Summary:

- Snowflake’s data warehouse and data lake are the vital funnels for AI ingestion and should remain an essential cog in the AI revolution.

- Its market leadership in data warehousing will keep it as a preferred provider for the AI data deluge.

- It has strong competitive advantages of an agnostic platform, switching costs, and the network effects of a shared marketplace.

- Snowflake has a strong pipeline of new products, including Cortex AI, to continue growing.

- The stock has come down to a much better valuation with limited downside.

Sundry Photography

Snowflake’s (NYSE:SNOW) recovered to $137 from its 52-week low of $122 in late June. I believe the downside is limited from here and if it executes well the stock should continue going up.

It’s had a disastrous year so far, down 31% YTD. On earnings day, Feb 28th, Snowflake announced that the existing CEO Frank Slootman was leaving his role but continuing on as chairman. Neeva’s cofounder, which was taken over by Snowflake in 2023 to augment its AI capabilities, Sridhar Ramaswamy, was taking his place. It also lowered guidance for the next quarter and full year FY2025. The stock tanked from $237 to $184 in a matter of days, and then steadily declined to about $155 around Q1-25 earnings. Snowflake actually beat Q1-2025 earnings, provided higher guidance and announced several new initiatives, but given the skittishness in the markets, the “only” 24% forecasted revenue growth just wasn’t good to instill confidence in investors.

I bought around $150-155 initially, believing the stock to be a bargain, and have added more between $125 and $135. I believe that there are several strong catalysts to goose the stock. Besides, it is no longer selling for 16-20x sales, instead it’s now below 13x sales, more in line with its more sedate mid-twenties revenue growth.

The Bull Case

The proliferation of data

Snowflake filled in a large void in the previous decade when it launched its cloud-based data warehouse, replacing cumbersome, painful, and slow-moving data storage and processes from on-premise systems to the cloud. The jump to an agnostic, cloud native and unencumbered platform was a godsend for companies with their vast treasure troves of data and Snowflake replaced databases with data warehouses by the millions, growing revenues at a clip of 96% from a measly $97Mn in FY2019 to $2.8Bn in FY24.

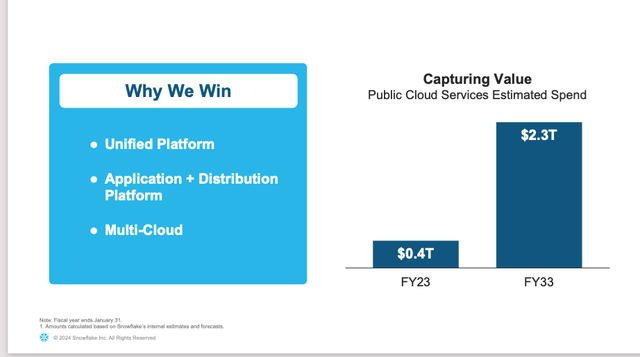

The creation of meaningful, monetizable AI use cases without large amounts of data are not possible, and clearly with these estimates below of cloud spend, the data deluge will continue. You can’t train large language models without data. Snowflake has the first mover advantage with its data warehousing strengths, where it is one of the market leaders along with the big three Amazon’s (AMZN) AWS, Microsoft’s (MSFT) Azure and Alphabet’s (GOOG) Google Cloud.

The Data Deluge (Snowflake)

Clearly, regardless of the method and the carrier, you can’t get any AI solutions unless you can make the data easily ingestible and analyzable; Data warehouses and data lakes would be the right way to do it. As these estimates show, there is a sixfold increase in data spend from data collection and analytics, which will increase usage of Snowflake’s platform and strengthen Snowflake’s stickiness.

Neither Snowflake nor closest competitor, Databricks have moats yet, and they both face significant competition from AWS, Azure, and Google Cloud, but in my opinion, both have the best tools to synthesize data for machine learning and large language modeling to make the most of this demand. Snowflake offers both data warehousing and data lakes, which cuts out significant costs of ownership for enterprises on numerous public clouds.

Expanding its pipeline

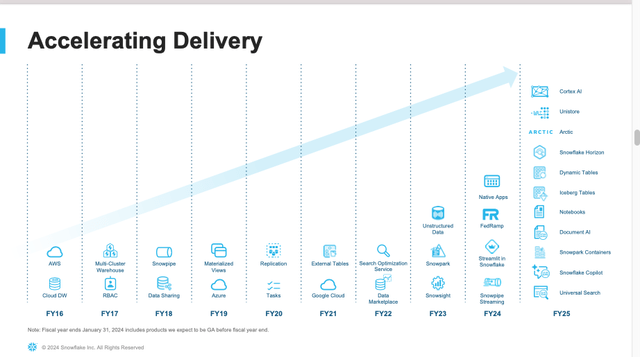

As we can see from the pipeline, Snowflake has added several products to its Cloud DW.

