

pcess609

Introduction

Snowflake Inc (NYSE:SNOW) has been hovering around its 52-week lows, which prompted me to see how the company has performed and whether that large dip is a good time to start a position. Unfortunately, many reasons keep me away from the company, as I think it is a bit too speculative for me. The risks still outweigh the rewards even at this price right now, therefore I will continue to be on the sidelines and revisit if anything major happens in terms of the company’s operations.

Briefly on Financials

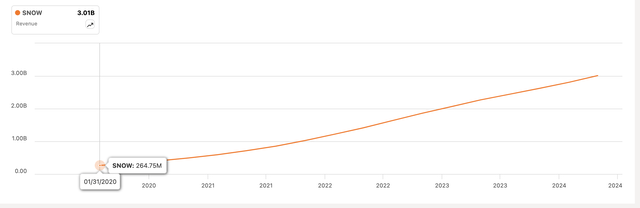

SNOW’s revenue growth has been what I expected from a relatively new company. Since the beginning of 2020, the company has managed to grow its revenues at a whopping 80% CAGR. In the last three years, it has slowed to a still respectable 51% CAGR, but it is concerning since it is slowing down. The most recent revenue growth numbers came in at around 35% y/y, and the company is expecting this growth to decelerate further to around 24%. This is somewhat concerning in my opinion. A company in this stage of development should be growing at a much higher pace.

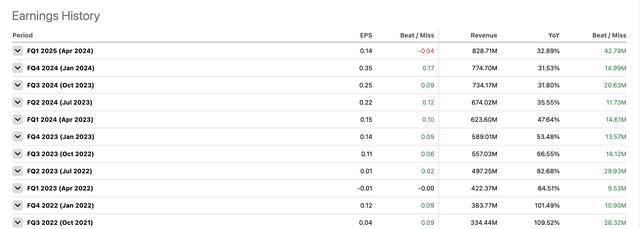

Although the management has been known to lowball these estimates and comfortably beat expectations. If we look at the company’s earnings history, we can see massive beats on EPS, which supports the notion of lowballing estimates in my opinion.

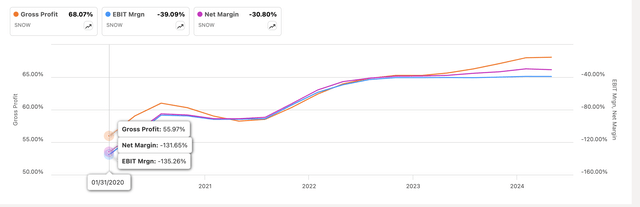

In terms of profitability, on a GAAP basis, the company is nowhere near profitable yet, however, these have been trending up since 2021, which is a good sign, but it is hard to tell when the company is going to be GAAP profitable. Furthermore, the recent guidance, which saw the company share slide, shows lowered non-GAAP margin estimates, the operating margin was cut in half to 3%, while the gross margin saw a 100bps cut also. A lot of it was due to the costs of R&D expected to grow faster than before, especially the costs of GPUs regarding AI. These costs will weigh on gross and operating margins, which explains the lowered guidance. It seems that Nvidia’s (NVDA) AI GPUs are quite expensive.

In terms of the company’s overall financial health, as of Q1 ’25, which was filed on May 31st ’24, SNOW had around $3.5B in cash and short-term investments, against zero debt. That is a great position to be in, especially in that growth phase, where every resource available should be used for further growth of the company, rather than allocating some of that capital to pay down annual interest expenses on debt. This position of the company should attract many investors, especially the ones who are more risk-averse and don’t like it when companies use leverage. I don’t think leverage is bad if the company utilizes it smartly. Nevertheless, the company’s financial position is strong, and it is not at any risk of insolvency.

Overall, everything is heading up. Still ways away from being GAAP profitable, and we are not sure when this will turn positive, which makes it a very risky investment in my opinion. The company’s balance sheet is very strong, with lots of dry powder for growth initiatives, and I hope growth rates rebound going forward.

What Keeps Me Away from Investing in SNOW?

