Summary:

- SolarEdge faces significant short-term challenges due to high inventory write-downs, declining demand, and fierce competition, leading to a Hold rating.

- The company’s Q3 2024 results showed a substantial impairment loss, decreased revenues, and operational restructuring, impacting its market position and financial stability.

- Regional regulations and subsidies in Europe and the US are disrupting solar demand, forcing SolarEdge to sell products below cost and scale down operations.

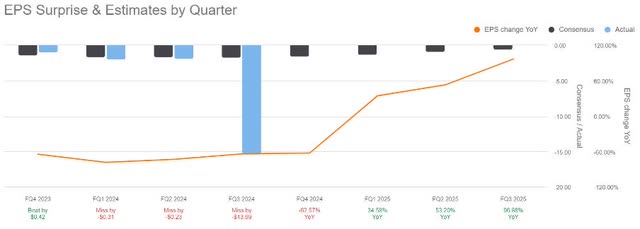

- Despite current setbacks, SEDG aims to achieve positive free cash flow and profitable growth within the next year, with expected EPS recovery in the next four quarters.

Justin Paget

Introduction

On 19 August, my bullish outlook on (NASDAQ:SEDG) was based primarily on the promising bolstering of market demand and a growing customer base. The company showed a positive recovery trajectory amid fierce competition, which signalled an opportunistic outlook that is, I must admit, a bit too optimistic.

Following low market demand and a high write-down in Q3 2024, it is my belief that there could be fundamental changes which has impacted the company in the past few months. However, my Hold stance is short-term, giving it the next year when the company is expected to rebound with as expected positive EPS. This is driven by its projection of the following two quarters reporting low revenues from written down inventory, generating low gross margins.

I believe its high inventory and market demand will be slower than expected in 2 quarters following high Enphase (ENPH) competition at 48% market share, an edge ahead of SolarEdge’s 40%. SEDG is undergoing a restructuring moment after a $1 billion impairment loss and write-down that resulted in a 12% staff reduction, which is a good reason to hold.

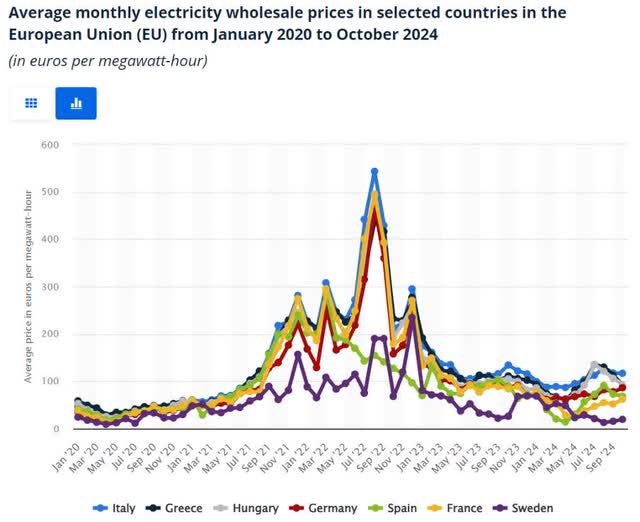

In my previous article, I anticipated the change in the market by pointing out other renewable and reliable sources, such as hydropower. The risk was insignificant per se, but they declined market share in Q3’24 shows that the cause for the decline is majorly driven by low electricity costs and competition, especially in the UK. However, far from what was expected, the global regulations around the solar supply chain have been the greatest undoing for SEDG in its recent SEDG decisions to mitigate the impacts of these regulatory changes. This disrupted the demand for solar. Due to a huge impairment loss recorded in the last quarter, I have to downgrade the company to a Hold rating as low market demand recovery persists in the projected 4 quarters ahead.

Significant impairment shows major headwind

The company’s third quarter 2024 asset valuation analysis resulted in a huge inventory write-down and impairment loss. When I delve into the market dynamics that resulted in this loss, I find that declining demand, a saturated market, and operational restructuring in Q3’24 contributed to this market dynamic. Residential products decreased by 34%, while commercial sales were down by 25% in Q3’24 Quarter-over-Quarter (Q-o-Q) compared to Q2’24, which remained sluggish.

