Summary:

- Snowflake’s stock has declined significantly, with a 30% drop over the last twelve months and a 45% YTD decline in 2024.

- Despite impressive revenue growth, Snowflake’s profitability metrics and EPS have stagnated due to high R&D investments and increasing outstanding shares.

- Key business metrics like RPO and NRR show disappointing trends, indicating potential challenges in sustaining strong revenue growth and EPS expansion.

- Valuation remains high with a forward P/E ratio of 183, and DCF analysis suggests the stock is around 13% overvalued, highlighting significant red flags.

Sundry Photography

Investment thesis

My previous bearish thesis about Snowflake’s stock (NYSE:SNOW) aged well as the stock lost almost a third of its value since late May.

Despite the stock’s dip, my DCF model and valuation ratios suggest that the valuation is still not attractive. Moreover, recent dynamics across crucial fundamental metrics do not look bright. SNOW still demonstrates impressive revenue growth, but the pace is decelerating notable, and profitability stagnates. This is especially warning as the AI industry is thriving, meaning that SNOW is not capitalizing on strong secular tailwinds. All in all, SNOW is a “Sell”. I am slightly upgrading it from “Strong Sell” due to improved [but still unattractive] valuation.

Recent developments

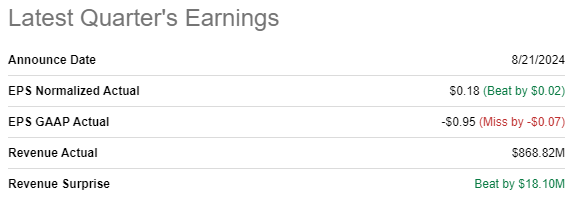

Snowflake released its latest quarterly earnings on August 21, surpassing consensus estimates in terms of the topline and the adjusted EPS. Revenue grew by an impressive 29% YoY. Despite robust revenue growth, the adjusted EPS decreased YoY from $0.22 to $0.18.

Seeking Alpha

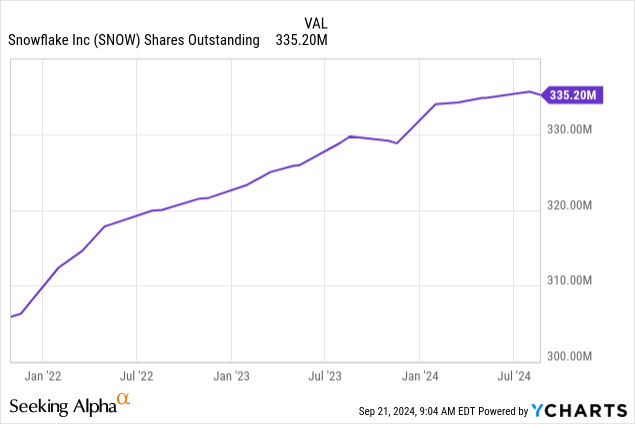

The adjusted EPS decreased due to two factors. First, key profitability metrics like the gross and operating margins did not show significant improvements on a YoY basis. Second, the outstanding shares count continues expansion. This also does not add more value for investors on a per share basis.

On the other hand, it is crucial to emphasize that SNOW’s profitability stagnated due to increased investments in innovation. According to the company’s P&L over the last several quarters, its R&D spending as a portion of revenue grew YoY from 46.6% to 50.4%. Unlike technological behemoths as Microsoft (MSFT) or Google (GOOGL), Snowflake does not have a multi-decade record of successful R&D spending. Therefore, there is a high level of uncertainty of whether these R&D costs will pay off in the future.

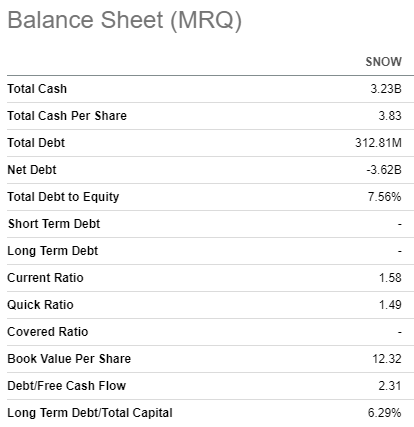

What is positive for Snowflake’s investors is that the company has ample liquidity with a massive $3.2 billion cash pile. Such a strong financial positions SNOW well to continue investing in growth and innovation.

Seeking Alpha

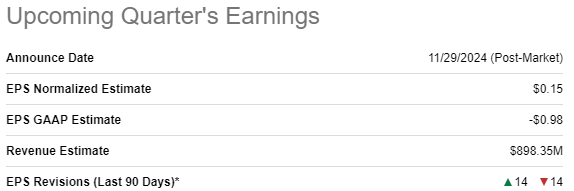

The upcoming earnings release is scheduled for November 29. Wall Street analysts forecast quarterly revenue to be $898 million, which will mean a 22% revenue growth. The adjusted EPS is expected to shrink once again in Q3, from $0.25 to $0.15. Wall Street’s sentiment around SNOW’s upcoming earnings release is somewhat mixed with the equal number of EPS upward and downward revisions.