There are a few items that keep me away from it, even after it is at 52-week lows. Many consider the company much less risky now since it has plummeted around 42% since the recent highs of $237. One of the reasons it went down this much was because of the poor guidance the company provided. Another reason was the company decided to change up the management a little, with Frank Slootman stepping down as the CEO to be replaced by Sridhar Ramaswamy, which I don’t think was a bad decision. He was previously running Google’s (GOOG) ad business.

Competition

The company’s product is easily integrated within the major cloud platforms like Amazon’s (AMZN) AWS, Microsoft’s (MSFT) Azure, and Alphabet’s Google Cloud Platform, however, they are also the company’s largest competitors, as per its 10K filing. AWS has its Redshift, which is also designed to store and analyze large datasets for intelligence and analytics purposes, just like SNOW. Both leverage SQL, which makes it easy for users to access who are knowledgeable in it. Alphabet’s BigQuery and Microsoft’s Azure are similar to the two mentioned also. This means the company is competing with the cloud juggernauts. In a lot of ways, the competition may have an advantage if the customer is already familiar with each respective cloud offering, further integration within the cloud will be much easier as there will be tight integration with other services offered by those cloud providers.

These juggernauts have much bigger pockets than SNOW, so what if they decide to inject a lot of money into making a product that would become a much better product than SNOW’s? That’s a big risk.

Stock-based Compensation

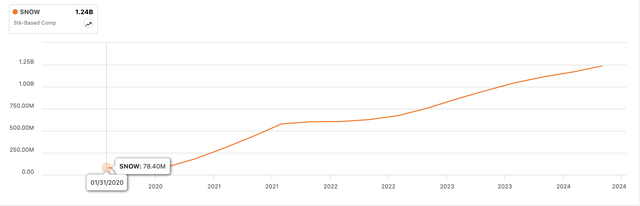

Another item that is weighing on the company’s profitability is the ever-increasing stock-based compensation, or SBC. It is also the largest culprit of the company’s low operating margins as compared to gross margins (over 35% of total OpEx can be attributed to SBC). We can see below that SBC has been on an aggressive upward trajectory with no slowing down. It went from $78m in 2020 to $1.24B in the latest quarter, TTM. It is not surprising that the company uses so much SBC. Many companies at this phase of growth employ it, but that just makes it very uncertain as to when the company will stop relying on it. The company’s free cash flow, which doesn’t take into account SBC, has therefore been positive, but with over $1B in SBC, that would easily be in the negative territory.

Slowing Growth Numbers

I mentioned earlier the company’s growth numbers have been slowing considerably down, and with the latest guidance coming in much lower than expected, I would like to see how these growth numbers develop over the upcoming few quarters or even a full year. They may have lowballed estimates, but I can’t go by that hunch, so I will take it at face value for now to keep it safe and assume that the growth is slowing down until proven otherwise.

Valuation

The last reason I am not eager to invest in the company is its valuation. For the DCF model, I went with the company’s adjusted numbers because, under a GAAP basis, the company is nowhere near profitable.

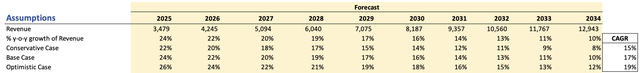

For revenues, I went with quite high growth but much slower than the past 5 years. The reason is that, as I mentioned earlier, the growth numbers are weakening, so I would need to see this trend reverse before assuming higher growth numbers for the model. Nevertheless, a 17% CAGR for the next decade is quite high still. See below the three scenarios.

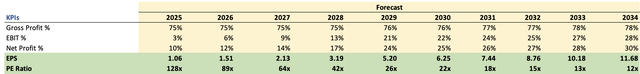

For margins, I went with 75% gross margins and 3% operating margins, which over time will improve quite generously, so it is not the most conservative forecast mainly because I would like to see how the company could perform and the result is not going to change that much in the end, as you will see. Also, because these are non-GAAP estimates, for now, I will have to add a larger discount to the final intrinsic value.

