Summary:

- Snowflake is seeing selling pressure in FY 2024 despite the cloud platform seeing strong top line growth and a 1 PP revenue acceleration in FQ1’25.

- The company’s net losses are a concern, but free cash flow remains strong, with a 40% margin in the last quarter.

- Relatively new and evolving product offers like Snowflake Cortex AI make the Snowflake platform more attractive to enterprise customers.

- Snowflake’s valuation is currently a bargain, with a 53% discount to its historical price-to-revenue ratio.

BlackJack3D

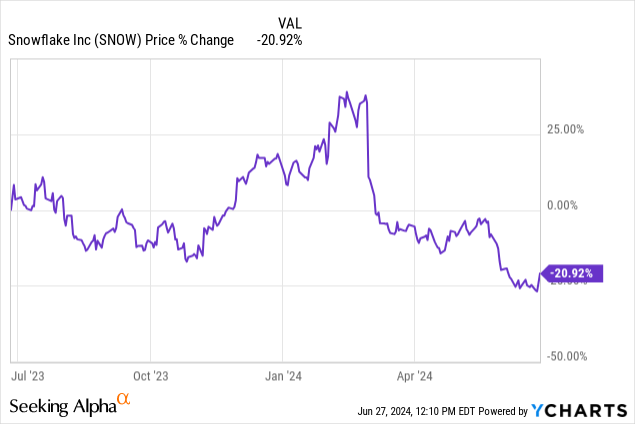

Since the company’s earnings report at the end of May, Snowflake (SNOW) has seen serious pricing weakness, although the earnings report was quite solid. The data cloud service provider generated very strong top line growth, saw a sequential revenue acceleration and raised its guidance for full-year revenues. Nonetheless, the company’s shares fell to a new 1-year low in June on concerns over profitability. I believe investors are massively overreacting to the company’s earnings report and I think the excessive drop this year is a golden opportunity for investors to load up the truck!

Previous rating

I rated shares of Snowflake a strong buy in March 2024 after the CEO announced that he was leaving the company and investors panicked as a result. Since then, shares of Snowflake have revalued 30% lower, although the data cloud’s actual business performance in FQ1’25 was not bad at all. In my opinion, investors are too dismissive of the cloud platform’s free cash flow strength and Snowflake has an attractive opportunity to grow its AI product offerings.

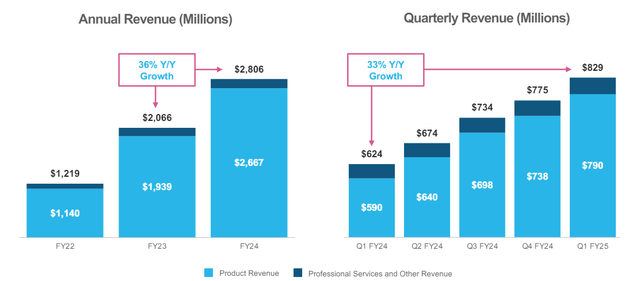

Strong top line growth, revenue acceleration

Snowflake’s financial performance results for FQ1’25 were very strong, but the market currently is not ready to reward the company for it, in part due to concerns over profitability. Snowflake’s FQ1’25 revenues came in at $829M (+33% Y/Y), and consisted mostly of recurring product revenues. Compared to the previous quarter, Snowflake benefited from a 1 PP top line acceleration as the company’s cloud products remain in high demand and Snowflake continue to do well with its largest customers.