Seeking Alpha

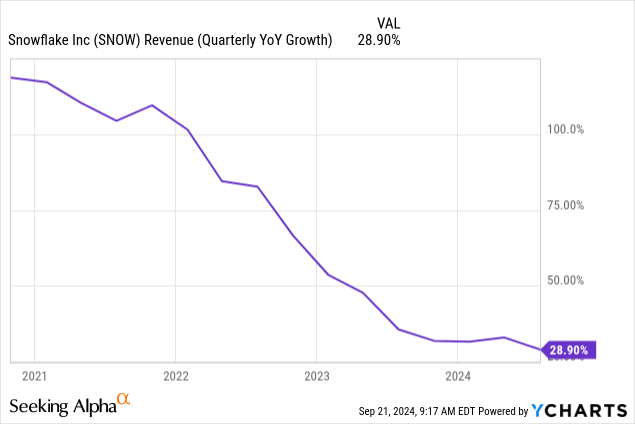

Sharply decelerating revenue growth is an apparent warning sign for growth investors. As I mentioned in the previous paragraph, the Q3 YoY revenue growth is expected to be 22%. This will mean another quarter of notable deceleration. The below chart speaks volumes, in my opinion.

The trend becomes especially warning if we recall that we currently live in a reality of the overall IT boom when companies boost their IT spending. According to Gartner, the global IT spending is expected to grow by 7.5% in 2024. Moreover, let us not forget that SNOW is positioned as an AI company. The AI industry is the hottest one in IT at the moment, but Snowflake’s revenue growth pace does not justify that the company is capitalizing on industry tailwinds.

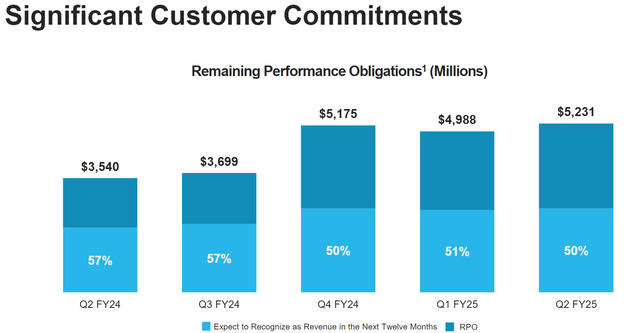

SNOW’s latest earnings presentation

Remaining Performance Obligations [RPO] is a good underlying metric reflecting the potential to drive revenue growth acceleration. SNOW’s RPO growth looks impressive on a YoY basis. However, if we look sequentially, the metric has been stagnating over the last three quarters.

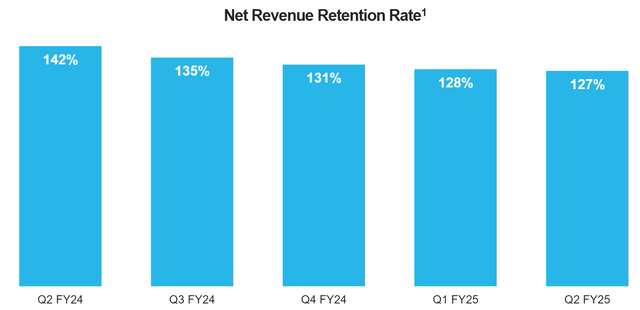

Moreover, the company’s net revenue retention rate [NRR] has deteriorated once again sequentially. On a YoY basis the picture looks even worse as the metric plunged by 15 percentage points. The NRR is still well above 100%, but the rapid deterioration suggests that SNOW is likely close to its cross-selling potential peak. With a limited potential to further expand its potential to cross-sell and up-sell, it will be more difficult for the company to sustain strong revenue growth and EPS expansion.

SNOW’s latest earnings presentation

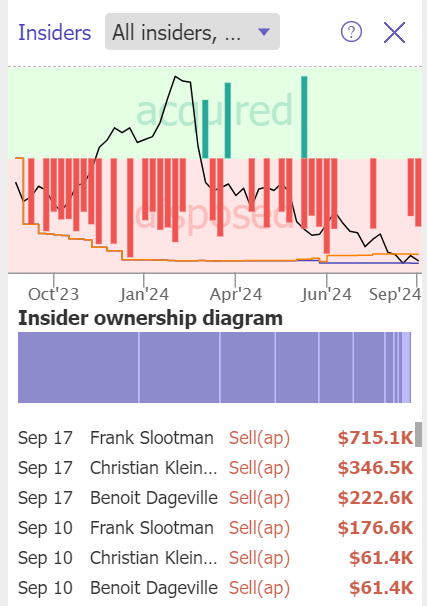

Last but not least, despite the stock losing almost a third of its value since my previous thesis, insiders are not rushing to buy the dip. Insiders were mostly selling over the last twelve months, which might indicate that they expect the stock to dip further soon.