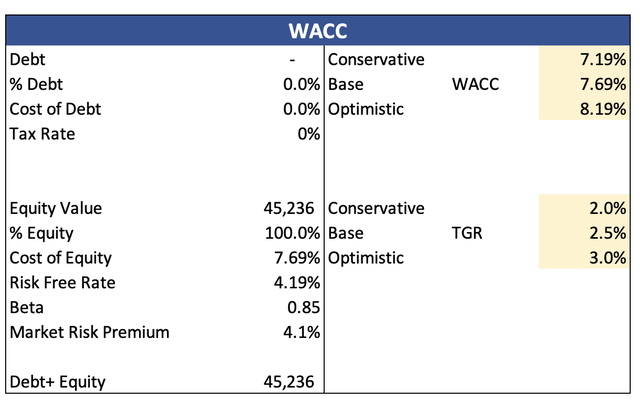

I am using the company’s WACC of around 7.7% as my discount rate and a 2.5% terminal growth rate.

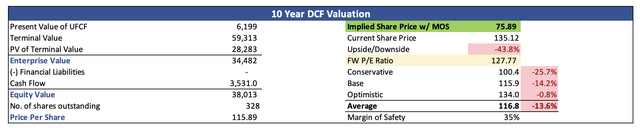

I am also going to add a 35% discount to the final intrinsic value calculation because I believe the company is quite risky at this stage of development. After all, it is still unprofitable and has a huge reliance on SBC. So, SNOW’s intrinsic value and what I would be willing to pay for it would be around $76 a share, which means even after the decent pullback, I am not going to start a position here.

Comments on the Outlook

There are of course many reasons that we may not see my PT reached, but I have seen such things happen before, so it is not out of the realm of possibility.

The company’s involvement within the AI space may keep it afloat for a lot longer, and even help it push into profitability, especially if the company’s top-line growth rebounds and operating expenses come significantly down, especially within the R&D segment. If the company stops utilizing SBC as much going forward, this will add a lot to the company’s margins going forward and SNOW would reach GAAP profitability rather quickly. I don’t see this happening anytime soon. In terms of R&D, the massive increases here may yield very good results in the end, and once that phase of experimentation passes, operating costs will come down significantly. On the other hand, all this spending on R&D may not yield a very good return and end up just burning cash for suboptimal returns. Cash that could have been used for some other growth driver. This heavy investment within the AI space better brings good returns and improves its position here, or I wouldn’t be surprised if its share price comes down further.

The company’s ability to keep the revenue retention rate this high is admirable. As of the latest quarter, the number stood at 128%. This means the company retained all its customers and was able to increase that revenue by either upselling to convince them to upgrade or just straight-up price increases in general. This is a pretty healthy statistic, and I would like to see how it develops over the next few quarters.

Another metric I would like to see continue to perform well is the company’s remaining performance obligations. This is essentially revenue that has been contracted but not yet recognized as such because the service is not yet delivered fully, like deferred revenue. In the latest quarter, RPO was 46% higher than in the same quarter the previous year, which is fantastic. So, I will be interested to see how this is going to develop over time.

In short, I think the AI hype will continue to affect the company positively as it slowly becomes profitable. The hype may keep it afloat until it turns considerably profitable, and if it can maintain such growth numbers and retention rates going forward, the stock price will not see a large dip any time soon.

Closing Comments

The company’s operations, poor guidance numbers, valuation, and fierce competition are what keeping me away for now. Therefore, I am assigning a hold rating, as in, I am going to hold off from starting a position right now. Nevertheless, I believe the R&D efforts will yield results in the end, and there will be a place for it amongst the big cloud providers that have similar products. The good thing about SNOW’s product is that it has multi-cloud functionality, which means there should be many customers to find in the future.

To me, it doesn’t seem to be a good risk/reward profile currently, even after the big dip recently. I think the company is still rather expensive and a bigger pullback would be welcomed, but I am not holding my breath. Nevertheless, I will follow the company and will set a price alert closer to my PT and revisit the company if anything changes like its operations improve quicker than expected, and its reliance on SBC starts to come down.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.