Snowflake

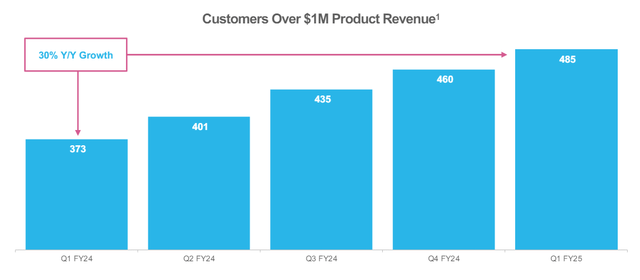

One area in which Snowflake continues to do very well is in customer accounts that generate at least $1.0M in recurring annual product revenue. These accounts typically belong to enterprise customers and are obviously very lucrative for the data cloud provider. In the first fiscal quarter of FY 2025, this group of customers saw massive 30% growth compared to the year-earlier period. At no point in the company’s history did Snowflake have more high-paying enterprise customers in its portfolio: a total of 485 which is the equivalent of 5% of the entire customer base.

Snowflake

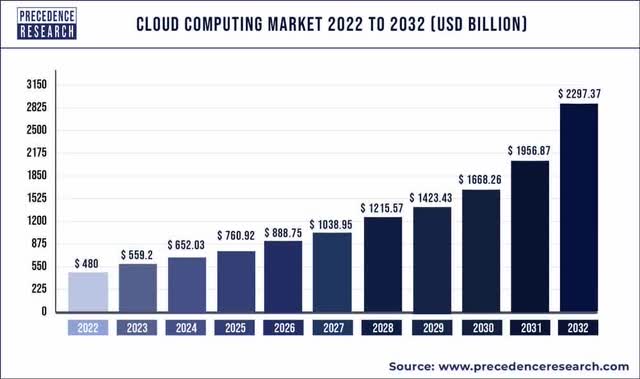

Long term market opportunity in Cloud/AI

The market for cloud computing platforms is only going to grow as more workloads (which are increasingly driven by AI) are moving to the cloud. According to Precedence Research, the cloud computing market could be worth up to $2.3T by the end of FY 2033 which implies an average annual growth rate of 17%.

Snowflake has a significant lever for long term revenue growth, in my opinion, and this is the company’s focus on AI products that allow enterprise customers to build their own AI apps and deploy them at scale. One vehicle that Snowflake is using here its the new Snowflake Cortex AI tool which allows customers to scale applications and engage with enterprise data through chatbots. The benefit for customers here is that they can leverage the strength of Snowflake’s AI models without a coding background and customize the AI for their industry-specific needs.

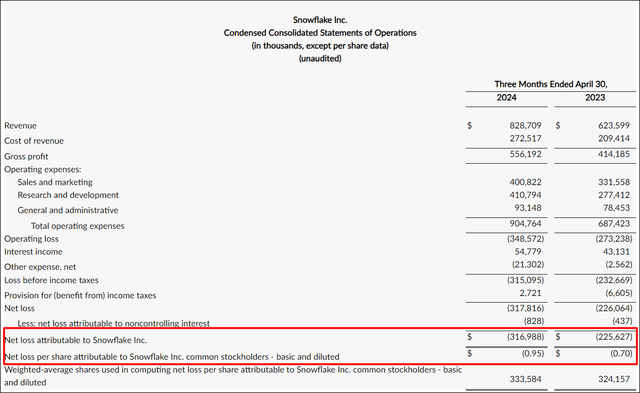

High SBC, but impressive free cash flows

One aspect that seems to weigh more heavily on investors lately is Snowflake’s lack of profitability. In FQ1’25, the data cloud service provider lost $317M which calculates to a net margin of (38)%: this means that the could platform lost 38 cents for each dollar it brought in in revenues and a major driver of this loss is stock-based compensation. In FQ1’25, Snowflake spent $360.4M on SBC which was almost singularly responsible for the cloud platform’s net loss. Software companies tend to have high SBC expenses, however, and Snowflake is hardly alone here.

