Summary:

- Snowflake Inc. stock has continued to decline despite market growth, reflecting concerns about slowing business growth and rising operating costs.

- I consider the Q1 financial results to be weak, with a declining net revenue retention rate and poor guidance for EBIT margin.

- Concerns about customer retention issues following a data breach and high valuation multiples suggest a “Sell” rating for Snowflake stock before Q2 FY2025 release.

DNY59/iStock via Getty Images

Intro & Thesis

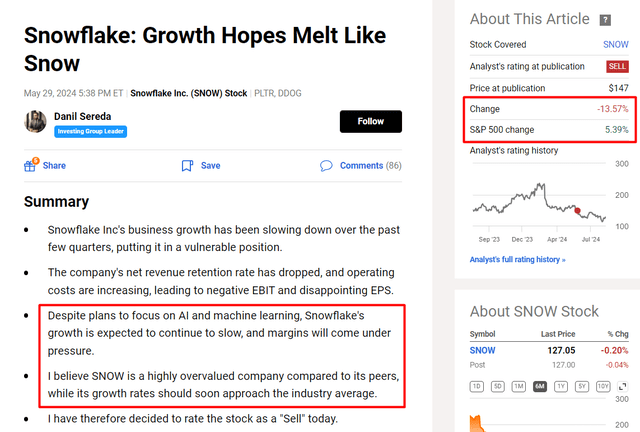

In May 2024, I issued a “Sell” rating for Snowflake Inc. (NYSE:SNOW) stock when it was trading at $147 apiece. Since then, despite some serious volatility, the broader market, as represented by the S&P 500 index (SP500) (SPY), has grown by over 5%. However, the SNOW stock has continued its downward trend, which started with the Q4 FY2024 report released in late February 2024.

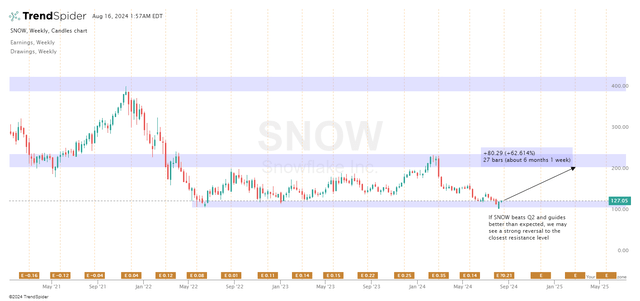

TrendSpider Software, SNOW, the author’s notes

I was basing my thesis on the slowing business growth, declining net revenue retention rate, and rising operating costs, which have led to negative EBIT and disappointing EPS. I argued that despite the company’s focus on AI and machine learning, I expected growth to continue slowing and margins to be pressured. Additionally, I wrote that Snowflake seemed significantly overvalued compared to its peers, with its growth rates likely to soon align with the industry average.

Seeking Alpha, my article on SNOW

To this day, the fall in the stock price justifies my thesis. But to what extent can it still be considered relevant after the company’s latest data and the changes surrounding SNOW in general?

I try to stay as unbiased as possible and look at SNOW with a fresh eye, but I don’t see any major changes in this story that would cause me to upgrade. Therefore, the stock is still a “sell” as the price doesn’t seem sustainable to me before the Q2 FY2025 release (set for August 22, 2024).

Why Do I Think So?

I’ve already analyzed the company’s results for Snowflake’s first quarter of the 2024 financial year – my previous article was a kind of review. Let me briefly discuss those figures: for Q1 Snowflake reported product revenue of $789.6 million, a 34% increase YoY, contributing to a total revenue of $828.7 million, which grew by 33% YoY. The net revenue retention rate dropped to 128%, which looks good on an absolute basis (anywhere >100% is considered good), but compared to the previous quarters the slowdown on this front looked obvious. Although Snowflake’s gross margin widened by ~70 basis points on a YoY basis, the company was struggling with rising operating costs: While revenue growth slowed, operating expenses managed to surge by 31.61% YoY, pushing EBIT deeper into negative territory, from -$273 million last year to -$348.5 million this year. As a result, even on an adjusted basis, Snowflake’s EPS fell short of expectations, missing estimates by over 19%. Adjusted for SBC, the operating cash flow didn’t look impressive as well. The management guidance was lowered as SNOW was expecting to show only 3% in GAAP EBIT margin for Q2 instead of 4% (which in both cases is not enough for sustainable profitability in the long term, as you can guess).

