Summary:

- Snowflake is a leader in cloud-based data warehousing, offering a centralized platform for storing and analyzing data across multiple cloud providers.

- The company faces competition from established players like Amazon, Google, Microsoft, and Oracle, but its unique architecture and focus on cost-effective data management give it a competitive advantage.

- Snowflake’s financials show strong revenue growth and a healthy balance sheet, making it an attractive investment option compared to its peers. However, the long-term moat in its operations is uncertain, and it may face challenges from well-funded competitors.

D4Fish

Snowflake (NYSE:SNOW) is one of the new leaders in data warehousing, and its success hinges on competing effectively with established forces in the field and partnering with them through unseparated data access across cloud services. I think the business model is good, but I question how much of a moat there is in its operations at the time of this writing. As such, to begin with, I will be looking at a small allocation, if any, while I watch how its strategy, reputation, and results progress.

Operations Analysis

Snowflake is a leader in cloud-based data warehousing, offering a data platform that allows users to store and analyze data through its cloud-based hardware and software. Crucially, its architecture is built to operate across multiple cloud providers, including Amazon (AMZN) Web Services, Microsoft (MSFT) Azure, and Google (GOOG) (GOOGL) Cloud Platform. Snowflake’s model separates storage and compute processes, so data storage is handled independently of data processing, allowing for more scalable and efficient management of resources. For example, costs and performance can be optimized through scaling up or down computational resources without affecting the data that is stored. Snowflake’s centralized approach to data storage also allows all data to be stored at a single point of access, immensely simplifying data management and analytics.

Snowflake’s services can most succinctly be broken down as follows:

| Data Warehousing | Snowflake provides centralized storage of structured, semi-structured, and unstructured data, with support for data analytics. |

| Data Lakes | Snowflake can store vast amounts of raw data in its original format until it’s needed. It can then transform that data for analysis. |

| Data Engineering | Snowflake can enable the preparation, integration, and transformation of data for analysis. |

| Data Science | Snowflake can facilitate machine learning models directly within its platform, supporting data science operations. |

| Data Applications | Snowflake enables developers to build and run data-intensive applications on its platform. |

What I believe Snowflake offers, which is highly valuable in an increasingly digital world, is data management with a focus on cutting-edge capability. But it must be noted that it has a significant amount of competitors in the field, and this is no surprise as we enter a new age of automation, AI and robotics, where data is going to be akin to the gold of classical antiquity. The four biggest competitors to Snowflake in data warehousing and big data are Amazon Redshift, Google BigQuery, Microsoft Azure Synapse Analytics, and Oracle (ORCL) Cloud Infrastructure Data Warehouse. Each of these offers extensive data warehousing and analytics capabilities, and one has to argue, where exactly does Snowflake’s competitive advantage lay? Snowflake also faces competition in database and analytics services from IBM (IBM) Db2 Warehouse on Cloud and Teradata (TDC) Vantage.

The competitive advantage lies in its unique architecture, which separates storage and compute capabilities. That is much more worthwhile for smaller businesses that may not have the financial leeway other companies with bigger data demands have. So, pay-as-you-go, with iterating costs, is an absolutely valuable offering. But also, Snowflake has emphasized its data sharing and collaboration features, and it is operable across AWS, Azure and GCP with a unified experience that is unique, as cloud services are often separated.

However, while I believe these services are valuable, I am unsure how strong the moat in operations is. I believe it is absolutely critical for Snowflake to focus on scaling and reducing its prices, which is possible at a larger scale. Otherwise, its product offering seems quite easily replicable from firms that have the necessary funding to compete.

Recently Frank Slootman has also resigned, and Sridhar Ramaswamy is replacing him as the new CEO. Slootman will now be chair of the board. Ramaswamy was previously Senior Vice President of AI at Snowflake, which I think is a very powerful position to come from, as I think that is an area where Snowflake will continue to offer massive value for smaller, AI-focused firms, but also in assisting smaller firms reliant on AI and machine learning with their data loads. A CEO with massive experience in artificial intelligence seems prudent.

Peer Analysis & Financials

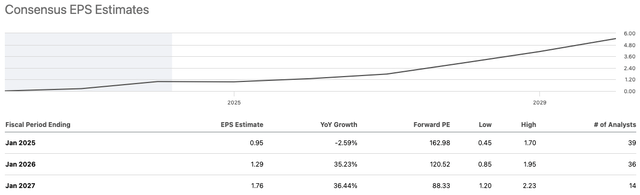

Snowflake had its IPO in just 2020, and since then, it has lost nearly 40% in value. However, analysts are expecting, on consensus, the growth of the firm to be exceptional, and I believe it has now become much more reasonably valued, which I will discuss below.

However, as the firm is still so new, it is difficult to compare it on many figures to established competitors in big data, so it is more appropriate to compare it to smaller-scale and earlier-stage peers to gauge relative performance.

