Summary:

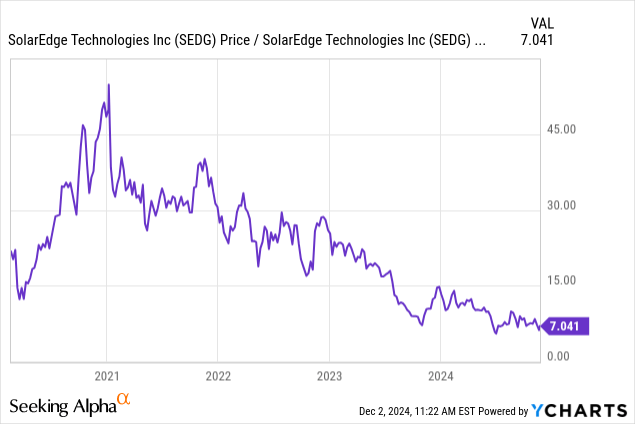

- SolarEdge Technologies, Inc. has significantly underperformed, dropping 71% since I initially flagged its balance sheet weaknesses and competitive disadvantages against Enphase.

- In August, I predicted an unlikely recovery and anticipated a substantial inventory write-down due to the competitive obsolescence of its stagnant products.

- Q3 results confirmed my suspicions, with a $1B write-down leading to a sharp stock decline and subsequent layoffs and unit closures.

- Trump tariffs and other regulatory changes may exacerbate headwinds in US solar demand, which should not recover until borrowing costs are much lower or power is pricier.

- Although I remain bearish, SEDG’s high short interest and potentially low forward valuation give it upside potential, particularly if macro headwinds subside.

filo

The solar inverter company SolarEdge Technologies, Inc. (NASDAQ:SEDG) has been one of my better-performing picks this year. I initiated a bearish outlook in May, seeing that the company was likely losing its edge on Enphase (ENPH) and was likely to hemorrhage value due to its balance sheet weakness. It is down 71% since then. I updated my view in an August article, “SolarEdge: Low Probability That Residential Solar Will Recover In 2025,” seeing a recovery as unlikely and predicting it would face a significant write-down on its excessive inventory as it became competitively obsolete.

That is precisely what happened in Q3, leading to an over $1B write-down, which resulted in a ~16% stock decline after its disappointing report. It is now down ~30% since my August report. The company recently decided to close its energy-storage unit and lay off 12% of its staff. It is currently down 30% since my August report. The stock continued losses throughout the first half of November, likely due to concerns regarding the incoming administration’s impact on US green energy policy, given most solar (TAN) and wind (FAN) stocks fell markedly in early November.

That said, SEDG did rise ~40% from its November low to Monday, signaling some investors may be looking for a value opportunity. Short interest on the stock is extremely high at 33.5%, and its forward EPS estimate is -$17.23, far above its $15.2 price (as of Monday morning). Thus, there is ample speculation and interest on both sides, with some sure that it will recover and others betting that it may fail or face other significant financial pressures. To determine this, we must consider its financial situation, the macroeconomic environment, and changes to its management team’s operating focus.

SolarEdge Needs More Global Power Inflation

SolarEdge’s issues are multifaceted. In my view, it faces difficulties on three fronts. The largest is the macroeconomic decline in solar demand, which has shifted the solar inverter market into a glut. This is overshadowed by what I believe to be poor financial and operational management, which has exacerbated its exposure to what should have been a predictable economic headwind.

My premise is that most people adopt solar to save money in the long term. Three years ago, interest rates were meager and electricity costs quickly rose in the US, making solar a money-saving investment. In my last article, I calculated that the average American household would likely see a net gain from solar if they could borrow at around 5% (given the payment on a $20K 20-year loan would be about equal to the average electricity bill). That assumes the Federal tax credit remains in place, which Donald Trump may not keep.

Of course, not counting rate buydown options, most borrowers will pay a 3-7% spread on solar loans to the long-term Treasury rate. Again, as with mortgage rates, the Federal Reserve does not dictate long-term rates and long-term interest rates. The 20-year Treasury rate (US20Y) remains around 4.5% and has not moved significantly since 2022, meaning most solar loans will have an effective borrowing cost of ~9%. Thus, rooftop solar is generally not an economic benefit for homeowners in the US unless they assume extreme increases in electricity costs over the next twenty years.