With AI being the need of the hour, in FY23 it added crucial data lakes for unstructured data. Data lakes are used to store not just structured data within a database or data warehouse, but also data that is not yet fully indexed (either unstructured or semi structured data), which is ingested into AI models for training and indexed for data warehouses as structured data to easily be queried.

Snowpark, which was first introduced in Q1-FY2023 as a faster migration tool to accelerate workloads, has already reached 50% adoption by Q1-FY2025, showing that customers have responded well. Unstructured data, which was one of Databricks key strengths, has an adoption rate of over 40%.

The current year, FY2025, has the largest pipeline with eleven new products.

Snowflake Product Pipeline (Snowflake)

The AI initiative

Snowflake’s foray in AI is Cortex AI, which it launched this year and will start contributing to revenue in 2H-FY2025. As I mentioned earlier, Snowflake bought Neeva for AI, and having its co-founder now running the parent company is a huge plus. At the end of Q1, 750 customers were using Cortex AI. Snowflake has positioned Cortex AI as a value creation for the end customer; like all its other products, it’s consumption based, easy to use so that customers can iterate fast, use it in their products and get value out of it for themselves. This in turn could lead to bigger commitments without customers having to pony up a lot of capital upfront.

Speaking of Cortex AI, this is what CEO, Sridhar Ramaswamy said on the earnings call…

Uniformly, the feedback that we get about Cortex, which is our AI layer, from pretty tough tech reviewers is that, yes, we truly make the hard easy because anybody that can write SQL, now is able to do some pretty nifty things with AI. I think that combination of simplicity and ease of use is an incredibly powerful quality for Snowflake. And while I knew it, I think it is still a surprise, a pleasant surprise every time customers bring it up.

Snowflake’s platform agnostic data

Snowflake lowers the cost of building data warehouses and lakes for enterprise customers, similar to the big cloud service providers. It does have a competitive advantage over them – Snowflake’s data platform is agnostic for its customers. Building a data warehouse with the big three means being stuck in a walled garden, as Redshift only runs on AWS and Azure’s Data Warehouse runs only on Azure. Imagine the run time and humongous expenses when you combine mergers with two or three disparate walled gardens of data, so the switching costs are arduous and enormous. It gets worse if the data is critical to the business. With Snowflake there are no walled gardens and therefore no need for conversions.

Switching costs makes it sticky

Another advantage is the stickiness, in spite of not having a subscription model with multi-year contracts. Snowflake’s is a consumption-based model, and if they decide to go for a Subscription as a Service, the business could get even stickier. Switching costs in enterprise software are more dependent on implementation pain points and costs, rather than lock ins. Snowflake’s NRR of 128% speaks volumes for Snowflakes’ stickiness.

Snowflake’s Network Effects

The Snowflake Data Marketplace allows and encourages data sharing. Some examples are FactSet for financial data, the CDC and AccuWeather – data from these companies can be purchased by other companies. Purchasers and sellers of data don’t have to worry where each other’s data is housed or where the workloads are. With Snowflake, such data sharing across different public clouds can happen seamlessly and be transferred easily. This has a network effect, and is likely to keep growing, with more customers and more data available in the same marketplace. As of Q1-FY25, more than 33% of customers were sharing data, up from 24% a year ago.

Snowflake’s Operating Metrics

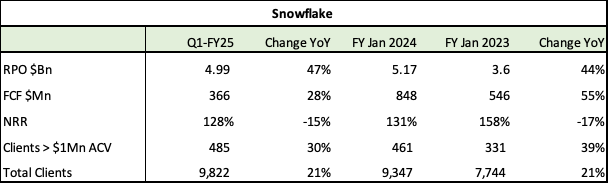

Snowflake’s operating metrics (Snowflake, Seeking Alpha, Fountainhead)

These are pretty good metrics, and it’s always a plus when the RPO is growing faster at 47% and 44% respectively than the mid-twenties earnings growth that we saw in Q1-FY2025. I also suspect that given the strong RPO and better the first quarter revenue beat, there is scope for the guidance being conservative.

Free cash flow is growing at 28% and is at 30% of revenues. With the heavy SBC of $331Mn and lack of operating profits, this is still a revenue growth story and churning out a 30% cash flow margin is excellent.

While the Dollar based Net Revenue Rate (NRR) declined by 15%, at 128% it’s still high and a sign of strength.

Large clients (over $1Mn in ACV) continued to grow in Q1-FY25 at 30%, easily outpacing the 21% overall client growth.