Here is a table of five peers of slightly varying market caps but close in terms of stage of development and field of expertise:

| Snowflake | Datadog (DDOG) | MongoDB (MDB) | Palantir Technologies (PLTR) | CrowdStrike Holdings (CRWD) | |

| Equity-to-Asset | 0.63 | 0.52 | 0.37 | 0.77 | 0.35 |

| Cash-to-Debt (Including Lease Obligations) | 13.36 | 2.86 | 1.7 | 16.02 | 4.38 |

| 5Y Avg. Revenue Growth Rate (‘YoY’) | 108.82% | 69.16% | 47.89% | 30.4% | 73.87% |

| Levered FCF Margin % (‘TTM’) | 39.03% | 27.73% | 14.26% | 29.64% | 32.75% |

| Price-to-Sales (‘FWD’) | 15.14 | 16.1 | 13.55 | 18.84 | 18.91 |

| Market Cap | $51.96B | $41.63B | $26.29B | $50.47B | $75.17B |

| IPO | 2020 | 2019 | 2017 | 2020 | 2019 |

From this table, we can see that Snowflake has some particular advantages. Firstly, its five-year average revenue growth rate is the highest of all of my chosen peers, as is its levered FCF margin. Additionally, Snowflake has one of the best balance sheets, with a healthy equity-to-asset ratio and cash-to-debt, almost as good as Palantir’s balance sheet, which has recently stood out to me as being quite exceptional. Considering how much higher the revenue growth is, and the profitability is indicated to become through the FCF margin, Snowflake looks like it could be a more financially lucrative investment than Palantir over the long term, and I recently rated Palantir a Buy. While I believe Palantir offers a stable investment, albeit at a rich valuation, Snowflake offers almost the same stability but with much higher growth.

Of the five peers, I am least drawn to MongoDB, as it shows from the above table a relatively weak growth, balance sheet, and levered free cash flow margin.

I must note that most of these peers are not direct competitors to Snowflake, as Snowflake’s operations are quite unique in data warehousing and analytics, but many of the peers in the above table offer technology interfaces that either directly compete with Snowflake or compete in areas very closely related to data warehousing, such as Datadog, which is a specialist in monitoring and analytics. Each of the peers, however, is vital in assessing the opportunity cost of investing in early-stage tech companies involved in data, analysis and monitoring; Snowflake seems to be one of the best of them to me.

Valuation

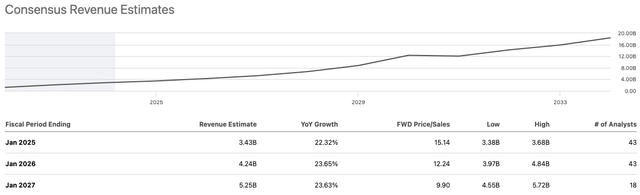

I briefly touched on the valuation above, especially bringing in the high EPS consensus estimates, which I believe support investment at this time and contribute to justifying its present valuation. But for deeper value analysis, I would like to bring in analyst’s consensus revenue estimates for Snowflake:

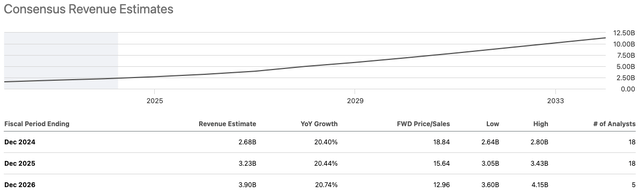

As we can see, the growth is compelling. In fact, over the next three years, analysts are expecting a revenue CAGR of 23.31%. Let’s compare this to Palantir:

Analysts are expecting, on consensus, a 20.48% CAGR for Palantir’s revenue over the next three years. So, my above thesis that Snowflake has the higher growth of the two stands up against near-term top-line estimates. When we then compare that Snowflake has a forward price-to-sales ratio of around just 15, compared to Palantir’s almost 19, we can begin to see the opportunity here. I am by no means suggesting that Snowflake is cheap, but it is more a question about what the market can tolerate over the long term and whether the company can maintain growth and market relevance over decades. As a very long-term investor, this is core to what I am looking for. I believe Palantir might have this long-term competitive advantage slightly more than Snowflake, considering it is involved in vital defense work and is building a formidable moat in advanced data tasks that are considered military-grade. I do not think Snowflake offers such a long-term moat, so I think it is much more likely that Palantir is the better investment over an ultra-long-term horizon, which is my investment preference. There is simply too much risk that Snowflake will fail in vital iterations or pivots or fall prey to new technological capabilities that will be rife during this period of widespread technological evolution. Therefore, while Snowflake’s valuation is lower than Palantir’s at this time, it is less favorable to me, and I am skeptical of investing in it for this reason.

Risks

As I mentioned above, I think Snowflake has a very compelling offering, specifically as it relates to smaller businesses needing cost-effective data warehousing. However, I would like to reiterate that I am not sure how strong Snowflake’s moat is when compared to firms like Palantir and Amazon with AWS and Redshift. Each of these two competitors offers massive moats. Palantir has a highly specialized capability in a market that is incredibly difficult to breach, especially for defense contracts. AWS offers a similar highly specialized set of offerings, but it also has a massive scale. Snowflake has yet to prove it can reach a scale to provide a long-term moat in operations based on price or ultra-advanced data services. Instead, its present offering is a price-based one as it relates to separated storage and compute, but I think this is easily replicable and is already being done by well-funded competitors, including in-house at Amazon with Redshift. Additionally, Amazon is recently iterating its focus to higher margin services for third-parties, and as such, I see it quite feasible that it begins to hone in on its offerings that help support smaller firms with cost-efficient data services.

What Snowflake is left with that is truly unique is its cloud-agnostic approach, which allows its customers to work across AWS, Azure, and Google Cloud Platform from its single point of access. This may not be as easily replicable, but it is my opinion that the moat here is not strong enough for me to consider this an exceptional long-term investment.

Conclusion

Overall, I am quite impressed by what Snowflake is designing here, and I do not want my analysis to detract from the important and great work that the company is doing. However, as a potential shareholder, I would like to see more investment in services that are truly unique and cannot be replicated. I am sure that management already has this in mind, but as an investor with a very long-term horizon, it may be too early for me to tell if this is a company worth allocating to. I may start with a small amount and see how management progresses operations. If it starts to reach a truly compelling scale, then I think its moat could be a byproduct of a difficult barrier to entry in infrastructure build and brand reputation. But it is not quite at that stage yet, in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.