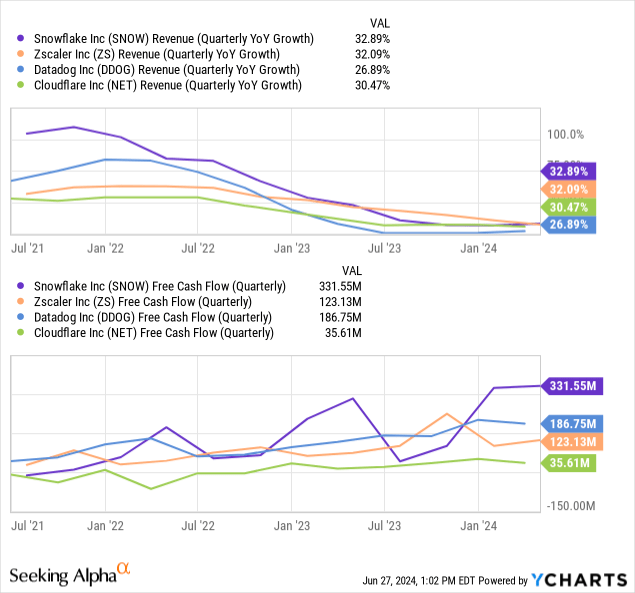

While the net income/SBC picture does not look very compelling, Snowflake’s free cash flow looks great. The cloud company generated $331.5M in free cash flow (+17% Y/Y) just in the last quarter on revenues of $828.9M. This calculates to an impressive free cash flow margin of 40%. Compared to the previous quarter, the FCF margin dropped 2 PP, but overall Snowflake is not exactly doing poorly in terms of free cash flow generation.

|

$ in thousands |

Q1’24 |

Q2’24 |

Q3’24 |

Q4’24 |

Q1’25 |

Y/Y Growth |

|

Product Revenue |

$590,072 |

$640,209 |

$698,478 |

$738,090 |

$789,587 |

34% |

|

Professional Services |

$33,527 |

$33,809 |

$35,695 |

$36,609 |

$39,122 |

17% |

|

Total Revenue |

$623,599 |

$674,018 |

$734,173 |

$774,699 |

$828,709 |

33% |

|

Net Cash from Operating Activities |

$299,444 |

$83,191 |

$120,907 |

$344,580 |

$355,468 |

19% |

|

Property, Plant & Equipment |

($6,970) |

($6,298) |

($8,746) |

($13,072) |

($16,519) |

137% |

|

Capitalized Software Development Costs |

($9,341) |

($7,874) |

($9,889) |

($7,029) |

($7,404) |

-21% |

|

Free Cash Flow |

$283,133 |

$69,019 |

$102,272 |

$324,479 |

$331,545 |

17% |

|

Free Cash Flow Margin |

45% |

10% |

14% |

42% |

40% |

-5 PP |

(Source: Author)

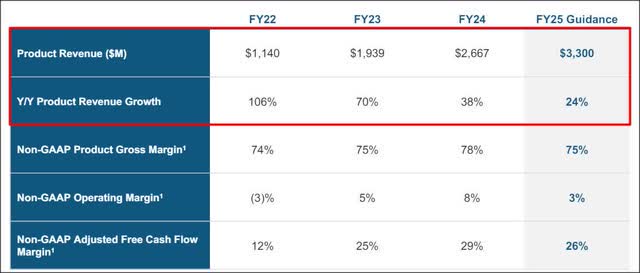

Guidance raise

Snowflake raised its guidance for full-year revenues by $50M to $3.3B due to strong customer interest in the company’s AI data cloud. The new outlook implies a 24% top line growth as opposed to 22% before. I believe Snowflake has an opportunity here especially with enterprise clients as the cloud company scales its AI data cloud platform. Snowflake is bringing generative AI solutions to the enterprise cloud market which could lead to accelerating product uptake as well as a boost to the company’s already strong product momentum in the foreseeable future.

Snowflake

Snowflake’s valuation

Snowflake is a bargain, in my opinion. The data cloud service provider saw its share price decline by 33% year-to-date which is not the result of weak business performance or execution. What has changed in recent months is that investors have been more concerned with costs rather than top line growth which explains why shares of Snowflake have somewhat rotated out of favor with investors.

