Summary:

- SolarEdge Technologies has faced a significant decline of ~59% since a bearish outlook was published by me in May due to poor Q2 performance amid macroeconomic challenges.

- The company’s cash-flow fundamentals are weak, and a substantial inventory buildup could lead to significant write-downs and financial issues by 2025.

- Customers may choose to avoid SolarEdge in favor of Enphase due to perceptions of its stability risk.

- Even if interest rates decline, a hard economic landing may increase solar lending costs sufficiently that it remains uneconomic for most homeowners.

- Although SolarEdge’s downside risk remains significant, it is likely too dangerous to short, given excessive short interest on the stock and its recovery potential, given a potential soft economic landing.

1shot Production

In May, I published a bearish outlook on the solar product company SolarEdge Technologies (NASDAQ:SEDG) in “SolarEdge: Lost Its Edge Over The Competition.” At the time, I had a particularly bearish outlook on the stock due to a combination of headwinds that I expected would hamper its valuation.

These include the impact of high-interest rates and weaker consumer strength on residential solar demand, negatively impacting all companies in the solar market. This was exacerbated by its apparent competitive decline against Enphase (ENPH) and the risk that Tesla (TSLA) may eventually expand its existing inverter product line, using its vast capital supply. Lastly, I had a bearish outlook because SolarEdge’s cash-flow fundamentals appeared abysmal, with no promise that its inventory buildup may eventually solve the issue.

Since then, SEDG has declined by a staggering ~59%. Its Q2 earnings report was a miss, with a non-GAAP EPS of -$1.79, $0.23 below expectations, while its sales were down 73% YoY. Most troubling was its continued negative gross margin, seeing its TTM gross margin fall to 7.8%, down from the mid-30% range during its stronger years of 2016-2022. Its inverter shipments also crashed 80% YoY, mainly as it produces products but is struggling to sell them, allowing its inventory to build up in hopes that prices will recover, and it will clear inventories in 2025.

Last month, the company laid off 400 workers, its second significant round of layoffs this year. Accordingly, this year, it has laid off around 23% of its previous year-end workforce, indicating it is fighting severe financial pressure. It offered $300M in private convertible debt in June at a 2.25% interest rate due 2029, converting at ~$34 per share. The stock is now down to $21, but this offering indicates the firm may need to dramatically dilute its equity (currently worth ~$1.2B) to try to maintain its cash position.

When a stock is down by over 90% from a stable high range, I think it’s reasonable to question its viability or perceptions of such. Clearly, the market’s expectation of it has turned abysmal. The main question, for me, is if it will manage to sell its colossal inventory buildup. A major cause of its crash is that it simply has seen a massive decline in sales but has maintained relatively high production, resulting in a staggering inventory of $1.5B. To recover, it must sell this inventory, and ideally do so at a profitable price. We must consider potential changes in macroeconomic and competitive conditions to determine the feasibility of that.

Lower Rates Will Not Save SolarEdge

The solar market has been particularly impacted by the rise in interest rates, which has hindered demand for both residential and commercial applications. The average electricity bill is around $147 per month in the US today (though it is far higher in some states). When homeowners could invest in solar with a $20K loan at <5%, they may be paying around $150 per month, which is likely a saving on power. However, now that rates are 5% higher, that payment is likely closer to $230, meaning solar is no longer a savings outside a few states like California (assuming a $25K loan – after tax rebates, not counting “loan buydown” situations). However, California also removed incentives for rooftop solar, hampering one of the best global markets for companies like SolarEdge.

This trend is generally similar in Europe. In January 2023, SolarEdge’s CEO announced that he expected booming demand from Europe. However, Europe’s demand for SolarEdge’s products plummeted last year, likely as its natural gas prices surprisingly moderated, minimizing impacts from the Russia-Ukraine war. Higher rates and weaker macroeconomic strength also harmed demand.

In both North America and Europe, interest rates are likely to have peaked and will soon fall. However, as detailed in many of my recent articles and potentially confirmed over recent weeks, a “hard landing” seems more likely than a “soft landing.” In other words, interest rates may fall, but only because the economy is falling faster. Solar loans are unsecured, so they are particularly risky for banks, indicating rates may not decline with Treasury rates if economic consumer strength is falling.

Overall, I think there is no reason to believe solar macroeconomic conditions will improve in the foreseeable future. The market needs a return to rare “goldilocks” conditions of relative economic stability and near-zero interest rates. Historically speaking, those conditions are rare despite being common over much of the past decade and likely are a culprit behind the recent inflationary pressures. In my view, the best macroeconomic condition may be a sharp rise in natural gas prices due to geopolitical issues that cause electricity to become so expensive that solar again becomes a reasonable investment. However, even then, the macroeconomic fallout of an energy crisis may be too significant to favor large capital investments. Thus, I do not see any return to the strong economic conditions that SolarEdge is counting on.

