Summary:

- Recently, shares of leading solar inverter system supplier SolarEdge Technologies, Inc. have deteriorated to new multi-year lows.

- With the company’s core European market plagued by weak customer confidence, regulatory uncertainties, and competitive pressures, investors are heading for the exits.

- On Tuesday, competitor Enphase Energy reported disappointing Q3 results and provided a weak near-term outlook, with Europe expected to deteriorate even further.

- SolarEdge needs to significantly reduce operating expenses, improve gross margins, and likely raise additional capital to ensure survival beyond next year.

- Given these issues, I am downgrading SolarEdge Technologies’ shares from “Sell” to “Strong Sell” going into the company’s Q3 report on November 6.

romaset

Note:

I have covered SolarEdge Technologies, Inc. (NASDAQ:SEDG) or “SolarEdge” previously, so investors should view this as an update to my earlier articles on the company.

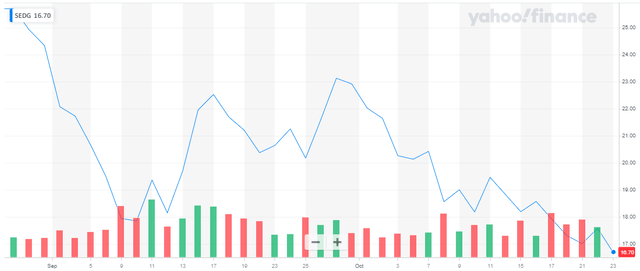

Since my last update on leading solar inverter system supplier SolarEdge Technologies, the company’s share price has deteriorated to new multi-year lows:

Recently, numerous analysts have become increasingly cautious about near-term prospects for SolarEdge’s core European market.

According to TD Cowen, Q3 residential installations in Germany, one of the company’s largest markets, were down 13% on a sequential basis and 29% year-over-year due to several issues, including:

- Customers have become less concerned about rising energy prices.

- Weak economic conditions have resulted in reduced customer confidence levels and declining purchasing power.

In addition, other leading European markets are experiencing headwinds from regulatory uncertainties (Netherlands) and anticipated lower utility rates (France).

Moreover, with Chinese competitors aggressively trying to take market share, pricing pressure remains a concern.

After the close of Tuesday’s session, competitor Enphase Energy, Inc. (ENPH) or “Enphase” reported disappointing third quarter results and provided very weak fourth quarter guidance.

While Enphase’s sales in Europe were down 15% sequentially, sell-through of the company’s products was down an eye-catching 34% thus resulting in the requirement to further reduce shipments into the European channel.

Even worse, Enphase management expects things in Europe to get even worse in the near term.

However, Enphase derives only 25% of its revenues from sources outside the United States, as compared to 75% for SolarEdge. In FY2023, Europe represented approximately 64% of the company’s sales.

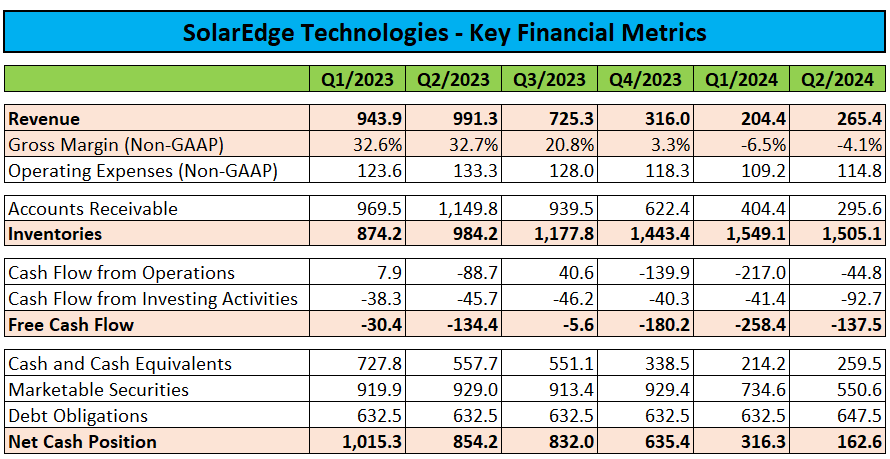

In addition, Enphase has continued to generate substantial free cash flow in recent quarters, while SolarEdge has burned $750 million since the beginning of 2023.

Following a $300 million convertible notes offering in June, the company finished the second quarter with $810.1 million in cash and liquid investments and $647.5 million in debt. After quarter-end, the company issued another $37 million in 2029 convertible notes due to initial purchasers exercising the overallotment option.

Company Press Releases / Regulatory Filings

However, with negative gross margins, high inventory levels and a weaker-than-expected operating environment in Europe, cash burn is likely to continue for at least the next couple of quarters which would be in contrast to management’s previously stated expectations.

Remember also that SolarEdge will have to redeem $347.5 million in convertible notes in less than twelve months. Assuming a quarterly cash burn of around $135 million, the company would end Q3/2025 with cash and liquid investments below $100 million, implying a cash runway of about a year.

In addition, with quarterly revenues down and inventories up by more than 70% year-over-year, I would expect SolarEdge’s Q3 results to include a sizeable inventory charge.

Please note also that following the abrupt resignation of the company’s long-standing CEO Zvi Lando two months ago, SolarEdge still hasn’t installed new permanent leadership.

However, with the company’s core markets deteriorating even further, decisive action will be required. SolarEdge needs to significantly reduce operating expenses, improve gross margins and likely raise additional capital to ensure survival beyond next year.

Given these issues, I am downgrading SolarEdge’s shares from “Sell” to “Strong Sell” going into the company’s Q3 report on November 6.

Bottom Line

With SolarEdge Technologies’ core market expected to deteriorate even further going into 2025, interim management will likely be required to take decisive action.

For my part, I wouldn’t be surprised to see the company announce substantial headcount reductions, facility closures and material inventory charges when the company reports Q3 results in early November. Even another capital raise might be in the cards.

Given these issues, I am downgrading SolarEdge Technologies’ shares from “Sell” to “Strong Sell” going into the company’s Q3 report on November 6.

Risk Factors

While highly unlikely, a better-than-feared Q3 report and outlook would likely result in a major relief rally in SolarEdge Technologies, Inc.’s shares.

However, competitor Enphase Energy’s disappointing third quarter results and outlook have made it apparent that there won’t be an easy cure to SolarEdge’s persistent issues anytime soon.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Massively Outperform in Any Market

Value Investor’s Edge provides the world’s best energy, shipping, and offshore market research. Even during turbulent market conditions, our long-only models have outperformed the S&P 500 by more than 30% YTD.

We also offer income-focused coverage geared towards investors who prefer lower-risk firms with steady dividend payouts. Our 8-year track record proves the ability of our analyst team to outperform across all market conditions. Join VIE now to access our latest top picks and model portfolios.