An Inventory record of $800 million compared to the previous quarter’s $1.5 billion is due to a $612 million impairment loss in inventory. The company expects low sales in the next two quarters due to low demand in the European region as power prices continue to reduce. See below;

The increased demand for domestic products and Chinese solar rival companies caused a significant decline in SEDG demand. Also, raw materials related to Store-Keeping Units (SKUs) underwent a partial write-down in valuation from the promotions and price reductions implemented in Europe as the company plans to sell below cost. I note that $47 million in noncancelable raw material orders was included as a charge.

Considering machinery retirement, the company took a $94 million write-down on unused machines after reducing manufacturing. The salvage value of the specialized machines used in manufacturing was assumed to be zero or close to zero, which is a considerable loss. The energy storage business experienced an impaired loss of $113 million due to Sella 1’s low utility as a manufacturing asset, resulting from uncertainty for future customers.

Regarding deferred tax assets, the company acknowledges that it does not know when it will fully utilize its specific credit carry forwards and operating losses, among other deferred tax assets. I think such uncertainty depicts management’s poor operational and financial planning, which can be referenced in unclear forecasting of solar demand in Europe. I propose that the weakness in the company’s operational and financial controls has led to the appointment of Mr. Shuki Nir as the new CEO. See below;

Mr. Nir has experience in consumer business from SanDisk, where he led the company from a loss-making Incorporation to a profitable global market leader.

As such, upon valuation, the company lost $131 million in deferred tax assets, which will not be realized. Adding a write-off of $28 million from intangible assets and some investments valued higher than the fair market value shows a gap in the company’s weakness in unpreparedness in foreseeing market dynamics.

Regional regulations are disrupting solar demand

SolarEdge, whose business model is aligned with sustainable energy, faces a global green subsidy race. Major solar market competitors, such as the US, China, and Europe, compete to subsidize domestic manufacturers seeking market dominance which has drawn investors’ attention.

In Europe, where the SolarEdge market shrunk by 32% in Q3’24 Q-o-Q, the Net-Zero Industry Act, which intends to make clean technologies more appealing, has taken shape. The law wants to accelerate the demand for solar products manufactured in Europe. This strategic move has provided tax credits, loans from NZIA, direct investments, and grants amounting to €375 bn. The EU is in a race to match the renewable energy subsidies adopted by China and the US.

My previous analysis highlighted China as the primary challenge in solar energy, with over 80% of the world’s solar panel market share. So far, the disruption has impacted the enactment of regulations such as the Net-Zero Industry Act in Europe. With these regulations, I see minimal hope for SolarEdge products following the decline of foreign demand for solar, forcing the company to sell its products below cost. For example, the Biden-Harris Administration 2022 Inflation Reduction Act aiming to subsidize cleantech businesses and investments in a $369 bn package angered European officials, prompting the EU to accuse Washington of breaching the World Trade Organisation. Still, given that 18 Republican members of Congress have written to the Republican House Speaker Mike Jackson to consider preserving the tax credits on cleantech, citing it would be a worst-case scenario to repeal it fully, I recommend investors focus on companies doing well domestically. The Net Zero law was quickly proposed in 2023 to counter IRA, and the results can be seen in SolarEdge’s market demand decreasing towards 2024 and in the years to come. In fact, SEDG is selling its storage division activities assets including the manufacturing equipment for packs and battery cells, to focus on PV products only.

The new solar tariffs will affect US companies, with the anti-dumping law imposing a 271% tariff on Southeast Asian products. SolarEdge, which operates primarily in South Korea, faces this tariff difficulty combined with Europe’s Net-Zero law. These market dynamics have informed SEDG to scale down its Southeast Asian operations and bring most of its manufacturing operations back to the United States. I, therefore, attribute the high impairment loss in the latest quarter to the closure of its energy storage division, evidenced by a 12% workforce reduction due to deemed future regulations uncertainties.

Following American solar manufacturers’ complaints of flooding the U.S. market with unfair solar products, U.S. trade officials set preliminary tariffs on solar cells from Southeast Asia. I consider SEDG a hold also because the Commerce Department’s anti-dumping rates in the four Southeast Asian countries do not impact South Korea, where SEDG has its solar operations remaining after the closure of the storage division. The set preliminary anti-dumpling rates affect Vietnam imports from 53.3% to 271.28%, Cambodia from 125.37%, Malaysia from 81.24%, and Thailand from 77.85% to 154.68%.

