Summary:

- Snowflake’s stock surged 48% since my ‘Strong Buy’ rating in August 2024; I reiterate a ‘Strong Buy’ with a $215 price target.

- SNOW’s strategic partnership with Anthropic will enhance Cortex AI, driving significant growth and adoption among existing customers.

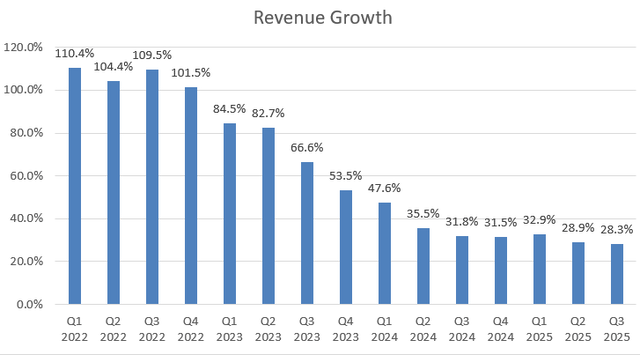

- Q3 FY25 results showed 28.3% YoY revenue growth, 55% RPO growth, and a net retention rate of 127%, prompting raised full-year guidance.

- Key risk: Databricks’ rapid growth and AI model development could challenge Snowflake’s market position; investors should monitor closely.

Laurence Dutton

Since I published my ‘Strong Buy’ thesis on Snowflake (NYSE:SNOW) in August 2024, the stock price has surged by more than 48%. I discussed the potential impact from their cyberattack in the previous article. Snowflake delivered a strong Q3 result, beating the market expectations. I reiterate a ‘Strong Buy’ with a one-year price target of $215 per share.

Anthropic Will Be Available Within Snowflake Cortex AI

On November 20th, 2024, Snowflake and Anthropicsigned a multi-year strategic partnership to integrate Anthropic’s latest Claude 3.5 Sonnet model into Snowflake’s platform. Anthropic’s AI model will be available for uses within Snowflake Cortex AI. As discussed in my previous article, Snowflake Cortex AI can help customers build generative AI applications, leveraging fully managed large language models (LLM). Customers could utilize AI models with no-code, SQL and Python interfaces. With the partnership with Anthropic, I believe Snowflake can bring its Cortex AI to the next level.

During the Q3 FY25 earnings call, the management highlighted significant adoption of Cortex AI among existing customers and improvements in go-to-market efforts. Snowflake Cortex AI could become a significant growth driver for Snowflake in the near future, in my view.

Q3 Result and Outlook

Snowflake released its Q3 FY25 result on November 20th after the market close, reporting 28.3% year-over-year growth in revenue and 55% growth in remaining performance obligations (RPO).

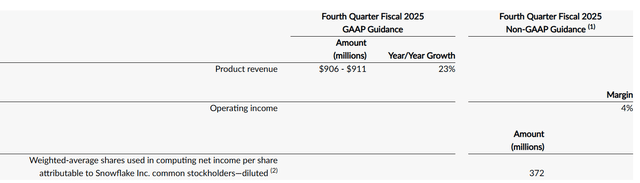

Following the strong growth in revenue and RPO, the company raised its full-year guidance for product revenue growth to 23% year-over-year growth. Notably, Snowflake also reported a net retention rate of 127%,reflecting strong adoption of Snowflake’s platform and AI functionality.

On the capital allocation front, Snowflake repurchased $1.9 billion of own stocks year-to-date, with $2 billion remaining on their authorization through March 2027, as noted during the earnings call.

For the near-term growth, I am considering the following drivers:

- As discussed in my previous article, Snowflake operates on a consumption-based pricing model, with revenue tied to actual customer usage. It is quite normal for enterprise customers to test some workflows on Snowflake’s platform, then scale usage for data analytics. I anticipate Snowflake will generate 10% annual revenue growth from existing customers as consumption increases.

- Snowflake has done a great job to increase their large-customer base. As of Q3 FY25, there were 542 customers with trailing 12-month product revenue greater than $1 million, growing by 24.3% year-over-year. I anticipate the company will continue adding new customers, contribute 20% growth to the overall topline.

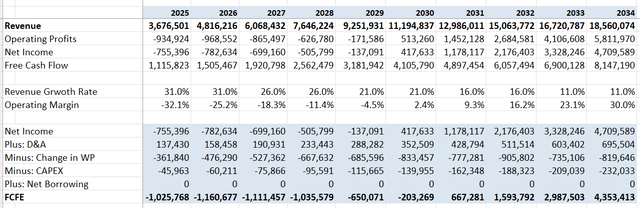

- I anticipate the company will allocate 5% of revenue toward M&A, contributing 1% growth to the topline.

- Snowflake spent heavily in R&D and sales/marketing, representing over 45% and 49% of revenue in FY24, respectively. I project the company will continue investing in their R&D, sales and marketing. However, as the business scales, I anticipate the company will generate operating leverage from both R&D and sales/marketing. I calculate the total operating expenses will grow by 24.5% annually, leading to an operating margin expansion to 30% by FY24. I think a 30% operating margin is typical for software companies.

- The cost of equity is calculated to be 14% assuming: risk free rate 3.6%; beta 1.49; equity risk premium 6%.

With these assumptions, I calculate the free cash flow from equity (FCFE) as follows:

Discounting all the future FCFE to the year-end of FY25, the one-year target price is calculated to be $215 per share, as per my estimates.

Key Risk

Databricks is Snowflake’s main competitor. As reported by the media, Databricks expects to achieve $2.4 billion in annualized revenue, growing 60% year-over-year. While Databricks’s revenue is slightly lower than Snowflake’s, Databricks is growing rapidly. In addition, Databricks has been developing their own AI model, DBRX, with a plan to launch under an open-source license. Snowflake’s investors should pay attention to Databricks’s progress with their own AI model and customer adoption.

Conclusion

Snowflake delivered a robust quarterly result, firing on all cylinders. I think their partnership with Anthropic could potentially strengthen their platforms and AI offerings. I reiterate a ‘Strong Buy’ with a one-year price target of $215 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.