SolarEdge’s Inventory May Not Become Cash

SolarEdge’s management indicated it expected inventory to fall in Q1 with higher spring installations. Its inventory declined, as seasonally expected, but not enough to demonstrate strength or recovery. As such, we have a growing risk that its products in inventory will become obsolete, potentially resulting in significant write-downs. Though the firm maintains it is avoiding that, it becomes more likely as its competitor, Enphase releases new models, such as its recent commercial iQ8 microinverter.

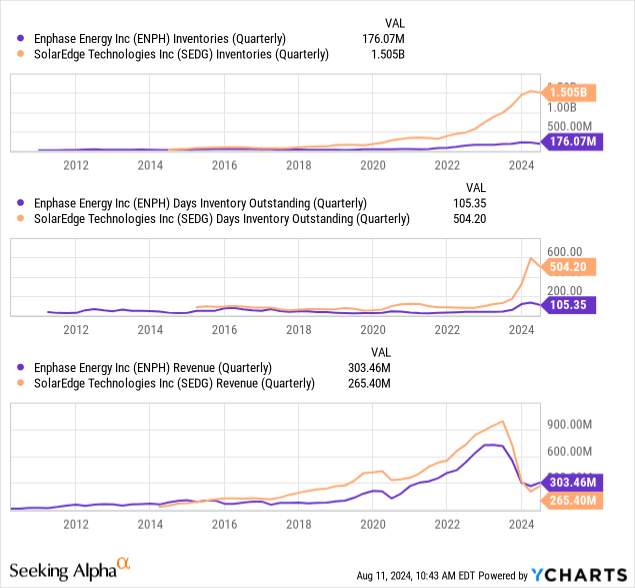

Now, both Enphase and SolarEdge have struggled with current macroeconomic conditions. However, Enphase was much quicker to slow its production, and has faced a lower percentage decline in sales. SolarEdge was dominant before the crash, but now has weaker sales. More importantly, only SolarEdge has a huge inventory buildup. See below:

Although solar sales are weak, there is still significant room for technological innovation in the market. As such, the value of SolarEdge’s inventory will decline every day it fails to sell. Again, I do not expect global macroeconomic conditions will recover in 2025 as the company hopes, meaning it may need to sell these products at a more significant discount soon.

The need is becoming dire. Its current liabilities were ~$567M, while its TTM CFO was -$361M. It had $260M in cash and $690M if we count short-term investments. The company has enough liquidity to manage the rest of the year. Still, unless it can dramatically reduce inventories (as it hopes to), I do not think it can avoid financial issues by 2025.

The Bottom Line

Before the spike in its profits and collapse after 2021, it earned around $150M per year, with similar CFO levels. Thus, if it were to recover, it may trade at a “P/E” of around 7-10X, depending on what its net interest costs turn out at. Given the risk that the macroeconomic environment will not recover quickly enough, I do not think that is necessarily a low enough valuation. That said, those with a bullish macro view on residential solar may be justified at its current valuation, particularly assuming it will convert its inventory to liquidity in early 2025 as it hopes to.

In my opinion, it is more likely to face the knock-on effects of a crisis in confidence from both investors and customers. Ultimately, companies that require liquidity depend greatly on investor confidence to give it a high enough valuation to make it worthwhile. However, when the stock is plummeting, its ability to sell equity or convertible debt at a reasonable cost becomes very low.

The potential customer confidence issue may be much worse. Whether or not SolarEdge is a going concern risk (I’m not saying it necessarily is), it undoubtedly appears to be one when looking at its stock price, particularly compared to Enphase, which has stabilized in 2024. So, if you’re a solar sales & installation company or a customer, you may factor this risk into deciding whether to go with Enphase or SolarEdge. It would likely be challenging to fulfill a warranty or maintenance issue on a company if it was no longer in business.

Now again, this may not be an actual risk, but I imagine some solar sales companies may be opting for Enphase because they perceive it to be a more stable company. Of course, unstable companies may also excessively cut costs, hampering their technological edge or customer satisfaction. Thus, for me, SolarEdge does face some existential risk due to a potential decline in customers’ perception of stability.

Overall, I do not believe SEDG is clearly undervalued despite its vast decline. If we assume a soft economic landing and recovery in residential solar that allows it to profitably offload its inventory without write-downs and eventually return to its former position, it would certainly be undervalued today. That said, I think the economic outlook for solar, combined with its fundamental financial position and growing competitive weakness, is sufficient to make its risk too high.

I would not bet against it. Short interest is now 30%, and it has not had a recent short squeeze. Thus, there is a decent risk that it will have a dead-cat bounce or a recovery. Still, I think the combination of macroeconomic, industry-specific, and company-specific headwinds is sufficient that it may continue to slide.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.