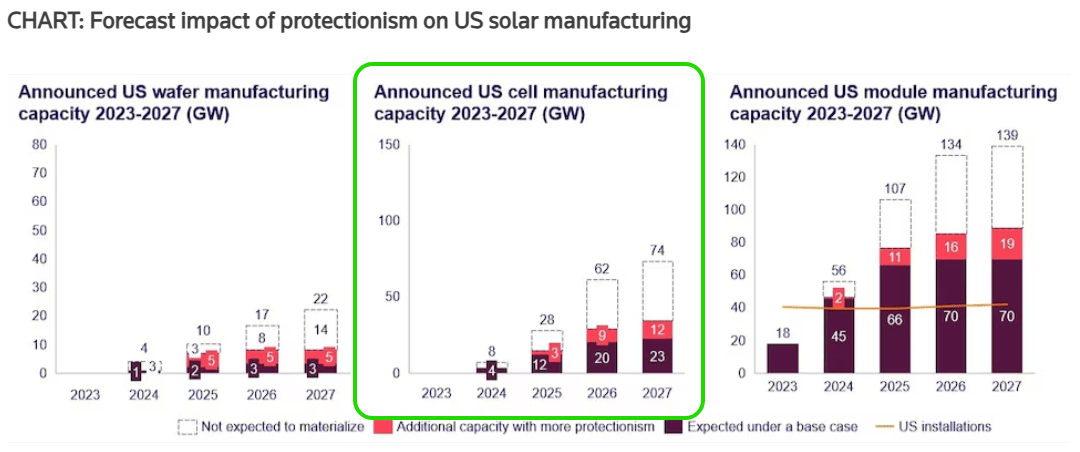

Based on these disrupting regulations and uncertainties, the future of foreign manufacturing operations in South Korea is also deemed. What I draw from the protection of U.S. solar manufacturers by imposing solar importation tariffs is that I expect domestic manufacturing to bolster. For example, 60% of all China’s imports pose a significant competition threat in solar manufacturing, so the impact is worthwhile. SolarEdge, at 40% U.S. market share, has a bullish potential in a projected 53% increase in cell manufacturing capacity by 12 GW/year by 2025, which is why I Hold.

Wood Mackenzie

However, recall that the closure of the storage division is indeed the beginning of SEDG scaling down foreign solar production. I believe that President-elect Donald Trump’s trade decision to impose an additional 20% on imports from other countries where South Korea is positioned is a move that favors its foreign operations. However, with the regulations and uncertainties around foreign operations informing the company’s response to the changes in the U.S trade environment, it’s a strategic move to uplift its 40% U.S. market share.

American Clean Power (ACP) spokesman Phil Sgro notes that the U.S. is on a trajectory to create a stable regulatory framework for the solar supply chain. In an interview with Reuters Events, Sgro assured that the U.S. has intentional policies to protect and stabilize its solar transition to a secure solar supply chain for the committed intensive capital investments in solar.

Q3’24 Highlights

The Quarter highlights a significant setback driven by the operational restructuring and macroeconomics. Revenues declined by 64.0% Year over Year (Y-o-Y) in the quarter recorded, resulting in a gross margin loss of 269.2%. The operation loss, from $16,726 to $1,085 266, was 6,388.5%. This explains the closure of storage division activities following the change of regulations. The net loss was the highest in the quarter, at 1,870.3% Y-o-Y. This reduced the Free Cash Flow (FCF) to a loss of $111.2 million from the same quarter last year, negative $5.36. In the quarter, Chief Financial Officer Ronen Faier stated that after the operational restructuring, the company’s top priority is achieving a positive free cash flow and profitable growth, which will recapture the market share.

