Summary:

- SolarEdge Technologies is thriving amidst supply chain disruptions through government support and a growing customer base.

- The company is well-positioned to benefit from the intention to cut interest rates, resulting in affordable borrowing costs.

- SolarEdge is recovering from fierce competition, with a positive earnings review and valuation, making it a good investment option.

Jeff_Hu/iStock via Getty Images

Introduction

SolarEdge Technologies (NASDAQ:SEDG) designs, manufactures and sells inverter systems to enable the generation of optimized solar energy photovoltaic installations. Its technologies have diversified products such as power optimizers, inverters, and cloud-based monitoring systems. The company initially targeted residential markets, but it has started commercial needs.

While the rapid demand for electricity in the world is expected to rise to 160 exajoules by 2040, the company has faced increasing threats of supply chain disruption and fierce competition since 2023, which has led to its stock’s bad performance.

However, with SolarEdge’s firm commitment to accelerating the shift to a low-carbon world powered by a distributed and decentralized energy network, as its CEO reaffirms, the company has realized its vision and has recorded a good quarter in Q2 2024, coupled with government support. Therefore, we rate the SolarEdge as a Strong Buy.

SEDG is thriving amidst supply chain disruption through the follow ways

Government Support

China poses a major solar energy disruption in the US, where SolarEdge operates. China installed more solar panels than the US in 2023. Currently, China operates 80% of the world’s solar panel market share, which is a major warning to SolarEdge.

The US government introduced subsidies that favour US-based companies towards the production of affordable solar panels. SolarEdge and its competitors have a competitive edge over China’s solar panels since the subsidies policy. The US has also introduced tariff rates to protect local manufacturers from China’s affordable imports.

This decision favoured SolarEdge, as reported in Q2 2024. The company has started recording positive revenues even with reduced shipments due to a favourable environment.

SolarEdge is well-positioned to benefit from the US Federal Reserve’s intention to cut interest rates resulting in affordable borrowing costs.

SolarEdge has recorded an operational income loss from Q4-2023 -$237.milion to Q2-2024 – $160.2 million. Access to low-interest-rate loans will allow SolarEdge to ramp up its operations. The solar energy sector is poised to benefit from lower interest rates as a declining inflation rate will increase consumer spending. Consumers are expected to have disposable income to invest in solar panel installations.

Bolstered market demand

Currently, only 4% of US power generation comes from solar panels. The forecast for solar generation growth is tremendous as more businesses and people push for clean energy.

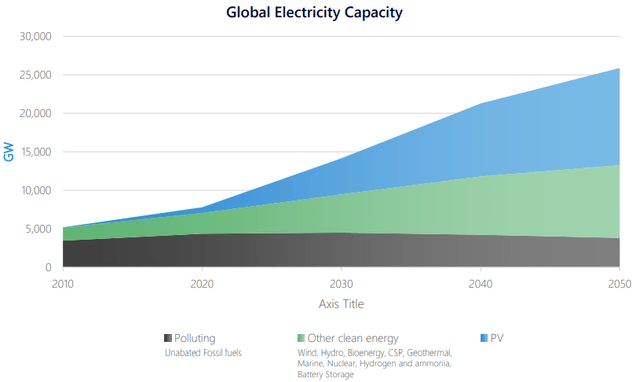

Photovoltaic (PV) energy demand is increasing globally. According to SolarEdge, in Q2-2024, the company is actively positioning itself to this demand, recognizing the growth of electrification and independent energy demands. Decarbonization commitments also scale PV, as most industries are driven by ESG standards. The company will also benefit from other US government’s decarbonization initiatives.

Since these policies were implemented, solar energy peers, including SolarEdge, have started to recover from the projected increasing demand for solar energy. A further exponential increase in solar power compared to other alternatives is expected as renewables start dominating electricity.

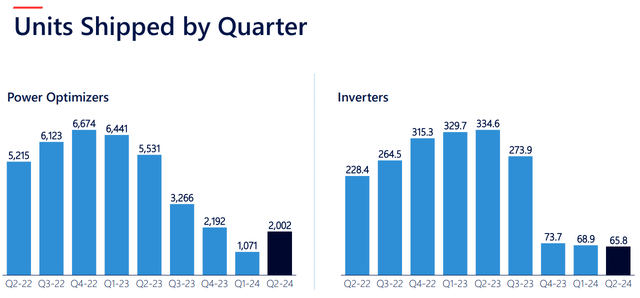

SolarEdge, in its latest Q2-2024, reported a rise of monitored systems to 4 million, 128.2 million shipped power optimizers, 54.5 GW capacity systems, and 5.7 million shipped inverters. With the forecast for the next two years’ US energy power generation expected to be driven by wind and solar energy, SolarEdge is prepared to profit from a 75% growth in solar energy demand. By 2025, there will be an increase in solar power generation from 163 billion KWh in 2023 to 286 KWh in 2025.

Growing customer base

There is a demand for solid solar energy as power prices surge, which will also drive the rise of other electricity sources, including solar energy generation. Recall that the existing 4% US solar generation will experience a tremendous score bearing the opportunities available for solar expansion. This creates a better chance to prepare a buy amid the imminent shift to clean energy.

The US government intervention has significantly improved solar energy efficiency. Solar panel technology has been made more affordable. The subsidy policy will greatly enhance solar panel manufacturing efficiency and improve commercial customer demand.