TrendSpider

I think that significant revenue growth deceleration is a warning sign for SNOW’s investors, especially in the current environment when high-quality AI companies are thriving. Key business metrics that reflect future growth potential also demonstrate disappointing dynamics, which might mean further revenue growth deceleration for the next few quarters.

Valuation update

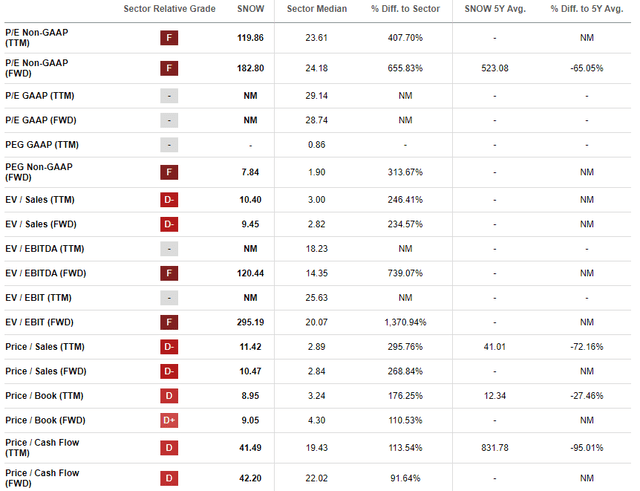

SNOW has lost around 30% of its value over the last twelve months. The picture in 2024 is even worse with a 45% share price decline YTD. SNOW’s valuation ratios are still sky-high with a forward adjusted P/E ratio of 183. For a company with sharply deteriorating revenue growth and stagnating profitability, such an extremely high forward P/E multiple is not justified.

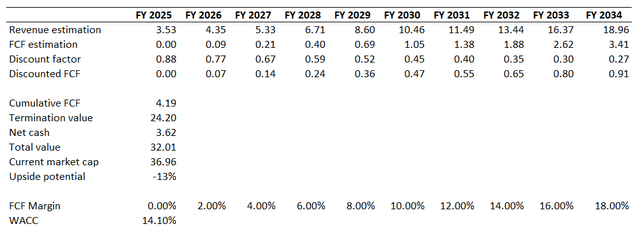

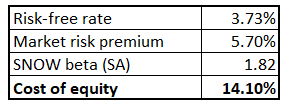

The DCF model will help better assess SNOW’s valuation. I am figuring out SNOW’s cost of equity in the below table using the CAPM approach. All variables for the CAPM formula are easily available on the Internet. Cost of equity will be used as a discount rate for my DCF model, which is 14.1%.

Author’s calculations

Despite my cautiousness, I think that long-term revenue growth forecast for SNOW from consensus is a reliable source. Wall Street analysts project a 20.5% revenue CAGR for the next decade. SNOW’s TTM FCF margin ex-SBC is close to zero, which will be my base year’s assumption. Since I have an overall cautious thesis, I think that I need to balance it with an aggressive assumption for the FCF expansion. For my DCF I incorporated a 200 basis points yearly expansion.

According to my DCF simulation, the business’s fair value is around $32 billion. This is still almost $5 billion lower than the current market cap, meaning that the stock is around 13% overvalued. I think that such a premium is not justified given all the red flags I have mentioned in my analysis.

Risks to my bearish thesis

As I mentioned in my earlier paragraphs of the analysis, SNOW also invests a lot in R&D and has a strong liquidity position that will allow for more innovation for longer. Thus, there is always the chance that the company might unveil some new compelling offerings or partnerships that will help to reaccelerate revenue growth. If SNOW indeed starts to grow revenues more aggressively, this might trigger a re-risking sentiment around the stock.

Lower interest rates from the Fed is an obvious bullish tailwind for all growth stocks. We can see from the CAPM equations above that the risk-free rate is a key input for DCF models, and the Fed Funds rate cut will push this number lower. A lower risk-free rate will lower the required discount rates for valuation models, which will raise the fair value of long-term growth stocks such as SNOW. Thus, if the Fed cuts rates faster than the market prices in, then this is a very favorable catalyst for SNOW.

Bottom line

In conclusion, SNOW is still not an attractive investment for me. I upgrade from “Strong Sell” to just “Sell” due to improved [but still not attractive] valuation. On the other hand, the fundamentals still do not feel particularly strong.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.