Overall, Q1 seemed pretty weak to me. However, I noted that the customer base was doing well according to the more detailed comments from management, which gave hope for further business growth and subsequent full monetization (I mean margin expansion in this particular case).

We only know that Snowflake now has 485 customers generating over $1 million in TTM product revenue, marking a 30% increase, and 709 Forbes Global 2000 customers, an 8% rise YoY, according to the press release. I therefore see no major problems with demand for the company’s products.

However, ahead of the Q2 FY 2025 report, I am concerned about the results of a study (survey) by Well Fargo that provides disappointing data for SNOW:

The data breach was first reported by Snowflake on its blog in late May. It’s since come to light that the breach affected significant customers, such as AT&T (T), Live Nation Entertainment (LYV) subsidiary TicketMaster and LendingTree (TREE).

“From our quarterly survey of >$1M customers, we came across multiple breach impacted customers stating plans to move off of SNOW, inc. two >$25M in ARR and another >$5M,” Turrin [Well Fargo analyst] noted.

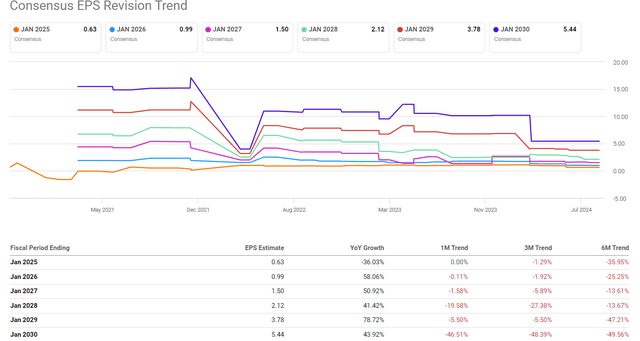

If the company’s main customers have really started to look for new solutions on the market (of which there have clearly been a lot in recent years), then Snowflake could clearly be in trouble in the area we couldn’t doubt just a few months ago. Even if the influx of new customers remains at the same level, the outflow of old customers could put significant pressure on potential margin growth – in which case even the EPS forecasts, which have been sharply reduced in recent months (but still drawing growth in profitability in the coming quarters), will prove too optimistic.

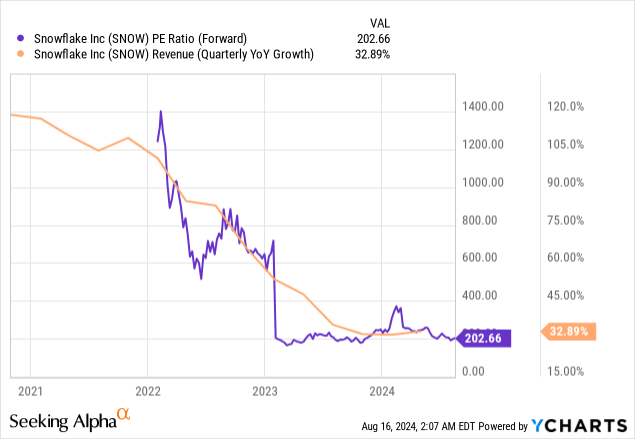

The still excessively expensive SNOW valuation adds fuel to the fire of the current situation. As I noted in my previous article, I think it’s logical to think that as growth slows, and the company breaks into profit, its stock’s valuation multiples should also fall – in SNOW’s case, this is still not happening as expected:

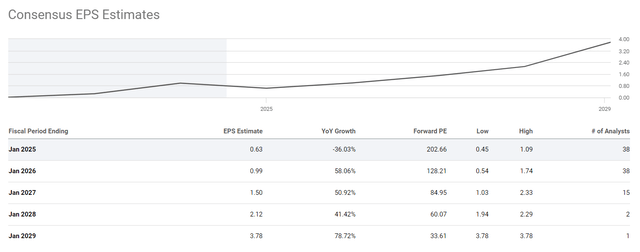

Of course, P/Es are highly sensitive to even minor changes in EPS, where just a few cents more in EPS can significantly alter the whole picture. Management has indicated that the EBIT margin for Q2 and FY2025 will likely be worse than in Q1, and I currently see no reason to doubt this. So with an EBIT margin of 3%, it’s puzzling how SNOW could achieve $0.63 EPS for FY2025, as the consensus expects. Additionally, it’s unclear why SNOW should maintain such high valuation multiples in the coming years, even considering the forecasted strong earnings growth due to the low-base effect. So the company’s valuation premium still looks unforgivably high to me, and there’s more downside to the growth built into current EPS projections (following Wells Fargo’s recent survey findings) than we could have assumed before.

