Summary:

- SolarEdge faces significant challenges with inventory issues and organizational instability, despite a recent CEO change and efforts to refocus on core businesses.

- The company has cut its Energy Storage business and laid off 500 employees, but cost savings are minimal, and the new CEO’s strategy remains unclear.

- Goldman Sachs upgraded SolarEdge to a Buy, but with a turnaround not expected until 2026, it’s too early for a confident investment.

- SolarEdge needs to resolve inventory problems and demonstrate sustainable sales at non-discounted prices before a solid investment base can be established.

Mike_Russell

While the solar sector got some good news on the interest rate front, the sector didn’t benefit from Donald Trump winning the U.S. election. SolarEdge Technologies, Inc. (NASDAQ:SEDG) continues to try to turn the business around with a new CEO while working to solve the lingering inventory issue. My investment thesis is still Neutral on the stock, though a key analyst issued a double upgrade on SolarEdge in a sign that the stock looking for a bottom.

Source: Finviz

New Disruptions

Just back on December 5, CMO Shuki Nir took over as the new CEO. Ronen Faier served as interim CEO since August and the company has already gone through massive disruptions during this period.

While SolarEdge was making progress in turning around the business, the company missed Q3 results and the turnaround stalled. The company only guided to Q4 revenue of $180 to $200 million, on par to set a new low for the cycle.

In addition, SolarEdge cut the Energy Storage business, eliminating one of the future bright opportunities for the business. The company cut 500 employees from South Korea in the process, but the cost savings only amounted to $7.5 million.

Oddly, this decision was made a week before the new CEO was promoted to the position. Investors now go into year-end with no real view of the new CEO’s position on the turnaround.

Back on the Q3’24 earnings call, the interim CEO set out three priorities and the recent news doesn’t help the first priority one bit:

- Achieve financial and organizational stability.

- Recapture market share.

- Refocus on our core businesses.

The biggest issue facing SolarEdge is organizational stability. Since the earnings report, the company has replaced the Chairman of the BoD, announced the hiring of a new CEO, and closed the Energy Storage business.

All of these moves are moving towards the goal of refocusing on the core business and achieving organizational stability. The problem is that this can’t occur until the top executive is in place and the person officially highlights the corporate goals going forward.

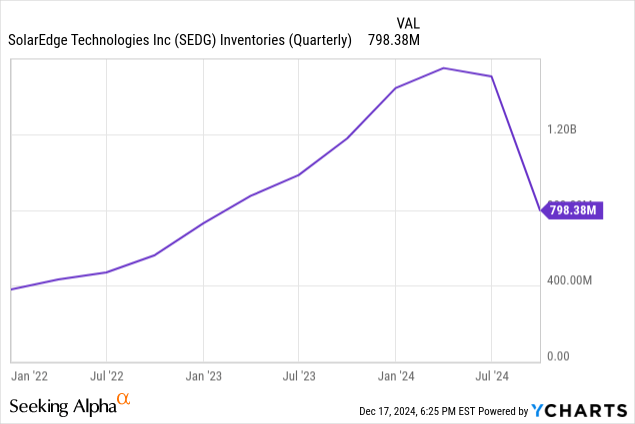

SolarEdge still faces a major inventory issue with the balance sheet cluttered with ~$800 million. The amount is down from near peak levels due primarily to writing down $612 million worth of inventory during Q3.

SolarEdge only consumed $95 million worth of inventory for sales of $261 million in the last quarter. The issue has been compounded by the company’s constant under-shipping sales due to extra inventory held by distributors.

The company only has a goal of reaching inventory levels of 90 days by the end of 2025. In a year, SolarEdge will have some old inventory on the balance sheet

For this reason, SolarEdge appears to be pushing even more inventory into the channel via promotions when existing inventory isn’t selling through the channel. On the Q3’24 earnings call, the CEO made the following statement on promotions:

…this inventory has already been paid for and allowed us to launch aggressive share recapturing measures. Last week, we rolled out price reductions and promotions in Europe and international markets which will allow us to better compete and reduce the pricing gap with our low-cost competitors. We believe that these price levels in conjunction of the 45x manufacturing credits and the rollout of next-generation products which will carry significantly improved cost structures will enable us to return to our historic gross margin levels of over 30% once existing inventory is consumed.

The statements are very alarming because they highlight the prime issue with the inventory situation. SolarEdge is having trouble moving inventory due to both price and technology with the distributors stuck with older products now.

The company suggests the promotional pricing will hit revenues for at least two quarters with normalized results not showing up until Q2’25, at the earliest. SolarEdge still claimed a massive difference between the sell-through number and actual sales by nearly $200 million as follows:

- Q3’24A: $261M, $189M under shipped.

- Q2’24A: $265M, $275M under shipped.

- Q1’24A: $200M, $250M+ under shipped.

- Q4’23A: $316M, ~$200M under shipped.

In essence, SolarEdge is suggesting quarterly sales are still in the $450 million range amounting to nearly $2 billion on an annual base. The big question is how much the sell-through is based on promotions, especially with the company now providing discounts for the distributors to take the product, so these companies are likely dumping the product on the market.

Too Early For A Buy Rating

This week, SolarEdge received a rare double upgrade by Goldman Sachs from a Sell rating to a Buy. The analyst even suggests the call is a bit early and is oddly more bullish on the stock due to the ‘shrink-to-grow strategy’. Goldman Sachs doesn’t forecast a key inflection until 2025 and has estimates below consensus numbers.

With a turnaround not really designed until 2026, investors have no reason to rush into SolarEdge now. The solar energy market could face some pressure from tax credits due to the new administration favoring traditional oil and natural gas, though a recent bill would preserve the 45X credits for American companies and block Chinese manufacturers from obtaining the credit via U.S. production facilities.

The stock might be scraping off the bottom, but SolarEdge needs to get beyond this lingering inventory issue and see the plans of the new CEO before any rally is sustainable. As typical, the new CEO could have more restructuring plans, which again goes counter to the priorities presented by the interim management team just over a month ago.

SolarEdge has a cash balance of $678 million and should be able to continue monetizing high inventory levels to quickly shift toward positive cash flows. Though a few more quarters of large losses and cash burn rates, the thesis could turn more risky due to the company having $676 million in convertible debt.

Takeaway

The key investor takeaway is that Goldman Sachs appears to have jumped the gun here. SolarEdge still needs to clean out excess inventory in the system and prove that the company can still sell inventory at non-discounted prices under unknown plans from a new CEO.

Investors don’t need a perfect situation to start investing in solar stock again, but SolarEdge needs to signal more signs of actually reaching the bottom before a solid base can be built.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.