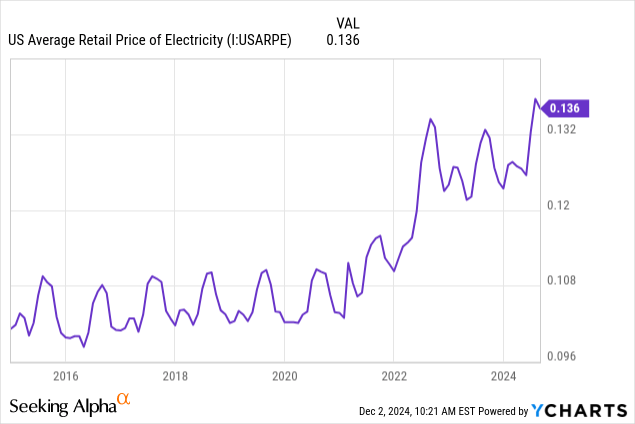

On that note, average US power prices recently made a new high and broke above the range from late 2022 through most of this year. See below:

I expect that SolarEdge will not see significant demand rebound unless power costs surge again, as they did in 2022. Still, with long-term interest rates where they are, I believe that even a 2021-2022 style power increase would not have the same positive impact for SolarEdge. Household buying power is, in my view, not strong today compared to then (buoyed by COVID-19 stimulus), so I remain doubtful regarding SolarEdge’s macro prospects for the years to come.

Undoubtedly, this issue could be exacerbated by the Trump administration’s plans. SolarEdge produces and exports from numerous countries and could face financial pressure from tariffs. However, it has some manufacturing operations in the US. Still, solar panels almost all come from China, which is expected to face added tariffs. That would come on top of significant existing tariffs on Chinese solar products. Although these tariffs may be needed due to human rights issues in China’s solar factories and are of strategic importance, they are certainly a net negative for SolarEdge.

The US is not SolarEdge’s only market but its most significant. Further, most other Western markets are seeing similar issues. This includes notable demand declines in Europe, making it more difficult for SolarEdge to complete its plan of retaking European market share to offset US losses. Fundamentally, all Western countries are seeing much higher long-term interest rates today, and although few are in economic crisis, few are seeing the economic strength common in the 2010s.

Many analysts expect SolarEdge’s sales to recover over the coming years. Its sales are expected to rebound from $920M this year to $1.3B in 2025 and back up to over $2B by 2027. Based only on the macroeconomic environment, I do not see much evidence for this. I doubt that rooftop solar demand will return to 2021 levels outside a return to the odd conditions of 2021, with high-powered inflation and meager borrowing rates.

SolarEdge’s Financial Position is Alarming

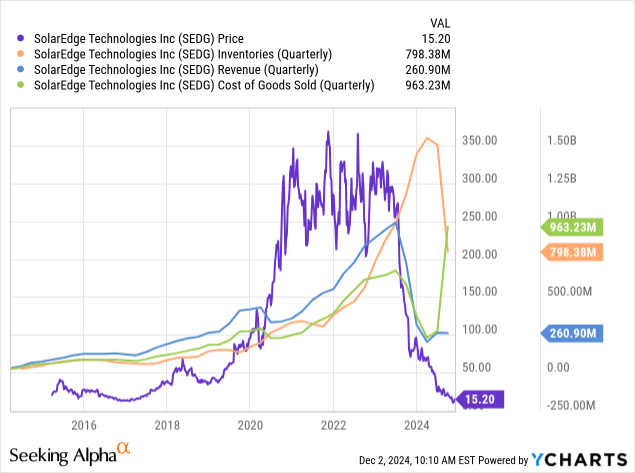

SolarEdge has had an immense inventory buildup due to a collapse in its sales. As its sales plummeted, it continued to have high output levels for some time, as seen in its cost of goods sold. Its COGS eventually fell to meet its sales around Q2 of this year, allowing a peak to its inventories. However, in Q3, it took a massive write-down to the value of its inventories. See below:

The significant spike in its cost of goods was driven by an increase in inventory write-down accruals of $642M (10-Q pg. 12), meaning the direct COGS for the quarter was likely in line with Q2. This implies a continued shift from production as the company lays off more of its workforce and reorganizes. Ideally, this will keep its inventory buildup risks low, but regardless, its sales are likely not large enough to offset all of its expenses.

Per its investor presentation, its non-GAAP operating expenses were 44.6% in Q3, compared to 14-17% from 2021 to 2023. Its non-GAAP gross margin was also -265%, implying it is immensely unprofitable even if we do not account for some of its recent one-off charges.