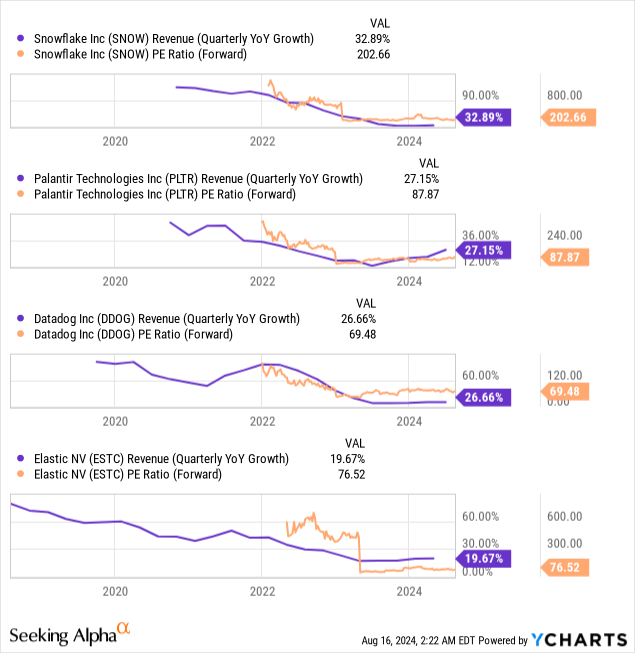

When comparing Snowflake to its closest peers in the SaaS industry, such as Palantir (PLTR), Datadog (DDOG), and Elastic (ESTC), SNOW’s valuation multiples are, on average, twice higher. However, its revenue growth rate is not exceptionally high and doesn’t surpass its peers by 2x (the difference is just 6.3%, i.e. SNOW’s last quarter revenue growth rate is only 1/5 higher compared to the peers’ average). Additionally, with SNOW’s management forecasting a slowdown in growth from 33% to 26.5%, SNOW’s Q2 revenue growth rate will be approximately on par with Datadog’s Q1 revenue growth, despite the significant difference in valuation multiples.

I expect another weak quarter for the company, at best, with a confirmation of past guidance. However, the risk that management will again delay plans to stabilize margins and achieve operating profit on an unadjusted basis seems greater than ever. Hence, my “Sell” rating less than a week before the Q2 release.

Where Can I Be Wrong?

Maybe I’m too pessimistic about what SNOW can actually do. Perhaps I’m focusing too much on just one source from the sell side. Some banks are much more optimistic. Goldman Sachs, for example, puts SNOW on its famous Conviction List, calling it a “next-layer gen AI winner with a new CEO focused on accelerating product innovation”:

Goldman Sachs [proprietary source, August 2024]![Goldman Sachs [proprietary source, August 2024]](https://static.seekingalpha.com/uploads/2024/8/16/49513514-17237898317838397.png)

Perhaps the new management will really dispel all my doubts at the Q2 earnings call, and then the upward reaction could signal the start of a new recovery phase. In any case, technical analysis suggests that if this scenario materializes, we have a chance to see a massive reversal back to the $210-220/sh level.

TrendSpider Software, SNOW, the author’s notes

The Bottom Line

Despite the above upside risks to my bearish thesis, as in the past, I tend to think SNOW is a highly overvalued company relative to its peers, with growth rates likely to approach the industry average soon – a very poor starting point for investors, even considering that a lot of bad news has already been reflected in the stock price through EPS downward revisions.

I think the risk/reward ratio has shifted to the risk side due to recent indirect indications that Snowflake may have customer retention issues – if this risk materializes, I don’t know what support the SNOW stock price could receive. Given the risks associated with the stock, I’ve decided to reiterate my previous “Sell” rating less than a week before the Q2 FY2025 release.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!