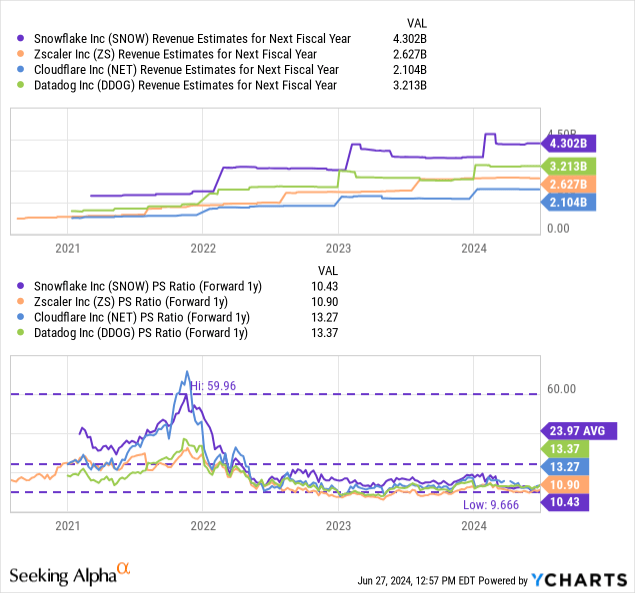

From a valuation point of view, however, I believe Snowflake currently makes the best value proposition in at least one year. Shares of the data cloud company are valued at a price-to-revenue ratio of 10.4X which is not an outrageously expensive revenue multiplier to pay for a software/cloud company that is expanding its revenue base by 33% Y/Y.

Between FY 2025 and FY 2030, Snowflake is expected to grow its revenues at an average annual rate of 28% and the company could have a period-end revenue base of $12.2B. If Snowflake can maintain a 35-40% free cash flow margin until this time, the cloud platform could be on track to generate $4.3-4.9B annually in free cash flow, a large portion of which could be returned to shareholders through stock buybacks. The massive ramp in free cash flow is why I believe shares of Snowflake are undervalued.

Snowflake was valued at an average price-to-revenue ratio of 24.0X in the last three years… meaning investors buying the drop here get a 56% discount to the longer term P/S average. In my last work on Snowflake in March I stated that I saw a fair value P/S ratio of 20.0X for the cloud company, chiefly because of its enormous free cash flow and significant top line growth that is expected to last for years as more enterprise customers are likely to sign up for Snowflake’s AI-supported data cloud and specific tools such as Snowflake Cortex AI.

Rival cloud platforms like Datadog (DDOG), Cloudflare (NET) and Zscaler (ZS) all trade at least at 10.0X forward revenues and are all more expensive than Snowflake. However, Snowflake has the highest top line growth and generates significantly more free cash flow.

A 20.0X P/S ratio implies a fair value in the neighborhood of $257 (down slightly from my previous estimate of $261 due to a correction in top line estimates) which calculates to approximately 92% revaluation potential for shares of Snowflake.

Risks with Snowflake

The biggest risk for Snowflake, as I see it, is a potential deceleration of the company’s top line growth and a widening of losses in the short term. Snowflake is paying too much in terms of SBC, which is something that I don’t like about many companies, including Salesforce or Palantir (PLTR). However, free cash flow looks great. I would change my opinion on Snowflake if the company were to see a drastic drop-off in its free cash flow (margins).

Final thoughts

Snowflake actually delivered quite decent results lately, so I believe the post-earnings sell-off is not really justified. I said the same thing after the CEO left earlier this year (about which I was wrong), but a look at the company’s latest performance results shows clearly that Snowflake is actually executing its business strategy very well… and the company continues to benefit from strong enterprise customer demand for its cloud services. I expect positive updates about product adoption of Snowflake Cortex AI going forward. While high operating expenses weigh on Snowflake, driven by SBC, the company’s free cash flow looks great. And since free cash flow is more valuable than GAAP net income, I believe this is a great time to load up the truck!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.