A survey shows that 90% of SolarEdge inverter users recommend the company products following high energy conversion ranging between 5-25% compared to traditional inverters. SolarEdge inverters can convert a quarter of sunlight, making it an attractive option for businesses and homeowners.

Recovering amid fierce competition

Some of SolarEdge’s competitors include Allegro MicroSystems (ALGM) and Enphase (ENPH). Let’s look at how SolarEdge is completing with Enphase. Under Inverters, the two companies have leverage in producing efficient inverters for home and business use. SolarEdge and Enphase are close competitors in the production of inverters sharing a market share of 95%. Enphase has 48% and SolarEdge 40% of the world’s inverters’ market share.

|

Competition differences between SolarEdge and Enphase |

|

|

SolarEdge |

Enphase |

|

The size of SolarEdge inverters is limited to the central inverter, which can only take a specified number of solar panels. |

Enphase inverters have microinverters that can take a flexible number of solar panels. Consumers who prefer to expand in the future prefer Enphase products. |

|

SolarEdge inverters are compatible with multiple high-voltage batteries, such as LG Chem RESEU. LG batteries are ranked as the best energy storage battery solution. |

Enphase has not partnered with battery manufacturers. Instead, Enphase makes its proprietary batteries. |

|

SolarEdge inverter has a 99.25% overall efficiency. |

Enphase IQ 7 series has 97% efficiency. |

|

Warrant coverage

|

Warrant coverage

|

The recent new optimizers influenced the increased shipment in Q1-2024 as they have become affordable and provide better energy harvesting capacities. SolarEdge integrated options offer consumption monitoring, vehicle charging, and more, giving it an edge over Enphase.

By having a competitive edge over its competitors, SolarEdge Q3-2024 forecasts an increase in revenues from the solar segment from $245 million to $280 million. IRA manufacturing tax credit is accounted as the basis of achieving a positive gross margin between 0% to 4%. The company can report revenue of between $260 million and $290 million.

Earnings review and valuation

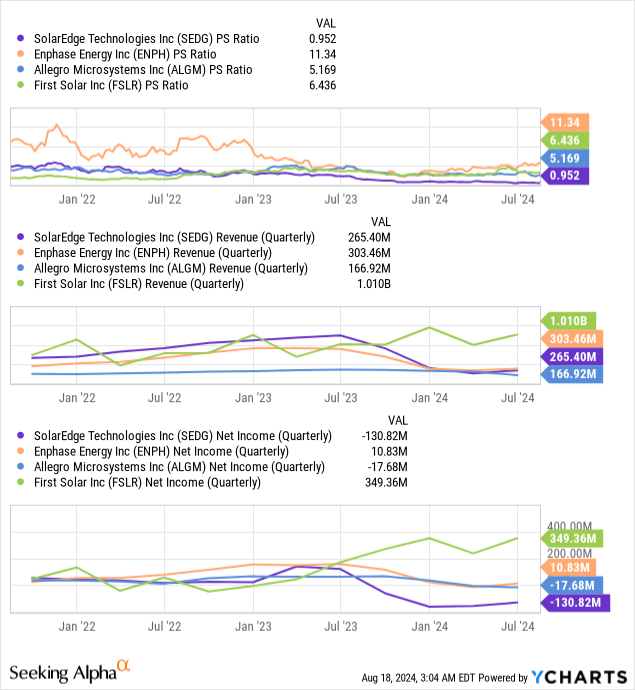

While the company is still bothered by disruptive hurdles like supply chain and competition, it still announced record positive results in Q2 2024, which shows its solid business model and profitability. The revenues increased to US$265.2 million in Q2 2024 from US$204.2 million in Q1. Non-GAAP net profit margin reduced from Q1 2024 -6.5% to positive 0.2% in this quarter. This shows that the company is recovering from a its negative earnings position, which may enhance its stock performance

In terms of valuation, the PS ratio is at slightly lower than 1x, while its closest competitors such as Enphase and Allegro Microsystems are at around 11x and 5x respectively, even the sales performance of the company is no worse than its peers. This is mainly attributed to the loss SolarEdge is experiencing in the last couple quarters, from which the company is recovering from as discussed.

Therefore, I forecast that the SolarEdge PS ratio will climb back in the next few quarters given the macro and company-specific factors. One major reason being that the solar sector will be experiencing increased customers, with clean energy policies starting to take shape. For example, the reduction of interest rates in US government subsidies is projected to improve disposable income and solar panels’ affordability. Inevitably, customers are about to demand more inverters as projected. As such, we project that the PS ratio will climb slightly closer to its peers to around 1.7x – 2.5x this year.

With consensus revenue at around US$1.1 billion in this financial year, this will indicate a target price range at around $31 – $45, which is a more than 20% upside. Therefore, we rate it as a Strong Buy.

Investment risks

- Government inaction: The US Federal Reserve Bank may fail to lower interest rates. The anticipated affordable credit financing and disposable income would diminish declining sales and revenues.

- Increasing competition: Microinverters from companies like Enphase pose a significant threat to SolarEdge inverters. The two close competitors fiercely compete for the power optimizers’ market share, with Enphase in the lead.

- Changing market: Solar energy, while being a reliable and economic source of renewable energy, has its problems of intermittency and lower utilization rate. Therefore, other types of renewable energy like wind and hydropower, may come on top in the future.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.