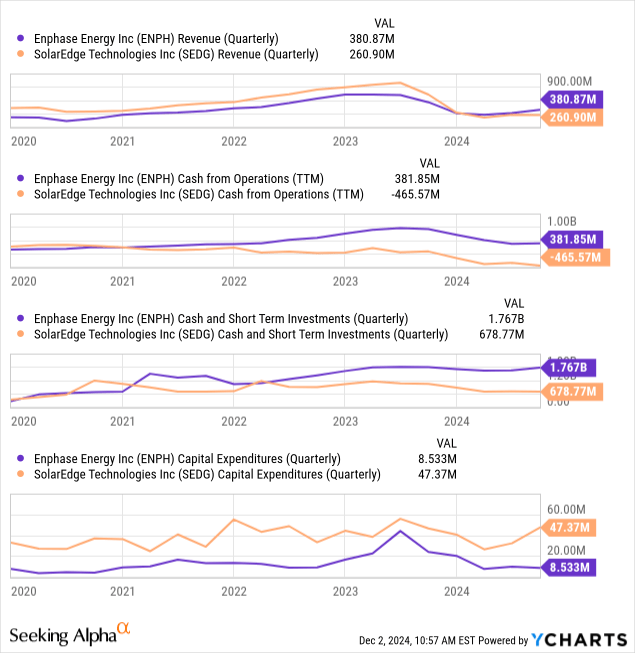

The gap between SolarEdge and Enphase has continued to grow. Enphase has also lost sales, but managed to see a slight sales rebound last quarter. Enphase has also maintained positive operating cash flows despite significant macroeconomic headwinds. Its cash and ST investment position has increased slightly, while SolarEdge’s has trimmed lower. Despite this, SolarEdge has outspent Enphase on capital investments. See below:

Although these two companies are highly similar and direct competitors, their approach to the slowdown differs. Enphase was quick to pull back and focus on financial stability. SolarEdge was slightly dominant prior, was not quick to lower its production level, and has maintained large investment spending, even when it may need to focus on its liquidity position. That spending is likely based on its US projects that could not be stalled. SolarEdge expects its capital spending to fall as soon as those projects are completed.

It is early to say which approach will be best; however, Enphase has a clear short-term advantage regarding its financial position to handle continued strain. If, for whatever reason, solar demand rises rapidly over the next year or two, SolarEdge may be in a better position because it has ample inventory to sell and likely greater production capacity. However, if we assume the slowdown continues, I think it lacks the financial stability to handle it, given its poor margins and cash flows.

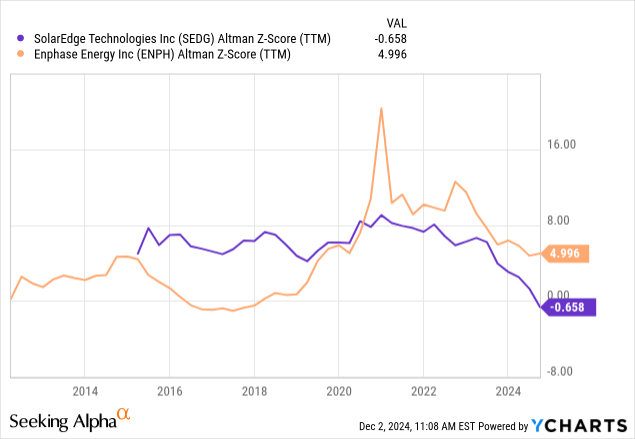

The Altman Z-score measures financial restructuring or bankruptcy risk. It is not perfect, but it is generally accurate in predicting bankruptcy for manufacturing companies, using a broad set of measures in a weighted measure. Key inputs include working capital, retained earnings, returns on assets, liabilities to market-cap, and sales compared to assets. Theoretically, scores below 1.8 indicate high risk. SEDG is currently in the negatives, implying very high risk. See below:

I believe the number itself is less telling than the spread between it and Enphase. SolarEdge’s negative Z-score would imply very high bankruptcy risk; however, it may be skewed by the one-off impact of the write-downs and other issues. Still, it’s incredibly low compared to Enphase’s, which is strong.

I think the most significant risk for SolarEdge is if installers become concerned regarding its future operating status. When choosing between Enphase and SolarEdge, I imagine some may factor in SolarEdge’s sharply falling stock price as a sign that it may not have the same operational footprint in the future, creating risks for product warranties. There is not much firm information on this point, but interesting recent anecdotal evidence of this issue on Reddit. I’ll be curious regarding how this factor changes, but I suspect that its sales may continue to decline while Enphase rebounds as installers shift toward what may be a financially and operationally more stable competitor.

The Bottom Line

In my view, SolarEdge’s survival is far from guaranteed and is, in part, outside its control. The company is aggressively laying off staff and shuttering non-core and underperforming operations in a belated effort to improve its profitability and reduce its excessive inventory buildup. However, in my opinion, unless the macroeconomic landscape for solar recovers, I think it will eventually fail against its competitor Enphase. The timeline for that is undetermined, but likely not in the coming quarters given its cash and ST investment position should be adequate to face realistic cash-flow pressures. Further, my base case view is that the macroeconomic demand landscape for solar will worsen in 2025 due to tariffs, regulatory changes, and general economic pressures, some of which may be mirrored in Europe.

That said, I would not take a position in SEDG today. The analyst consensus continues to point to a rebound. Based on two-year ahead EPS estimates, SEDG’s 2027 forward “P/E” today is ~7X, far below its previous levels. See below:

SEDG could have a significant upside at this valuation if it can cut costs while the macroeconomic demand environment rebounds. Although I do not expect that, my views differ from the analyst consensus. At this point, I feel SEDG has fallen enough and has such high short interest that it may also have significant short-squeeze upside potential, which we’ve seen over the past two weeks. Still, my long-term view is bearish, and aside from a substantial positive change in solar’s economics (i.e., higher power costs or lower interest rates), its competitive position is weakening rapidly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.