The Bear Case

The giants are looking over your shoulder

Amazon, Microsoft and Alphabet have been bundling data management and analytical services similar to Snowflake’s, with one estimate suggesting that Amazon’s data analytics business grew by over $3Bn last year. All three have money to spare to enter into this business.

The big three could open the walled gardens

Snowflake and Databricks made it big because of AWS’, Azure’s, and Google Cloud’s walled gardens. Customers not willing to be locked in to the big three leapt at the chance of an agnostic, easily movable data warehouse consumption model. Though the chances of the big three going cloud neutral are low, it remains a threat to Snowflake’s business model.

The Databricks threat

Databricks’ faster growth of 50% and supposed lead in AI could be a threat to Snowflake. The perception that Snowflake is playing catch up could see it lose market value, when even a beaten down P/S ratio of 13 could drop like a brick. Databricks has made headway in AI, and as the article suggests at a reasonable cost and speed, similar to Snowflake’s. Perhaps it had to, Databricks was proactive enough to realize OpenAI shouldn’t capsize its business. For now, Snowflake and Databricks are the vital funnels for AI ingestion and should remain an essential cog in this wheel.

It must keep growing fast

Snowflake cannot take its foot of the accelerator in any way; I would think that 24-25% revenue growth is the bare minimum, especially when even their adjusted operating margins are a paltry 3-5%, you could very easily see them below 10x revenues with a weak quarter, especially when they haven’t taken part in this AI revolution, where even when the moribund Hewlett Packard (HPE) has bounced back 26% in the past year on AI hopes.

Competitors

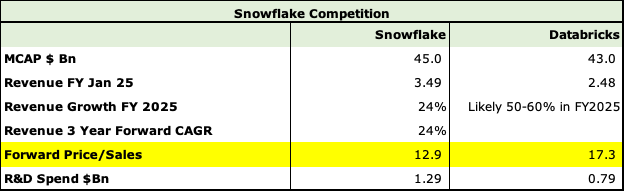

Snowflake and Databricks (Snowflake, CNBC, The Information, Fountainhead)

Note: Databricks is a private company and its market cap/valuation is based on the last funding round in Sep 2023 and is an estimate.

Snowflake’s chief competitor is Databricks, which grew faster at 50% last year compared to Snowflake’s 36%. Of course, that’s on much lower revenue. This year it’s also expected to grow over 50% compared to Snowflake’s 24%, and at $2.5Bn in sales, is now narrowing the gap to Snowflake’s $3.5Bn. Based on the $43Bn valuation, Databricks’ P/S is much higher at 17 to Snowflake’s 13, but that’s normal considering the growth.

I believe that there is ample room for both competitors, they are essential data funnels for AI training and inference.

Valuation

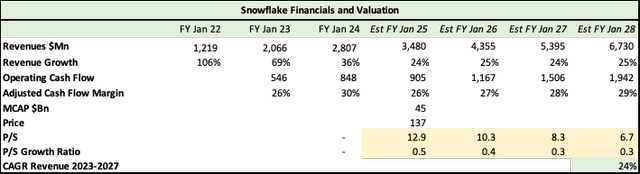

Snowflake valuation (Snowflake, Seeking Alpha, Fountainhead)

Snowflake is a revenue growth story, and besides the cash flow margin of 30%, there are no operating profits to speak of, (most of that is because of AI related R&D spend, including GPU purchases, so how bad can that be) and no visibility of any operating profits for at least for the next two years, and I’m aware of that risk. This spending actually resulted in the very fast development of their own LLM, Arctic – I believe that’s the right way to go.

Revenue growth is a reason to buy, and unlike other older and slower legacy enterprise software, SaaS businesses, which deserve lower multiples, Snowflake is an emerging cloud native AI company that deserves a premium. I don’t think 24% annual revenue growth is something to be sneezed at, and a new focus on AI related business could be the kicker. Cortex AI revenue is not included in these estimates. Snowflake was extremely rich for the past year – its 52-week high was $237, over 20x sales, and with a 19% decline in the past year, it’s now worth buying at 13x sales. With an estimated 3-year revenue CAGR of 24%, the P/S drops to 8, and the P/S growth ratio drops to 0.3. This is a long-term story and I do expect some volatility and will add more on declines.

I’m recommending a buy for its market leadership and strengths in data warehousing and data lakes, which will keep it as a preferred provider for the data deluge.

Snowflake’s data warehouse and data lake are the vital funnels for AI ingestion and should remain an essential cog in the AI revolution.

It has strong competitive advantages of the stickiness of a data agnostic platform, shared platform network effects and high switching costs. I also believe in its strong pipeline of data and AI products.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW, AMZN, GOOG, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.