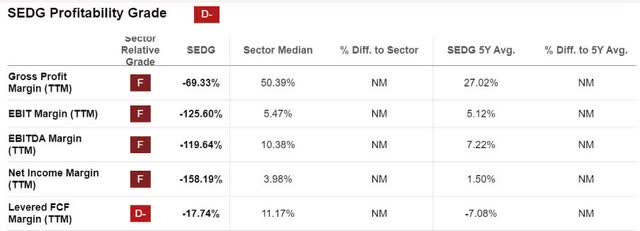

Given a substantial net loss and a depressed revenue generation, the company has maintained unprofitability, failing to achieve a 5-year average sector median. SolarEdge’s revenue has been declining by over 3.8% yearly, showing a weak demand.

Valuation

My bullish rating in the previous article focused on bolstering the consumer base and market demand. However, the market has been faced with abrupt market dynamics that seek a change in company operations. Following these operational restructuring changes, I am taking a bearish angle because the U.S. manufacturing strategy may take longer to recover than anticipated following high competition from its rival Enphase Energy.

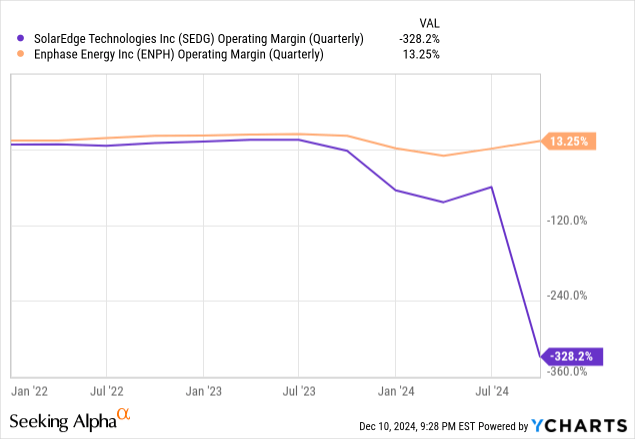

When I compare SolarEdge’s and Enphase’s operating margins and risks, I see that Enphase Energy has a stronger edge over its close competitor in terms of margins (GAAP) and risks. Starting with the operating margin, Enphase Energy recorded a decreased operating margin of 24.7% in the last five years. This confirms that the company has also experienced a sluggish demand for solar power. However, ENPH maintained a high margin, revealing its positive profitability potential at 16.2%.

Compared to SolarEdge’s operating margin, which generated a negative operating margin of 416%, Q3’24 revealed declining demand from abrupt market dynamics, accelerating SolarEdge’s financial distress. Adding asset valuation analysis during the quarter, which resulted in an impairment and a write-down of $1.03 billion, the company has since plummeted by 50%.

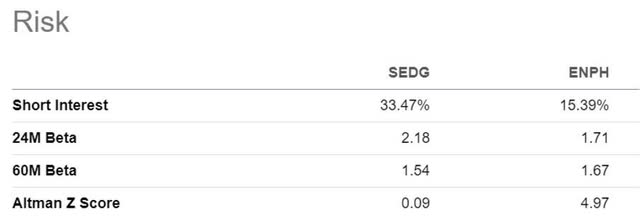

Going to risks, Enphase Energy has a high short interest percentage, at 15.39%, compared to SEDG’s at 33.47%. This shows that most investors are skeptical about the stock and thus bearish following its poor performance in the last quarter. At 1.71, 24M Beta indicates that ENPH is less volatile than SEDG at 2.18. Indeed, it is right to state that if the market makes a.1.71% move, SEDG is supposed to make 2.18% in that direction, which shows its weak performance.

After the appointment of Mr. Nir, who is currently in charge of the operational restructuring, the company has the potential for a bullish trend in early 2026. The company has mitigated further impairment loss, and the change of administration is why I am taking a Hold position.

Investment risks

- Regulations – More regulations in the cleantech sector will continue to impact the company’s rebound of its market share, such as uncertainties around IRA under President-elect Donald Trump. I expect the Republicans to continue with the planned subsidies following Congress’ positive response, but the decision has yet to materialize.

- Competition – Currently, SEDG faces a precarious financial strain when it comes to matching its financially well-off competitors, such as Enphase. Despite the low demand for solar in the previous quarter, the company has maintained its profitability with an impressive operating margin. Clearly, SEDG could face a delayed recovery compared to what it anticipates in the next 2 quarters. Investors expect a rebound in the next 4 quarters, when the company expects EPS estimates to cross to the positive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.